MicroStockHub/iStock via Getty Images

Introduction

Despite seeing a disappointing start 2022, thankfully there were emerging green shoots for Genesis Energy (NYSE:GEL) following the second quarter, notwithstanding the dark clouds forming on the horizon given the gloomy economic outlook for 2023, as my previous article discussed. Alas, it remains too early to tell how the economy will play out in the year ahead, although thankfully, they are building a solid base with positive momentum heading into 2023 on the back of their financial performance improving materially and strong guidance.

Coverage Summary & Ratings

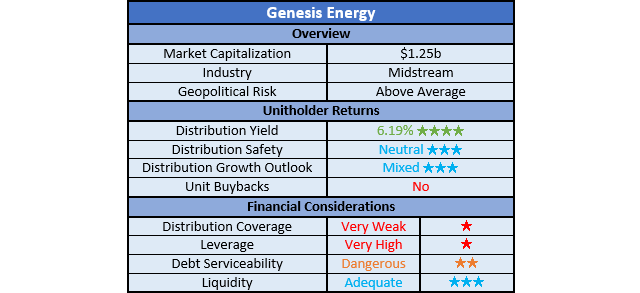

Since many readers are likely short on time, the table below provides a brief summary and ratings for the primary criteria assessed. If interested, this Google Document provides information regarding my rating system and importantly, links to my library of equivalent analyses that share a comparable approach to enhance cross-investment comparability.

Author

Detailed Analysis

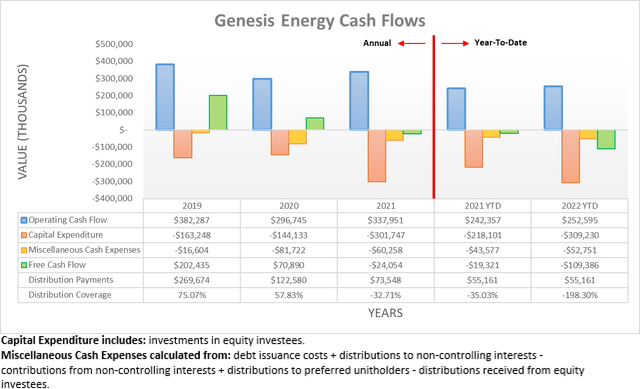

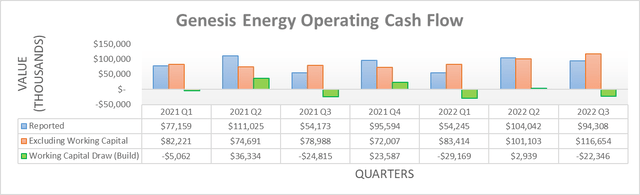

Even though their cash flow performance saw a disappointing start to 2022 in the first quarter, it was positive to see emerging green shoots during the second quarter. Now their results for the third quarter have been released, thankfully these have grown stronger with their financial performance improving materially, both on the surface and underlying levels. Starting with the former, their operating cash flow during the first nine months landed at $252.6m and thus for the first time in a while, shows an improvement year-on-year versus their previous result of $242.4m during the first nine months of 2021. This is a material improvement compared to the first half of 2022, which saw their operating cash flow down almost 16% year-on-year or during the first quarter, which saw its result down even more at almost 30% year-on-year, as per my previously linked article.

If moving onwards to the underlying level, it is easier if viewed on a quarterly basis whereby their working capital movements are more visible, which saw a build of $22.3m during the third quarter of 2022. If these are excluded across the first nine months, it shows their underlying operating cash flow at $301.2m and thus a very impressive circa 28% higher year-on-year versus their previous equivalent result of $235.9m during the first nine months of 2021. Unsurprisingly, this is also a material improvement compared to the first half of 2022, whereby their equivalent result was only 17.59% higher year-on-year or in the case of the first quarter, its result was only broadly flat year-on-year, as per my previously linked article.

