gremlin

Boeing (NYSE:BA) is one of the largest aerospace firms in the world and is the world’s leading manufacturer of commercial aircraft designed to meet the needs of both passenger and cargo airlines. Moreover, the company develops and commercializes military aircraft, which play a key role in the defense of NATO member states and counter-terrorism operations. While General Electric (NYSE:GE) is the main supplier of engines not only to Boeing but also to other large aircraft manufacturing corporations, whose production volumes are growing at a significant pace after the end of the COVID-19 pandemic. However, only one of the companies discussed in the article has a more efficient business model, high revenue, and EBITDA growth rates, which makes it more attractive to investors during the Fed’s interest rate hike.

Financial position of General Electric vs. Boeing

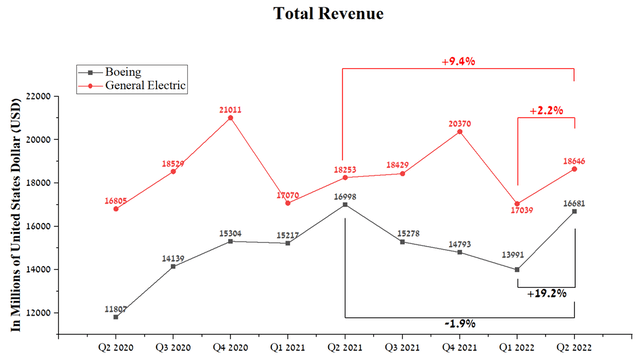

General Electric’s revenue was $18,646 million in Q2 2022, up 9.4% year-over-year. At the same time, Boeing’s revenue was $16,681 million in Q2 2022, down 1.9% from Q2 2021, but QoQ sales were positive mainly due to increased demand for the Boeing 737.

Source: Author’s elaboration, based on Seeking Alpha

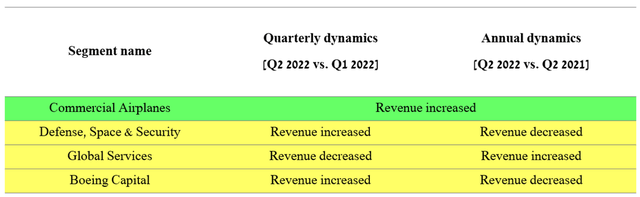

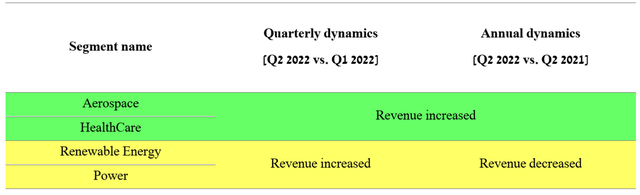

Three of Boeing’s four segments have struggled to show either quarterly or yearly positive revenue trends despite the end of the acute phase of the COVID-19 pandemic.

Source: Author’s elaboration, based on quarterly securities reports

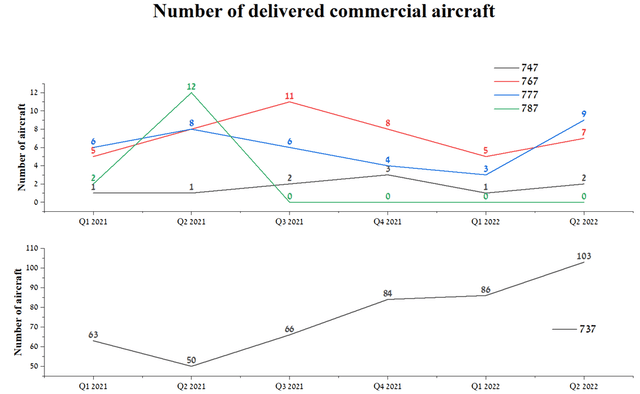

Commercial Airplanes segment revenue was $10,380 million, up 0.9% year-on-year. The reason for the slight increase is higher 737 MAX deliveries, which partly offset a fourth consecutive quarter of no 787 deliveries due to product quality issues and unresolved issues with the FAA. At the end of 2020, the company resumed deliveries of 737 MAX aircraft after approval from the FAA. In addition, most regulators also approved the return to service of this aircraft, but not China, which has chosen a tougher policy on the 737 MAX. In addition, Boeing management has decided to suspend production of the 777X-9 between 2022 and 2023, and according to Reuters, the first deliveries of these aircraft will occur at least in 2025, and as a result, this will negatively affect the company’s revenue growth in the medium term.

