sanfel/iStock Editorial via Getty Images

Elevator Pitch

My investment rating for Wynn Resorts, Limited’s (NASDAQ:WYNN) stock is a Hold. I did a comparison of Wynn Resorts and its peer MGM Resorts International (MGM) in my prior January 25, 2022 article.

I have downgraded my rating for Wynn Resorts from a Buy to a Hold with the publication of this latest update on WYNN. Although recent developments relating to COVID-19 restrictions and reopening for Zhuhai and Hong Kong are encouraging, there is uncertainty relating to WYNN’s bid to win a new gaming license for the Macau market with the emergence of a new bidder. This explains my decision to rate Wynn Resorts as a Hold rather than a Buy.

WYNN Stock Price Performance

Wynn Resorts’ shares have done poorly in 2022 thus far, but its recent share price performance in the past month has been good.

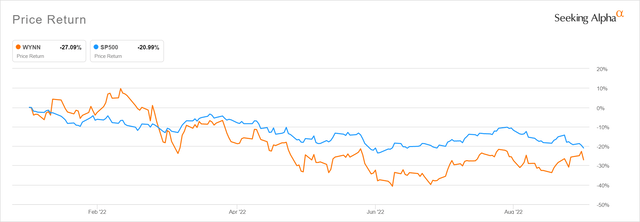

WYNN’s 2022 Year-to-date Stock Price Chart

Year-to-date, Wynn Resorts’ stock price fell by -27.1%, and this is worse than the S&P 500’s -21.0% correction during the same period. It is easy to understand why WYNN’s shares have performed badly in this year thus far. Macau’s gross gaming revenue or GGR for the first eight months of 2022 dropped by -53% YoY to MOP$28.9 billion, and this only represents 15% of the pre-pandemic GGR for Macau. I noted in my previous late-January 2022 update for Wynn Resorts that Macau accounted for more than three-quarters of the company’s pre-COVID EBITDA for 2019.

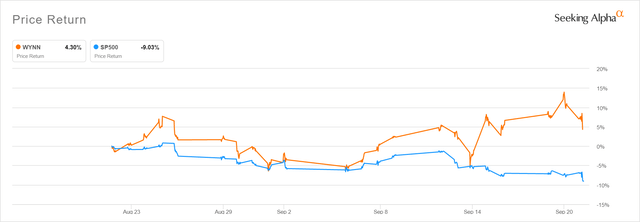

Wynn Resorts’ Stock Price Performance For The Last One Month

However, there has been a reversal of fortunes for Wynn Resorts in the recent month. WYNN’s shares rose by +4.3% in the past one month, while the S&P 500 declined by -9.0% in the same time frame.

For the rest of the article, I touch on the factors that drove WYNN’s recent share price outperformance and discuss whether this is sustainable.

Hopes Of Increased Tourist Arrivals During Golden Week Holiday

On September 19, 2022, local media The Macau Post Daily reported that Chinese city “Zhuhai has raised the validity of the negative COVID-19 nucleic acid test (or NAT) result (a COVID-19 travel requirement in China) for arrivals from Macau to 48 hours from just 24 hours.” Gaming publication GGR Asia had previously highlighted in an August 1, 2022 article that Zhuhai is “the main land entry point for Mainland (Chinese) tourists to Macau.”

Prior to the pandemic outbreak in 2019, Mainland Chinese visitors made up around 90% of the tourist arrivals for Macau. Separately, a major holiday for Mainland China, National Day or Golden Week will fall in the period between October 1 and October 7, 2022, and this has traditionally been a key window for tourists from Mainland China visiting Macau.

As such, the change to NAT requirements for Zhuhai and Macau has come at an important time, just weeks before the Golden Week holiday starts. It is reasonable to assume that this new development will help to drive higher Mainland Chinese tourists arrivals to Macau (and increased gross gaming revenue for the Macau gaming sector) during the National Day holiday next month. Therefore, it isn’t a surprise that Wynn Resorts’ stock price went up by +3% on September 20, 2022, a day after the new Zhuhai NAT requirements were announced.

There is also another piece of positive news that boosted WYNN’s share price on September 20, 2022, which I will discuss in the next section.

