herkisi

The full video special report version of this article was published on Dividend Kings earlier this week.

—————————————————————————————

This bear market has created incredible opportunities for high-yield income investors like you to take charge of your financial destiny and lock in dividend streams that could help you retire in safety and splendor.

And that doesn’t just mean crashing stock prices, either.

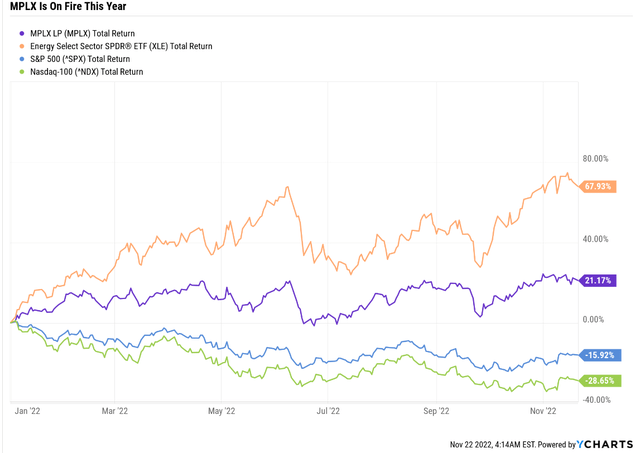

MPLX LP (NYSE:MPLX) is one of Wall Street’s darlings once more, driven higher by strong fundamentals this year, including a recent 10% hike to the payout.

That’s why it’s yielding a safe 9.4%, a potentially life-changing rich retirement payout, despite a 21% gain this year.

But this bear market is potentially far from over, and the worst might still be to come for the S&P.

So let me show you the three reasons you might want to buy MPLX today, but also be ready to back up the truck in case it gives back those gains (as it’s done twice this year) and the safe yield surges to 11% to 12%.

Reason One: MPLX Is One Of The Best Midstreams On Wall Street

Tax Implications

- Magellan is an MLP and uses a K-1 tax form

- 5 Things All MLP Investors Need To Know

- typical foreign investors have a 37% withholding (whether they can recoup it depends on their country’s tax code)

- MLPs are best owned by US investors in taxable accounts.

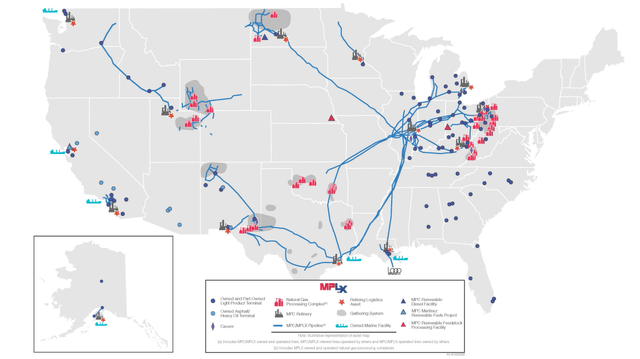

MPLX is the MLP Marathon Petroleum (America’s largest independent refiner, not an oil company) set up to own its midstream assets.

- the pipelines feeding its refineries.

It’s made many acquisitions over the years, including MarkWest, in 2015, the largest gas gathering and processing MLP in the Marcellus and Utica shale.

- Appalachia, Ohio, and PA

- America’s largest shale gas fields.

In November 2017, MPLX completed a mega-deal that bought out the remainder of MPC’s refinery transport capacity as well as its IDRs.

- reducing its cost of capital and significantly increasing its cash flow.

In 2018, MPC completed a $23.3 billion acquisition of Andeavor, a rival refining company, becoming the largest independent refiner in the U.S.

MPLX acquired Andeavor Logistics, gaining the refined product pipeline capacity Andeavor owned.

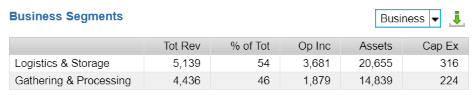

(Source: 10-K) FactSet Research Terminal

MPLX has now diversified its business, and 46% comes from non-MPC sources.

- BBB stable credit rating is still tied to MPC though

- 7.5% 30-year default risk.

