theasis/E+ via Getty Images

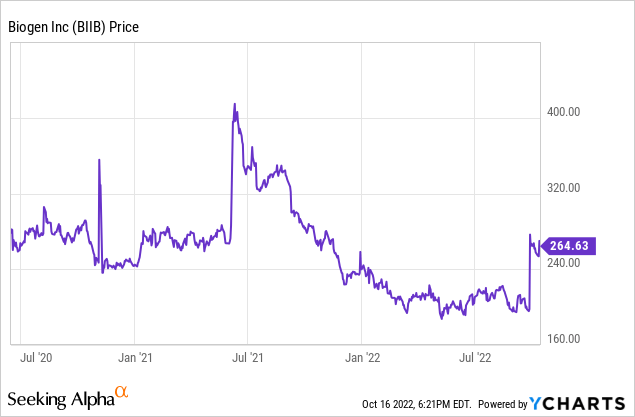

Last month’s news that lecanemab met its primary endpoint in the Phase 3 trial for Alzheimer’s spelled something of a redemption arc for Biogen Inc. (NASDAQ:BIIB) after the Aduhelm kerfuffle. The market responded by restoring Biogen’s stock price to December 2021 levels overnight. Naturally, given the skepticism we laid out in our previous analysis of Biogen, we would be remiss if we didn’t assess whether the price spike is all a true increase in valuation or if there is some degree of overcorrection baked in.

A lot of our analysis process stems from the advice of mathematician Carl Jacobi, often quoted by Charlie Munger, to “invert, always invert.” Instead of trying to throw darts at the dartboard with prognostication, look at what the market is saying and decide if it sounds reasonable. So, let’s invert the reaction to lecanemab and dissect the numbers.

The market’s implied lecanemab valuation

A weighted binary decision

Biogen’s share price increased 33% in response to lecanemab’s successful phase 3 trial and subsequent filing, with a final decision expected in early 2023. We saw Biogen reach $400/share last June after the Aduhelm approval, which gives a good data point for the actual perceived revenue potential of lecanemab.

We believe the market is projecting a weighted probability of the company’s worth whether lecanemab gets approved or not. We previously assigned a valuation of $160/share to Biogen; that number still seems reasonable from our perspective in the case that lecanemab fails to receive approval. At $400/share, the company market cap is $58 billion, an increase of $35 billion versus the unsuccessful scenario. The macroeconomic environment has worsened, so this $35 billion increase has to be discounted at a higher rate when applied to the future. U.S. treasury yields have risen from around 3% to 4.5%, so we will increase the discount rate from 15% in our previous analysis to 16.5%. Solving for g in the Gordon model, we see that the market is giving Biogen a 12.3% growth rate in the case that lecanemab does receive approval.

We then ask: what would $35 billion of present value look like as revenue from lecanemab over the indefinite future? Using time-value of money formulas for annuities, we calculate that $35 billion of present value is equivalent to a $1.3 billion perpetuity growing at 12.3%, subject to the 16.5% discount rate. For our valuation methodology, this $1.3 billion would be added to owner’s earnings:

owner’s earnings = net income + depreciation – capex + change in working capital

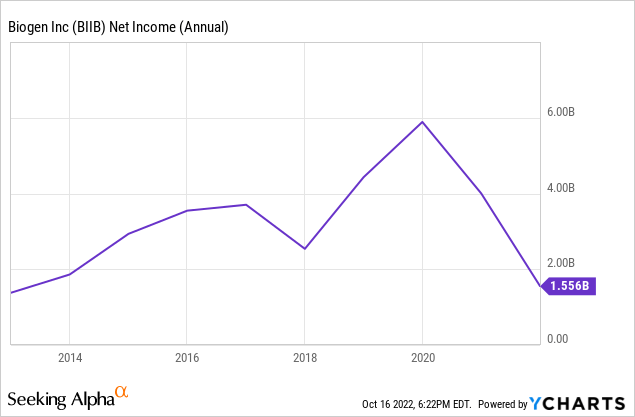

The jump in price has to be attributed to higher net income. We think it’s entirely reasonable to add $1.3 billion to Biogen’s net income for next year, looking at their numbers over the last several years.

