AlexSecret

Genesco Inc. (NYSE:GCO) expects to increase its store count even considering the incoming economic recession. Financial analysts are also expecting an increase in free cash flow (“FCF”) in the coming years. In my view, correct selection of stores, more digitalization, and perhaps acquisitions could imply a Genesco valuation of close to $85 per share. I do see risks from changing customer taste or inventory markdowns. However, the current stock valuation appears to undervalue significantly how much GCO is worth.

Genesco Inc.

Nashville-based specialty retailer Genesco is footwear-focused. It runs close to 1,400 stores in the U.S., Canada, the UK, and the Republic of Ireland. The company combines well-known brands with its own products:

Source: PowerPoint Presentation

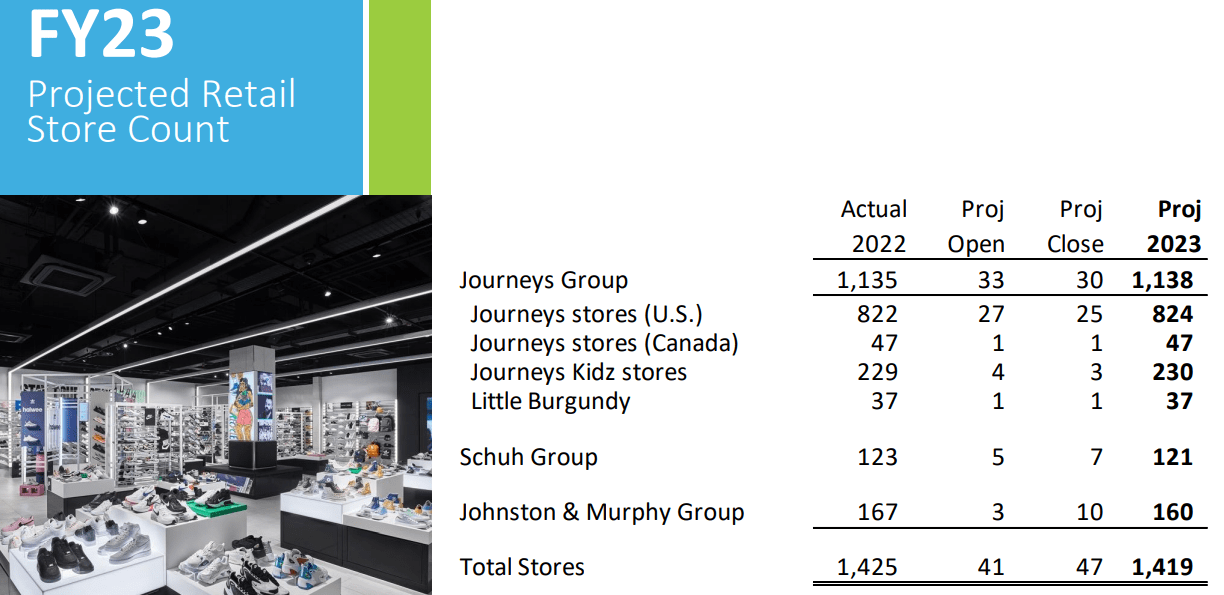

In my view, there are two main reasons to review the company’s financial figures. First, Genesco does not expect to close stores in the near future. The company expects to open close to 33 new stores and run a total of 1,138 stores by 2023. With everybody talking about an economic recession, the fact that the number of stores is not expected to decline is, in my view, very positive.

Source: PowerPoint Presentation

The second reason to like Genesco stock is that the Board of Directors appears to be aggressively buying a lot of its own stock. In my view, if the stock repurchase program continues in the near future, the demand for the stock will likely increase.

Over the last three years, we have repurchased $176 million of common stock at an average price of $51.18, or 22% of our outstanding shares. Source: PowerPoint Presentation

As of January 29, 2022, we accrued $4.8 million for share repurchases that will settle in Fiscal 2023 which is included in other accrued liabilities on the Consolidated Balance Sheets. We were operating under a $100.0 million repurchase authorization from September 2019. Source: 10-k

