President Biden Visits GM ZERO Factory In Detroit, Where Battery Electrics Are Being Assembled Nic Antaya

As Mary Barra, General Motors Co. (NYSE:GM) chair, expressed with exquisite understatement during the second-quarter earnings call with analysts on July 26: “This is a truly unique and dynamic market that presents both challenges and opportunities for GM.”

GM has built roughly 90,000 vehicles – probably worth upwards of $4 billion – that can’t yet be shipped to dealers because one or more parts (often, semiconductor chips) are lacking. GM dealers, meanwhile, have only a ten-to-twenty day supply of vehicles, probably a third of what they need to meet consumer demand.

Tight retail inventory

In such an environment, GM and the dealers are able to sell vehicles at full mark-up, thereby generating strong profitability. But the total cash generated is down sharply – and that cash is needed to pay mounting bills for battery electric vehicle (BEV)-related investments such as the new Ultium Cells LLC plant in Lordstown, Ohio that will supply GM’s Detroit assembly plant that builds the new GMC Hummer EV. Between 2020 and 2025, GM is targeting $35 billion in capital, engineering and development costs for new technologies including BEVs, autonomous vehicles and hydrogen fuel cells.

Mary Barra, CEO (GM)

The prospect for robust BEV sales looks positive, by one measure, with more than 80,000 “reservations” for Hummer pickup and SUV models; 150,000 reservations for Silverado EV in 2023 and other BEV models such as Cadillac Lyriq, Chevrolet Blazer EV and Chevrolet Equinox EV due through 2023. BrightDrop Zevo commercial van production is due to start later this year at GM Canada and Cruise is piloting commercial payment for robotaxis in San Francisco.

In the meantime, GM is adding debt to bolster its finances, apparently to cover a drop in cash caused by short-term shortages of saleable vehicles to ship to dealers. A $2.5 billion Department of Energy loan to the GM joint venture building the Ohio plant – as well as future plants in Tennessee and Michigan – will come from the department’s Advanced Technology Vehicles Manufacturing program, which provides loans to support U.S. manufacturing of light-duty vehicles, parts and other materials that improve fuel economy.

Cash from DC

Terms of the government loan haven’t yet been disclosed; GM previously announced that the Ohio plant represented a $2 billion investment, which was to have been financed internally. With battery technology strongest at the moment in China, South Korea and Japan, Energy Secretary Jennifer Granholm, a former Michigan governor, said: “As electric cars and trucks continue to grow in popularity within the United States and around the world, we must seize the chance to make advanced batteries — the heart of this growing industry — right here at home.”

On Jul 28 GM said it was announcing the pricing of two series of senior unsecured fixed rate notes totaling $2.25 billion. The so-called “Green Bonds” include $1 billion of 5.40% notes due in 2029 and $1.25 billion of 5.60% notes due in 2032. They are designed to help fulfill GM’s environmental, social and governance (ESG) goals, including carbon neutral operations by 2040.

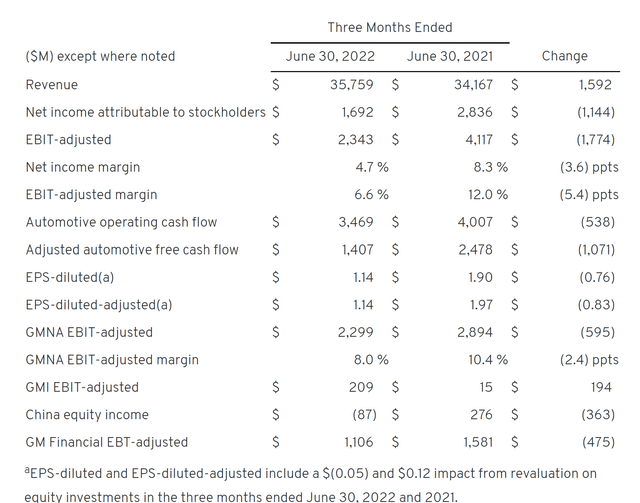

The $4.75 billion of new debt comes on the heels of a second quarter financial report. GM’s net income in the second quarter fell to $1.6 billion ($2.3 billion on an EBIT-adjusted basis) from $2.8 billion ($4.1 billion on an EBIT-adjusted basis) a year earlier.

GM’s capital expenditures rose to $2.1 billion in the quarter from $1.5 billion a year earlier. With net automotive cash from operating activities falling to $3.5 billion for the quarter from $4 billion a year ago, adjusted automotive free cash flow fell to $1.4 billion from $2.5 billion. In other words, on a quarterly basis GM’s capex rose 40% YOY while adjusted free cash flow fell 44% — setting the stage for securing additional debt.

GM Q2 2022 Income Statement (GM)

Given the backdrop of rising interest rates, GM’s initiative to secure debt before it becomes more costly could prove prudent. As Barra noted during the earnings call:

“While demand remains strong, there are growing concerns about the economy to be sure. That’s why we are already taking proactive steps to manage costs and cash flows, including reducing some discretionary spending and limiting hiring to critical needs and positions that support growth.”

Tight credit ahead

Barra is exercising prudence. While the supply of semiconductors and other parts may improve in the second half, the economy has shown signs of recession and may weaken further as the Federal Reserve tightens credit in order to stanch inflation. Political uncertainty is rising as well, with federal money for EV consumer incentives and charging infrastructure looking less generous following the sinking of the Democrats’ Build Back Better spending package.

The lesson from the runup to GM bankruptcy’s in 2009 is that excessive debt can sink any company, even (or especially) a behemoth with a legendary name and reputation. If Barra and her contemporaries learned anything, they certainly found out that maintaining a solid balance sheet and credit rating are key survival tactics for any business – and they’ve endeavored to let investors know they got the message.

GM’s strategy is predicated on sufficient cash flow from internal combustion engine (ICE) vehicles – principally the Silverado pickup – support the massive investment in BEVs, autonomous tech and fuel cells. As the transition takes place over the next decade or so, GM projects that revenue and cash flow from electrified products like Silverado EV, Blazer EV and Cadillac Lyriq will replace that produced by today’s products.

The risk to investors in GM common is that imprudent borrowing habits from the past will return, loading down GM with debt, compromising its credit rating and leaving it vulnerable to unforeseen catastrophes such as the Global Financial Crisis. The timetable for widespread acceptance of BEVs remains murky – it’s still not clear how soon average consumers will be trading in their ICE vehicles for plug-ins.

GM shares continue to sell more or less for the same $33 a share they did at their initial public offering in 2010. With cash tight, GM can ill afford to pay a dividend. (Cross-town rival Ford Motor Co. (F) has restored its dividend and raised it to its pre-COVID rate.)

GM, in this writer’s opinion, remains a HOLD. Owners of GM shares don’t face much downside risk at the current price in the low 30s. The exception would be if the automaker steps up borrowing – and debt rises precipitously – without an adjustment in the company’s investment spending on BEVs and other advanced technology.

GM bonds barely qualify as investment grade. Credit rating agencies will be watching GM closely, so investors must pay attention to the raters for any evidence of balance sheet weakening.

Be the first to comment