Sundry Photography

Broadcom (NASDAQ:AVGO) is one of our favorite stocks in the semiconductor industry. AVGO operates a wide range of semiconductors and infrastructure software solution businesses. Our bullish stance on the stock is because we believe AVGO provides an attractive risk-reward situation at current levels because of its diversified semiconductor business. The company also has a diversified and expanding software segment that provides a stable profit stream during demand headwinds within semiconductors. We believe the company is well-positioned to beat the semiconductor market indices in the coming quarters.

The semiconductor market is facing demand headwinds to which AVGO is not immune. Yet, we believe the stock will still beat the competition and indices. In 2Q22, AVGO revenue grew 23% to $8.1B and, in turn, beat consensus estimates by around 3%. We recommend investors buy into the tech giant because we expect it to be among the few that will weather current market volatility and beat expectations.

Optimistic due to AVGO’s broad reach into the semiconductor market.

AVGO operates in semiconductor and software segments, but its main business and stronghold is its semiconductor business. During 2Q22, semiconductor solutions made up 77% of revenues, while the rest was software solutions. AVGO’s business touches upon several markets within the semiconductor industry. The company’s role in semiconductors is that of a global supplier of products used in enterprise and data center markets, home connectivity, broadband access, telecommunications equipment, smartphones, data center servers, and storage systems, among others.

We believe the company’s wide range of businesses within semiconductors makes it extremely well-positioned to beat competitors and indexes who are more exposed and vulnerable to single markets within the semiconductor industry.

AVGO is focused on growth despite volatile demand.

Even though the company makes most of its revenue from the semiconductor segment, we believe AVGO is utilizing its software segment to stabilize the company when semiconductor demand headwinds arise. The company has been expanding its software offerings by acquiring enterprise software companies. AVGO acquired Symantec Enterprise Security business in 2019. A year earlier, AVGO acquired CA Technologies. The company is also working to close the deal to acquire VMware (VMW). VMW is the industry leader with a steady revenue stream from its virtualization software business that includes server, storage, and networking virtualization and Virtual Desktop Infrastructure (VDI) technology.

AVGO is beating competitors and semiconductor indices.

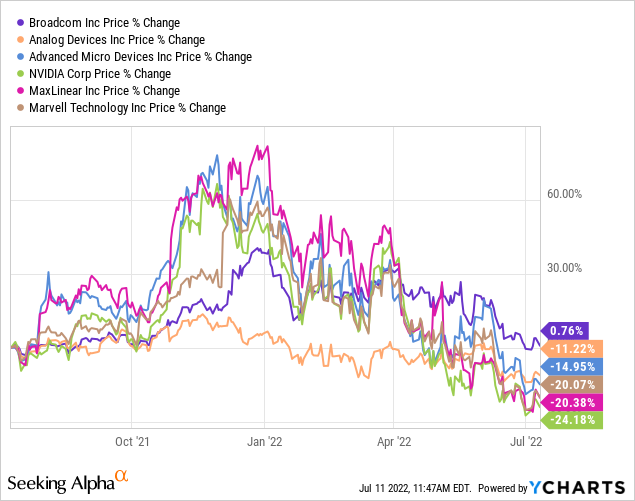

Although AVGO operates in a highly competitive industry, we expect the company will likely beat competition and semiconductor indexes because it already has. AVGO’s significant competitors are Analog Devices (ADI), Advanced Micro Devices (AMD), Nvidia (NVDA), MaxLinear (MXL), and Marvell Technology (MRVL). The following graph outlines AVGO’s stock performance over the past year compared to the competition. AVGO is the only company among its primary competitors that showed positive growth throughout the past year. Our bullish stance on the stock is primarily because the company is well-positioned to weather market volatility. We expect the positive momentum in the stock to continue, as shown in the graph comparing AVGO to its competition. The company is already introducing new product lines and managing risks of over-ordering. We believe the company is a buy because it will continue to beat the competition.

