adaask

Both Antero Midstream (NYSE:AM) and Enbridge (NYSE:ENB) are high yield midstream businesses with dividend yields of 8.7% and 6.2%, respectively.

In this article, we will review their Q2 results and then compare them side by side and offer our take on which one is a better buy.

Antero Midstream Vs. Enbridge: Q2 Results

AM generated solid results in Q2. Its biggest takeaways were:

- The company continues to bring new projects online, resulting in attractive returns on invested capital as well as reduced capital expenditures.

- Thanks to improving volumes and reduced capital expenditures, AM anticipates being able to begin reducing debt in the second half of 2022, with this trend accelerating in 2023 and 2024.

- By some point in 2024, management expects to have achieved its long-term leverage target of 3.0x or lower and will then consider returning more capital to shareholders.

ENB’s Q2 was pretty boring as the company continued to crank out solid results in-line with management’s expectations. Highlights included:

- Sanctioning new USGC and Western Canada pipeline expansions

- Extending the BC value chain with investments in Woodfibre LNG

- Continuing to increase investments in renewable energy and low-carbon growth opportunities.

- ENB continues to grow its dividend (~3% annual rate expected in 2022) and also opportunistically buy back shares ($150 million in share repurchases in the first half of the year).

Antero Midstream Vs. Enbridge: Business Model

AM’s assets are low risk as they combine to offer a midstream infrastructure system that has a fully integrated value chain. What makes this business model so low-risk is that it is 85% focused on natural gas processing and gathering and 15% is focused on water handling in the lowest cost natural gas basin in the United States. Furthermore, its primary client – Antero Resources (AR) – owns a large stake in AM, so the relationship between them is symbiotic. Given that AR is using its 25% free cash flow yield to pay down its debt hand-over-fist and will likely soon be investment grade, AM’s contracts seem rather secure at the moment. The main risk for AM is that all of its cash flow is essentially concentrated in a single counterparty, so in the event that something bad were to happen to AR, AM would be financially devastated.

ENB on the other hand has a very diversified asset portfolio and list of counterparties. While it has plenty of natural gas exposure – including the second longest natural gas transmission pipeline network in the United States and the number one position for distributing natural gas in North America – it also has significant exposure to crude oil with the longest crude pipeline network in North America. On top of that, it also has a growing portfolio of renewable power production assets. Its cash flows are even more stable than AM’s given the meaningfully superior diversification as well as the fact that 98% of its contracts are linked to commodity price-proof contracts and 95% of its cash flow is backed by investment grade counterparties.

Antero Midstream Vs. Enbridge: Balance Sheet

AM’s balance sheet is inferior to ENB’s as evidenced by its junk credit rating (BB from S&P) compared to ENB’s sector-leading BBB+ credit rating. That said, AM is making solid progress at improving its balance sheet and is could very well find itself achieving investment grade credit ratings in the next few years as it expects to pay down debt aggressively over the next two years and reduce its leverage ratio from 3.6x to below 3.0x and its main counterparty expects to achieve investment grade credit ratings in the not-too-distant future as well due to its ongoing aggressive debt paydown.

ENB meanwhile has access to debt on very attractive terms thanks to its lofty credit rating. As a result, it has a large percentage of its debt on fixed interest rates and not maturing until the 2030s, 2040s, 2050s, 2060s, and even in 2080. As a result, it should be able to compound that very cheap money at attractive spreads for many decades to come. This should enable investors to sleep well at night, knowing that ENB has a very low risk of financial distress.

Dividend Safety

Based on consensus analyst estimates for 2022 and 2023 distributable cash flow per unit and total dividends per share, AM’s dividend coverage ratio is expected to be 1.54x this year and 1.62x in 2023. Meanwhile, ENB’s is expected to be 1.56x this year and 1.55x next year. Given that neither dividend appears even remotely at risk at this point and the coverage ratios are very similar, we consider this one to be a draw.