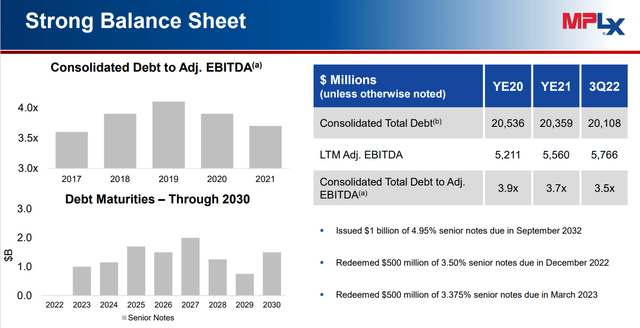

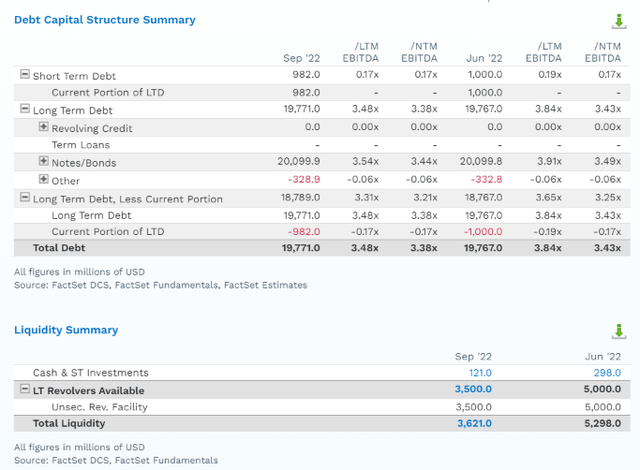

MPLX has been steadily deleveraging from safe levels to steadily safer levels of leverage.

- 5.0X or less debt/adjusted EBITDA is safe according to rating agencies.

Analysts expect MPLX’s leverage ratio to keep falling over time.

- 3.4X in 2023

- 3.0X by 2027

- thanks to its FCF self-funding business model.

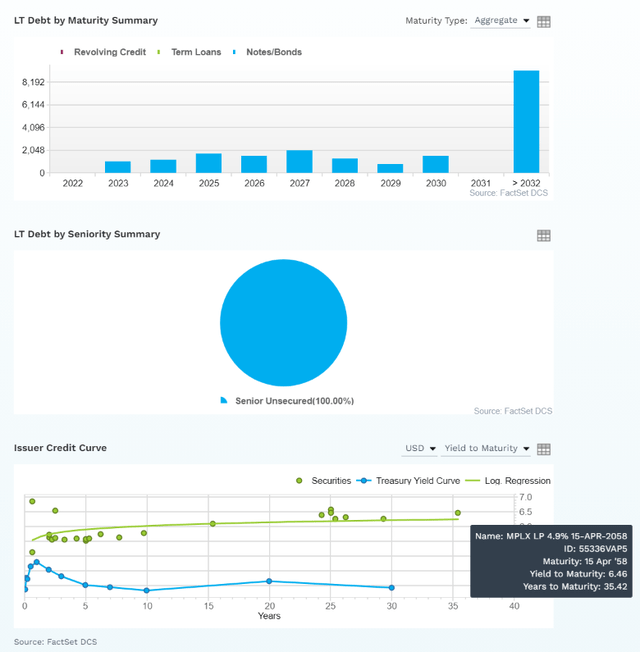

MPLX has well-staggered bond maturities, and 100% unsecured bonds for maximum financial flexibility, and the bond investors are so confident in its long-term energy transition plan they are willing to lend to it until 2058.

- the “smart money” on Wall Street” thinks MPLX will still be around in 36 years.

Get Ready To Potentially Back Up The Truck On MPLX

MPLX is one of Wall Street’s darlings once more, driven higher by strong fundamentals this year, including a recent 10% hike to the payout.

- “the safest dividend is the one that’s just been raised” – Wall Street adage.

A big reason for MPLX’s strong performance this year is energy is the best-performing sector.

That’s due to the price of oil almost doubling in the last year.

| Metric | 2021 Growth Consensus | 2022 Growth Consensus | 2023 Growth Consensus | 2024 Growth Consensus |

2025 Growth Consensus |

| Sales | 17% | 22% | -7% | -1% | -20% |

| Distribution | 5% | 10% (Official) | 6% | 5% | 8% |

| Operating Cash Flow | 9% | 1% | 0% | -2% | NA |

| Distributable Cash Flow | 13% | 4% | 5% | 1% | 4% |

| EBITDA | 9% | 17% | 2% | 2% | NA |

| EBIT (operating income) | 15% | 29% | -5% | -1% |

(Source: FAST Graphs, FactSet)

Energy prices are expected to mean in the coming year, but MPLX’s cutting spending will keep cash flows growing. Management’s commitment to a distribution-friendly capital allocation policy is expected to keep the payout growing at one of the fastest rates in the industry.

- growth spending was cut from $2.6 billion per year to $760 million due to the Pandemic oil crash.

Why might you want to buy MPLX today? Because of the safe and growing 9.4% yield.

That’s expected to hit a 12.2% yield on today’s cost in 2027.

BUT MPLX could easily suffer a major correction in the coming months.

- the blue-chip consensus is that stocks are going to roll over in Q1 2023 and possibly bottom 15% to 27% lower in Q1 or Q2.