Ycharts

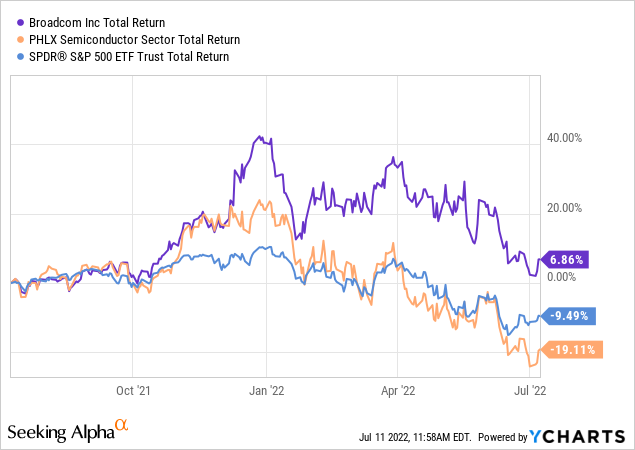

AVGO is not only beating the competition, but it is also beating semiconductor indices. The following graph compares AVGO to its semiconductor peers. We at Techstockpros look for companies that are likely to outperform peers. We look for companies that are likely to grow faster than the industry and can gain share. We recommend AVGO because we believe the company is likely to beat the semiconductor market in the coming quarters.

Ycharts

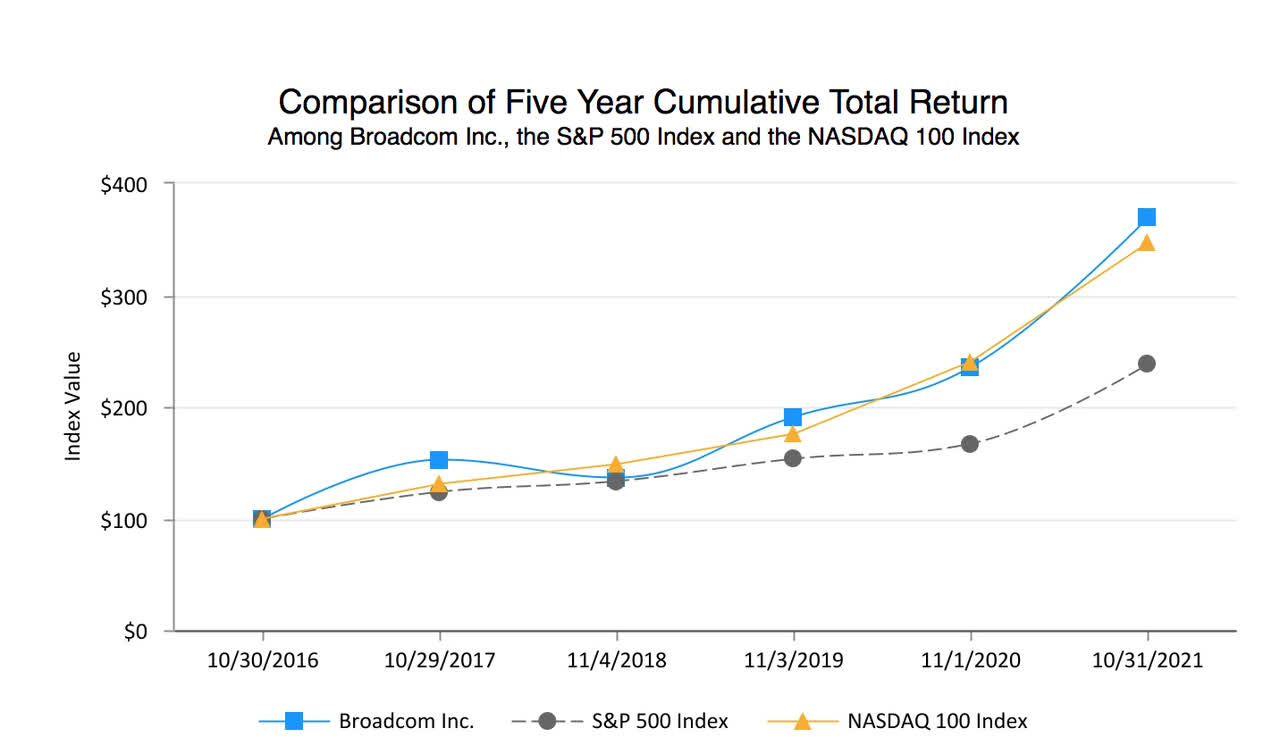

AVGO’s outperformance of semiconductor indices is not new. The following graph from the company’s 2021 10-K also shows a comparison of the five-year cumulative total return of AVGO in contrast to the S&P 500 index and NASDAQ 100 index. We believe AVGO will continue to beat the semiconductor market and recommend it as a buy.

