deberarr

Introduction

GEO Group (NYSE:GEO) operates secure facilities, processing centers, and community reentry services in the United States, as well as in Australia, South Africa, and the United Kingdom.

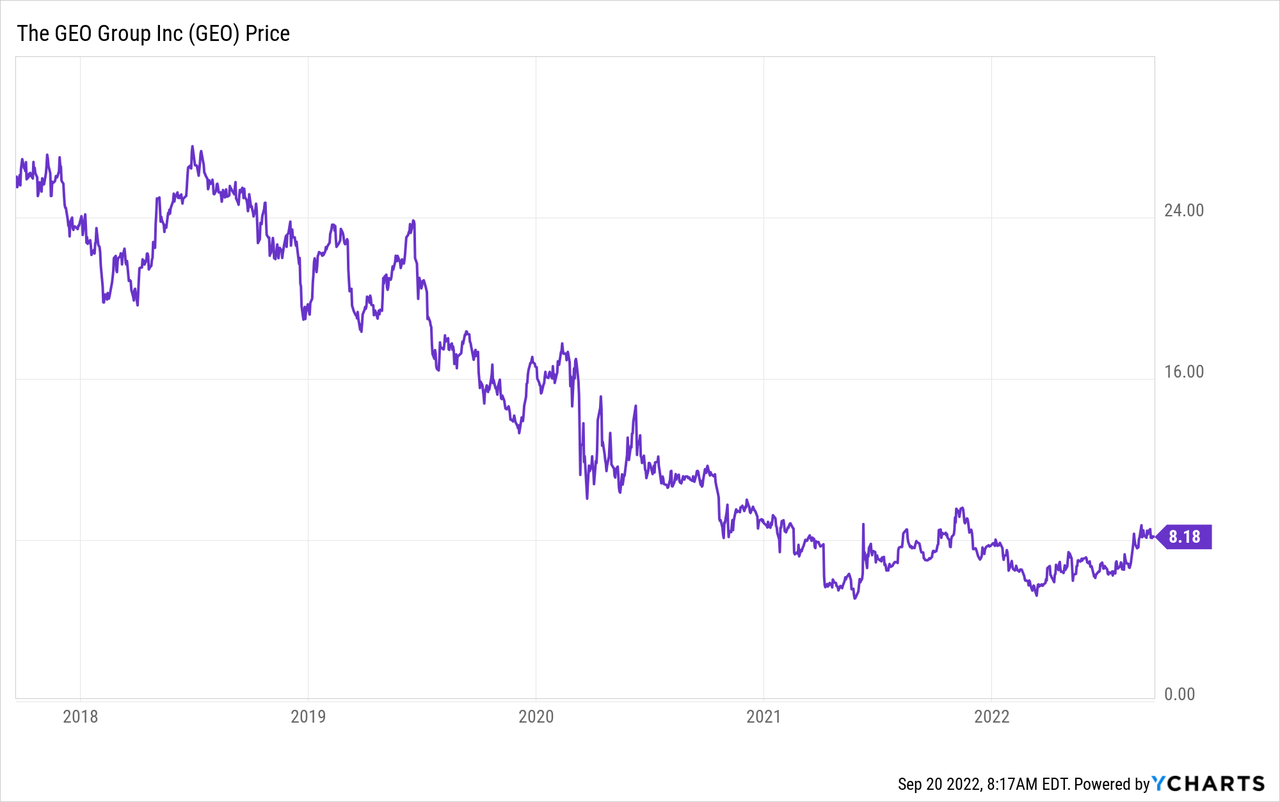

Over the past 5 years, the stock has fallen sharply because they had a large amount of debt maturing in the near future that was difficult to refinance. At the time, the stock was a REIT, which means that 90% of its profits must have been paid out as dividends. The REIT structure made it difficult to pay off their debts. Therefore, GEO was converted from a REIT to a C-Corp in 2021 and the dividend has lapsed.

The share price has fallen sharply, making the share worth investigating.