(Source: NY Fed, CNBC, DK S&P 500 Valuation Tool)

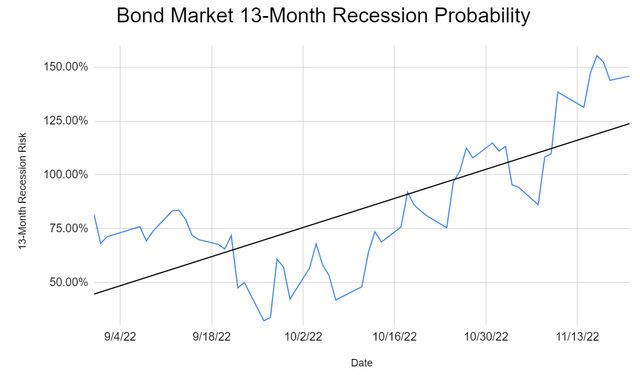

The bond market is 100% confident that we’re getting a recession next year.

How can a 13-month recession risk be over 100%?

- the bond market is pricing in a 100% risk of recession earlier than 13 months

- Bloomberg economic model says 100% recession probability in 2023.

85% of CEOs in the recent Conference Board survey say they expect a recession in 2023.

- brief and shallow

- 44% still plan to keep hiring

- just 14% plan to cut back on growth spending.

But even a shallow and mild recession is likely to send oil prices lower and even though that will have a minimal impact on MPLX’s long-term contracted revenue, it could potentially give back its recent 22% gains.

- POTENTIALLY sending the yield up to 11% to 12% in that potential scenario

That’s why you might want to buy some MPLX today, but be ready to buy more aggressively, using limits to lock in steadily better yields if the market offers them.

How would MPLX’s 9.4% yield (potentially on its way to 11.3% yield) be safe?

MPLX Is FCF Self Funding: Platinum Safety Standard For The Industry

| Year | Distributable Cash Flow | Free Cash Flow | Distribution | DCF Payout Ratio | FCF Payout Ratio | Distribution/Unit |

| 2022 | $4,750.3 | $3,913.34 | $2,987.82 | 62.9% | 76.3% | $2.97 |

| 2023 | $4,709.0 | $3,953.58 | $3,158.84 | 67.1% | 79.9% | $3.14 |

| 2024 | $4,754.6 | $4,144.72 | $3,329.86 | 70.0% | 80.3% | $3.31 |

| 2025 | $5,041.0 | $4,557.18 | $3,581.36 | 71.0% | 78.6% | $3.56 |

| 2026 | $5,124.0 | $4,718.14 | $3,822.80 | 74.6% | 81.0% | $3.80 |

| 2027 | $5,231.0 | $4,899.22 | $4,024.00 | 76.9% | 82.1% | $4.00 |

| Annual Growth | 2.0% | 4.6% | 6.1% | 4.1% | 1.5% | 6.1% |

(Source: FactSet Research Terminal)

In this industry, 83% of DCF payout ratios are safe, according to rating agencies.

MPLX has a 63% payout ratio for this year and uses an FCF self-funding business model.

- distributions covered by free cash flow

- FCF = operating cash flow – all spending (growth and maintenance)

- DCF = operating cash flow – maintenance spending (REIT equivalent of AFFO).

Midstream has moved to an equity self-funding business model, with some MLPs (like MPLX and EPD) going further to FCF self-funding.

- equity self-funding = zero reliance on new stock issuance to fund growth (just low-cost debt)

- FCF self-funding = zero reliance on new stock OR new debt to fund growth.

MPLX is expected to grow its distribution by 6% annually, raising the DCF payout ratio to a still-safe 77% by 2027 and the FCF payout ratio to 82%.

- a 100% FCF payout ratio is safe as long as the DCF payout ratio is 83% or less.

MPLX is expected to retain around 20% of FCF long-term to give it financial flexibility.

- for acquisitions

- debt repayment

- or buybacks.

MPLX has done $315 million in buybacks this year and has an additional $1 billion in further buybacks authorized.

- enough to repurchase 3% of its stock at current valuations.

Management Reiterates No MPC Acquisition Is Likely (emphasis added):

We’ve received questions on the structure of MPLX and whether MPC will acquire the partnership’s outstanding public units. So we want to restate what we’ve said in the past. First, we’ve grown MPLX into an entity with a public float of approximately $12 billion, which, compared to recent MLP roll-ups, is substantially larger. MPLX is a strategic part of MPC’s portfolio. MPLX has continued to demonstrate earnings growth. With the increased distribution announced today, MPC expects to receive $2 billion of distributions from MPLX annually.

