courtneyk

Investment Thesis

Lincoln National Corporation (NYSE:LNC) is a provider of retirement, insurance, and wealth protection products, leading the market with approximately 16 million customers.

LNC maintains a Risk-Based Capital Ratio (RBC) of 400%. RBC is a measure of the total cash and investments on the company’s books, divided by the minimum amount of capital required to be held on hand. This means that LNC has approximately 4x the capital on hand required to be considered solvent. LNC attempts to stay at or above $450 million on hand at any time.

As pandemic-related claims have come down, LNC is expecting to deliver a CAGR of 8% to EPS. Despite some minor downturns in regard to the market and persistent COVID mortality concerns, we believe that LNC is well positioned to weather any volatility and continue to pay out a consistent dividend.

|

Lincoln National Corporation |

E2022 |

E2023 |

E2024 |

|

Price-to-Sales |

0.5 |

0.4 |

0.4 |

|

Price-to-Earnings |

6.0 |

4.4 |

3.9 |

|

EV/EBITDA |

7.8 |

6.3 |

5.6 |

Products

LNC’s strategy maintains a level of fluidity to create adequate adjusted returns. This is done through the “reprice, shift, new” framework published by management. It is best boiled down as repricing underselling products, shift sales toward products that have the best demand weighted returns and adding new products that may fit a niche.

The weighted average duration of assets in the portfolio is 9 years, with 13.5 years for life insurance topping the charts, and the bottom of 5.5 years for annuities.

Despite unfavorable markets, the annuity lines have performed as expected, with a return on equity (ROE) of 20% reported in 1H22 and a 0.71% return on assets (ROA). Part of LNC’s annuity business includes reinsurance block and flow, flow being a percentage of future premiums and block being an entire pool of accounts that already exist. The most recent deal is the Talcott VA flow agreement, which is up to $1.5 billion in sales from 2Q21-2Q23.

2Q22 LNC Report

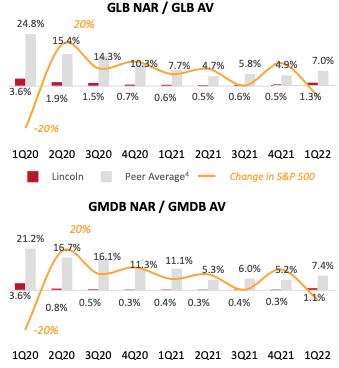

Overall, risk levels for annuities of all types are consistently below peers in net amount at risk (NAR) divided by account value (AV); in 1Q22 LNC had 1.1% for guaranteed minimum at death policies and 1.3% for guaranteed living benefits policies. In these percentages, the lower number is better, as they represent the difference between the face value of the plan that LNC will have to pay out versus the amount that the insured has paid into the plan plus earnings on invested cash from the account.

Life insurance was hit particularly hard during COVID-19, with mortality rates being 115% (calculated by actual deaths to expected) for 2020, and 2021. 1H22’s mortality rate remained higher than expected at 109%. Aging population coupled with COVID-19 mortality has increased life insurance sales for LNC by 53% year over year. To combat the added risk, sales have been shifted toward higher-premium or lower payout products.

Retirement planning services have been relatively unaffected by COVID and have seen solid results despite poor market performance. Sales have grown by 34% year over year with a 7% increase in recurring deposits into accounts. However, the largest amount of revenue increase has come from expense management; since embarking on a campaign to streamline operations and replace antiquated systems LNC has saved $30 million since 2017.

Group protection is the smallest market but is well positioned to be strong through periods of volatility with contracts tending to be variable and enter periods of renegotiation every 1-3 years. Premiums have gone up 6% year over year, with LNC increasing margins on accounts to 6.8%.

Risk Profile and Financial Health

97% of investments are in NAIC-declared investment-grade assets, 60% being rated A or higher, with no one sector coming out as a majority position. Increasing interest rates could prove to be a positive return on investment for high-grade debt.

53% of shares have been repurchased since 3Q10 for $8 billion. Additionally, over the same period, LNC has increased dividends by 30% on a 10-year CAGR basis. This includes a 7% increase for FY2022 announced in 4Q21.

LNC is attractively valued compared to its peers. LNC beat revenue targets by $73.4 million in 2Q22, and normalized EPS (removed one-off transactions before calculating earnings per share) was reached. Analysts’ consensus says that this could be sustainable, estimating EPS to grow by 29.3% year over year (2Q23).

Risk

The primary risk facing LNC has already been realized with a pandemic. Increased mortality rates greatly increase the risk realized by LNC; nonetheless, throughout the pandemic, the company has remained solvent and has only increased its RBC ratio, while also providing ample returns to shareholders in the form of dividends and buybacks.

Be the first to comment