Source: Author’s elaboration, based on quarterly securities reports

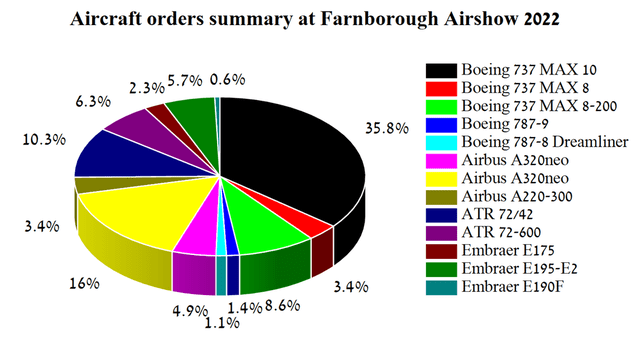

Boeing fully lived up to investors’ expectations with orders for 176 aircraft at the Farnborough Air Show, ninety-one more than Airbus. A major contributor to the success was Delta Air Lines (NYSE:DAL), which ordered more than a hundred 737 MAX 10s.

Source: Author’s elaboration, based on airline press releases

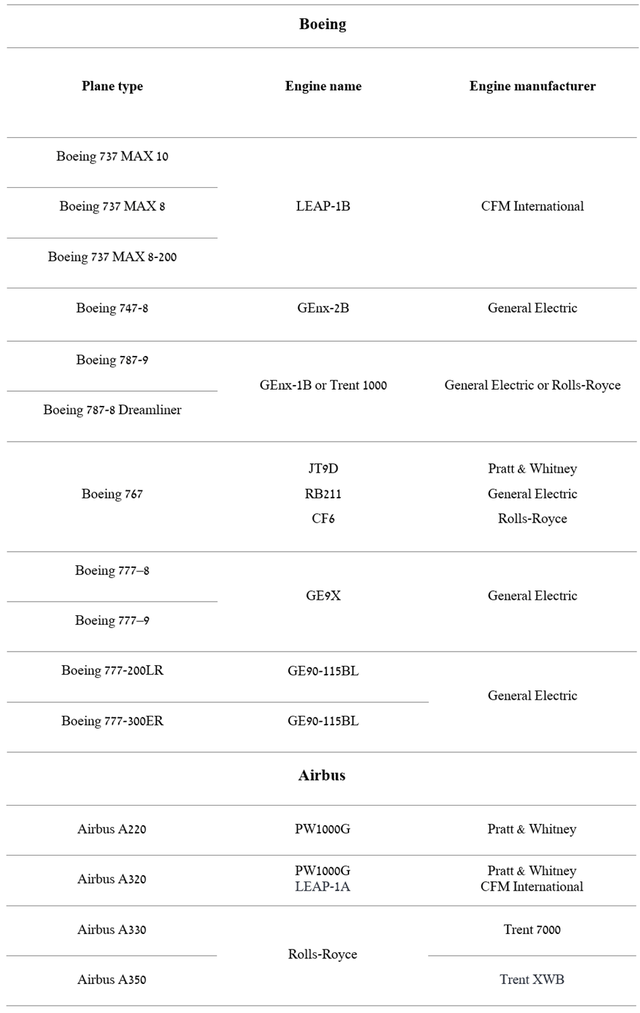

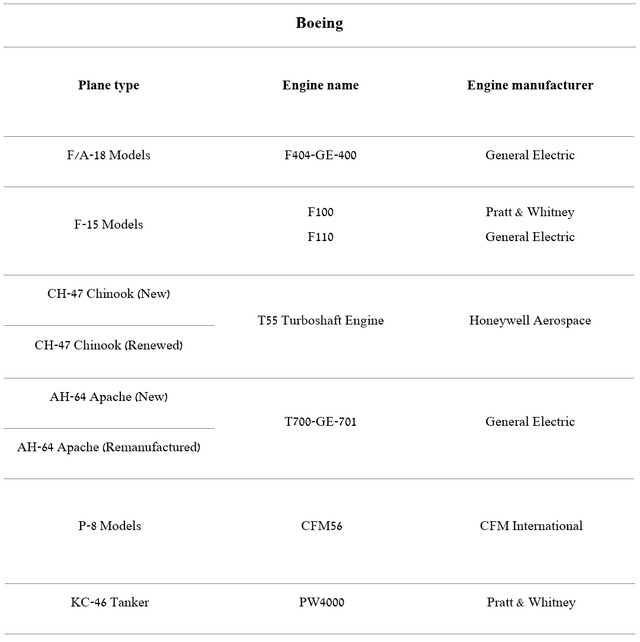

At the same time, the main suppliers of engines for Boeing and Airbus aircraft are General Electric and CFM International, an enterprise formed by GE Aviation and Safran Aircraft Engines. In my estimation, demand for GE aircraft engines will only grow as a result of the easing of COVID-19 restrictions.

