AsiaVision

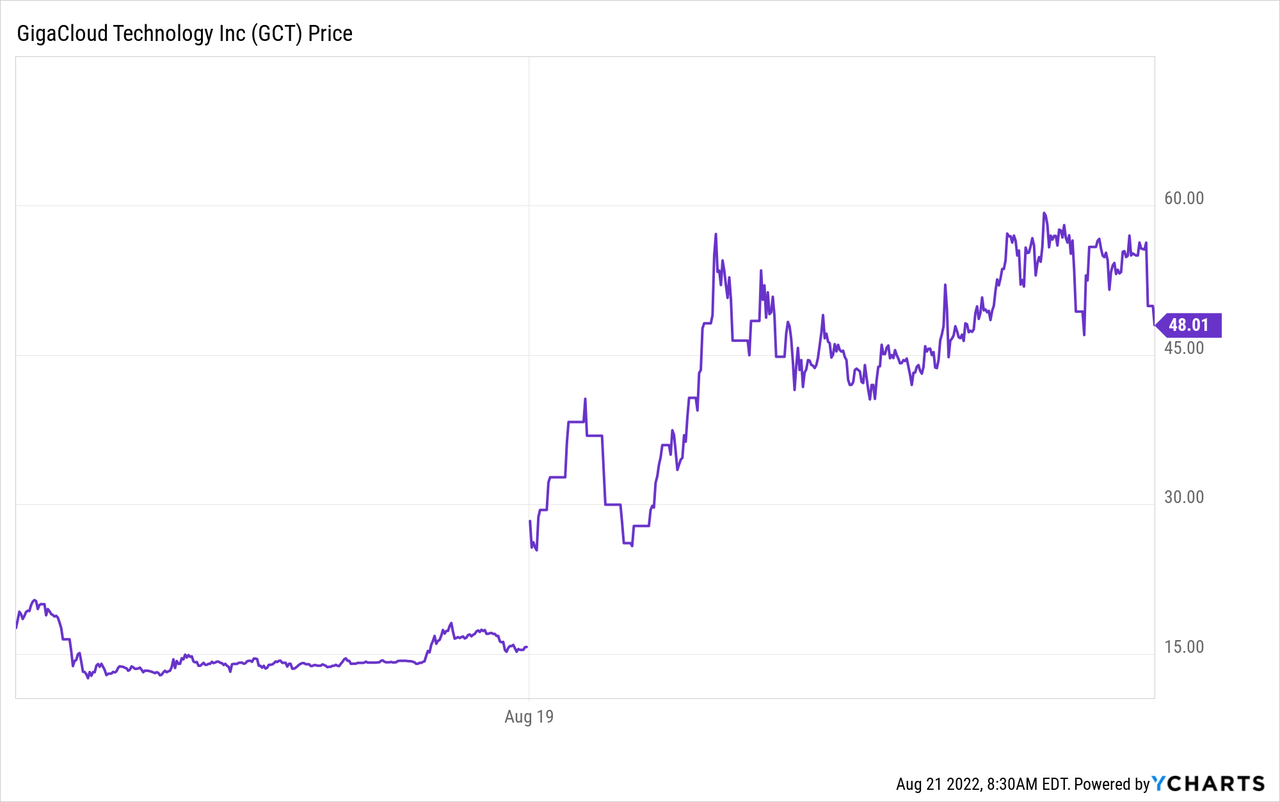

GigaCloud Technology (NASDAQ:GCT) is a high flying Hong Kong IPO stock that is getting a lot of attention on social media lately.

The company filed an IPO at $12.25 but shares started trading at $19.20 on Thursday August 18th 2022.

GCT volume was so high on Friday August 19th 2022 that a short squeeze occurred and sent the share price as high as $60.

Trading volume has gone up from 11 million shares traded on its first day to 36 million on day 2 of trading.