Good Financial Shape

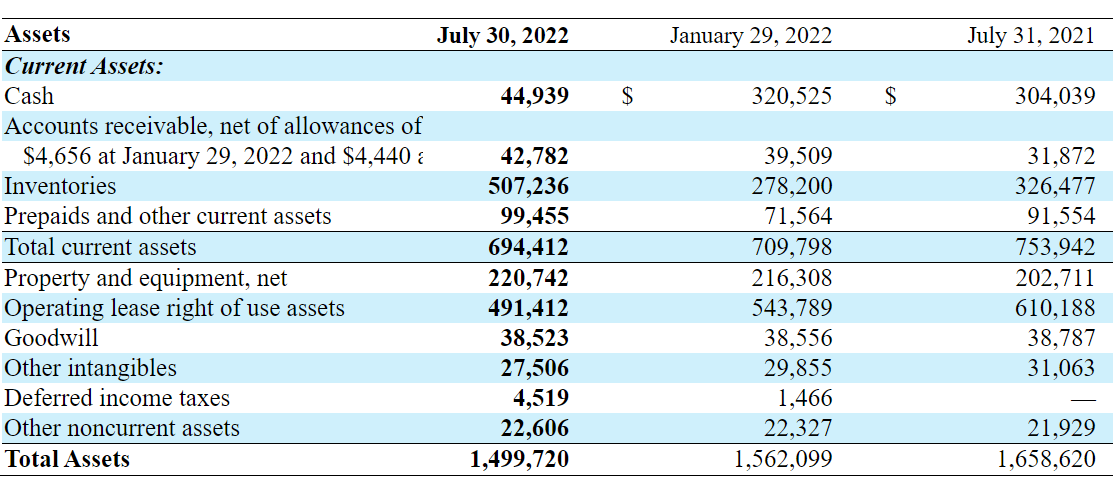

On July 30, 2022, Genesco reported total cash of $44 million, accounts receivable worth $42 million, and inventories worth $507 million. With total current assets worth $694 million, I believe that the company has a considerable amount of liquidity. Total current assets are larger than the current liabilities.

Genesco also owns property and equipment worth $220 million, operating lease rights of use assets of $491 million, and a small amount of goodwill. Finally, total assets were $1.499 billion, which makes an asset/liability ratio larger than 1x. I believe that the company’s financial situation is in good shape.

Source: Quarterly Results From Genesco

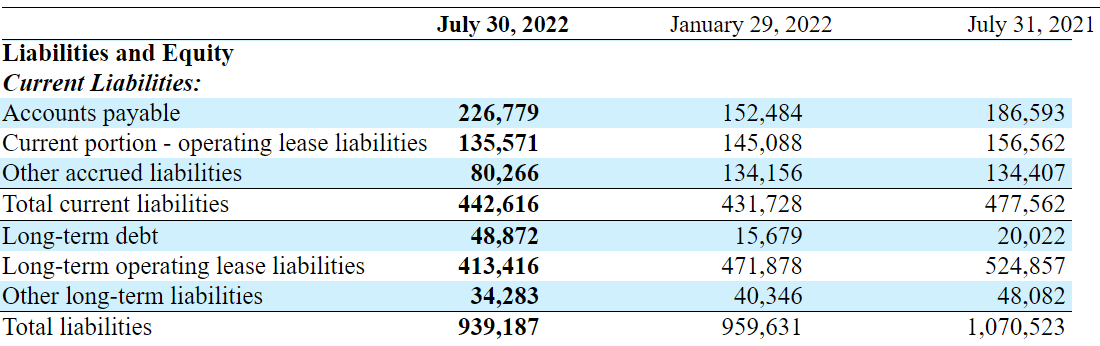

As of July 30, 2022, Genesco also reports accounts payable of $226 million, operating lease liabilities of $135 million, and accrued liabilities worth $80 million. Total current liabilities were close to $442 million, and long-term debt stands at $48 million, with long-term operating lease liabilities of $413 million. The total liabilities stand at $939 million. Considering future free cash flow of more than $99 million, in my view, the total amount of debt does not seem worrying.

Source: Quarterly Results From Genesco

Expectations Include 3%-5% Sales Growth And EBITDA Margin Close To 7%

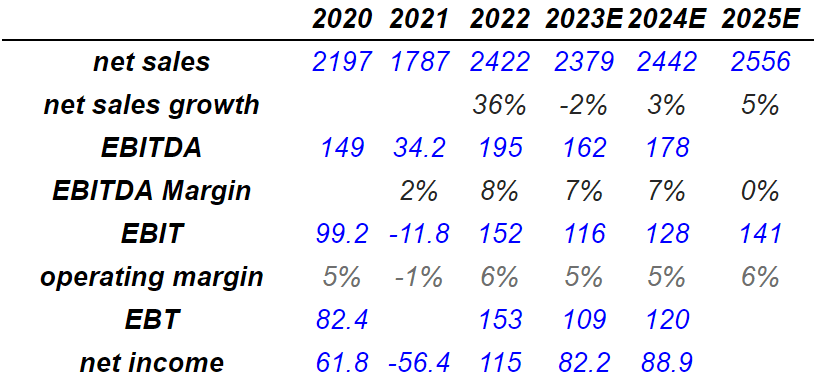

The expectations of other investment analysts for 2025 include total net sales of $2.5 billion, with net sales growth of 5%. Forecasts also include an EBITDA of $178 million. Regarding 2025 EBIT, analysts expect a sum of $141 million, with an operating margin of 6%. Finally, total net income would stand at close to $89 million.