Notwithstanding this positive development, there is still an important caveat to consider, which is their continued very high capital expenditure, relatively speaking. Whilst their operating cash flow is finally improving, it is mirrored by higher capital expenditure that clocked $309.2m during the first nine months of 2022, thereby sitting significantly higher than the $218.1m spent during the first nine months of 2021. As a result, they still saw negative free cash flow of $109.4m during the first nine months of 2022, once considering their accompanying $52.8m of miscellaneous cash expenses as listed beneath the first graph above. Despite their operating cash flow improving, this is still down sequentially versus their previous result of negative $64.4m following the second quarter and thus once again, their distribution payments remain debt-funded with very weak coverage.

On one hand, the relatively small size of their distribution payments of $55.2m compared to their operating cash flow of $252.6m during the first nine months of 2022 creates medium to long-term scope for growth as they are not necessarily burdensome. Whereas on the other hand, their accompanying relatively high capital expenditure leaves no free cash flow thus far, which means in the short-term higher distributions would merely see more debt piled onto their already very highly leveraged balance sheet, thereby leaving their distribution growth outlook mixed. As of the time of writing, they have not given concrete information regarding their forecast capital expenditure during 2023, which is not necessarily unusual but nevertheless, they still see further material double-digit earnings growth for the year ahead, as per the commentary from management included below.

Assuming steady performance from our other business segments, we do not see any reasonably likely scenario where we do not generate adjusted EBITDA next year in the mid-700s. Accordingly, we would otherwise expect to deliver more than 10% sequential growth from 2022 to 2023 from our base businesses.”

– Genesis Energy Q3 2022 Conference Call.

Even though their capital expenditure remains a mystery, as they do not routinely provide its guidance, the prospects for their adjusted EBITDA to grow by circa 10% year-on-year should see the positive momentum continue into 2023. Importantly, it also lowers the risks of a distribution cut because their operating cash flow should grow comparably, thereby automatically further lowering the relative size of their distribution payments or preferably, increasing the prospects for free cash flow that may finally end their reliance on debt funding. Either way, their distributions are no longer risky because to give credit where due, management skilfully sustained them amidst the ups and downs throughout the past years, which often at times saw them skating on thin ice, proverbially speaking, as my other article highlighted in late 2021.

That said, the dark clouds as mentioned in my previous article following the second quarter of 2022 remain on the horizon as the economic outlook for 2023 is certainly no brighter than a few months ago and thus risks remain. Although, at least this time around they are heading into this uncertain year with positive momentum and thus a solid base, thereby helping mitigate the severity of the risks.

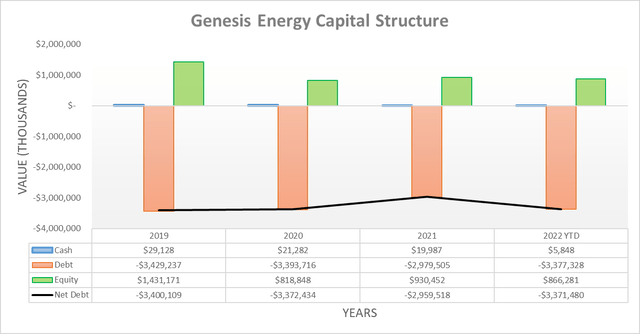

Naturally, deeper negative free cash flow resulted in higher net debt with its level landing at $3.371b following the third quarter of 2022, thereby higher versus their previous level of $3.315b following the second quarter. Thankfully, this was only an immaterial difference that should in theory, be replicated once again during the fourth quarter.

When looking ahead into 2023, the direction their net debt takes will be heavily influenced by their unknown capital expenditure. Even though they do not provide exact guidance for this variable, they still stated their “expected growth in earnings and increasing amount of cash generated by our businesses will provide flexibility to comfortably fund our remaining capital expenditure and further simplify our capital structure in the coming years”, as per slide two of their December 2022 Wells Fargo presentation.

Whilst this outlook is more positive than expecting to borrow to fund capital expenditure, this generalized guidance does not necessarily mean their operating cash flow will fund both their capital expenditure and distribution payments, nor does it technically apply to any given year. At least if nothing else, it seems their net debt should only increase at a fairly modest pace during 2023 and possibly beyond, although this obviously remains a wait-and-see situation.