As MPLX pursues its growth opportunities, we expect the value of this strategic relationship will continue to be enhanced. MPC believes its current capital allocation priorities are optimal for its shareholders, and it does not plan to roll-up MPLX. As we continue to grow our cash flows, we also remain focused on executing the strategic priorities of strict capital discipline, fostering a low-cost culture, and optimizing our asset portfolio.” – MPLX CEO, Q3 conference call

The biggest risk to MPLX’s distribution has always been MPC rolling it up and buying it in an all-stock deal. MPC owns 64% of MPLX’s voting rights, and if it wanted to acquire it MPLX investors couldn’t stop it.

- MPC yields 2.5%

- even with a premium, it would be a big effective payout cut for MPLX investors.

Fortunately, MPC is happy just to keep collecting its safe and steadily growing distributions from MPLX, now totaling $2 billion per year.

Reasons To Potentially Buy MPLX Today

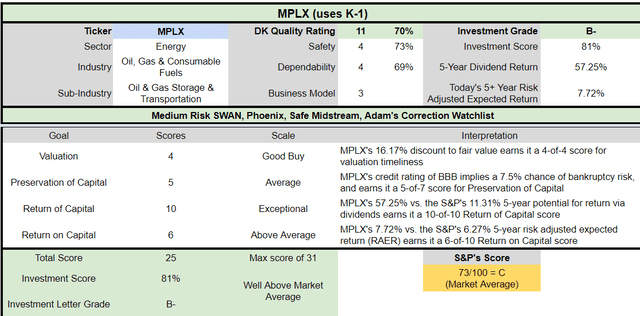

| Metric | MPLX |

| Quality | 70% 11/13 SWAN (Sleep Well At Night) Midstream MLP |

| Risk Rating | Medium Risk |

| DK Master List Quality Ranking (Out Of 500 Companies) | 450 |

| DK Master List Quality Percentile | 11% |

| Dividend Growth Streak (Years) | 10 (Every Year Since IPO) |

| Dividend Yield | 9.4% |

| Dividend Safety Score | 73% |

| Average Recession Dividend Cut Risk | 1.0% |

| Severe Recession Dividend Cut Risk | 2.70% |

| S&P Credit Rating |

BBB Stable Outlook |

| 30-Year Bankruptcy Risk | 7.50% |

| LT S&P Risk-Management Global Percentile |

47% Average, Medium-Risk |

| Fair Value | $39.07 |

| Current Price | $32.83 |

| Discount To Fair Value | 16% |

| DK Rating |

Potential Good Buy |

| P/cash flow | 6.9 (Anti-bubble blue-chip) |

| Growth Priced In | -3.2% |

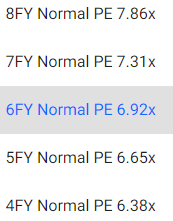

| Historical PE | 7 to 8 OCF |

| LT Growth Consensus/Management Guidance | 3.0% |

| 5-year consensus total return potential |

10% to 15% CAGR |

| Base Case 5-year consensus return potential |

11% CAGR (50% more than S&P) |

| Consensus 12-month total return forecast | 27% |

| Fundamentally Justified 12-Month Return Potential | 29% |

| LT Consensus Total Return Potential | 12.4% |

| Inflation-Adjusted Consensus LT Return Potential | 10.1% |

| Consensus 10-Year Inflation-Adjusted Total Return Potential (Ignoring Valuation) | 2.61 |

| LT Risk-Adjusted Expected Return | 8.03% |

| LT Risk-And Inflation-Adjusted Return Potential | 5.70% |

| Conservative Years To Double | 12.63 |

(Source: DK Zen Research Terminal)

MPLX is trading at 6.9X cash flow, an anti-bubble valuation.

- as long as MPLX grows faster than zero, long-term investors can’t possibly lose money

- unless they become panic sellers for emotional or financial reasons.

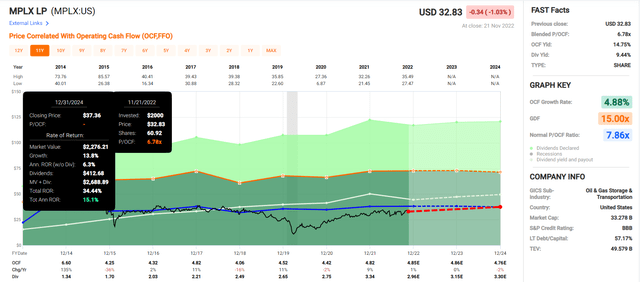

MPLX 2024 Consensus Total Return Potential

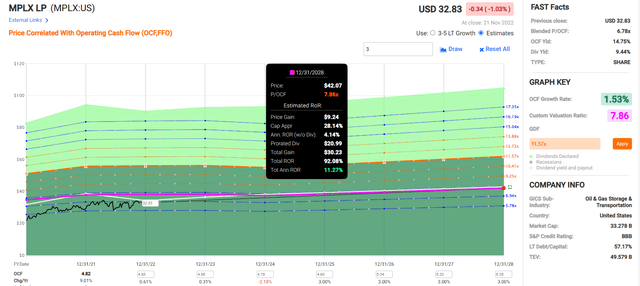

(Source: FAST Graphs, FactSet)

If MPLX grows as expected through 2024 (basically none at all), analysts think it could potentially deliver 15% annual returns.

