EXTREME-PHOTOGRAPHER

Co-produced with Treading Softly.

I was always considered weird for having down-to-earth goals when I entered the workforce.

I wasn’t always like that. I had big nebulous ideas and dreams as a child. I wanted to be a superhero, a war hero, or a marine biologist. No idea how to get there or what education I would need. They just sounded “cool” to my childhood mind.

When I got older, I embraced the concept of SMART goals, ones which you could readily measure and determine your progress towards achieving. So I worked hard to achieve my varied goals in life to get to where I am today. I still have goals for the future and am actively working to achieve them.

I remember when I started working, and they had us all stand in a circle and state a career goal. Many said, “Become the CEO,” which elicited laughs as we all knew that was extremely unlikely. When I got asked, I simply said I wanted to earn enough to retire early. I received silent looks of shock or aghast looks. People felt it was more unlikely to retire early than become the CEO before we all left that workplace.

I can tell you, no one in that group is the CEO. They hired someone from outside the company – go figure! While I don’t work there anymore, many consider me to be semi-retired, working for myself, the CEO of my own company.

So how did I achieve it? Diligent income investing. I bought high-yield, strong income-paying investments and sprinkled in investments with growing dividends.

With this type of investing philosophy – I coined the term Income Method to encapsulate it – you can achieve your retirement goals and plans.

Perhaps your goal will be to have $2 million in your retirement account before retiring, or earning the equivalent of what someone with $2 million in their account would earn using the 4% withdrawal rule – $80,000.

I have two excellent picks to help you actively achieve that goal. One is high yield income now, and the other is medium yield but growing its dividend rapidly.

Let’s dive in.

Pick #1: MPW – Yield 7.2%

Medical Properties Trust, Inc. (MPW) reported a quarter in line with guidance and reaffirmed annual guidance.

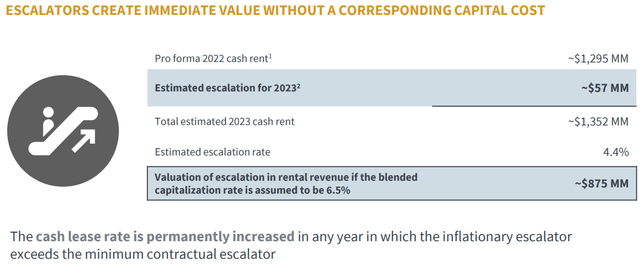

On the earnings call, MPW reminded shareholders that they have escalators on their rental contracts. Most of which are calculated based on CPI with a cap. With CPI going to be well over the cap, MPW has visibility for rent increases of $57 million next year. (Source: MPW – August 2022)

That is revenue growth without any additional investment and not including any new acquisitions. Since the leases are triple-net, MPW has very little exposure to inflation-sensitive expenses.

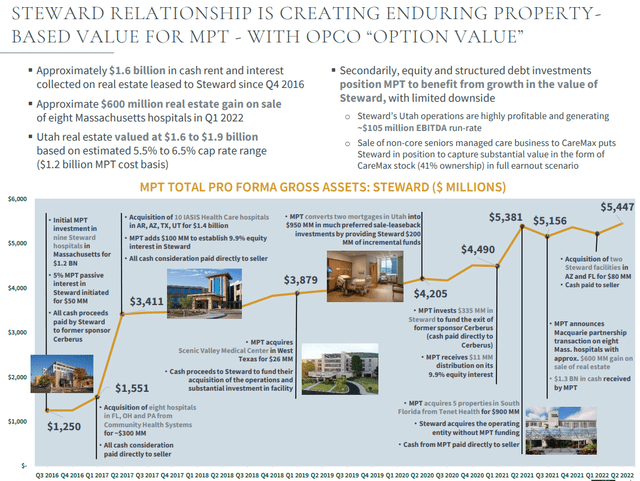

Management spent a lot of time discussing Steward, which many in the market have been worrying about. We haven’t been. Why? Because Steward has been an exceptionally profitable investment for MPW.

Let’s look at the history of MPW’s investment in Steward.

The initial $3.4 billion invested in 2017? That was huge for MPW at the time, it was 37% of gross assets. It was a big gamble. MPW has added to that investment over time and is now just under $5.5 billion in gross assets. Relative to the size of the portfolio, it is closer to 25% of gross assets.

Let’s look at cash. MPW’s returns to date include $1.6 billion in rent and interest plus $1.3 billion in cash received from the Macquarie transaction. About 52% of MPW’s entire investment in Steward has come as cash, and MPW still owns 41 Steward properties that are still paying approximately $500 million/year in rent and interest. Plus, MPW has picked up a 9.9% equity interest in Steward, which could have significant upside down the road. However you cut it, Steward has been a fantastic investment for MPW to date. As MPW discussed in considerable depth on the earnings call, they believe Steward as a company is far healthier today than before.

Focusing on MPW, which we believe is more important, they are doing what they said they would. They made some progress towards deleveraging, bringing debt/EBITDA down from 6.5x to 6.3x during the quarter. That is down from 6.7x last year. Their target and the target of the rating agencies is to get below 6.0x. They are on track to hit that target, an important milestone in their quest to get an “investment grade” credit rating.

