DarthArt/iStock Editorial via Getty Images

Investment Thesis: While Hyundai Motor Co. (OTCPK:HYMLF) may see growth in sales from the Hyundai Ioniq 5, I take the view that investors will prioritize cash flow growth and long-term debt reduction in the current inflationary environment.

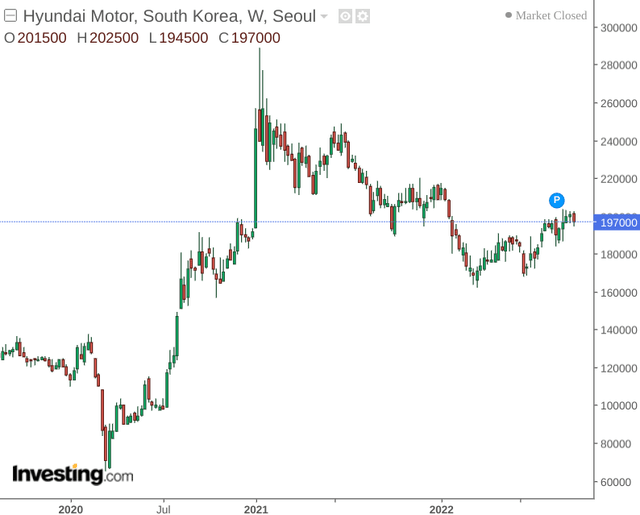

Hyundai Motor Co. has seen a decline in performance since early 2021 – as inflation and supply chain concerns continue to weigh on the automobile industry as a whole.

The purpose of this article is to assess whether we can expect Hyundai Motor Co. to see a rebound in performance once market conditions become more stable.

Performance

From a balance sheet perspective, here is a calculation of the quick ratio (calculated as cash plus trade notes and accounts receivable all over total current liabilities) for June 2019 and June 2022.

| June 2019 | June 2022 | |

| Cash and cash equivalents | 9491773 | 16129381 |

| Trade notes and accounts receivable | 4112803 | 4087083 |

| Total current liabilities | 50465688 | 71761301 |

| Quick ratio | 0.27 | 0.28 |

Source: Figures sourced from Hyundai Motor Co. – June 2019 and June 2022. Figures in millions of Korean won. Quick ratio calculated by author.

We can see that the quick ratio is virtually unchanged over this period – and while cash and cash equivalents has increased strongly over this time – so has total current liabilities.

With sales coming under pressure due to a potential recession going forward – investors are likely to pay more attention to cash flow, in order to ensure that Hyundai Motor will be able to buffer itself against a drop in sales.

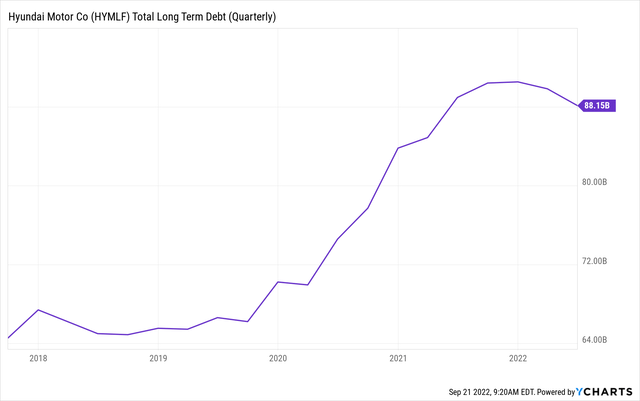

Additionally, long-term debt levels have also increased strongly for Hyundai Motor Co. over the past five years.

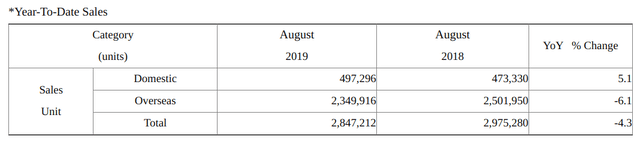

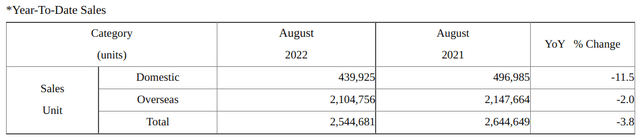

When looking at sales performance for August 2022 as compared to August 2019 – we can see that domestic and overseas sales are still below that of 2019 levels:

August 2019

Hyundai Motor Co.: August 2019 Sales Results

August 2022

Hyundai Motor Co.: August 2022 Sales Results

From this standpoint, lower sales coupled with increasing pressure on cash flow could place some pressure on the stock going forward.

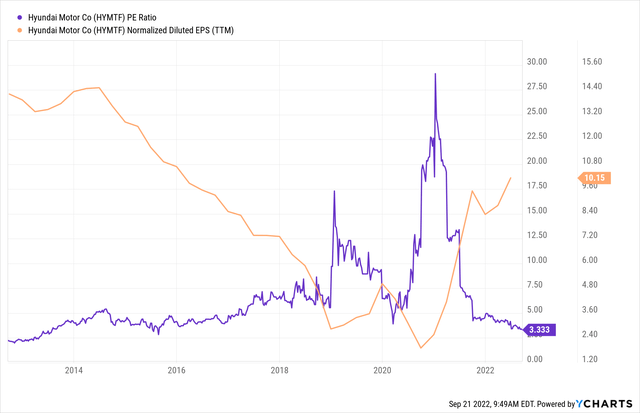

Additionally, we can see that while Hyundai Motor has seen its P/E ratio trade near 10-year lows along with a recovery in earnings growth – investors might take the view that potential pressure on sales and cash flow might make the stock too risky at this time.

Looking Forward

Going forward, Hyundai Motor Co. will continue to face the same risks inherent to any major automobile company – inflation and supply chain risk.

Additionally, should these factors hinder the company’s ability to bolster its cash flow and pay down long-term debt – then this could also make investors apprehensive.

With that being said, there could be some cause for optimism. While August 2022 sales are still technically below that of 2019 levels – it is also noteworthy that plug-in car sales were up by 25% – with the Hyundai Ioniq 5 remaining the top-selling EV vehicle at approximately 8,000 units per month.

Moreover, the model was also listed as being among the top 10 best-selling electric vehicles in 2022. In this regard, should the prospect of recession not be as severe as anticipated in the coming year – then I see significant potential for Hyundai to bolster sales back past 2019 levels.

Conclusion

To conclude, Hyundai Motors has seen the macroeconomic pressures of supply chain risk and inflation weighing on sales growth to a degree – with sales yet to surpass 2019 levels. However, strong performance by the Hyundai Ioniq 5 could mean that we see a rebound in sales growth.

At the same time, investors are likely to pay more attention to cash flow growth and long-term debt to determine if the company can continue to invest sustainably into its business over the longer-term.

My overall view is that while the stock could have upside potential over the longer-term, investors may tread cautiously in the short to medium-term.

Be the first to comment