- 33% more than the S&P 500.

MPLX 2027 Consensus Total Return Potential

(Source: FAST Graphs, FactSet)

If MPLX grows as expected through 2027 (1.5% CAGR) it could almost double, delivering 11% annual returns.

- 50% more than the S&P 500 consensus

- and a 12.2% yield on cost.

In other words, MPLX offers superior returns to the market but almost all in the form of a safe and rapidly growing distribution.

- the fastest growing payout in blue-chip midstream.

MPLX Investment Decision Tool

DK Dividend Kings Automated Investment Decision Tool

MPLX is a potentially satisfactory and reasonable ultra-yield SWAN opportunity for anyone comfortable with its risk profile. Look at how it compares to the S&P 500.

- 16% discount to fair value vs. 2% premium S&P = 18% better valuation

- 9.4% safe yield vs. 1.8% (5.2X higher and growing almost as fast)

- approximately 25% long-term annual return potential

- about 15% higher risk-adjusted expected returns

- 5X higher income potential over five years.

Reason Two: Steady Growth Prospects For Many Years Or Even Decades To Come

MPLX is priced for -3.6% growth, but here’s what analysts actually expect.

| Metric | 2021 Growth Consensus | 2022 Growth Consensus | 2023 Growth Consensus | 2024 Growth Consensus |

2025 Growth Consensus |

| Sales | 17% | 22% | -7% | -1% | -20% |

| Distribution | 5% | 10% | 6% | 5% | 8% |

| Operating Cash Flow | 9% | 1% | 0% | -2% | NA |

| Distributable Cash Flow | 13% | 4% | 5% | 1% | 4% |

| EBITDA | 9% | 17% | 2% | 2% | NA |

| EBIT (operating income) | 15% | 29% | -5% | -1% | NA |

(Source: FactSet Research Terminal)

MPLX’s cash flows aren’t growing fast, but they are growing, powering the best payout growth rate in blue-chip midstream.

What about the long-term?

MPLX Long-Term Growth Outlook

(Source: FactSet Research Terminal)

Long-term analysts expect MPLX to grow at a modest 3% rate.

- with a safe 9.4% yield that’s more than adequate to recommend it.

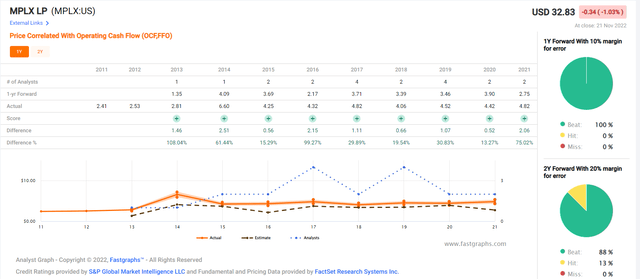

How accurate are analyst forecasts on MPLX?

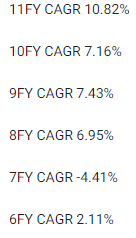

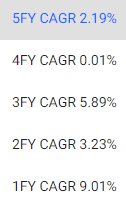

MPLX has beaten analyst forecasts every single year since its IPO.

- smoothing for outliers we’re using -a 5% margin of error to the downside and 30% to the upside

- 2% to 4% margin-of-error/historical adjusted growth consensus range.

(Source: FAST Graphs, FactSet) (Source: FAST Graphs, FactSet)

MPLX’s early double-digit growth was due to MPC dropping down lots of assets to it and buying MarkWest.

- outside of the dropdown era MPC grows at low single digits.

I consider analyst forecasts of 2% to 4% growth to be reasonable.

- MPLX’s biggest growth opportunity lies in natural gas transportation to LNG export terminals

- a huge new permanent growth opportunity thanks to the Russian invasion.

MPLX is also building crude pipelines for exports of US oil to Europe.

