Morsa Images/DigitalVision via Getty Images

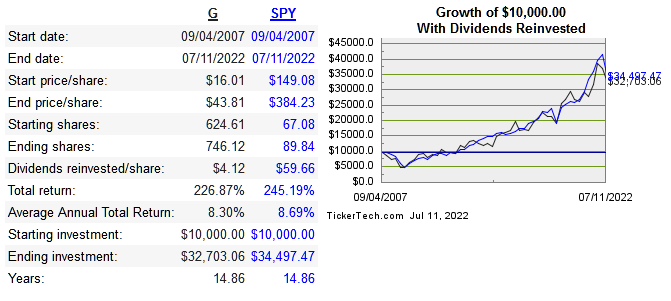

Genpact Limited (NYSE:G) was created inside General Electric (GE) in the late 90s as a method to help implement the revered Six Sigma initiatives throughout the company. The project was so successful that it eventually became independent of GE in the mid-2000s and was sold to two private equity firms. The separated business was taken public in 2007, which of course was an unfortunate time to begin as a public company. The chart below shows how the stock has performed versus the market.

dividendchannel

Essentially matching the market for almost fifteen years by itself is not a promising sign, but this does overshadow what is a very good company underneath. Whether the share prices offer a good deal on a company with this kind of earnings power is another thing.

G isn’t the biggest, but it is clearly one of the best in its category, with many Fortune 500 companies and beyond as customers. Below are return metrics compared with peers.

|

Company |

10-Year Median ROE |

10-Year Median ROIC |

10-Year EPS CAGR |

10-Year FCF CAGR |

|

G |

19% |

10.2% |

9% |

10.8% |

|

12% |

9.6% |

11.8% |

15% |

|

|

14.1% |

11% |

8.8% |

9.4% |

|

|

16.3% |

14.4% |

25.3% |

n/a |

Capital Allocation

Management’s ability to allocate the growing free cash flow (“FCF”) is the key question going forward. They regularly make acquisitions and use debt to fund much of these purchases. A dividend has been paid regularly since 2017 and has increased yearly around 11% CAGR. They have been a net repurchaser of shares since 2014, but share count has shrunk by a mere 2%. They’ve indicated spending around 50% of operating cash flow on dividends and buybacks

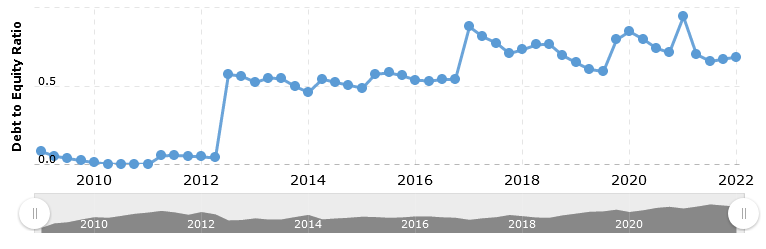

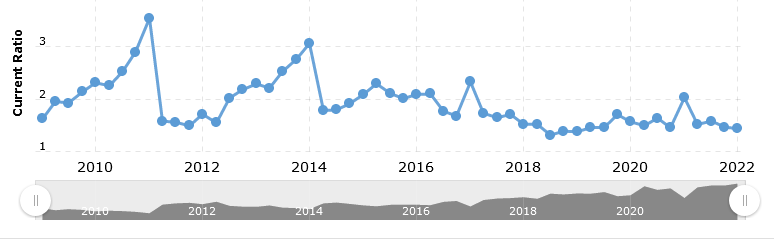

Long-term debt has increased noticeably over the past decade, but at this point, FCF has increased at a healthy rate, and the ability to aggressively pay down debt exists at any time, even if it never really happens. They do regularly repay debt as well, so the increase of longer-term debt shouldn’t be an issue. The current ratio has never gotten out of control historically, and this is with regular acquisitions every year.

macrotrends

macrotrends

Valuation

Below is a table of relative pricing by multiple.

|

Company |

EV/Sales |

EV/EBITDA |

EV/FCF |

P/B |

|

G |

2.1 |

12.8 |

19 |

4.4 |

|

EXLS |

4.3 |

21.6 |

49.3 |

7.3 |

|

TTEC |

1.6 |

12.4 |

29.4 |

5.2 |

|

WNS |

3.1 |

20.5 |

20.9 |

5 |

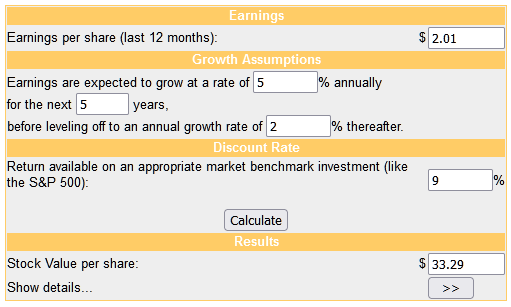

Below is an extremely conservative discounted cash flow (“DCF”).

moneychimp

For all the reputation that GE has as a decline of a great American business, G was one good aspect to come from the parent. It was a corporate creation to help with efficiency that did its purpose and expanded beyond serving the parent company effectively. Credit should be given, since historically implementing the use of internal consultants doesn’t always work out as intended.

To be specific, I see G as a very good company, but not great. This means that in order to get great returns over a longer time horizon, you need to buy at a pretty big discount. The company has reached a certain level of maturity now, and the top line growth will slow, but this doesn’t mean that EPS won’t grow at the same time.

At current prices, this isn’t an attractive bet, especially since dividends will contribute a more meaningful impact on total return going forward with the current dividend yield only 1%. Even though the price currently sits at around 20% lower than its highs in early January, this is modest compared to the more hyped growth companies. I see G as slightly overvalued here, but would be interested if lower prices offer a higher dividend yield.

Conclusion

The history of Genpact deserves respect, considering it was created from scratch at an already massive conglomerate. Growth of EPS and FCF have been impressive so far, but the company is at a new stage of maturity, which means that capital allocation takes on increasing importance. There is nothing suggesting that they will enter a new phase of far above-average returns on capital, since incremental returns on here will undoubtedly lower, proven by current and stated dividend and repurchase policy. G appears overvalued fundamentally and only modestly underpriced on a relative basis.

Be the first to comment