Justin Sullivan/Getty Images News

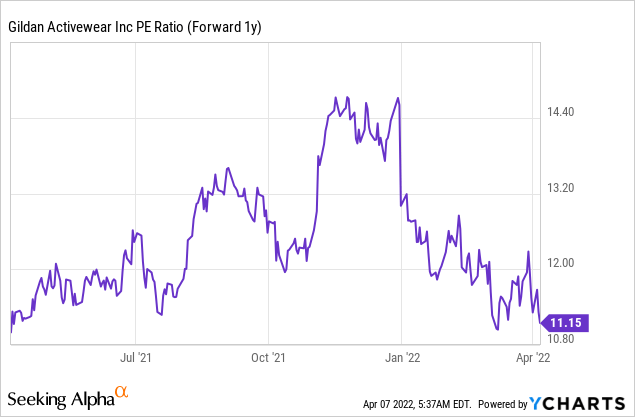

Gildan (NYSE:GIL) is one of the most established textile manufacturers in North America, having grown its market share in basic print wear significantly over the years. What sets Gildan apart is its ability to operate at the lowest cost in its industry by a wide margin, and its resulting scale economies has afforded it with the broadest product offering as well. Gildan’s impressive moat is largely the result of management’s willingness and ability to allocate capex to state-of-the-art manufacturing facilities and vertical integration across key parts of the value chain, from yarn to cut and sew in low-cost geographies. Even with its entrenched competitive position, GIL isn’t resting on its laurels – management recently outlined plans for more capacity expansion projects in the pipeline to support an incremental ~$1bn of sales post-2024, building on the ~$1bn from ongoing projects in the key Central America and Bangladesh regions. Relative to a mid-term guidance for 7-10%/year revenue growth at an 18-20% EBIT margin, GIL’s ~11x fwd P/E valuation is undemanding.

A Compelling Earnings Growth Algorithm

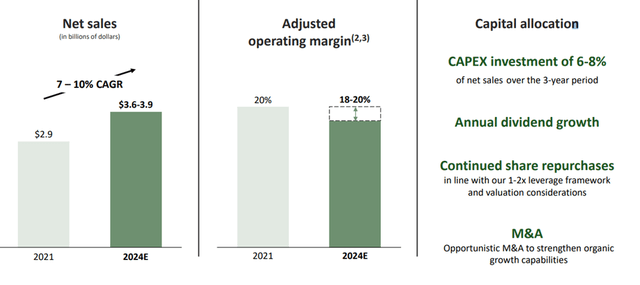

GIL’s playbook in recent years has worked well. In general, management has focused on optimizing its SKUs, consolidating its distribution footprint, and exiting non-core businesses such as its ship-to-the-piece operations to realize margin improvements. Now that the heavy lifting is completed and the margin benefits look to have stuck, GIL plans to cement its leadership within the value chain by scaling up its production footprint. The plan entails a ramp up in capex, but assuming successful execution, GIL could deliver a net sales CAGR of 7-10% and an 18-20% adjusted operating margin, implying a return on net assets of >20% from 2022-2024.

Gildan

I think these targets are very achievable given the growth drivers. For one, GIL will prioritize higher-margin fleece product sales, which has already been growing at a low-double-digit pace and has limited competition. The Bangladesh facilities are also coming online and should play a key role, given their focus on higher-growth fashion basics products, while plans to increase sales capacity by ~$1bn through further expansion in Bangladesh and Central America could yield incremental upside to the earnings growth outlook.

Capitalizing on Secular Trends Across Categories

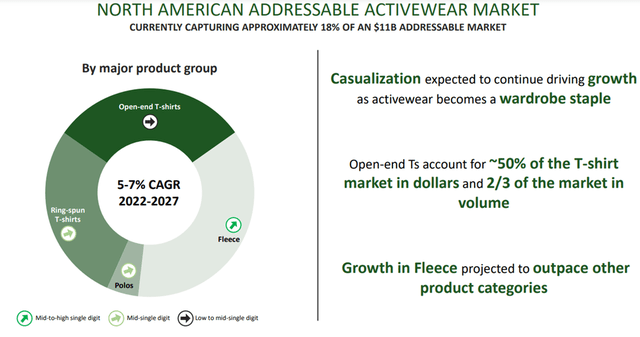

As a cost leader in its markets, GIL is well positioned to gain further share in its target categories over the coming years – per management, the North American addressable market opportunity for the activewear category alone is ~$11bn (a 5-7% CAGR through 2027). Thus far, GIL has executed well, leveraging its low-cost advantage to maintain a meaningful price gap relative to its competitors. For instance, its core ring-spun T-shirts maintain an average price gap of ~30%. If GIL can extend this into the higher margin fleece category, the earnings opportunity could be significant – not only is there less competition in fleece, but the recent Frontier Yarns acquisition also affords the company a competitive advantage in MVS yarn supply (more moisture-absorbent and not as readily available as open-end yarn). Assuming GIL executes well and unlocks growth here through better product availability and service, any incremental revenue from fleece should be highly accretive to margins going forward.