Long-term it plans to become a dominant hydrogen producer as well.

| Investment Strategy | Yield | LT Consensus Growth | LT Consensus Total Return Potential | Long-Term Risk-Adjusted Expected Return | Long-Term Inflation And Risk-Adjusted Expected Returns | Years To Double Your Inflation & Risk-Adjusted Wealth |

10-Year Inflation And Risk-Adjusted Expected Return |

| MPLX | 9.4% | 3.0% | 12.4% | 8.7% | 6.4% | 11.3 | 1.85 |

| Safe Midstream | 5.9% | 6.4% | 12.3% | 8.6% | 6.3% | 11.5 | 1.84 |

| REITs | 3.9% | 6.1% | 10.0% | 7.0% | 4.7% | 15.4 | 1.58 |

| Schwab US Dividend Equity ETF | 3.6% | 8.5% | 12.1% | 8.4% | 6.1% | 11.8 | 1.81 |

| Dividend Aristocrats | 2.6% | 8.5% | 11.1% | 7.8% | 5.4% | 13.2 | 1.70 |

| S&P 500 | 1.8% | 8.5% | 10.3% | 7.2% | 4.9% | 14.8 | 1.61 |

| Nasdaq | 0.8% | 11.8% | 12.6% | 8.8% | 6.5% | 11.0 | 1.88 |

(Sources: DK Research Terminal, FactSet, Morningstar, Ycharts)

MPLX is the highest-yielding safe midstream and offers Nasdaq like long-term return potential.

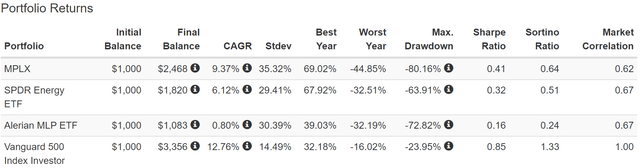

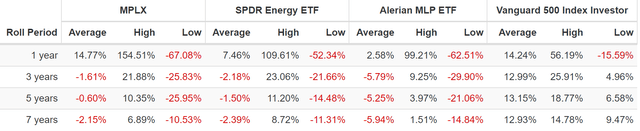

MPLX Historical Returns Since 2012

Despite the worst energy bear market in human history, MPLX has done a great job outperforming the energy sector and crushing the most popular MLP ETF.

The average 12-month rolling return is almost 15% CAGR, 2X that of the energy sector, 5X that of MLPs, and slightly more than the S&P 500.

- MPLX is not a value trap

- it’s a survivor of the worst industry bear market in human history.

Reason Three: An Anti-Bubble Valuation

(Source: FAST Graphs, FactSet)

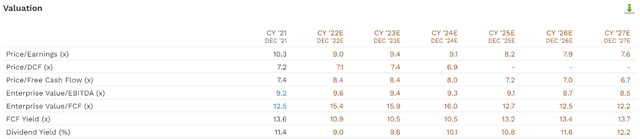

During the midstream bear market income investors have consistently paid between 7 and 8X cash flow for MPLX.

| Metric | Historical Fair Value Multiples (11-Years) | 2021 | 2022 | 2023 | 2024 |

12-Month Forward Fair Value |

| 5-Year Average Yield | 9.14% | $36.76 | $33.92 | $33.92 | $36.21 | |

| 13-Year Median Yield | 6.38% | $52.66 | $48.59 | $48.59 | $51.88 | |

| Operating Cash Flow | 7.86 | $37.89 | $37.41 | $37.41 | $37.41 | |

| Average | $41.33 | $39.07 | $39.07 | $40.75 | $39.07 | |

| Current Price | $32.83 | |||||

|

Discount To Fair Value |

20.57% | 15.96% | 15.96% | 19.44% | 15.96% | |

|

Upside To Fair Value (Including Dividends) |

25.89% | 19.00% | 19.00% | 24.13% | 28.44% | |

| 2022 OCF | 20223 OCF | 2022 Weighted OCF | 2023 Weighted OCF | 12-Month Forward OCF | 12-Month Average Fair Value Forward P/OCF |

Current Forward P/OCF |

| $4.76 | $4.76 | $0.37 | $4.39 | $4.76 | 8.21 | 6.90 |

MPLX is worth about 8X cash flow and trading at 6.9X.

|

Analyst Median 12-Month Price Target |

| $38.58 (8.1X cash flow) |

|

Discount To Price Target (Not A Fair Value Estimate) |

| 14.90% |

|

Upside To Price Target (Not Including Dividend) |

| 17.51% |

|

12-Month Median Total Return Price (Including Dividend) |

| $41.68 |

|

Discount To Total Price Target (Not A Fair Value Estimate) |

| 21.23% |

|

Upside To Price Target (Including Dividend) |

| 26.96% |

(Source: FactSet Research Terminal)

Analysts expect a 27% 12-month return as MPLX returns to 8.1X cash flow within a year.