AFFO, which is the best metric for measuring dividend coverage for MPW was at $0.35 for Q2. This puts their $0.29 dividend at an 82% payout ratio. We expect MPW to maintain an 80-85% AFFO payout ratio.

The bottom line is that MPW is doing what they said they would do. AFFO is growing, the dividend is growing, and they are deleveraging following years of very aggressive growth. This year they expect to “only” invest about $1 billion.

We’re happy to follow the cash flow and let the market noise be our opportunity to build our positions.

Pick# 2: ACRE – Yield 10.1%

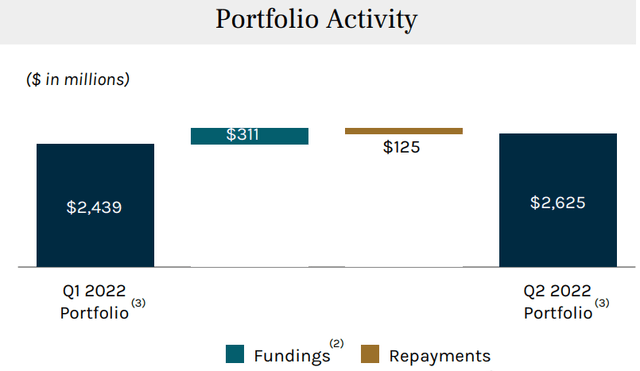

Ares Commercial Real Estate Corporation (ACRE) knocked earnings out of the park with $0.38 in distributable earnings. Easily covering its $0.33 regular dividend and $0.02 supplement. It did this with a leverage ratio of only 2.3x debt to equity. This ratio could easily be raised to 3.0x.

ACRE continued to grow its portfolio with $311 million in new fundings compared to $125 million in repayments. (Source: ACRE Q2 Presentation)

For commercial mREITs, the mortgages tend to be relatively short-term, so it is important to keep the pipeline full of new opportunities to quickly redeploy capital. ACRE is doing that.

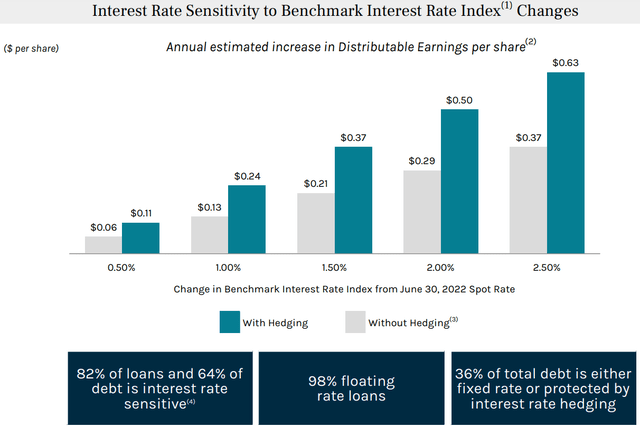

What attracted us to ACRE originally was to find a company that would benefit directly from rising interest rates to insulate our portfolio from the risk of the Fed hiking rates aggressively – which the Fed has been doing. Rising rates contributed slightly to ACRE’s earnings in Q2, but in Q3 are positioned to drive earnings even more aggressively. Here is the impact of rising rates on ACRE’s distributable earnings from June 30th – ACRE is well-positioned for a potential rise in short-term interest rates:

Commercial mREITs benefit from rising rates of the nature of their business model. ACRE, in particular, is especially well-positioned thanks to the hedges they bought when the market was of the opinion that rates would never be raised again.

The market seems to still be oblivious and the price is cheap. I’m happy to grab some more shares before the market wakes up and smells the cash flow!

Shutterstock

Conclusion

With MPW, I get a medium-yielding REIT with strong dividend growth. With ACRE, I get an excellently run mREIT with high yields and regular special dividends to boot.

These both actively help me achieve my long-term income goals. I can see rapid income growth via reinvesting my high-yield dividends today while also enjoying compounding growth from reinvesting my growing dividends. In the event I need to take all my dividends as income to cover unexpected expenses, MPW allows me to see continued growth. And if I reinvest it in MPW or ACRE, I can fine-tune my forward income vs. present income expectations appropriately.

I encourage investors to embrace the concept of “both/and” over “either/or.” Often portfolio management is not about finding a single stellar investment but finding multiple excellent investments and knowing how to mix and match to gain the benefits of multiple streams of income while covering the bases of any drawbacks they present.

Retirees need to have goals for how much income they need to live on and leave extra in case the unexpected arrives and attempts to derail their plans! Be prepared, and you’ll be successful. You can easily reach $2 million in retirement savings by holding excellent income generators like ACRE and MPW, along with others!

Within High Dividend Opportunities, we provide a Model Portfolio overseen by our team and designed to help investors reach their retirement income goals. You can do this on your own as well, we just provide a template to make the process easier.

Be the first to comment