Source: Author’s elaboration, based on quarterly securities reports

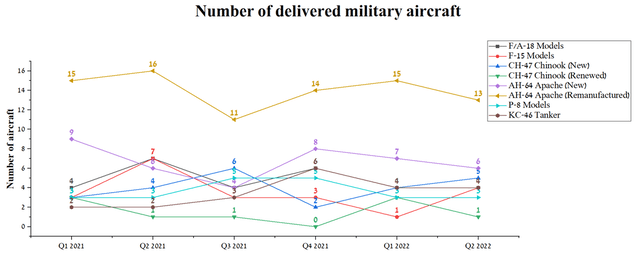

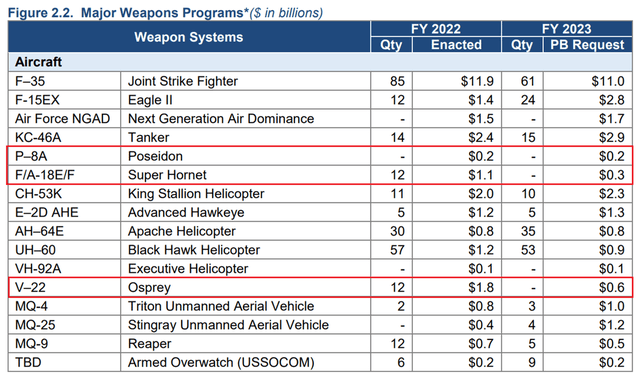

On the other hand, GE Aviation has a more diverse client portfolio and, as a leader in engine building, is less likely to lose orders, which is certainly a positive factor for investors in a time of geopolitical instability. At the same time, a much more negative situation occurs with the Boeing Defense, Space & Security (‘BDS’) segment. BDS revenue was $6,191 million in Q2 2022, down 10% from Q2 2021. The reasons for the deterioration in the financial position of this segment are lower revenues from the KC-46A Tanker program and lower deliveries of P-8 and F/A-18 models due to a disruption in the supply chain.

Source: Author’s elaboration, based on 10-Q

The 2022 Consolidated Appropriations Act included a $742.3 billion allocation to the U.S. Department of Defense and some of the money was designated to fund key Boeing programs, namely the CH-47 Chinook, F/A-18 Super Hornet, F-15EX, etc. As a result, new orders for the production of aircraft and helicopters supported the financial position of the military segment of the company, which is especially important during the military conflict in Eastern Europe and the tense situation in the Middle East and Southeast Asia. However, in the defense budget for 2023, there is practically no funding for programs involved in the production of P-8, F / A-18, CH-47F Block II, and V-22.

While other countries may be ordering the aircraft, continued uncertainty about these programs only lengthens Boeing’s recovery from the effects of the COVID-19 pandemic and slows down the company’s cash flow growth, which is critical to servicing its multibillion-dollar debt. At the same time, GE is one of the main suppliers of aircraft engines for civil and military aviation.

Source: Author’s elaboration, based on quarterly securities reports

If Boeing can successfully optimize the military segment business model, then this will also increase GE’s revenue by hundreds of millions. Otherwise, Boeing will suffer the most from the slowdown in the BDS segment, since General Electric is also an engine supplier for Lockheed Martin (NYSE:LMT), and Saab AB and is developing the South Korean KAI KF-21 Boramae fighter and the Indian HAL Tejas aircraft. Looking at GE’s business development, things are slightly better for Boeing, with two of the four segments showing revenue growth both year-on-year and quarterly, which is especially important ahead of GE Healthcare’s spin-off in early 2023.

