pixelfit/E+ via Getty Images

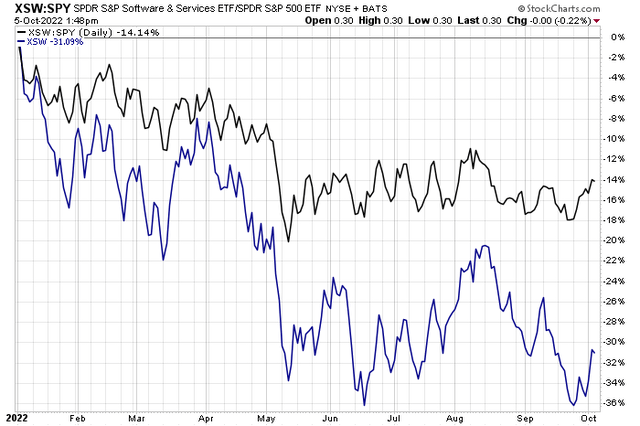

IT services stocks have sharply underperformed the S&P 500 in 2022. The SPDR S&P Software & Services ETF (XSW) is down about one-third as interest rates rise and the U.S. dollar soars. Looking forward, it’s possible that investments in IT and advisory services might be cut as firms trim the fat and watch their costs. One $8 billion market cap firm with heavy international sales exposure has an uncertain earnings future, but shares have been resilient. But is it a buy?

IT Software & Services Industry Struggling Amid Macro Headwinds

Stockcharts.com

According to Bank of America Global Research, Genpact (NYSE:G) is the pioneer and largest India-centric Business Process Management (BPM) vendor with calendar-year 2019 revenues of $3.5 billion and nearly 95,000 employees. Set up as the captive General Electric (GE) BPM arm in 1997, it became a third-party vendor in 2005. The company derives approximately 83% of revenue from BPM and approximately 17% from IT services, and vertically revs are split as 35% from financial services/insurance, 35% from hi-tech/ manufacturing, and the rest from diversified industries. GE currently accounts for 13% of revenues.

The Bermuda-based IT Services industry company, within the Information Technology sector, trades at a high 25.6 trailing 12-month GAAP price-to-earnings ratio and pays a small 1.1% dividend yield, according to The Wall Street Journal. To get a sense of what Genpact does, its competitors are companies such as Accenture PLC and Cognizant Technologies.

The company has had a nice string of profitable projects, but securing new high-margin customers could be a challenge in this tough macro environment. Those deals would be very accretive to earnings through high operating leverage, but the cyclical IT spending niche might come under pressure as economic growth slows. Currency risks are also something that could negatively impact profits. Still, management said on its most recent earnings call that its sales cycle is shortening.

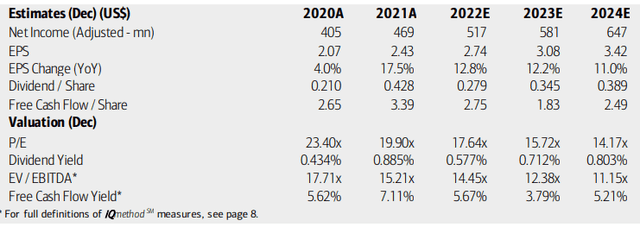

On valuation, BofA analysts see net income climbing at a very steady rate through 2024, while its dividend should follow suit. The firm’s operating P/E ratio should retreat to more favorable levels should the share price be unchanged, but given cyclicality in the business, those earnings estimates are questionable. Moreover, Genpact’s EV/EBITDA multiple suggests the firm is richly valued. Free cash flow is consistent but not high. Overall, the growth and valuation outlooks are so-so.

Genpact Earnings, Valuation, And Dividend Forecasts

BofA Global Research

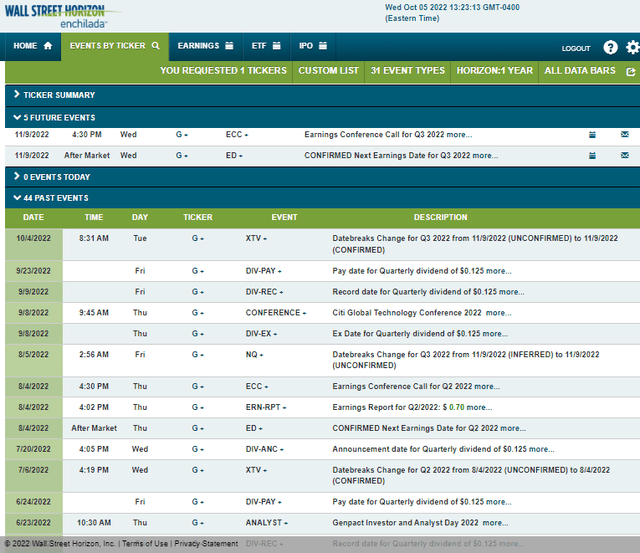

Looking ahead, corporate event data provided by Wall Street Horizon shows a confirmed Q3 earnings date of Wednesday, November 9 with a conference call immediately after results are posted. You can listen live here. The calendar is light through then, though.

Corporate Event Calendar

Wall Street Horizon

The Technical Take

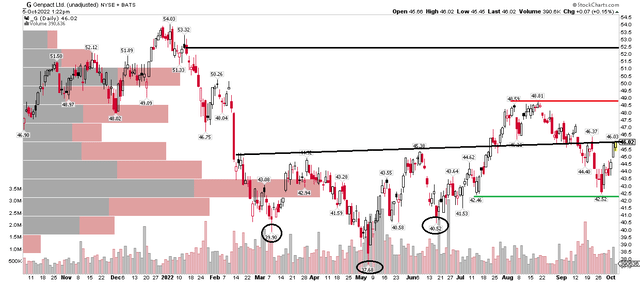

Genpact has held up well after falling hard during the first few months of 2022. The stock actually bottomed well before the S&P 500 hit its June interim low. There are a few interesting features I see on the one-year daily chart of G.

First, there’s a bullish inverse head and shoulders pattern that is waffling somewhat, but it’s still in play. The price target using the distance from the neckline to the head, added on top of the neckline, is in the $52 to $53 range – near the late 2021 highs. Before then, however, the stock must climb above an uptrend resistance line near $46. More importantly, the $48 to $49 range double-top must be recaptured.

On the bullish side right now is that the stock held $42.50 support during its September pullback. So long as the stock is above that point, owning shares looks good. Overall, the trend could be reversing to the upside.

G Stock Appears To Be Bottoming

Stockcharts.com

The Bottom Line

Genpact has an uncertain fundamental outlook while the company valuation does not scream cheap. The technical picture, though, looks strong within this volatile market environment. Combining the lukewarm valuation with a favorable chart, I think G is a buy here.

Be the first to comment