Justin Sullivan/Getty Images News

In the 1980s, hostile takeovers were common, and research shows that tender offers were made at a 10% to 20% premium to the market price.

Musk is in line with the historical average by offering to buy Twitter (NYSE:TWTR) at an 18% premium from closing. But from his own stake in Twitter, the premium is almost 50% from his dollar cost of acquiring the stock (estimated $36/share), which is currently valued at $3.34 billion.

Valuation of Twitter is difficult because of the intangible value of digital advertising. Musk’s offer to switch it to a subscription model has the market reassess that Twitter shares must trade lower because of a likely large drop of active users.

While management could to reject Musk’s offer, which would make it a formal hostile takeover bid, Musk can pursue to accumulate more shares while seeking financing options. He could sell a fifth of his Tesla (TSLA) shares outright or borrow against them which converts the tender offer into a leveraged management buyout.

To that effect, the price action in Twitter bonds and options tells an “end game” scenario.

Twitter has $4.4bn in callable debt that is trading below 100 at an average yield of 4.5 percent. The clause attached to the bonds in the event of a takeover or change of control, the involved parties (e.g. Musk) must repurchase the bonds at 101 cents on the dollar. Twitter bonds are for that reason trading up by 85 cents in price.

Twitter options’ volume surged in puts and calls for strikes of $45 to $55/share. Call options with strikes of $50/share and higher recorded volumes of 30K to 70K, which was triple the volume of puts.

On an option volume weighted basis for May expiration, calls are pricing in a share price at $50.34, based on the large trading volumes after Musk’s tender announcement. That is 8% above current stock price.

Musk’s tender offer is just 8 percent above $50.34 that is implied by large option volumes. That is much lower than the tender offer premium of 18 percent to Wednesday’s close.

Twitter stock was down its the intra-day high, and traded 16% below the tender offer price. Yet, options are “betting” that Musk may prevail in the deal given the large rollover volumes in April calls to May and June calls for $55/share strike, which is above Musk’s tender offer price (Figure 1).

Figure 1: Twitter call option volumes for May and June

Twitter

Musk says he has a plan B. But the Twitter board appears to view the tender offer as ‘unwelcome’ and may consider a poison pill. It is likely the tender offer is a hostile takeover that could invite a bidding war that can dilute Musk’s stake in Twitter and limit his ability to increase his stake and thereby upping the price of the original tender offer to attract financing from external parties.

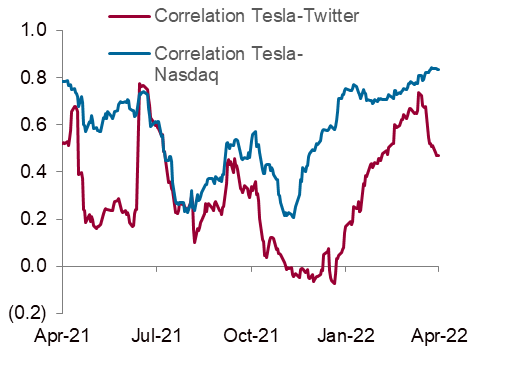

Social media stocks and ETFs were down on the day as it is unclear what Twitter’s valuation could be based on the tender offer. Moreover, Musk’s offer is above the stock’s 200-day moving average, making the shares short-term overbought. And, Musk’s actions are again affecting correlations in markets. Twitter and Tesla are tied to the hip, and that is driving up the correlation between Tesla and the Nasdaq (Figure 2).

A risk is that as Musk ups the stakes in the deal, the selloff in Tesla stock could weigh heavily on markets in the coming days. And that is likely dragging Twitter stock lower, making it harder for Musk to pursue the takeover.

Other bids for Twitter are in the works, but the valuation of the company may not reach much beyond Musk’s tender price. The stock trading at a 125x forward multiple remains very expensive no matter who ultimately wins the bidding war that is just getting started.

Figure 2: Twitter-Tesla-Nasdaq correlation

twitter (Twitter, Nasdaq)

Be the first to comment