Since their net debt is only an immaterially sub-2.00% higher since conducting the previous analysis following the second quarter of 2022, it would be redundant to reassess their leverage or debt serviceability in detail, especially as the primary focus of this analysis was their outlook heading into 2023. Furthermore, as their cash balance remains very small at only $5.8m following the third quarter versus its previous level of $10.1m following the second quarter, the same can also be said for their liquidity.

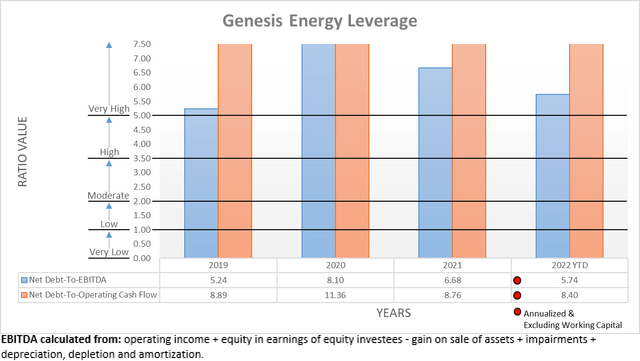

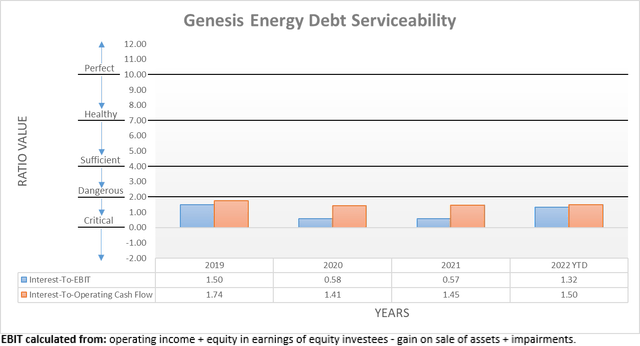

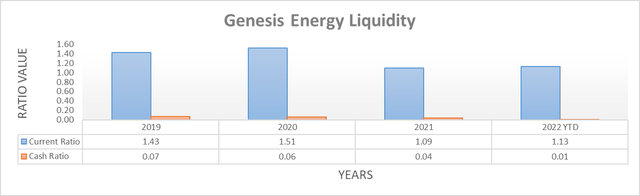

The three relevant graphs are still included below to provide context for any new readers, which once again show that despite their financial performance improving materially, their leverage is still very high. To this point, their net debt-to-EBITDA of 5.74 remains above the applicable threshold of 5.01 but the bigger concern is accompanying their net debt-to-operating cash flow, which is far higher at a seldom-seen 8.40. Unsurprisingly, this also leaves their debt serviceability at dangerous levels given their interest coverage of only 1.32 and 1.50 when compared against their EBIT and operating cash flow, respectively. At least their liquidity remains adequate with a current ratio of 1.13, despite their otherwise virtually non-existent cash ratio of 0.01. If interested in further details regarding these topics, please refer to my previously linked article.

Conclusion

Even though I have been quite skeptical of their distributions following their lagged recovery during 2021 and early 2022, to give credit where due, management skillfully skated across this proverbial thin ice. Thanks to their financial performance improving materially as 2022 progressed, it creates positive momentum heading into 2023 and combined with their accompanying strong guidance, their distributions are no longer risky. Although at the same time, their very high leverage and unknown free cash flow outlook still prohibits me from considering them safe, nor attest their growth outlook that remains mixed, thereby leaving my stance neutral whereby I could still see their distributions going either way heading forwards. Despite being an improvement since my previous analysis, since the potential impact of a recession during 2023 remains a dark cloud on the horizon, I nevertheless still believe that maintaining my hold rating is appropriate.

Notes: Unless specified otherwise, all figures in this article were taken from Genesis Energy’s SEC Filings, all calculated figures were performed by the author.

Be the first to comment