JHVEPhoto

Givaudan SA (OTCPK:GVDBF) engages its activities as a leading producer of flavour and fragrance ingredients. The company operates at a global level with two divisions, Fragrance & Beauty and Taste & Well-being. Givaudan’s Fragrances division primarily focuses on home and personal care, whereas the Taste & Well-being division is active in the Food & Beverage consumer industry. Givaudan has more than 250 years of heritage, indeed it was founded in 1796 and is headquartered in Switzerland. Even if it is the first time that we cover the company on Seeking Alpha, the flavour and fragrance sector is the one that intrigued us the most. This is mainly due to its defensiveness, low risk, high margins, and quality.

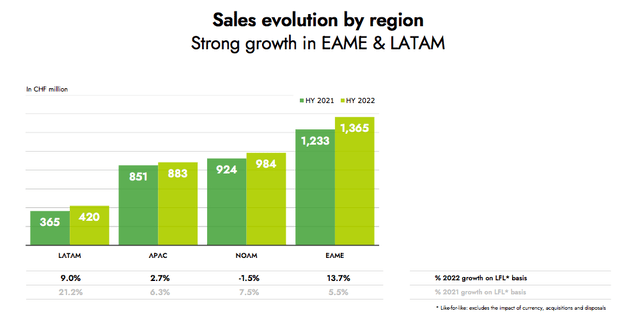

Givaudan GEO sales

Source: Givaudan half-year presentation results

Q3 Monthly Sales

Last week, the company released its nine-month sales. The next catalyst is planned for October 20 with an Investor Day. The Swiss company closed the period with sales of CHF 5.46 billion, signaling a plus +7.7% on an annual basis and at the CER level the increase stood at 6.1%. Looking more in detail, organic growth stopped at 5.8% and therefore, Givaudan lost momentum from the previous quarter, when the figure had reached +7.9%. Looking at the specific divisional details, the Fragrance & Beauty sector recorded an increase of 7.9% to CHF 849 million, while the Taste & Well-being division achieved a turnover of CHF 942 million with a plus 3.9%. Compared to Wall Street’s analyst consensus, the performance was below expectations, which was set for an organic growth forecast of 7.3% for the third quarter. As usual, the group did not provide the nine-month profitability result. However, Givaudan emphasized how revenue growth was more driven by price increases with the pass-through costs to its customers, a move designed to offset the increase due to the raw material inflationary pressure.

About our negative expectations

- Mare Evidence Lab’s main concern is due to the inventory levels, destocking is going to be a key catalyst in the short/medium term horizon. Inventories are exponentially above mid-cycle levels; however, logistic constraints are easing.

- We are reducing our 2023 EBITDA outlook by 500 basis points, this is mainly due to the higher COGS expected; despite that, we are confident that Givaudan’s pricing power will be beneficial for the 2024 accounts.

- FCF was negatively impacted by higher working capital requirements.

- The company is currently trading at a higher multiple compared to Symrise. Givaudan is the essence of the quality company, however, a P/E ratio of almost 30x on the forward consensus is quite important, given also the mid-single digit trend at organic growth and some margin pressure.

- Related to point 3), as for the medium-term strategic objectives, the company’s top management confirmed those previously set. Among these, there is an organic annual growth of revenues in the order of 4-5%.

- We believe that Symrise clientele exposure and end-market will outpace Givaudan’s revenue growth over the medium term, considering also higher M&A optionality. Moreover, we are forecasting a lower margin volatility thanks to better integration into raw materials.

What’s about the positives?

- From a pricing delta, our internal team is confident in Givaudan’s ability to fully pass through the reiterated 9% raw material inflation.

- A very good understanding is also given by Givaudan itself, you could have a look at their five reasons to invest in the Swiss company.

- Despite the leverage, the company has very low interest-rate expenses, and recently has signed optionality to extend its credit facility (again at favorable rates); M&A could again be a key catalyst in the company’s future strategy.

- Related to point 3), this year Givaudan announced the 48% stake acquisition in Nanovetores Group from The Criatec Fund, a Brazilian investment fund focused on innovative start-ups. The move is in line with Givaudan’s 2025 strategy, which includes development plans for the Active Beauty division, the group’s fastest-growing division. Supported by a team of 56, the Brazilian enterprise is known for its unique encapsulation technology for a wide range of ingredients used by beauty brands. The design and production of its products have a strong sustainable footprint and follows the principles of green chemistry, being water-based and free of organic solvents;

- New partnerships. Givaudan and LanzaTech, an innovative carbon capture and processing company will collaborate to develop sustainable fragrance ingredients from renewable carbon. Renewable carbon is the carbon that avoids or replaces the use of additional fossil carbon. This is supportive on the ESG side, and reinforces Givaudan’s state-of-the-art enterprises.

- These collaborations are expected to leverage synthetic biology capability and go beyond ethanol production. Seeking new opportunities to bring perfumery material innovations and having the common goal of using sustainable methods, will accelerate the company’s growth.

- Supportive FX development.

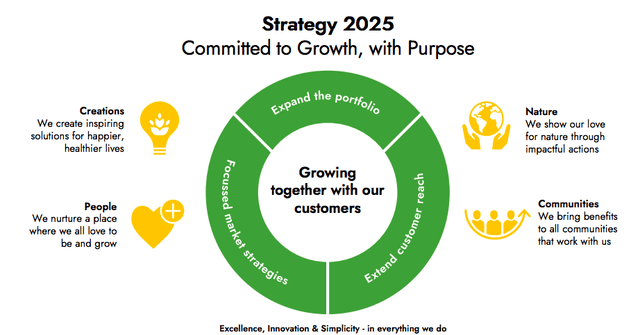

Givaudan strategy 2025

Source: Givaudan half-year presentation results

Conclusion and Valuation

Despite the positive highlights, in line with the negative point #4, Givaudan is currently trading at a ~25% consensus EV/EBITDA premium to Symrise. Therefore, we decide to initiate the company with a neutral rating and a target price of CHF 2.700 per share, deriving a peer average multiple of 17x on the EV/EBITDA with Symrise, IFF and Sensient (as its closest competitors).

Be the first to comment