Source: Seeking Alpha

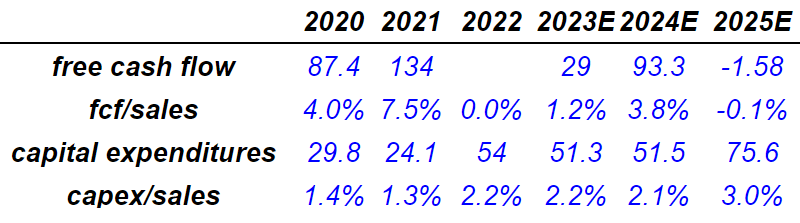

For 2024, analysts also forecasted free cash flow of $93 million and FCF/sales margin close to 4%. Let’s also note that the company does not require a lot of capital expenditures. In 2025, the capex/sales ratio stands at close to 3%.

Source: Seeking Alpha

Base Case Scenario: Enough Digitalization And Management Of Stores Could Imply Close To $85 Per Share

Under my base case scenario, I expect Genesco to accelerate digitalization to grow direct-to-consumer, and maximize the relationship between physical and digital channels. Under these two assumptions, I believe that the company has a significant room for improvement in terms of revenue growth and free cash flow growth.

Besides, if Genesco successfully deepens consumer insights to strengthen customer relationships, the company’s brand may get more reputation. If Genesco’s products are as recognized as major brands out there, revenue growth would likely trend north.

Finally, innovation and perhaps pursuing synergistic acquisitions could accelerate free cash flow and profitability in the coming years. Let’s also point out that closing unprofitable stores and opening new ones is one of the main pillars of the company’s strategy. Management explained these initiatives in the last annual report:

We anticipate optimizing our store footprint in the future, concentrating on locations that we believe will be most productive, as well as closing certain stores, perhaps reducing the overall square footage and store count from current levels, but improving productivity in our existing locations and investing in technology and infrastructure to support omnichannel and digital retailing. Source: 10-k

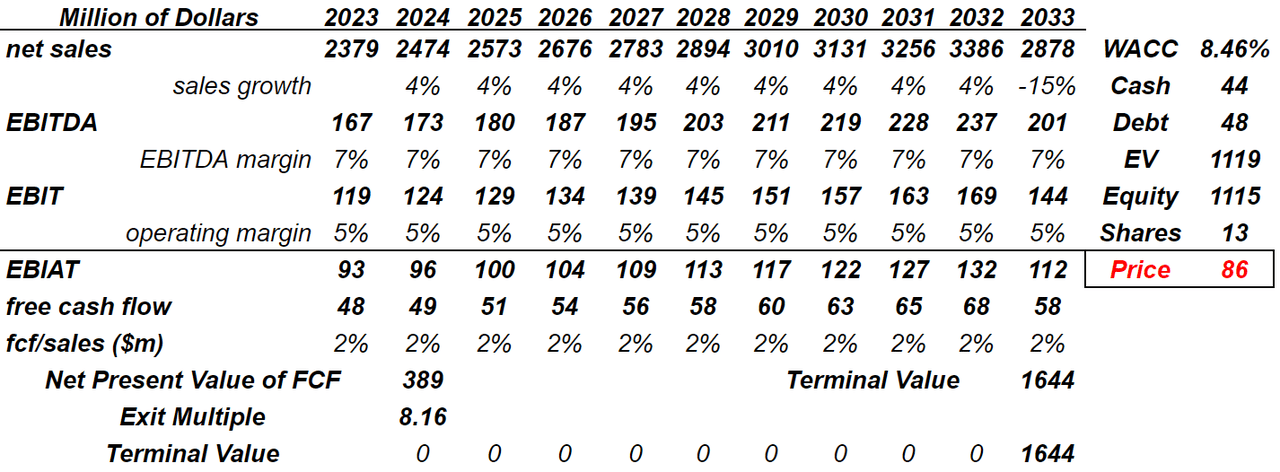

I expect, for 2033, a total net sales of $2.8 billion and an EBITDA of $201 million, with an EBITDA margin of 7%. Regarding EBIT, I expect $144 million, with an operating margin of 5%. The EBIAT could be close to $112 million in addition to a free cash flow of $58 million and FCF/sales of 2%. I anticipate the net present value of future FCF to be close to $389 million. The terminal value could be $1.6 billion. I anticipate the exit multiple to be 8.1x and a WACC of 8.46%, which would result in an enterprise value of $1.1 billion, equity of $1.1 billion, and a fair price around $85 per share.

