Pgiam/iStock via Getty Images

The ProShares UltraPro S&P500 (NYSEARCA:UPRO), is a leveraged ETF designed to earn three times the daily return of the S&P 500. It’s important to clarify exactly what this means. This is ProShares statement concerning it:

This leveraged ProShares ETF seeks a return that is 3x the return of its underlying benchmark (target) for a single day, as measured from one NAV calculation to the next.

Due to the compounding of daily returns, holding periods of greater than one day can result in returns that are significantly different than the target return, and ProShares’ returns over periods other than one day will likely differ in amount and possibly direction from the target return for the same period. These effects may be more pronounced in funds with larger or inverse multiples and in funds with volatile benchmarks.

So, the prospectus clearly states the target is three times the daily return of the S&P 500, compounded daily. Because of this many short-term traders use it to trade the market for three or five days, trying to get three times the return of whatever the S&P 500 produces. Because of the fund’s volatility, most people would find it difficult to stay invested in UPRO for an extended period of time. However, because it’s hard to take a loss and hope springs eternal, many well intended short term trades that go against the trader end up long term investments.

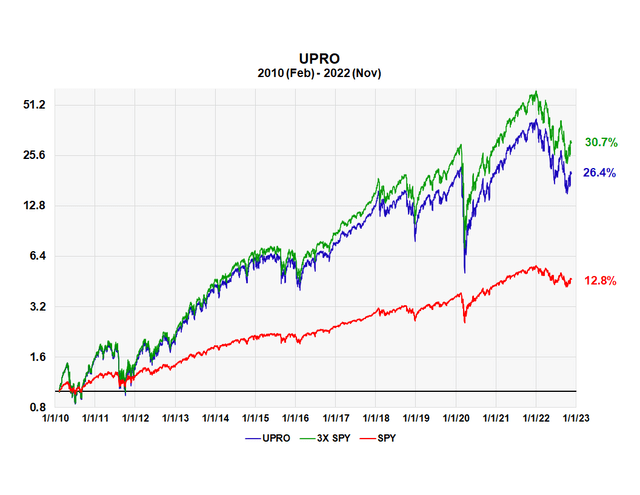

So, what has this fund’s long-term performance been? The chart below shows the results. We used February 6th, 2010 as the starting date since it allows us to measure all the leveraged ProShares funds from the same date.

Setting all values to $1 on that date, the SPY without dividends had a total annual return of 12.8% while UPRO had an annual return of 26.4%. This is 2.06X the S&P 500’s annual return. The green curve is the proxy of taking triple the daily returns of the SPY and compounding the results daily.

Long Term Performance of UPRO (Michael McDonald)

The graph makes the returns look quite spectacular. $1,000 invested on the start date in UPRO would have grown to $42,000 by December 31st of last year. However, this has been an unusually powerful bull market following the financial meltdown of 2007 and 2008. Since the start of this bear market the $42,000 has fallen to $20,000 as of last week, which is still pretty good.

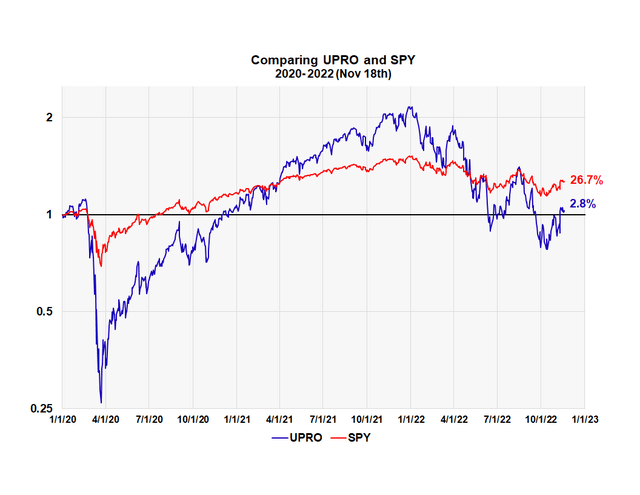

Performance of UPRO through two bear markets

We wanted to see how UPRO did through two bear markets, so we set the starting date to January 1st, 2020, just before the beginning of the COVID induced bear market. This would allow us to see the performance through two bear markets. The next chart shows the results.

Performance of UPRO and SPY through two bear markets (Michael McDonald)

The rally following the 2020 COVID induced bear market was so strong that the total return of the S&P 500 spider over the last two years, which includes both bear markets, is up 26.7%. The highly leveraged UPRO had a much smaller 2.8% return. One of the reasons for this large difference was because the strategy used in the ETF to obtain the 3X daily return broke down somewhat during the COVID decline, accentuating the losses. The starting value of $1 dropped to 28 cents by March before finally turning around.

If an investor can withstand the daily price gyrations of UPRO, we consider it a long term buy for the same reason we consider TQQQ a long term buy as explained in this article (here).

Summary

Except for unusual market circumstances, investors in UPRO can reasonably expect to achieve 3X the return of the S&P 500, both profit or loss, on short term trades. Over the long term they can expect just over 2X the long gain of the S&P 500 but will have to endure tremendous risks and emotional pressures almost every day on that long term journey.

Be the first to comment