Lim Weixiang – Zeitgeist Photos

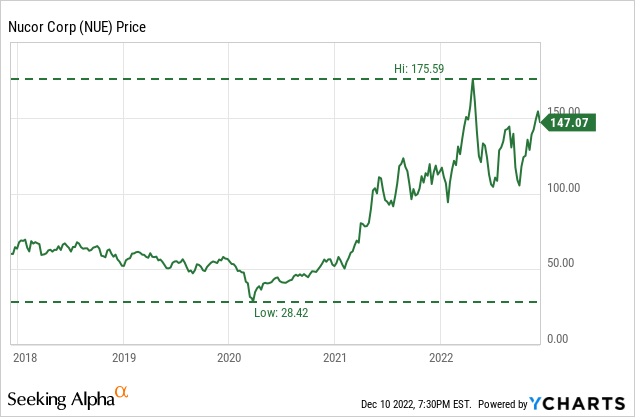

As of 2022, Nucor Corporation (NYSE:NUE) is one of the largest steel producers in the United States. The company has a strong track record of profitability and has demonstrated a commitment to innovation and sustainability. These factors alone would normally make Nucor an attractive option for investors who are looking for a solid, long-term investment, but Nucor has been on the receiving end of a perfect storm of supply Chain disruptions, loose monetary policy, and tailwinds brought about by strong construction demand. As The Federal Reserve transitions into More restrictive monetary policy, one has to ask whether the commodity leaders like Nucor could return to Earth.

When I wrote this article about the company, it was in the early innings of what turned out to be a commodity supercycle. The loose monetary policy implemented to support the US economy during the Covid-19 pandemic created the perfect conditions for domestic commodity stocks when combined with tariffs and supply chain disruptions. Loose monetary policy, or low interest rates, can have a positive impact on steel stocks. When the Federal Reserve lowers interest rates, it becomes cheaper for businesses to borrow money, which can lead to an increase in investment and construction activity. This can lead to higher demand for steel, as it is a key component in many construction and manufacturing projects. As a result, steel stocks can benefit from loose monetary policy, which can drive up demand for their products and lead to higher revenues and profits. Loose monetary policy can also make steel stocks more attractive to investors, as low interest rates can make other investments, such as bonds, less appealing.

One of the key reasons why Nucor has been a good buy in the past is its strong financial performance. Over the past several years, the company has consistently reported healthy profits, mainly due to its focus on cost control and efficient operations. But perhaps the most interesting thing about the company is the emphasis on safety. With other companies in the space facing serious backlash on the safety front, company safety efforts have now become a data point for some investors. Safety efforts were a major talking point in the recent earnings report, along with a strong EPS number:

-

Nucor posted earnings of $6.50 per share in the third quarter.

-

Earnings were lower in the third quarter due to metal margin contraction and reduced shipping volumes.

-

The company continues to see good demand for steel in the United States, particularly in the non-residential construction market.

-

Nucor’s focus on safety has led to two consecutive record-setting years in 2020 and 2021.

-

The company is on pace for the safest year in its history in 2022.

In addition to its financial strength, Nucor is also committed to innovation and sustainability. The company has invested heavily in research and development, leading to the development of new, more efficient steel-making processes. This focus on innovation has helped Nucor stay ahead of the curve in an increasingly competitive industry.

Furthermore, Nucor is committed to sustainability, with a goal of reducing its greenhouse gas emissions by 35% by 2030. The company has implemented several initiatives to achieve this goal, including investing in renewable energy sources and recycling steel scrap. This focus on sustainability not only helps the environment but also positions Nucor to capitalize on the growing demand for sustainable products.

Industry Outlook

The steel industry is facing slowing demand due to tightening from the Federal Reserve. As the Fed raises interest rates, it becomes more expensive for businesses to borrow money, which can lead to a decrease in investment and construction activity. This, in turn, can lead to lower demand for steel, as it is a key component in many construction and manufacturing projects.

The steel industry is also being impacted by trade tensions, as the ongoing trade war between the United States and China has led to tariffs on steel imports. This has made it more difficult for steel producers to compete with foreign producers, leading to lower sales and profits. In addition, the uncertainty surrounding trade negotiations can make businesses hesitant to invest in new projects, further contributing to the slowdown in the steel industry.

The slowing demand for steel is having a negative impact on steel producers, who are seeing their revenues and profits decline. This can lead to job losses and lower stock prices for companies in the industry. The steel industry needs to adapt to these challenges to remain competitive and weather the slowdown in demand. This may involve implementing cost-cutting measures, diversifying their product offerings, and finding new markets for their products.

Valuation and Forward-Looking Commentary

The steel industry is known for its cyclical nature, with revenue performance often fluctuating based on economic conditions. When the economy is strong, and construction and manufacturing activity is high, demand for steel typically increases, leading to higher revenues for steel producers. However, when the economy slows down, and there is less demand for steel, revenues for steel producers can decline. This cyclical nature of the steel industry can make it challenging for companies to plan for the long term, as they must be prepared for both highs and lows in demand.

