Justin Sullivan

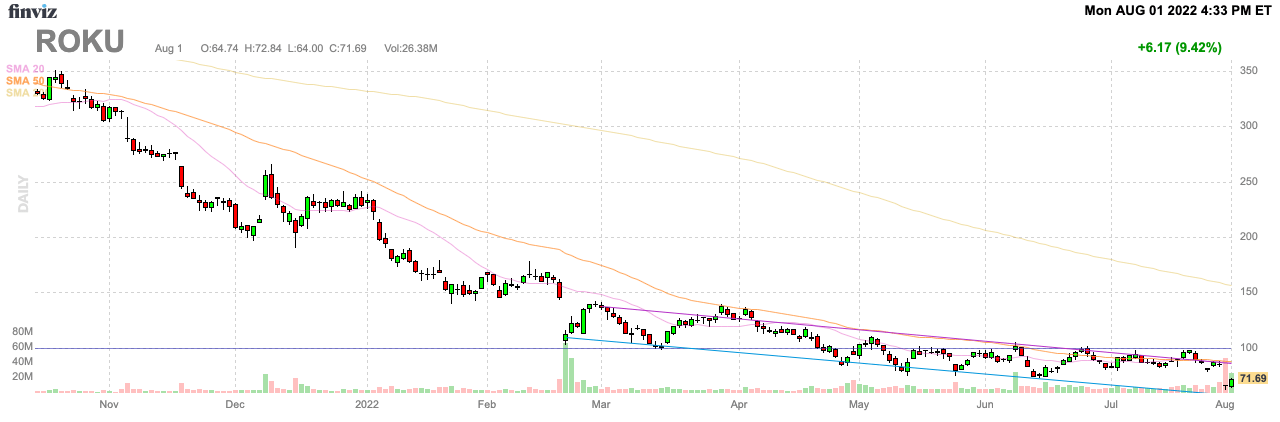

After Cathie Wood and ARK Invest (ARKK) made a bullish long-term case for Roku (NASDAQ:ROKU), the stock crashed following disappointing Q2’22 numbers. The market rushed out of Roku at the possible lows following a long dip this year. My investment thesis is Bullish on the streaming video platform noting the difficult transition to a new life as a video advertising player is clearly underway.

Source: FinViz

Video Advertising Crushed

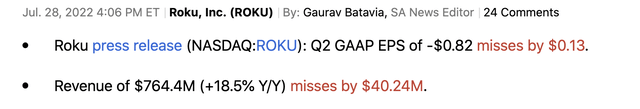

My bullish view prior to earnings had plenty of skepticism Roku could break into the digital video advertising market with so many strong players in the industry already. The company reported Q2’22 results backing up this fear with a reliance on the scatter ad market leading to a substantial revenue hit.

The bad news is that Roku missed revenue targets by a large $40 million, especially considering the revenue target was just $804 million.

Even worse, the Q3’22 revenue guidance was a massive $203 million below the $903 million revenue target. The total gross profits is only expected to dip $39 million from a previous estimate of $364 million due to the low margin portion of the business taking the hit. The Roku Player revenues had a -22% gross margin during the last quarter, so naturally lower player sales aren’t harmful to margins.

The good news is that these weak numbers don’t alter the long term view hatched up by ARK Invest. As the company builds up content with Roku Originals and viewers for The Roku Channel, the digital ad business will obtain more reliable Upfront advertisers and reduce reliance on the scatter market.

The other issue is that supply chain issues have limited supplies of new Roku players while the slowdown in smart TV sales have reduced the amount of new active accounts with access to Roku installed TVs. The combination leads to a slowdown in growing active accounts.

The company surpassed a new milestone of $1 billion in total commitments via Upfront deals for the 2022-2023 TV season. Roku will move further away from the ad scatter market with more guaranteed deals entering the next year reducing some of the risk faced in the recent periods.

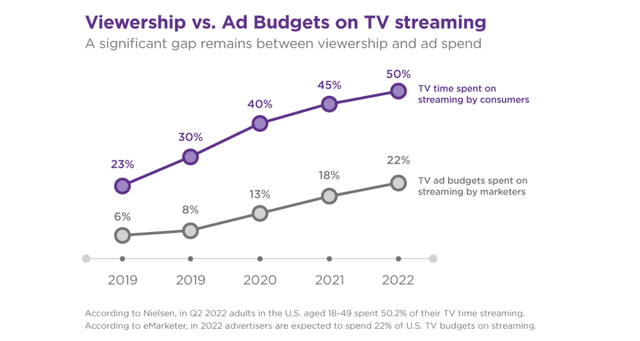

As the company highlights, viewership in TV streaming continues to far exceed the TV ad budgets assigned to streaming. A lot of the data continues to confirm Roku remains on target to capture more ad revenues and innovative products, such as Shoppable ads, provide innovative ways to grow their ad budget and enter the commerce sector with a simple checkout process using pre-populated Roku Pay data.

