Khosrork/iStock via Getty Images

Net lease REITs have taken a beating in recent months. However, some of the well-recognized names such as Agree Realty (ADC) and Realty Income Corp. (O) still trade at sub-5% dividend yields. This simply won’t make as much of a dent for those seeking to take advantage of the market sell-off to boost their income streams.

This brings me to Getty Realty (NYSE:GTY), whose share price weakness has now driven the dividend yield to a level that may be enticing for high yield investors seeking safe income. This article highlights the attributes that make GTY an attractive income play, so let’s get started.

Why GTY?

Getty Realty is an internally-managed REIT that specializes in the acquisition and development of convenience, automotive, and other single-tenant properties. At present, it holds a large portfolio of 1,014 freestanding properties that are spread across 38 U.S. states.

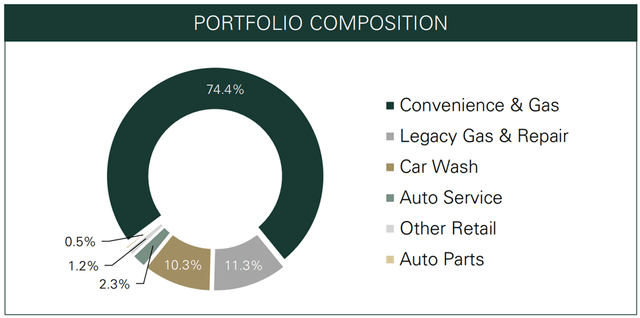

What sets GTY apart from many other net lease REITs is its pure-play focus primarily on automotive-related assets, many of which come with a convenience store component. This enables management to hone in on its core competency with fewer distractions. As shown below, nearly three quarters of GTY’s portfolio is tied to convenience and gas.

GTY Portfolio Mix (Investor Presentation)

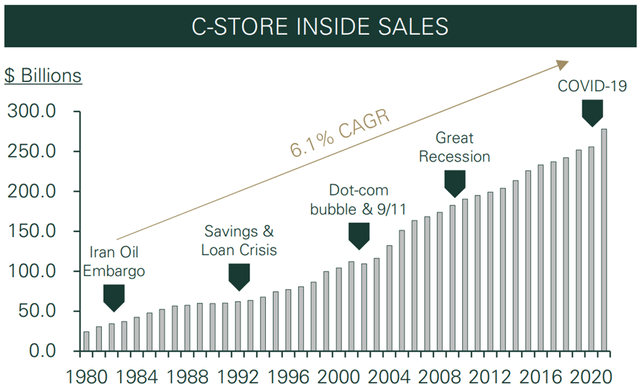

C-stores are among some of the most resilient asset classes due to their low price points and e-commerce resistant nature. As shown below, C-store inside sales have grown nearly every year, and through multiple energy and non-energy related economic crises.

C-Store Sales (Investor Presentation)

GTY’s portfolio is well put together, considering that 64% of its properties comes from a top 50 metropolitan statistical area, and that 70% of properties are situated in corner locations that garner higher foot traffic. GTY enjoys a long-weighted average lease term of 8.7 years, putting it on par with that of most net lease REITs, which have around 10 years WALT.

Moreover, GTY’s tenants appear to be in good shape with 2.6x tenant rent coverage and it enjoys a healthy 99.4% occupancy rate. Meanwhile, GTY continues to demonstrate respectable growth, as reflected by AFFO per share growing by 6.1% YoY, to $0.52 in the first quarter.

This was driven by rent spreads and by a fair amount of acquisition activity, including $8.8 million across five properties. Year-to-date, GTY has invested $53 million across 13 properties, including 3 convenience stores and 10 car washes.

Looking forward, GTY has a long growth runway as it continues to consolidate the fragmented automotive real estate segment comprised primarily of mom-and-pop type owners. This is supported by management’s comments on the robust acquisition pipeline and strong convenience store sales, as noted during the recent conference call:

We ended the quarter with a robust investment pipeline across a number of our target asset classes. We are remaining disciplined in our approach as we work through these and other opportunities. Our strategy is to acquire high-quality real estate across the convenience and automotive, retail and service sectors and to partner with strong and growing regional and national operators. Considering these factors, we are optimistic about our ability to continue executing on our investment strategy as the year progresses.

Based on the NACS annual survey data for convenience stores across every region of the United States, 2021 was another strong year for inside store sales, which grew more than 8% and reached a record $280 billion. Similar to last year, the NACS survey highlighted a 6% increase in the average basket size or dollar spent per transaction in the store, which is impressive as the prior year’s increase was up 15% due to pandemic-related shopping.

Risks to GTY include higher interest rates, which may increase its cost of funding on new acquisitions. In addition, some may have concerns around the viability of gas stations amidst the growth in electric vehicles, with gas prices on the rise. I believe these concerns are overblown, as electric vehicles have also become expensive with cost inflation in raw materials. In fact, the average price of an EV has now surpassed $60K, a figure that is simply out of reach for most American households.

Meanwhile, GTY sports a strong balance sheet with a low net debt to EBITDA of 4.6x, sitting well below the 6.0x safety mark that I prefer for REITs. This lends support to the high 6.4% dividend yield, which comes with 9 years of consecutive growth, a 5-year CAGR of 8.6%, and safe dividend payout ratio of 79% (based on Q1 AFFO per share of $0.52).

I see value in the stock at the current price of $25.48 with a forward P/FFO of just 13.0. This is considering GTY’s underlying growth in fundamentals, strong balance sheet, and long growth runway. Sell side analysts have a consensus Buy rating on GTY with an average price target of $32.50, implying a potential one year 34% total return including dividends.

Investor Takeaway

GTY is a quality net lease REIT with long-weighted average lease terms, a strong balance sheet, and a robust growth runway. The company continues to demonstrate respectable internal and external growth as it consolidates its fragmented market.

The recent share price action has driven the yield to an attractive level for investors seeking high and growing income. As such, I view the current share price as being a good entry point for this durable REIT.

Be the first to comment