Gildan Investor Deck 2022

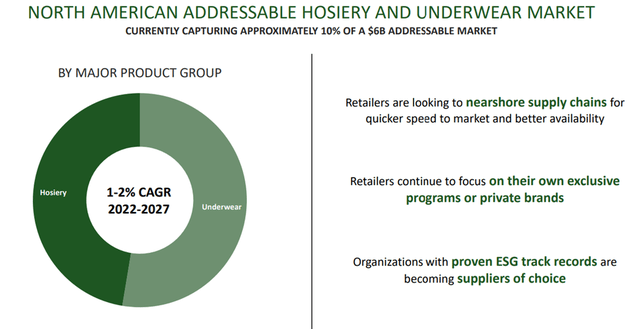

Another key opportunity lies in hosiery, which has seen revenue declines in recent years due to SKU rationalization to bring profitability more in line with activewear. Yet, underwear as a category has been strong on the back of private-label growth at Walmart (WMT). So, there remains room for growth, in my view – the addressable market opportunity is ~ $6bn (comprising socks and underwear), with GIL only commanding a ~10% market share. As more national retailers look to “nearshore” their supply chains amid an expansion in private label offerings, I think GIL could capitalize on above-trend growth over the coming years, particularly with many Chinese producers having to contend with inflation and environmental restrictions. With GIL’s production becoming increasingly competitive on a relative basis, nearshoring and private-label opportunities should allow for a solid 1–2%pts/year industry outgrowth scenario.

Gildan

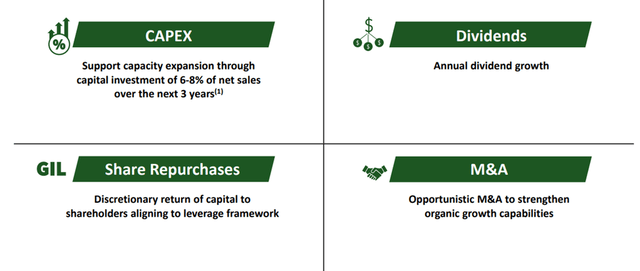

Balancing Reinvestment and Return of Capital

As GIL’s sales mix continues to shift toward higher margin apparel and the company’s excess capacity gets filled up, operating margins should expand toward the >20% target over time. In addition to the growth and operating margin upside, capex intensity is guided to reach 6-8% of revenues through 2024 (vs. the 3-5% range over the past five years), so FCF generation could move lower in the mid-term. Still, GIL has a well-capitalized balance sheet (net debt/EBITDA of <1x), and the core business generates more than enough free cash flow to cover its capex needs. Thus, GIL is equipped to continue returning capital, either through a dividend or further buybacks. Given where the stock trades today, I suspect buybacks would be the more accretive option. With management also generally favoring buybacks in the past, I see a significant reduction in the shares outstanding over the coming years as long as the equity valuation stays attractive.

Gildan

Capitalizing on the Post-COVID Tailwinds

GIL benefits from a virtuous circle – lower prices drive sales growth, allowing for more competitive pricing as the company spreads its fixed costs over a wider revenue base. This has allowed GIL to lead the way once again, as management outlined its plan to add a massive $600-900m of capacity over the next three years (a major step up from the ~$300m the last three yrs). The capacity ramp up positions GIL well to drive further market share gains and revenue growth as the North American economy fully reopens post-COVID. Plus, the near-shoring production trend is gaining traction and thus, GIL’s Central American operations gives it a significant proximity advantage relative to Asian supply chains. With management executing well on its Back-to-Basics cost out plan, I see a structural improvement in long-term margins, which coupled with a healthy balance sheet, should support continued shareholder return through the cycles. Bottom line, through GIL stock, investors get exposure to a secular compounder for a discounted ~11x fwd P/E.

Be the first to comment