My DCF Model

My Worst Case Scenario Would Bring The Stock Down To $42 Per Share

Under quite detrimental macroeconomic conditions, I believe that demand for the company’s products may decline. As a result, the company may have a lot of accumulated inventory, which may diminish the company’s profitability. If management decides to take inventory markdowns, relationships with suppliers may suffer. In sum, in the worst case scenario, an eventual decrease in free cash flow expectations could bring the stock price down.

Adverse economic conditions and any related decrease in consumer demand for discretionary items could have a material adverse effect on our business, results of operations and financial condition. The merchandise we sell generally consists of discretionary items. Reduced consumer confidence and spending may result in reduced demand for discretionary items and may force us to take inventory markdowns, decreasing sales and making expense leverage difficult to achieve. Source: 10-k

Genesco could fail to identify suppliers offering trending products. As a result, the company may offer products that customers simply wouldn’t buy. Let’s keep in mind that consumer tastes are very difficult to predict. Lack of demand for Genesco’s products could bring the revenue growth down, which may lead to decreases in future free cash flow.

The majority of our businesses serve a fashion-conscious customer base and depend upon the ability of our buyers and merchandisers to react to fashion trends, to purchase inventory that reflects such trends, and to manage our inventories appropriately in view of the potential for sudden changes in fashion, consumer taste, or other drivers of demand. Failure to execute any of these activities successfully could result in adverse consequences, including lower sales, product margins, operating income and cash flows. Source: 10-k

Finally, I believe that inflation could have a negative effect on Genesco’s P&L statement. If the company has to increase the price of products, and clients don’t want to pay, revenue growth may decline. Besides, if management does not want to increase the price of its products, the free cash flow margin would not grow.

In addition, inflationary cost pressure on the products we sell might limit our ability to pass on cost increases resulting in gross margin impact or reduced demand. Demand can also be influenced by other factors beyond our control. Source: 10-k

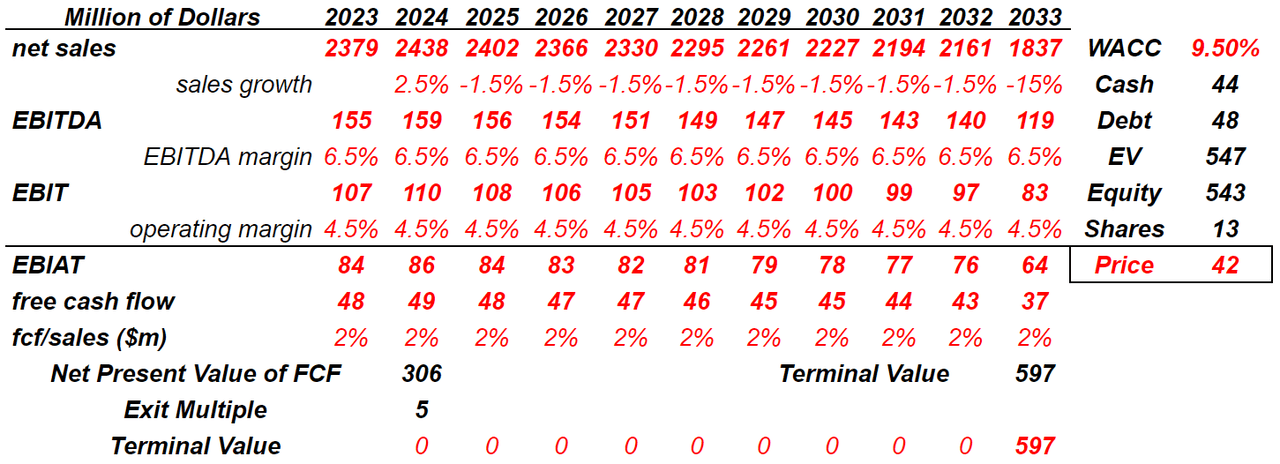

For 2033, I expect a net sales of $1.83 billion, with the sales growth of -15% in addition to an EBITDA of $119 million, with an EBITDA margin of 6.5%. I expect EBIT to be $83 million along with an operating margin of 4.5%. The EBIAT will likely be $64 million. I expect the free cash flow of $37 million and the FCF/sales of 2% million. I estimate a net present value of FCF of $306 million. The terminal value could be $597 million. With a WACC of 9.50%, I obtained an enterprise value of $547 million, equity of $543 million, and a fair price of $42 per share.

My DCF Model

Conclusion

Genesco runs a profitable business model with beneficial agreements with large suppliers. The company is doing great considering that store count is expected to increase in the near future. In my view, further digitalization, acquisitions, and correct selection of new stores could bring the stock price to around $85 per share. I do see risks from eventual lack of demand for the company’s products and changes in customer trends. With that, I believe that the discount of future free cash flow implies a valuation that is more significant than the current stock price.

Be the first to comment