- a fundamentally justified 12-month forecast

| Rating | Margin Of Safety For Medium Risk 11/13 SWAN Quality Companies | 2022 Fair Value Price | 2023 Fair Value Price |

12-Month Forward Fair Value |

| Potentially Reasonable Buy | 0% | $39.07 | $39.07 | $39.07 |

| Potentially Good Buy | 15% | $33.21 | $33.21 | $33.21 |

| Potentially Strong Buy | 25% | $29.30 | $29.30 | $29.30 |

| Potentially Very Strong Buy | 35% | $21.58 | $25.39 | $25.39 |

| Potentially Ultra-Value Buy | 45% | $21.49 | $21.49 | $21.49 |

| Currently | $32.83 | 15.96% | 15.96% | 15.96% |

| Upside To Fair Value (Including Dividends) | 28.44% | 28.44% | 28.44% |

For anyone comfortable with its risk profile, MPLX is a potentially good buy.

Risk Profile: Why MPLX Isn’t Right For Everyone

There are no risk-free companies, and no company is right for everyone. You have to be comfortable with the fundamental risk profile.

- non-U.S. investors might want to avoid MLPs entirely due to the very high tax withholdings

- new tax rules (according to Schwab) means that many investors might not be able to recoup those withholdings (which are increasing to potentially 55% in some cases).

MPLX’s Risk Profile Includes

- regulatory/political risk (in terms of energy production policy and project completion)

- green energy transition risk: MPLX is not an industry leader in green energy investments (that would be ENB)

- M&A risk: $3.4 billion in write-downs from overpaying for Andeavor Logistics

- labor retention risk (tightest job market in over 50 years)

- cybersecurity risk: hackers and ransomware (such as Colonial Pipeline)

- supply chain risk: disruptions during the last year

- Governance Risk: MPC owns 64% of MPLX and could one day decide to buy them

In March 2020, MPC completed a strategic review of MPLX and all its midstream assets.

- management reiterated that MPC has no plans to buy out MPLX

The outcome of the 2020 strategic review was disappointing, as it essentially maintained the status quo versus pursuing meaningful changes, highlighted by the focus on distribution. However, dealing with the large near-term impacts of the collapse in both oil demand and supply will consume the management team’s time in the near term. When market conditions improve as we expect in 2022, we may still see a C-corporation conversion or larger asset sales designed to rid the portfolio of weaker Andeavor Logistics assets.” – Morningstar.

Morningstar still thinks MPC will eventually buy MPLX, which could be a very bad thing for income investors.

- a taxable event for long-term MPC investors

- short-term investors might potentially be bought out at a lower price than they paid

- even with distributions they might break even if MPC buys them out

- a steep effective payout cut.

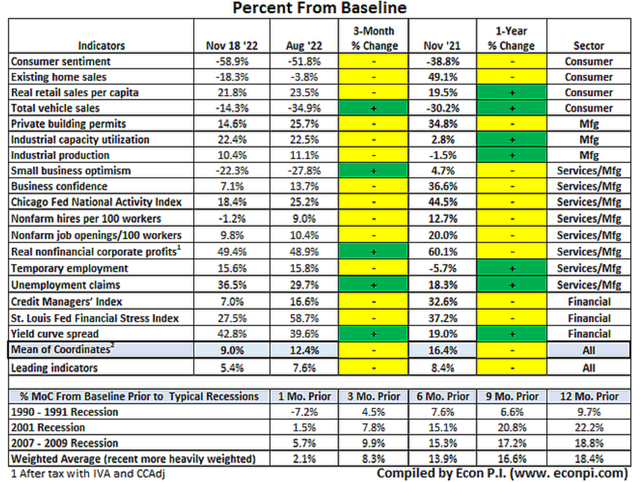

Recession is also coming in 2023, the bond market is certain of it.

18 economic indicators point to a potential recession beginning in four to five months.

- March to April

- agreeing with UBS and Goldman Sachs.

MPLX is likely to return to double-digit yields in the event of a recession during a 15% to 27% S&P sell-off.

How do we quantify, monitor, and track such a complex risk profile? By doing what big institutions do.

Long-Term Risk Management Analysis: How Large Institutions Measure Total Risk Management

See the risk section of this video to get an in-depth view (and link to two reports) of how DK and big institutions measure long-term risk management by companies

DK uses S&P Global’s global long-term risk-management ratings for our risk rating.

- S&P has spent over 20 years perfecting their risk model

- which is based on over 30 major risk categories, over 130 subcategories, and 1,000 individual metrics

- 50% of metrics are industry specific

- this risk rating has been included in every credit rating for decades.

The DK risk rating is based on the global percentile of how a company’s risk management compares to 8,000 S&P-rated companies covering 90% of the world’s market cap.