Meanwhile, GEO has managed to refinance its debt, leaving room for a dividend payment or share buyback program. GEO will have no problems paying off its debts in the coming years. Still, speculators are pessimistic, and short interest remains high. The improved outlook could cause the short sellers to close their positions, which should drive the share price up. Michael Burry (the well-known short seller during the financial crisis), also sees opportunities in GEO and has a large amount of GEO shares in his portfolio. The stock is worth buying.

Quarterly Earnings Were Impressive

Second quarter results were strong. Revenue was up 4% year over year and non-GAAP EPS came in at $0.11 above analyst expectations. The expectations for 2022 have been revised upwards. Previously expected to reach revenues of $2.22 billion, revenues have now been revised upwards to $2.35 billion (up 4% from 2022). Adjusted funds from operations for 2022 have also been revised upwards to $2.40 to $2.46 per diluted share. GEO’s results are excellent and came in strong.

GEO’s main priority is to reduce leverage and refinance its debt. Their leverage is reduced by funds from operations and asset sales. Recent quarterly figures show that GEO Group is in good financial shape.

Debt Maturities Are More Favorable Than Before

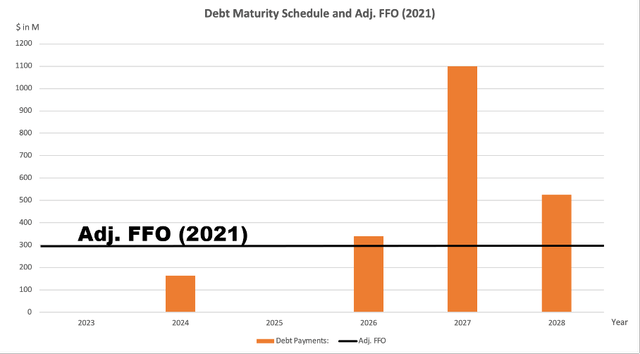

The management of GEO Group has made a strong effort to refinance the debt in the short term. This was successful, large amounts of debt do not mature in the near future. GEO has redeemed $126 million in senior notes due 2023, meaning there are no outstanding debt maturities before 2024.

Debt maturity schedule and adjusted FFO (GEO investor relations and author’s own visualization)

The adjusted FFO for 2021 was $299 million, comparing this figure to the debt maturity schedule, there is ample opportunity to pay a dividend or to repurchase shares in the near term.