Broadcom 10-K

Stock performance:

AVGO stock performance reflects a steady upward trend over the past five years. During that period, the stock rose around 94%. The stock is still well above the pandemic low of March 2020. AVGO stock peaked at $678 during its 52-week high and is currently trading at $491, closer to its 52-week low of $456. The stock performed better when compared to others in its peer group. YTD stock is down 30%. We believe the drop is not unique to AVGO but the reality of the semiconductor peer group due to demand headwinds. We believe AVGO is well-positioned to resume its upward trend when inflationary pressures ease and consumer spending speeds up. We recommend buying the stock based on its potential upside and attractive valuation.

The following graphs outline AVGO’s stock performance.

Ycharts Ycharts

Valuation:

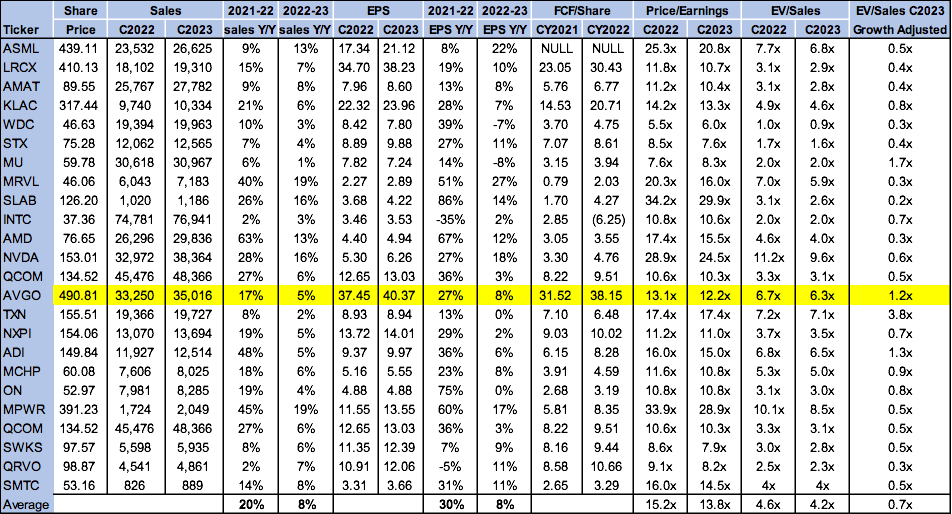

AVGO is trading at around $491. We believe the stock is reasonably valued with a P/E of 12.2x C2023 EPS of $40.37 compared to a peer group average of 13.8x. The stock is trading at 6.3x C2023 on an EV/Sales basis compared to an average of 4.2x. We believe the stock is considered a growth pick and are optimistic about the potential upside when the market stabilizes. The following chart illustrates the semiconductor peer group valuation.

Refinitiv

Word on Wall Street:

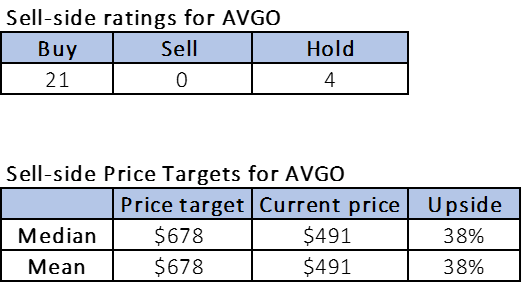

Wall Street consensus on AVGO is a buy. 21 of the 25 analysts are buy-rated, while the remaining four are hold-rated. AVGO price targets further affirm analyst optimism about the stock with a medium and mean price target of $678, leaving room for a 38% upside. The following chart indicates AVGO sell-side ratings and price targets:

Refinitiv

What to do with the stock:

We believe AVGO provides a favorable risk-reward situation. We believe the company’s broad exposure in the semiconductor business will likely maintain the company’s pattern of outperformance. We also believe the company’s software segment provides diversification of revenues alongside the broad semiconductor exposure. We believe the stock is a buy because we like the company’s prospects within semiconductors and its software franchises. While semiconductors are volatile, the software franchise provides a stable profit stream even in times of volatile semiconductor demand.

Be the first to comment