MPLX Scores 47th Percentile On Global Long-Term Risk Management

S&P’s risk management scores factor in things like:

- supply chain management

- crisis management

- cyber-security

- privacy protection

- efficiency

- R&D efficiency

- innovation management

- labor relations

- talent retention

- worker training/skills improvement

- customer relationship management

- climate strategy adaptation

- corporate governance

- brand management.

MPLX’s Long-Term Risk Management Is The 339th Best In The Master List (32nd Percentile In The Master List)

| Classification | S&P LT Risk-Management Global Percentile |

Risk-Management Interpretation |

Risk-Management Rating |

| BTI, ILMN, SIEGY, SPGI, WM, CI, CSCO, WMB, SAP, CL | 100 | Exceptional (Top 80 companies in the world) | Very Low Risk |

| Strong ESG Stocks | 86 |

Very Good |

Very Low Risk |

| Foreign Dividend Stocks | 77 |

Good, Bordering On Very Good |

Low Risk |

| Ultra SWANs | 74 | Good | Low Risk |

| Dividend Aristocrats | 67 | Above-Average (Bordering On Good) | Low Risk |

| Low Volatility Stocks | 65 | Above-Average | Low Risk |

| Master List average | 61 | Above-Average | Low Risk |

| Dividend Kings | 60 | Above-Average | Low Risk |

| Hyper-Growth stocks | 59 | Average, Bordering On Above-Average | Medium Risk |

| Dividend Champions | 55 | Average | Medium Risk |

| MPLX | 47 | Average | Medium Risk |

| Monthly Dividend Stocks | 41 | Average | Medium Risk |

(Source: DK Research Terminal)

MPLX’s risk-management consensus is in the bottom 32% of the world’s highest quality companies and similar to that of such other blue-chips as

- Nordson (NDSN): Ultra SWAN dividend king

- Honeywell (HON): Ultra SWAN

- Brown-Foreman (BF.B) Ultra SWAN dividend aristocrat

- NextEra Energy (NEE): Super SWAN dividend aristocrat

- Exxon (XOM): blue-chip dividend aristocrat

- Chevron (CVX): blue-chip dividend aristocrat

The bottom line is that all companies have risks, and MPLX is average at managing theirs according to S&P.

How We Monitor MPLX’s Risk Profile

- 14 analysts

- three credit rating agencies

- 17 experts who collectively know this business better than anyone other than management

- and the bond market for real-time fundamental risk-assessment updates

When the facts change, I change my mind. What do you do, sir?” – John Maynard Keynes.

There are no sacred cows at iREIT or Dividend Kings. Wherever the fundamentals lead, we always follow. That’s the essence of disciplined financial science, the math behind retiring rich and staying rich in retirement.

Bottom Line: Buy Some MPLX Today, But Be Ready To Back Up The Truck If It Crashes In The 1st Half Of 2023

Let me be clear: I’m NOT calling the bottom in MPLX (I’m not a market-timer).

SWAN (sleep well at night) quality does NOT mean “can’t fall hard and fast in a bear market.”

Fundamentals are all that determine safety and quality, and my recommendations.

- over 30+ years, 97% of stock returns are a function of pure fundamentals, not luck

- in the short term; luck is 25X as powerful as fundamentals

- in the long term, fundamentals are 33X as powerful as luck.

While I can’t predict the market in the short term, here’s what I can tell you about MPLX.

- One of the safest ultra-yield blue-chips on Wall Street.

- Safe 9.4% yield (5.2X the S&P yield and safer, growing 6% per year)

- 12.4% CAGR long-term total consensus, better than the S&P, aristocrats, SCHD, and almost matching the Nasdaq

- 16% historically undervalued, a potentially good buy

- 6.9X cash flow = anti-bubble blue-chip

- 92% consensus return potential over the next six years, 11% CAGR, about 50% more than the S&P 500

- 15% the risk-adjusted expected returns of the S&P 500 over the next five years

- 5X the income potential of the S&P over the next five years.

MPLX today offers one of the highest safe yields in the world, and is growing the distribution at 6% annually.

It owns one of the best asset bases in the country, with lots of growth opportunity in gas and oil exports to Europe.

It has one of the lowest leverage ratios in the industry, which is expected to keep falling for the next seven years thanks to its FCF self-funding business model.

MPLX MIGHT end up with a peak yield of 11% to 12% by the time the market bottoms…or it might not.

If the market gods are kind enough to offer us a life-changing yield like that, be ready to back up the truck and buy more.

But if the prospects of a safe 9.4% yield today, a relatively safe 12.2% yield on today’s cost in 2027, and S&P, and aristocrat beating 12.4% long-term return potential sounds good to you, then buy some MPLX today.

With an ultra-yield fast-income growth opportunity this good, buying today is likely to make you feel smart in 5+ years, and like a stock market genius in 10+ years.

Be the first to comment