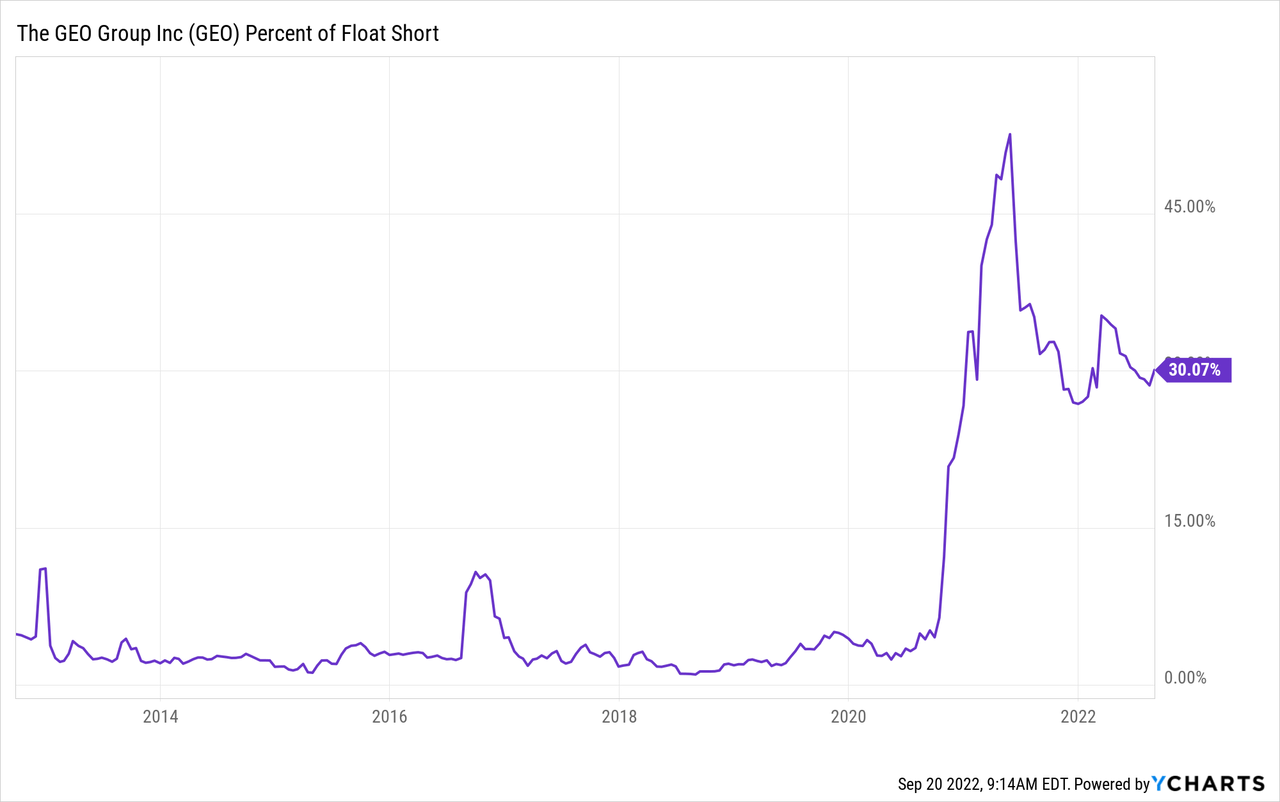

Short Squeeze Opportunity

Still, speculators remain pessimistic about GEO Group. Short sellers have prevailed over the past 5 years. Especially after 2020, short sellers started to gain the upper hand, more than half of stock float was short.

Is this a risk or an opportunity? I see this as a strong catalyst. The improved outlook and favorable debt maturities should ensure positive developments for the coming years. The short sellers could close their positions and buy the shares, which is 30% of GEO’s float. A short squeeze belongs to a certain possibility.

The management of GEO Group has not yet discussed share buybacks or dividend payments. But they are certainly possible, especially now that debt maturities are favorable.

If the short squeeze doesn’t happen, that’s no reason not to buy the stock. From now on, the maturities of the debts are favorable, and the low share price offers room for a possible dividend. I don’t see GEO Group’s revenue and profit growing strongly, but I do expect some stability in the dividend. The adjusted FFO for 2022 is expected to be $2.40 to $2.46. I don’t want to be too optimistic, but a high dividend can certainly be expected at a stock price of only $8.00.