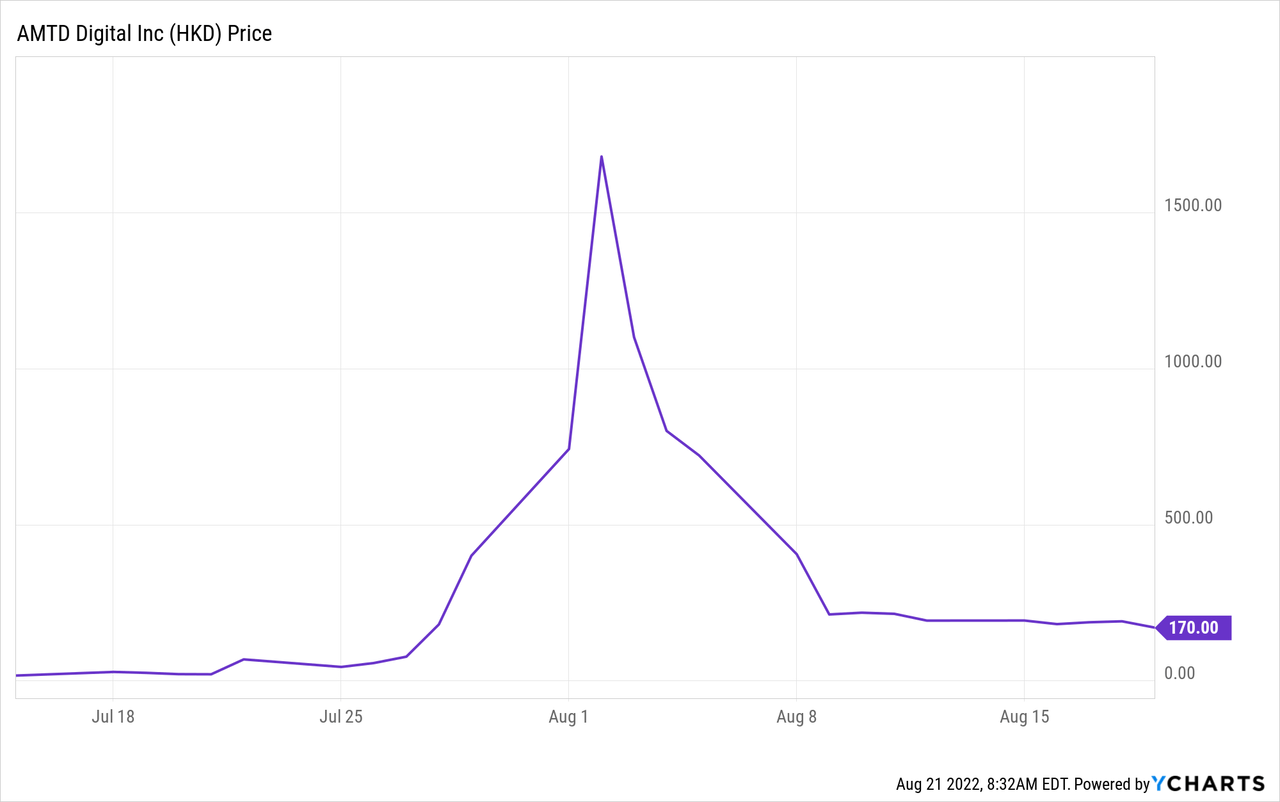

My theory is many traders believe GCT is like AMTD Digital (HKD) 2.0 and could soar to the moon.

According to Apewisdom, GCT is currently the #5 most popular stock on Reddit WallStreetBets.

After experiencing the BBBY pump and dump, I’m extremely skeptical of trending stocks on Reddit so I’m writing this article to provide more insight into GigaCloud Technology for prospective investors.

You can read the GigaCloud’s SEC prospectus if you want more background information on the IPO.

Business Overview

GigaCloud Technology operates the GigaCloud Marketplace, a b2b online store similar to Alibaba that allows suppliers and 3rd party sellers to conduct business on large items such as furniture and appliances.