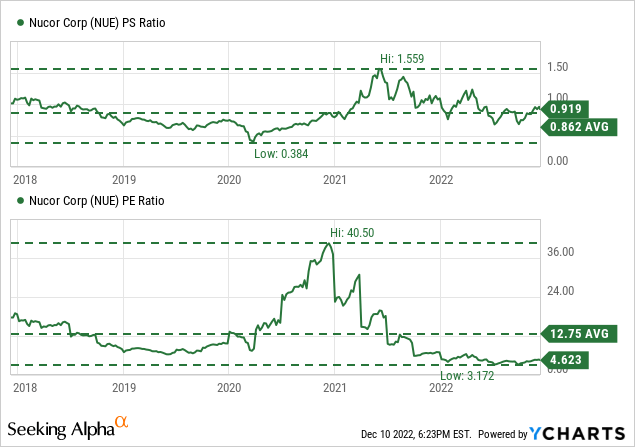

At a glance, one would argue that Nucor Corporation’s stock may be undervalued due to its low Price-to-sales (P/S) ratio and low Price-to-earnings (P/E) ratio. The P/S ratio is a valuation metric that compares a company’s stock price to its revenue, and a low P/S ratio can indicate that a stock is undervalued. Nucor currently has a P/S ratio of 0.91, which is around the 5-year average of 0.862. In addition to its low P/S ratio, Nucor also has a low P/E ratio. The P/E ratio measures a company’s current share price relative to its earnings per share. A low P/E ratio can indicate that a stock is undervalued, as it suggests that the market is not placing a high value on the company’s earnings. Nucor’s P/E ratio is currently 4.6, which is lower than the five-year average of 12.75. This suggests that the market may not fully value the company’s revenue and earnings performances, but there are more factors to consider.

The steel industry also benefited greatly from tariffs imposed on steel imports by former President Donald Trump. The World Trade Organization recently ruled that the tariffs violated global trading rules. The US government has suggested that they intended to reject or fight what they deem to be a flawed interpretation of the rules by the panel. investors should pay keen attention to headlines coming out of these developments, as the move to slap tariffs on imported steel contributed greatly to the strength in US steel stocks early on.

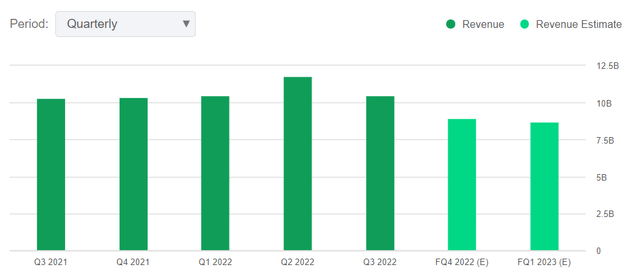

Despite this, I would argue that investors should be focusing on the cyclicality of the steel industry. We are on the cusp of what could be a major recession in 2023 due to a Federal Reserve seemingly willing to do anything to address inflation. A big part of the inflation the Federal Reserve is looking to address is construction costs and commodity prices. This puts steel in the firing line for the Fed, and we have already seen that the slowdown is beginning to take root. We can see in the graph below that revenue estimates have cooled for Nucor.

Seeking Alpha

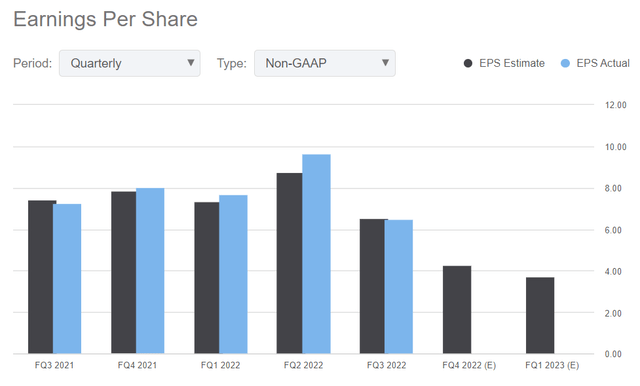

But more important is the expected significant drop-off in EPS performances for the company.

Seeking Alpha

The Takeaway

Overall, Nucor is a solid investment option for those looking to add a stable, profitable company to their portfolio. The company’s strong financial performance, commitment to innovation and sustainability, and track record of success make it an attractive choice for investors. At the company level, management has been flawless, but the situation becomes more complicated when we consider that macro headwinds may hit the industry in 2023. Bulls are currently having their day in the sun, but it may be prudent to book profits and wait out what could be a turbulent year for the stock. I rate Nucor as a hold.

Be the first to comment