Valuation Metrics

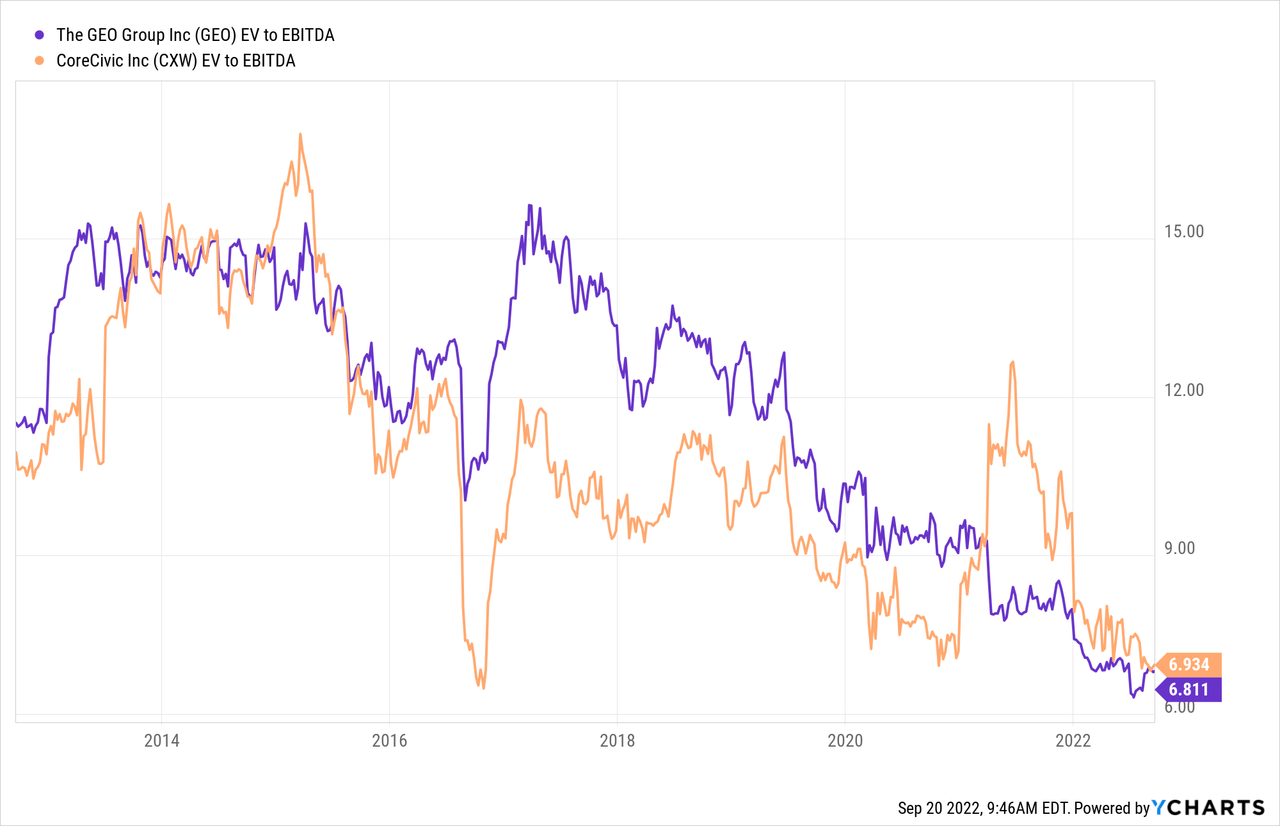

GEO Group’s competitor is CoreCivic, and since both companies had issues with their debt maturity schedules, it makes sense to compare the valuation metrics of each other.

I use the EV/EBITDA ratio for this because both debt, cash and market capitalization are compared to EBITDA. The graph shows that both companies are valued about equally cheaply. An EV/EBITDA of 6.8 is generally quite low, both companies are positioned very cheaply in the market.

In a previous article, I wrote about CoreCivic. CoreCivic has initiated a share buyback program with a repurchase yield of no less than 16%. The share buyback program will cause the supply of shares to decrease and demand to increase, which should drive CoreCivic’s shares up. GEO Group has not yet announced this, but due to the high short interest of 30% of float, this offers almost equal opportunities; there is more demand for GEO Group shares because the short sellers close their positions.

When comparing both companies, I prefer GEO Group. When short sellers close their positions, the share could rise sharply. GEO Group has the opportunity to initiate a share buyback program, this pushes the share price further up.

There is nevertheless a risk to GEO Group shares. GEO and CoreCivic are not popular with ESG conscious investors, and this is an ever-growing group. The increase in GEO Group shares will therefore have to come mainly from institutional investors without high ESG requirements and from individual investors with the same principles. As a result, I expect that the stock will never reach a high equity valuation.

Conclusion

GEO Group operates secure facilities, processing centers, and community reentry services. The stock has fallen sharply in recent years due to difficulties in refinancing its debt, and the emergence of ESG-conscious investors is also hampering its upside potential. The debt refinancing was successful. The next major debt payment will take place in 2026. This creates room to pay out a dividend or initiate a share buyback program. Since GEO Group was previously a REIT, this is not unlikely. Over 30% of float stocks have gone short, which I see as a strong catalyst to drive the stock price up. As fundamentals improve, I think speculators short in GEO stock will then close their positions which they do by buying the stock. This increases demand and thus should increase the share price. The share repurchase program should give an extra boost to the share price. GEO Group’s stock valuation is low, as is that of direct competitor CoreCivic. More and more investors are ESG conscious, they disapprove investment in prisons. The rise of GEO Group shares is therefore mainly dependent on less conscious ESG investors and individual investors. The improved outlook and financial situation, the potential to initiate a share buyback program or pay dividends, the high short interest and the low valuation make this stock worth buying.

Be the first to comment