Biogen’s net margins historically fluctuate around 30%, but since 2021 that number has dropped to around 15%, so to be as pessimistic as possible we will use the more recent margins. $1.3 billion of net income at a 15% margin implies $8.7 billion of additional revenue in the next year, all else held equal.

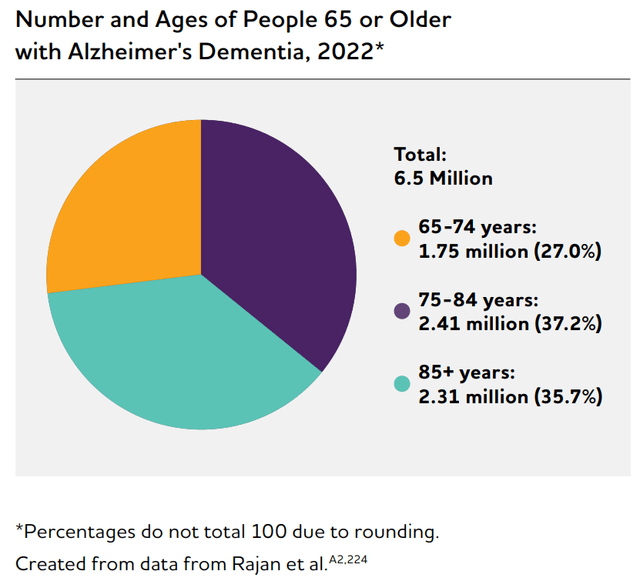

Required market share

Lecanemab has blockbuster potential, no doubt, but is it “$8.7 billion annually” levels of blockbuster? According to the Alzheimer’s Association, six million individuals age 65 or older in the U.S. alone have Alzheimer’s, and that number is expected to grow to almost 13 million by 2050. The WHO estimates that 55 million individuals worldwide have some form of dementia, with 10 million new cases each year, and that Alzheimer’s makes up 60-70% of those cases.

With an increasingly aging population and higher prevalence of Alzheimer’s as people age, the total addressable market (“TAM”) for disease-modifying treatments seems as ripe as ever. Aduhelm was heavily criticized for its price tag of around $50,000, so while it seems a) unlikely they’d ask that much for lecanemab, and b) that the margins will be better thanks to Aduhelm blazing the trail and helping iron out issues with the production process, we will still use Aduhelm as the baseline to remain pessimistic. $8.7 billion of revenue would require about 175,000 regimens of lecanemab to be purchased at that price, just 2.9% of the US market alone.

If we lower the projected price of lecanemab to $10,000, still high but perhaps easier for insurance companies/Medicare to swallow, we need 875,000 regimens to reach that much revenue, bringing us to 14.5% of just the U.S. market. This price range and initial market share makes a lot more sense, especially given the considerable financial and emotional burden dementia has beyond just the afflicted individual, and the fact that Medicare costs for “dementia care” averaged around $16,000 a person as recently as 2019.

Likelihood-weighted Adjustment

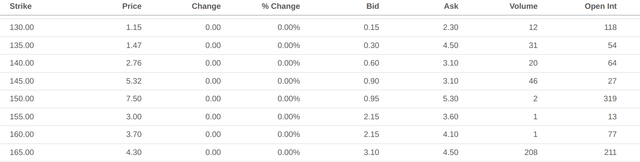

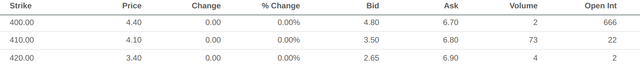

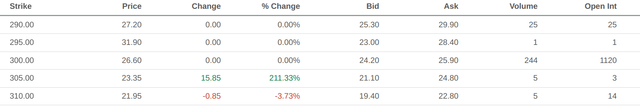

Having established the sensibility of the market’s previous success scenario, we can now determine the priced-in likelihood of that scenario. Option activity for April 2023 in the $160-165 range for puts and the $400-410 range for calls seems to corroborate the market’s expected values in both scenarios.

Put option data with expiry in April 2023 (Seeking Alpha) Call option data with expiry in April 2023 (Seeking Alpha)

If we use $160 and $400 as the valuations in either scenario, the current price of $260/share reflects a roughly 60/40 split against approval. It definitely feels like the market is having a “once bitten, twice shy” moment, and there’s certainly cause to be nervous.

