creisinger

General Electric Corporation (NYSE:GE) is scheduled to announce profits for its second quarter later this month, and there is a growing possibility that the company could retract its margin and free cash flow projection for 2022.

Wage inflation will be a worry for General Electric as a worldwide firm with a huge employee base. Inflation and wage pressures might cause a significant fall in General Electric’s operating margins, which are already under pressure.

If General Electric withdraws its free cash flow projection for 2022 and 2023, investors will most certainly face even more pain in the short run.

Why I Expect General Electric To Withdraw Its Guidance

The growth prognosis for General Electric has swiftly deteriorated in the second quarter, owing to an expanding collection of problems such as the Russia/Ukraine war, rising consumer prices (especially in the energy sector), and supply-chain challenges.

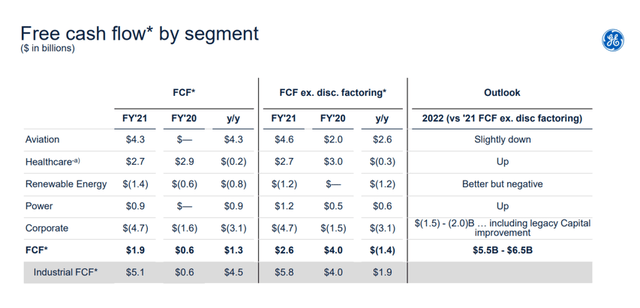

General Electric anticipates an increase in adjusted organic margins of 150 basis points in 2022, as well as free cash flow of $5.5-6.5 billion.

Free Cash Flow By Segment (General Electric)

General Electric already stated when it released its first-quarter results that it was sticking to its free cash flow guidance range for the time being, but that expectations have trended towards the lower end of this range due to mounting concerns about the global economy.

Inflation accelerated in the second quarter, reaching fresh four-decade highs in May, and June inflation figures are unlikely to show any significant improvement.

As a result, I believe there is a 60-70% risk that General Electric will cut its 2022 guidance.

General Electric’s Margins Are Set To Come Under Pressure Due To (WAGE) Inflation

General Electric is particularly reliant on the health and stability of the global economy because it supplies MRI scanners, engines, and turbines to customers all around the world.

Companies like General Electric, which have customers in numerous nations throughout the world, would most likely be the first to see signs of a slump.

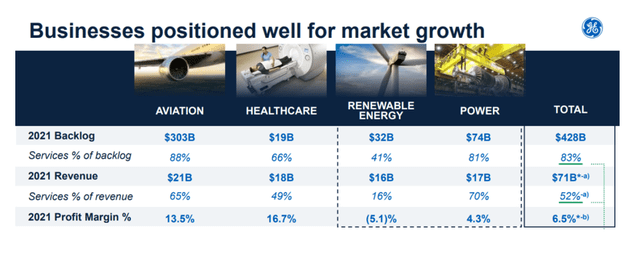

General Electric’s profit margins, which were greatest in the health-care division in 2021 at 16.7%, could come under pressure, resulting in General Electric failing to meet its margin projections for 2022.

2021 Profit Margin (General Electric)

General Electric’s margin concerns have also increased as inflation has continued to rise in the second quarter. In May, inflation reached a four-decade high of 8.6%, and inflation may not have peaked yet. Rising consumer prices are problematic for a variety of reasons, but especially because they tend to raise employees’ pay expectations to compensate for a loss of purchasing power.

In 2021, General Electric employed 168K workers worldwide, with 55K working in the United States, accounting for roughly one-third of the company’s global workforce.

Because of record inflation, wage demands are likely to be aggressive, implying that General Electric may face a significant increase in its labor bill coming forward and abandon its margin projection as a result.

General Electric’s Uncertain Outlook Doesn’t Make The Stock A Good Deal

Because General Electric projects $5.5-6.0 billion in free cash flow in 2022, the company now has a P/FCF ratio of 11.4x. Because General Electric’s free cash flow and margin concerns surged significantly in the second quarter, this may not be as good a day as some investors believe.

Why General Electric Could See A Higher, Not A Lower Valuation

General Electric is a worldwide corporation that relies on the overall strength of the global economy to generate positive financial results.

If the global economy avoids a recession and properly manages inflation, General Electric has the opportunity to do well and enhance its operating margins while keeping its free cash flow estimate. Moderate salary increases would also help General Electric meet its margin target.

My Conclusion

General Electric is a worldwide corporation that is more vulnerable to the whims of the global economy than the average American corporation.

General Electric would be hit harder than other U.S. corporations if global growth forecasts deteriorated since it sells its engines, turbines, and magnetic resonance imaging machines not just in the United States, but globally.

Runaway inflation exposes General Electric to greater costs, which could deviate from the company’s 2022 margin and free cash flow expectations.

I believe General Electric will withdraw or lower its free cash flow projection at the end of the month by 60-70%. The stock is likely to fall as a result of the canceled guidance.

Be the first to comment