Source: Author’s elaboration, based on quarterly securities reports

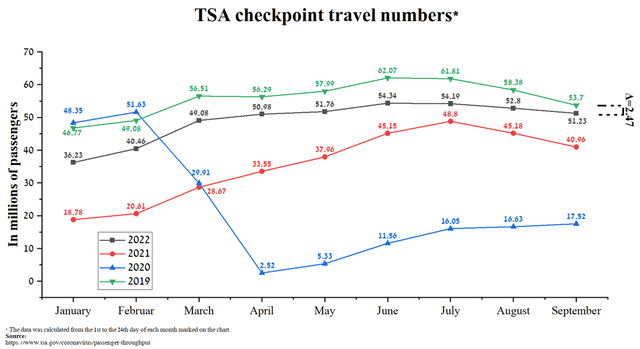

GE Aerospace’s revenue was $6,127 million in Q2 2022, up 26.6% year-on-year. This increase was due to the recovery of passenger air traffic after the horrendous consequences of the COVID-19 pandemic, despite some difficulties in the supply of parts necessary for the construction and maintenance of aircraft engines. According to the Transportation Security Administration, US airport passenger traffic was 51.23 million in the first twenty-four days of September 2022, down only 4.6% from 2019.

Source: Author’s elaboration, based on TSA

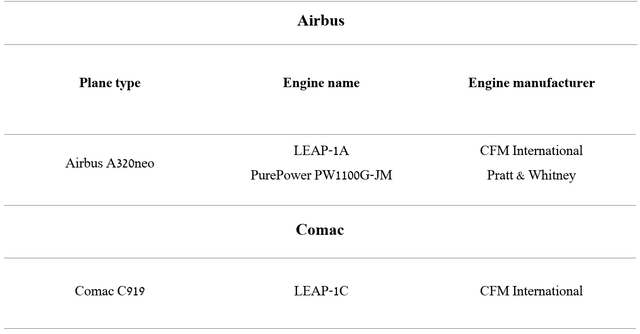

I expect the narrow-body market to recover to pre-COVID levels in the first half of 2023, which will have a positive impact on new aircraft production, and increased demand for spare parts and aftersales services. Difficulties in resuming Boeing 737 flights in China led to a revision of the business model of Chinese airlines, as Airbus won a deal to supply 40 A320neo series aircraft to China Southern Airlines, thereby reducing Boeing’s share in the fast-growing region. This contract is another blow to the American aircraft manufacturer, which came almost immediately after the conclusion of a deal for the purchase of 292 aircraft of the same series for a total of $37 billion by four Chinese airlines. The Airbus A320neo is powered by LEAP-1A engines and as a result GE will benefit from these agreements while Boeing continues to lose customers.

Source: Author’s elaboration, based on quarterly securities reports

In addition, China’s C919 aircraft, which will be powered by CFM International engines, is approaching certification as six aircraft have completed all test flight tasks. If the Comac C919 receives an airworthiness certificate from the Civil Aviation Administration of China, then this will challenge Airbus and Boeing, gradually squeezing them out of this market. However, this aircraft is heavily dependent on Western components, including GE’s avionics, and therefore the Chinese government will pursue a prudent policy towards the world’s aircraft giants. Either way, GE’s cutting-edge technology will keep its place in the sun no matter the outcome, while Boeing will continue to feel the pressure going forward.

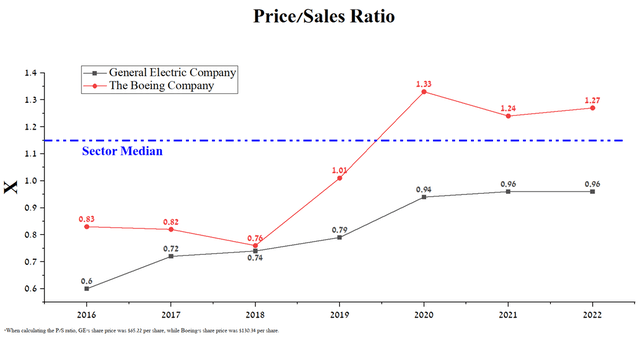

GE’s price/sales ratio is 16.5% lower than the industrial industry average, and given the company’s revenue growth both year-on-year and quarterly, this indicates it is undervalued by Wall Street. While this financial ratio for Boeing was 1.27, which is 32.3% more than the comparison company, thus showing that General Electric is the more undervalued asset in the sector.

Source: Author’s elaboration, based on Seeking Alpha

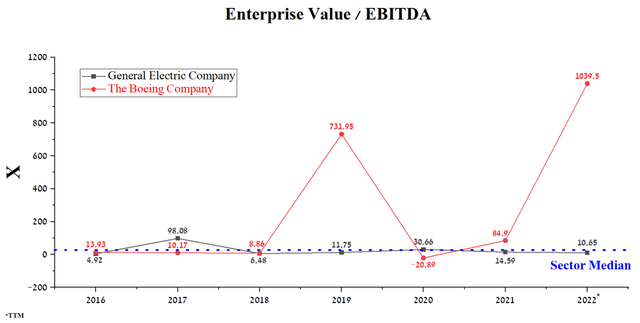

Another important financial ratio in assessing the investment attractiveness of compared companies is the Enterprise Value/EBITDA ratio. High inflation, declining production of some military aircraft, and two 737 MAX crashes have plagued Boeing to this day and weighed heavily on its EBITDA. As a result, Boeing’s EV/EBITDA has continued to grow at a tremendous pace in recent years and is well above the sector average. While General Electric’s EV/EBITDA is 10.65 and thanks to an efficient business model built by Larry Culp, this financial ratio continues to decline, increasing investment interest in the company.