Risks

This pessimistically-constructed implied valuation sounds like a low bar to clear, and we would agree with that assessment. However, these results can’t be taken in a vacuum.

Competition

Other amyloid-targeting antibody treatments from Roche (OTCQX:RHHBY) and Lilly (LLY) are following close behind, and with competition comes the need to undercut prices and/or heavily increase marketing budgets, both weighing on the bottom line. Meanwhile, Biogen’s fumarate business suffered a setback with patents related to Tecfidera, which will likely accelerate declines in revenue for that part of the business.

Regulation

Additionally, we can safely assume the FDA is going to scrutinize the lecanemab data very closely after the humongous backlash the organization received for its treatment of Aduhelm, including a deep difference of opinion and resignations of individuals who disagreed with the approval. Lecanemab had a failure in a Phase 2b trial which somehow turned around in Phase 3. Also, the quantitative improvement lecanemab showed is in the same range as Aduhelm’s successful Phase 3 trial; however, Aduhelm had another Phase 3 trial which showed no effect. It’s not unreasonable to suspect that lecanemab could have ended up the same way if put through another Phase 3.

Even if the FDA gives the go-ahead, there’s another gatekeeper to convince: Medicare. Congress has expressed their support for amyloid-targeting antibody treatments to have individual coverage decisions from Medicare, which would hopefully reduce friction on revenue, but that still doesn’t stop Medicare from denying coverage to lecanemab individually and Aduhelm, individually. The safety data for lecanemab versus Aduhelm is promising, but the risks versus benefits still create a hazy outlook.

Pragmatism

There is also the practical reality that this improved “cognition score” may not actually translate into improved quality-of-life. Scientist Derek Lowe made this comment in discussing the trial results which seems to sum up the skepticism:

It is no small thing, scientifically, to show such a difference in a patient rating score – but it might be too small a thing to notice for Alzheimer’s patients, their families, and their caregivers. The similarity to some cancer therapies is worth keeping in mind: in oncology, if you die at about the same time you would have otherwise, but with smaller tumors (and that only confirmed by imaging, not by quality of life), no one cares. It’s a scientifically valid point and might lead to something greater down the line, but the real-world impact is another matter. So I hope that this is not the case with lecanemab.

The pessimistic approval outlook

So how much would these forces weigh on lecanemab’s revenue and ultimately feed back into the valuation and likelihood calculations from above? First-year revenues will still likely be strong, as the competing drugs still need to actually clear their phase 3 trials and receive approval, which takes time assuming it actually goes through. Growth rate of those revenues is likely where the pain will be felt, as new competitors will require defending market share. If we take $1.3 billion as the base case and project it as a perpetuity growing at 10% against 16.5% discount rates, we get a present value contribution of $22 billion, for a share price of $310. The likelihood now tilts towards approval with two-to-one odds. Call options for April 2023 at a strike of $300 seem to corroborate this possibility as well.

Conclusion

Just looking at the market’s reaction to the news and extrapolating the implied effects on revenue, we see that the rally at the end of last month, while it certainly looked astonishing, was a fair pricing-in of the potential for lecanemab weighed against both the chance it will not receive FDA approval, the chance it will not be covered by Medicare, and the worsening economic outlook. The market penetration suggested by even last June’s numbers feels light, and a year or so of “first-to-market” price advantage followed by a competitive pricing closer to all-in dementia care costs would be an impressive revenue stream on which the company could powerfully pivot to post-MS neurological therapeutics. Granted, these two variables are heavily correlated, so trying to assign an expected first-year revenue using basic probability theory is a bit beyond us.

Our guts are saying that the implied likelihood of approval is also a touch low, given that lecanemab is safer and more demonstrably effective than Aduhelm, but again, the FDA and Medicare are absolute wild cards in this area. Given that this is as binary of an outcome as you’ll ever find in the market, we cannot in good conscience recommend long or short on the stock directly at this moment.

However, this setup is ripe for certain options strategies; the long strangle in particular is perfect for betting on a large movement in either direction, which is exactly what Biogen is facing come next year. We won’t be putting any real money either way, but we may enter it as a paper trade to get a feel for options in the wild before we start trying to use it as an income-generating approach.

Be the first to comment