The company built a cross-border fulfillment network optimized for large parcel products. GigaCloud Technology operates warehouses in four countries across North America, Europe, and Asia with 21 large-scale warehouses around the world totaling over four million square feet of storage space.

The United States is GigaCloud’s biggest market and the company sells large items on the GigaCloud Marketplace as well as 3rd party sites such as Amazon, Wayfair, Rakuten, and Walmart.

The company has increased revenue over the last 3 years and hit $414 million in 2021.

| Year | Revenue |

| 2019 | $122.3 million |

| 2020 | $275.5 million |

| 2021 | $414.2 million |

At the end of Q1 2022, the company had 410 active third party sellers and 3,782 active buyers on its GigaCloud Marketplace.

Growth has slowed recently but that’s completely normal for the entire e-commerce industry. The COVID-19 pandemic sent e-commerce stocks to the moon but now things are returning to normal.

In Q1 2022, the company generated $112 million in revenue and earned $4.7 million in net income. Net profit margins were around 4% during the quarter.

The company has $48.9 million in cash on its balance sheet as of Q1 2022 and drew a $50 million line of credit from Wells Fargo in July 2022 to improve liquidity.

The good news is that GCT is currently profitable and could help send shares much higher during its current YOLO pump cycle.

Why I Bought GCT Stock

GCT stock caught my attention because a massive short squeeze happened on Friday August 19th 2022. GCT stock soared from $26 to $52 on high trading volume on only its 2nd day of trading.

From a fundamental standpoint, GigaCloud Technology is a sound, profitable company that has the potential to grow in the long run.

However, I’m more interested in the short term upside that could come in the next few weeks.

I still cannot believe that HKD stock went from $20 to as high as $2,500 at its peak all based on hype and social media chatter.

It’s highly likely that GCT stock runs much higher in its first 2 weeks of trading then crashes down closer to its intrinsic value once the pump ends.

This is not a long term investment for me at all. I’m plan to sell my GCT once the hype fades and early investors take their profits.

Risk Factors

GCT could behave like HKD stock and you don’t want to buy at the top and become a bagholder.

There are several risk factors that come with buying GCT stock:

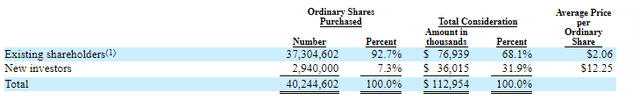

- Early GCT investors bought their shares at $2 pre-IPO and could dump them on unexpecting investors as the price begins to soar.

- The company will most likely dilute shareholders if the price continues to rise by offering shares to raise capital.

- E-commerce industry growth has slowed after the COVID-19 peak and many companies are laying off employees due to slower revenue growth.

- GCT’s low share float means investors are subject to wild price swings and things could do really well or get ugly fast.

My biggest fear is that early GCT investors will dump their shares aggressively once the pump ends. Over 37,000,000 shares or 92.7 of the float was purchased at just $2.06.

GCT Shareholders (gigacloudtech.com)

It’s only a matter of time until early investors dump their shares to lock-in profits.

GCT stock will probably pump higher so be sure to prepare your exit strategy once the dump occurs.

I would recommend using a stop loss order to minimize downside risk and don’t be afraid to cut losses quick if GCT starts crashing after its peak.

Some investors bought HKD stock for $2,000+ thinking it would double to $4,000. Now HKD trades under $200 so you do not want to hold onto a failing knife stock. Cut losses and move on to the next trade so you do not blow up your brokerage account.

Conclusion

GCT is a high risk, high reward YOLO stock that could soar to the moon. The company is profitable and currently trades under a $2 billion market cap.

HKD stock hit a market cap of $300+ billion at its peak so it’s possible that GCT could run much higher.

I’m bullish on the company over the long term because E-commerce will continue to grow in the future. Right now, I’m interested in holding GCT stock and seeing if GigaCloud Technology can become the next AMTD Digital.

Be the first to comment