Source: Roku Q2’22 shareholder letter

Double Down

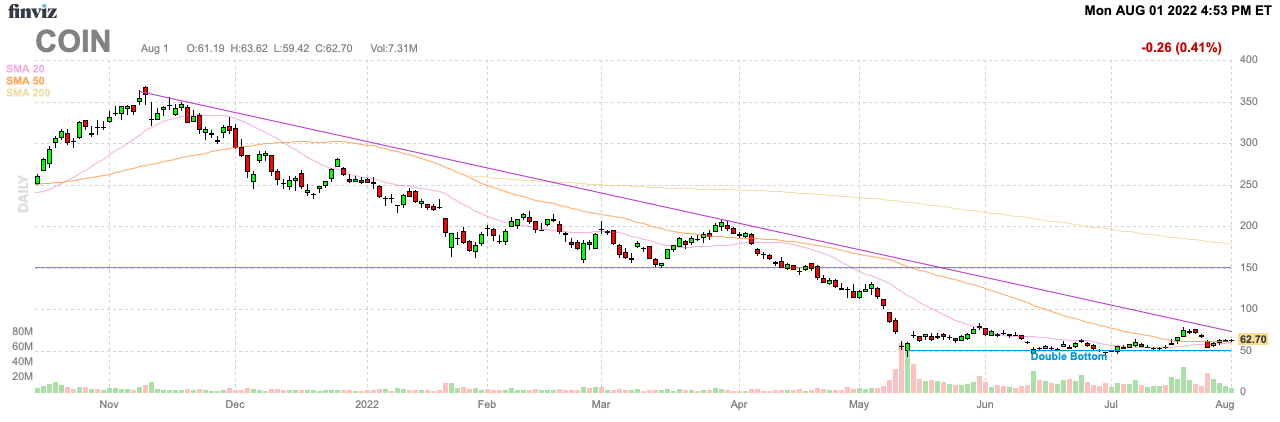

Anyone following Ark Invest over the last couple of years knows the firm takes outsized bets on innovators. The company regularly alters views on companies including dumping Coinbase Global (COIN) and Robinhood Markets (HOOD) at the recent lows after staying bullish all the way down from much higher levels.

The ARK Innovation ETF, ARK Next Generation Internet ETF (ARKW) and ARK Fintech Innovation ETF (ARKF) bought a combined 469K shares of Roku following the sell off last week valued at $30.8 million following the stock collapse after earnings last week. At the very least, ARK Invest appears to continue to back the thesis leading to a $605 price target for Roku in 2026 based on the bull case. Anyone following Cathie Wood here is warned that the above mentioned stocks were viewed similarly innovative until the story fell apart.

The Coinbase example is a prime issue with ARK Invest staying bullish above $350 and recently dumping shares at a potential bottom near $6o. The firm could’ve saved ETF investors tons of money dumping the stock as recently at $200 in March.

Source: FinViz

Roku has seen the market cap fall to below $10 billion, even with the nearly 10% snapback rally on Monday. Analysts have slashed revenue targets for upcoming years with the 2023 revenues estimate of $3.8 billion, down nearly 20% from last month.

The stock trades below 3x the lowered revenue target for next year. Investors get far better odds to invest in Roku down here with the shift to the video ad focus not altered by the current weakness. The stock is a much better deal versus when Roku traded above $400 and the market ignored all the pulled forward streaming demand.

The stock market got too aggressive on growth opportunities and now the market is far too pessimistic on the ability of Roku to start the next growth phase.

Takeaway

The key investor takeaway is that Roku remains a buy despite the disappointing quarter. The Upfront results provide the support for the business shift and patient investors will be rewarded in the long run.

ARK Invest buying more shares is a bullish sign, though investors should be cautioned this move is a mixed bag based on recent actions of the Cathie Wood ETFs. People selling Roku at the lows on Friday have already foolish missed out on a $10 rally.

Be the first to comment