Source: Author’s elaboration, based on Seeking Alpha

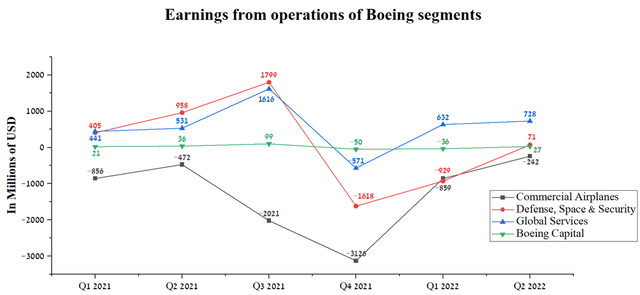

Boeing’s segment operating profit totaled $584 million in Q2 2022, down 44.5% from Q2 2021. At the same time, the operating margin of the Global Services segment was 16.9%, thus showing an increase of 3.8% year-on-year due to an increase in commercial services. I believe operating income in this segment will continue to grow by 15% YoY as the global economy and air transport business recover from the COVID-19 pandemic. The only Boeing sector that showed losses was the Commercial Airplanes sector despite strong 737 MAX deliveries. The company is still working on optimizing supply chains and resolving the catastrophic situation with the 777X-9. In my estimation, these factors will continue to put pressure on Boeing’s financial position in the next four quarters, and thus have a negative impact on the company’s share price.

Source: Author’s elaboration, based on quarterly securities reports

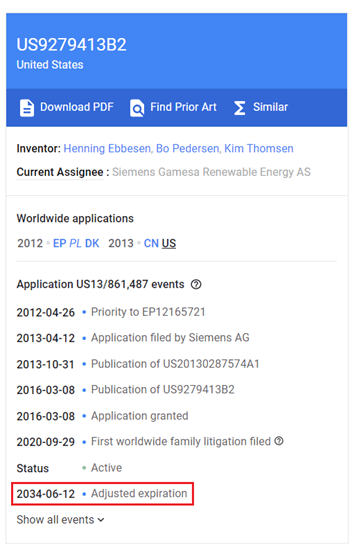

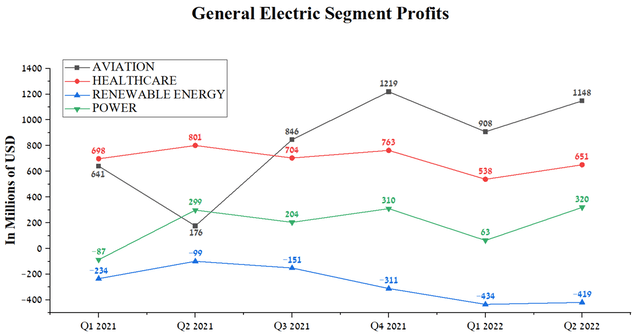

GE’s total segment profit was $1,701 million in Q2 2022, up 44.5% year-over-year. The main contributor to the increase in profits was GE Aviation, whose segment profit margin was 18.7%, thus showing an increase of 15.1% compared to 2Q 2021. I estimate that the company’s aviation segment profits will continue to grow as overall passenger traffic recovers and the engines in the F-35 aircraft and UH-60 and AH-64 Apache helicopters are replaced with more modern ones. While GE Renewable Energy continues to siphon profits from other segments of the company, showing negative margins in recent quarters due to declining volumes and margins in U.S. onshore wind power. I believe this segment of GE will continue to be unprofitable until it is spun off in conjunction with the GE Power and GE Digital businesses as a standalone GE Vernova company. The main reasons for this are high inflation and R&D costs and the ban on the production and sale of the flagship model Haliade-X wind turbines in the United States. In September 2022, Siemens Gamesa won a case proving that General Electric turbines infringe patent number 9,279,413, which expires in 2034.