Hong Kong Quarantine Requirements Change Is A Positive Signal For Macau

A September 20, 2022 Seeking Alpha News article mentioned that “Hong Kong wants to relax COVID rules such as mandatory hotel quarantine”, and it was also noted in this article that “Mainland officials are reported to have signaled their approval for new COVID rules” for Hong Kong.

As it stands now, people from abroad visiting Hong Kong have to undergo quarantine in hotels for three days, and then stay at “home or alternative accommodation” for the subsequent four days, which is referred to as the “3+4” system. The expectations are that Hong Kong will do away with hotel quarantine, and move to a “0+7” system for people entering Hong Kong.

This recent development for Hong Kong is seen as a positive move for the Macau Special Administrative Region.

Mainland China appears to be sticking firmly to its COVID-zero policy. But it seems that the Chinese authorities are willingly to make the Hong Kong Special Administrative Region an exception to some degree, and this raises hopes that the Macau Special Administrative Region could follow in the footsteps of Hong Kong in terms of a relaxation of COVID-19 restrictions. As defined by Thomson Reuters (TRI), both Hong Kong and Macau are Special Administrative Regions or “territories that fall within the sovereignty of the People’s Republic of China, but do not form part of Mainland China” which “have a high degree of autonomy.”

According to a September 21, 2022 Focus Gaming News article which cited a news report from Macao Daily News, “Andy Wu Keng Kuong, president of the Macau Travel Industry Council” was quoted in an interview (following the recent Hong Kong development) saying that “Macau should reduce quarantine days to five or fewer in order to attract more tourists.” Although nothing official has been announced, it is understandable that WYNN’s share price has been boosted by expectations of similar changes to quarantine requirements for Macau in time to come.

Nevertheless, there is a significant risk factor for Wynn Resorts that investors need to watch, and I touch on this in the subsequent section.

Macau Gaming License Tender Draws Attention

The biggest downside risk for Wynn Resorts is that its Macau business arm and listed subsidiary, Wynn Macau, Limited (OTCPK:WYNMF) (OTCPK:WYNMY) [1128:HK] doesn’t succeed in its attempt to secure a new Macau gaming license.

Bloomberg reported on September 15, 2022 that “a total of seven candidates will compete for Macau’s six casino licenses, with a firm (GMM Ltd.) linked to (Malaysia’s) Genting Group joining the bid in a surprise move.” Earlier, it was expected that only the six existing players in the Macau gaming industry, Wynn Macau, Galaxy Entertainment Group Limited (OTCPK:GXYEF) (OTCPK:GXYYY) [27:HK], Sands China Ltd. (OTCPK:SCHYY) (OTCPK:SCHYF) [1928:HK], MGM China (OTCPK:MCHVF) (OTCPK:MCHVY) [2282:HK], SJM Holdings (OTCPK:SJMHF) (OTCPK:SJMHY) [880:HK], and Melco Resorts & Entertainment (MLCO) will participate in the new gaming license tender.

In theory, the incumbents should have an edge over a new bidder in the gaming license tender by virtue of their respective operating track records. But it has long been a concern that US-linked casino operators like Wynn Macau might be disadvantaged in their respective bids to renew their existing gaming licenses due to poor US-China relations. With a new non-US, Asian company joining the Macau gaming license tender, this increases the probability that the regulatory authorities might favor the new entrant, GMM Ltd., over one of the existing US-linked Macau casino operators for the six licenses up for grabs.

In the worst case scenario, if Wynn Macau doesn’t win the new gaming license, Wynn Resorts could potentially lose up to three-quarters of its EBITDA on a normalized basis (pegged to pre-pandemic 2019 levels as highlighted earlier in the article). The winners of the new gaming licenses for the Macau market are expected to be revealed prior to the end of this year which is when the existing gaming licenses for Wynn Macau and other incumbents expire.

Bottom Line

I rate Wynn Resorts as a Hold. The key positive for WYNN is that there is some progress in terms of China’s reopening which might be beneficial for Macau’s tourism industry and gaming market. On the flip side, the major risk for Wynn Resorts is that the company’s key Macau subsidiary doesn’t obtain a new gaming license when the results of the new gaming license tender are announced.

Be the first to comment