Antero Midstream Vs. Enbridge: Track Record

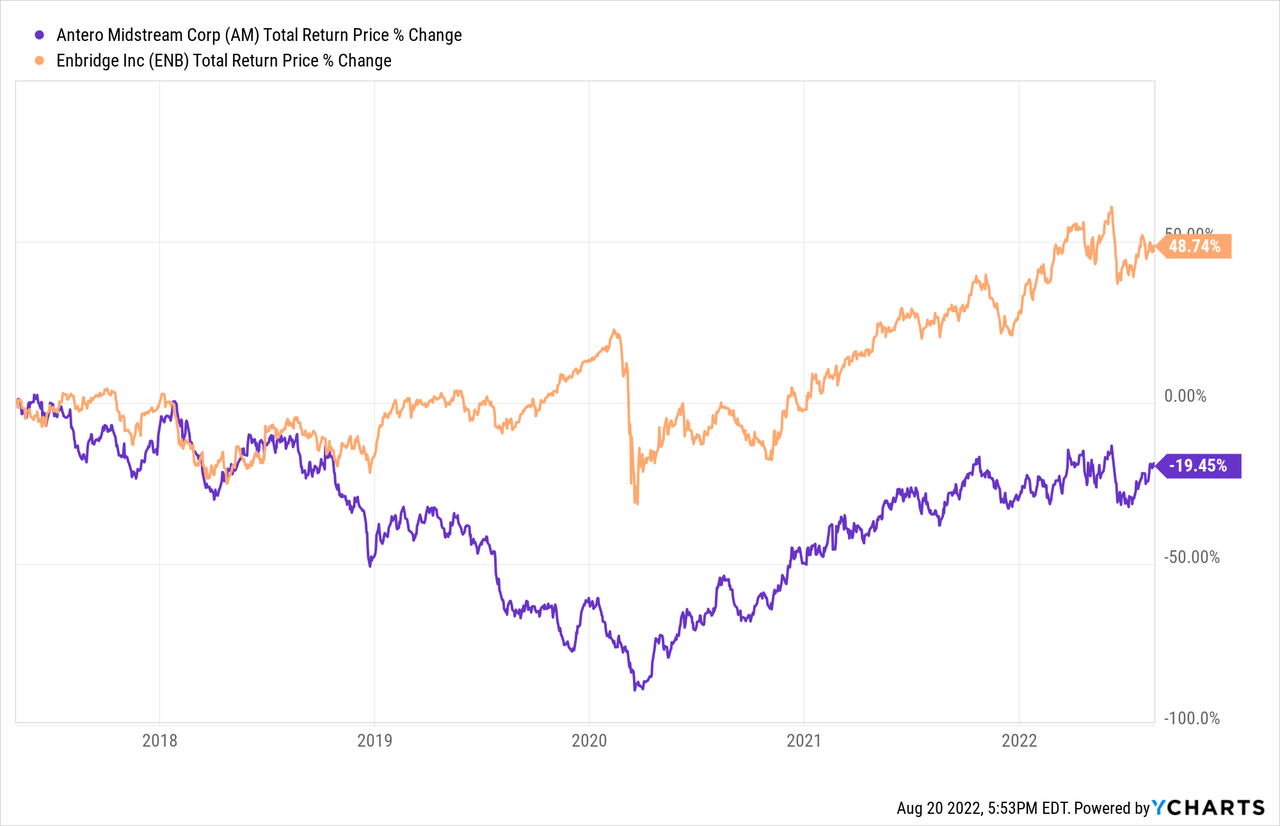

ENB crushes AM when it comes to track record thanks to its multi-decade streak of growing its dividend per share each year in contrast to AM’s track record of a dividend cut and a lack of dividend growth at present. On top of that, ENB’s total returns have massively outperformed AM’s during the period that both partnerships have traded publicly:

Catalysts And Risks

AM and ENB both face similar catalysts and risks in many respects given that they operate in the same industry. That said, AM’s risks are greater given its greater commodity, geographic, and counterparty concentration. If AR were to enter upon hard times and/or natural gas demand were to falter considerably relative to supply, it could have outsized negative impacts on AM. Alternatively, if AR were to continue to prosper as it has in recent quarters and achieve investment grade status, it would likely boost AM’s risk-reward profile meaningfully as well. Ultimately, AM’s fortunes are closely linked to AR’s, so its main catalysts and risks are held in common with AR’s.

For ENB, the risks really are minimal given its immense balance sheet strength and asset diversification. Still, if the energy industry were to enter a prolonged downturn, it would undoubtedly eventually begin to weigh on cash flows as recontracting would be weak and management would be forced to make some concessions to counterparties in order to keep volumes high through its systems.

AM Vs. ENB: Valuation

Both businesses also look reasonably to attractively priced when compared to their own histories. Here is a side-by-side comparison of them:

| AM | ENB | |

| EV/EBITDA | 8.95x | 12.73x |

| EV/EBITDA (5-Yr Avg) | 12.91x | 12.67x |

| P/DCF | 7.57x | 10.47x |

| Dividend Yield | 8.7% | 6.2% |

Overall, AM looks to be the clear winner in terms of cheaper valuation as its EV/EBITDA multiple is far cheaper than ENB’s and is also at a steep discount to its five year average. In contrast, ENB is actually trading at a slight premium to its five year average. AM’s price to distributable cash flow and dividend yield are also meaningfully more attractive than ENB’s are.

Investor Takeaway

Both AM and ENB offer very high dividend yields that appear quite sustainable for the foreseeable future. On top of that, both offer stable cash flowing business models that should be able to support their dividends through a wide range of macro environments.

That said, ENB is the clear winner when it comes to being more conservatively positioned, with both its balance sheet and business model coming in as significantly superior to AM’s. On top of that, ENB is making more aggressive long-term oriented growth investments whereas AM is having to continue to aggressively pay down its debt in order to secure itself against downside risks in the coming years. Additionally, ENB is continuing to grow its dividend, whereas AM is having to take the next few years to fully focus on paying down debt before it can consider growing its dividend.

On the other hand, AM is trading at a clear discount to ENB. As a result, it offers meaningfully superior current income and also great multiple expansion potential, while ENB offers better growth potential. Overall, we rate AM as a Buy and ENB as a Hold at present, while we view ENB as a Low Risk investment and AM as an Average Risk investment.

Be the first to comment