Vladimir Zapletin/iStock via Getty Images

After our initiation of coverage of Ecolab (ECL) – the global leading provider of water treatment, today we provide an update on Diversey Holdings (NASDAQ:DSEY). After our deep dive into the sector, our internal team remains convinced that Diversey Holdings provides a better upside in terms of valuation. Before jumping to a conclusion, let’s review our investment idea.

The company engages in providing infection prevention, hygiene, and cleaning solutions worldwide. It operates in two segments: Institutional and Food and Beverage. Diversey sells products and services, serving over 85k customers in over 80 countries – it is headquartered in South Carolina and was founded in 1923.

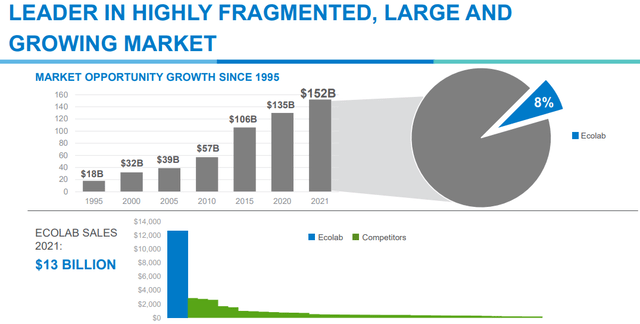

To sum up, Diversey is the second distant cleaning chemicals provider in the United States (after Ecolab), but at the same time, the company is the number one operator outside North America. After analysing Ecolab, we understood that the U.S. market is very fragmented, and our internal team believes that bolt-on acquisitions and organic growth can be achieved – allowing Diversey to gain market share.

Ecolab market opportunity

There are other positive long-term catalysts:

- Here at the Lab, we are forecasting more demand post-COVID-19 due to hand and surface sanitiser;

- Diversey is an ESG pure player, it definitely misses the Ecolab marketing tools, but its product offering serves themes such as water quality and water scarcity: relevant themes considering environmental issues;

- Looking at the market, the company is usually pricing its product offering at a significant premium compared to online resellers and distributors – this reflects the better level of service that they offer.

For the above points, we are confident in the management’s ability to raise prices over the medium-long term and overcome this pressure from raw material inflation and higher logistics costs.

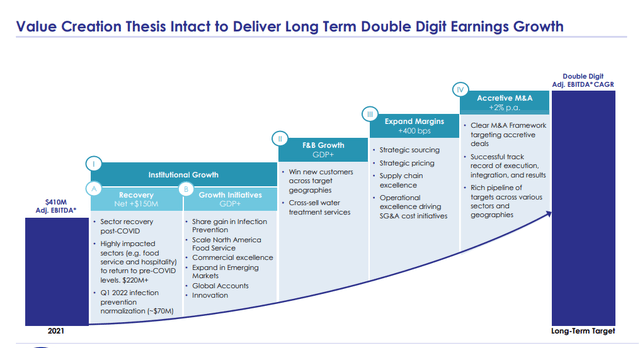

Diversey Holdings margin expansion

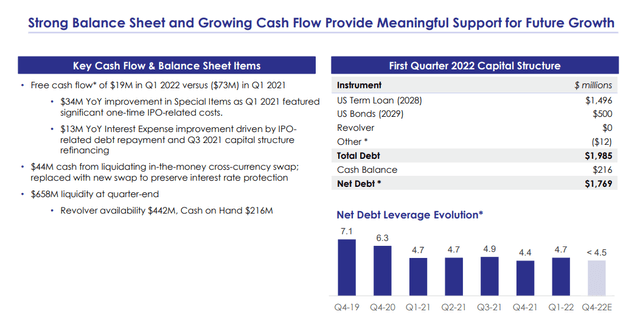

Another topic to mention is the high net debt to EBITDA ratio that now stands at 4.7x. Although it is a pretty high number, our internal team believes that the liquidity risk is not a problem thanks to Diversey Holdings’ business nature, asset-light model, and FCF generation.

Diversey Holdings Debt Evolution

Valuation And Conclusion

We based Ecolab’s target price over the twelve-month at $185, this was based on ~29x NTM with an EPS of $6.4 and looking at the implied EBITDA multiple we see 18x. We rate Diversey Holdings with a buy rating, given the significant discount compared to its close peer, we don’t believe that this discount is justified. We derived a $14 stock price based on a 13x multiple on an EBITDA projection of $470 million in 2024. We should note that even Ecolab carried some debt (net debt to EBITDA ratio stands at 3.3x). Risks to our rating should include Diversey’s free float, which is quite low (Bain capital controls a partition of its common equity stake); a leveraged balance sheet; slower recovery in demand from travel and hospitality, and execution risks. We should also note the recent investment from director Eric J Foss who bought 121,210 shares at a price range of $8.26-8.95 each, as per the latest SEC filing.

Be the first to comment