Source: Author’s elaboration, based on Google Patents

However, a judge allowed General Electric to manufacture and operate the Haliade-X for projects off the coast of New Jersey and Massachusetts with royalties paid to a Spanish-German company. As a result, GE Renewable Energy will need a lot of time and money to redesign the parts in the turbine that infringed the patent due to the need to modernize the production line and make changes to the supply chain.

Source: Author’s elaboration, based on quarterly securities reports

Debt Burden of General Electric vs. Boeing

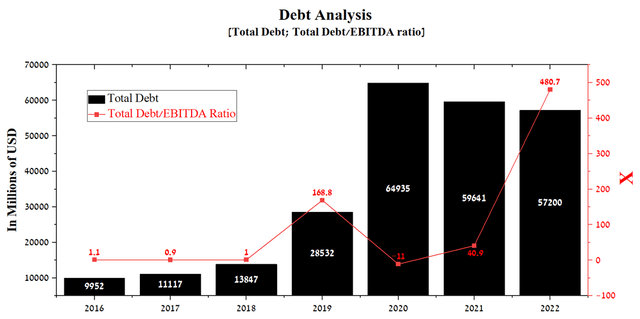

In 2020, Boeing actively raised billions of dollars in bond offerings to cope with business closures around the world during a significant decline in demand for air travel and the need to invest hundreds of millions of dollars to fix technical problems found in the 737 MAX aircraft. At the end of Q2 2022, total debt was $57,200 million, down only 4.1% from the end of 2021. Moreover, the company’s Total Debt/EBITDA ratio continues to rise to 480.7x, indicating significant risks associated with Boeing’s debt servicing.

Source: Author’s elaboration, based on Seeking Alpha

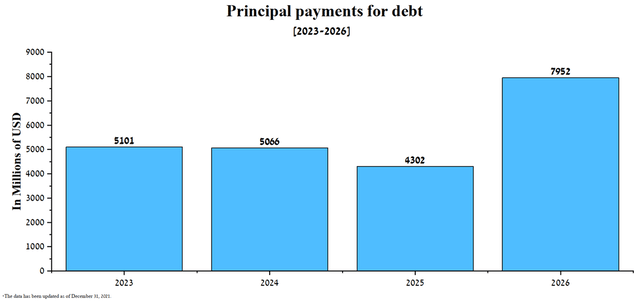

Scheduled principal payments between 2023 and 2026 range from $4.3 billion to nearly $8 billion. Given that Boeing’s operating income has continued to be negative since 2019 and there are no prerequisites for its improvement, it is highly likely that the company’s management will have to refinance most of the debt. As a result, this will hurt the company’s financial position in the current period of interest rate hikes by the Fed and central banks in Europe and Japan.

Source: Author’s elaboration, based on 10-K

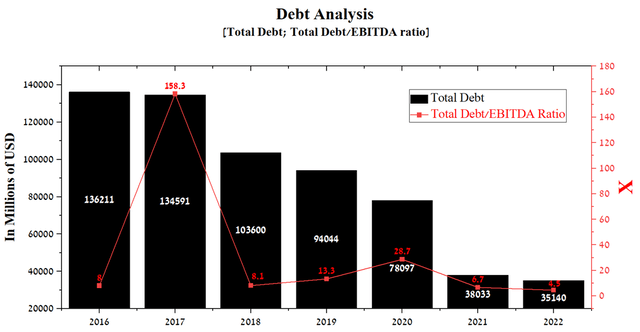

General Electric has already experienced a similar painful period in its history, when the company’s total debt exceeded one hundred billion dollars thanks to the sale of various assets, including the BioPharma business and hundreds of millions of Baker Hughes shares. As a result, GE’s Total Debt/EBITDA ratio was reduced from 158.3x to 4.5x.

Source: Author’s elaboration, based on Seeking Alpha

Conclusion

Boeing is one of the world leaders in the production of military and commercial aircraft, which play a key role in the life of every person on the planet, from the delivery of cargo to their use in military operations to protect the population. Whereas General Electric has a diversified portfolio of energy and healthcare assets, saving the lives of millions of patients and generating billions of dollars in revenue each year, in addition to the aviation business. At the moment, the primary challenge facing the management of Boeing is the question of survival, while trying to maintain the level of innovation and not lose the competition to Airbus. In my estimation, GE has already gone through this difficult period in its history, authorized a $3 billion share buyback program, and began to pursue an active investment policy. With faster revenue and operating income growth, dividend payouts, and significantly lower debt, I believe GE is a more attractive asset to long-term investors than Boeing.

Be the first to comment