Jonathan Kitchen

Dear Nordstern Capital Partners and Friends:

We anticipated and previously wrote about market exuberance, recession-risk, rising interest rates and inflation, all of which seem to be materializing. We continue to believe that we are well positioned for the storm…and/or for the eventual sunshine as well.

1970s

“Early in the 1970s, most Americans had never experienced inflation, so they weren’t wary of it and allowed it to blossom.”

– Ray Dalio, founder Bridgewater Associates[1]

In the 1970s the gold-linked monetary system broke down and money supply accelerated. The previously dominant Western energy conglomerates (the Seven Sisters) lost control of the oil market in a shift of power towards OPEC and oil producing countries. Inflation went rampant. Commodity prices surged, while the stock market remained flat for the decade.

2000s

“Supply side constraints are growing, demand from China must see margin expansion in the next few years. Now is the time to act.”

– Mick Davis, CEO Xtrata (today part of Glencore), internal memo June 27, 20012

Source: Data from CapitalIQ

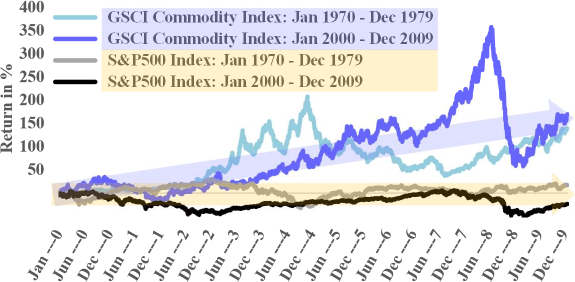

In resemblance to today, at the turn of the millennium the natural resource sector had seen many years of underinvestment. The resulting lack of commodity supply in the 2000s coincided with China’s rapid urbanization and industrialization, which created a seismic hunger for commodities that the world had never seen before. 0 Commodity prices surged over this -50 decade (see GSCI index), while the stock market declined (see S&P500 index).

‘Quality’

Popular investment sentiment today is to buy only ‘high quality companies’ and to accept paying higher multiples for alleged ‘high quality’. The underlying concept is that this ‘high quality’ would assure a longer duration of growth for the business. Several companies have experienced durable cash flow growth over many years, and therefore did prove that it was justified to pay up for them in the past.

Different investors emphasize different characteristics to define ‘high quality’, including qualitative criteria such as ‘moats’, or quantitative criteria such as return on invested capital. While investors might differ in their ultimate definition of ‘high quality’, what many have in common is that they do not see any ‘quality’ in commodity businesses.

Commodity Business vs. ‘Quality’ Business

Glencore data from reference 2. Other data from CapitalIQ

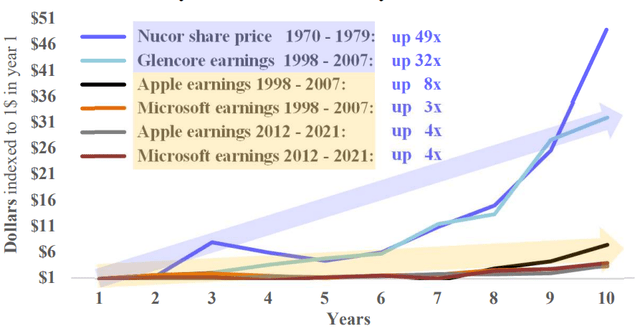

Commodity companies have been terrible businesses and ‘low quality’ on most measures over the last decade. Even over the boom decades of the 1970s and 2000s the GSCI commodity price index meagerly increased around 150%. Nonetheless, an environment of rising resource prices can do wonders for a commodity business, exemplified in the share price escalation of steel manufacturer Nucor Corporation (NUE) in the 1970s and the profit explosion of resources giant Glencore (OTCPK:GLCNF) in the 2000s.

If a ‘higher quality’ business is expected to generate higher future cash flows for the investor, then it deserves a higher valuation. The only relevant investment criterium is ultimately: price paid versus the present value of all future cash flows to and from the investor (aka ‘value’). Using price-to-value as the only relevant yardstick might lead to some juicy investments into commodity companies.

2020s

The first few years of the current decade have seen massive money supply growth in most of the developed world. Elevated demand is now clashing with severe supply chain disruptions. This scenario unfolds while many companies in commodity industries have refrained from investments into new production and/or capacity for decades.

Nonetheless, large parts of the emerging world are still striving to further industrialize, and the developed world is stuck in a low interest rate environment coupled with enormous debt loads. This mixture smells a bit like history and might herald structural inflation and a new commodity super cycle.

Nonetheless, many commodity businesses still trade at low single digit free cash flow multiples, pay double digit dividend yields and/or buy back large chunks of shares. Only the fortune teller knows the future, but if the current decade would indeed experience another commodity super cycle, then some of those neglected businesses might demonstrate similar ‘quality’ as steel maker Nucor Corporation in the 1970s.

Top NORDSTERN CAPITAL Investments

Arch Resources Inc (ARCH – stock price: + 9% in 2Q 2022)

“It’s atypical for a company with our cash-generating capabilities to have such modest cash requirements” – Paul Lang, CEO Arch Resources Inc[2]

This statement sounds like it came from a mature capital-light software giant. However, those are the words of the CEO of an American coal mine operator trading at 2-times free cashflow with a 25% forward dividend yield and a massive share buyback program.

Not everything is rosy in coal investor land. ARCH struggles with persistent rail and shipping issues. In the first quarter ARCH only sold about 16% of the met coal tonnage that management expects to sell throughout 2022. The company received only 60% of the required train capacity. Management cited inadequate rail service as the single biggest challenge. However, ARCH delivered record quarterly net income regardless.3

The rail service has improved. June was better than May, which was better than April, which was better than March[3]. Nonetheless, rail service is still inadequate, labor is still hard to find, and the ports are still clogged, and vessels delayed. However, coal sales volumes will be higher than in the first quarter.

Met coal prices deteriorated significantly over the last few months. Recession expectations project lower future steel demand. On the other hand, Europe’s energy crisis resulted in record prices for thermal coal. ARCH’s overall coal sales price realization in the second quarter should be higher than in the first quarter.

ARCH is a low-cost producer of an essential commodity in an industry with severe supply constraints. The ‘moat’ is structural, more supply won’t come. To the contrary, a ban on Russian coal is scheduled to go into effect August 10. A recession might temporarily decrease demand, but we believe it will bounce back: from large developing nations, from infrastructure upgrades in the US, from energy shortages everywhere.

Even in the near-term coal demand might soon be on fire again: China consumes more than half of the world’s coal and will likely overcome its covid issues at some point. China is expected to diverge from the course taken by western central banks by opting for economic stimulus rather than tightening. In addition, Germany is about to switch off its last three nuclear power plants this year and shift electricity production to coal.

Meanwhile, for ARCH we expect higher sales volumes, higher sales prices, and record income in the quarter ahead.

Embracer Group (OTCPK:THQQF) (stock price: – 2% in 2Q 2022)

“I am going to see every Bond film…if it’s bad I am going to be really upset…because I believe that that IP is always just beyond…And that’s the contract that Gearbox and 2K has with Borderlands customers” – Strauss Zelnick, Chairman & CEO Take-Two Interactive Inc[4]

Embracer Group AB (Embracer) closed out its “transition year”[5] last quarter in line with expectations. Mobile games and particularly Easybrain were once again the bright spot. For the upcoming quarter, management forecasted operational EBIT to come in at one seventh of the full year’s number. For the full year Embracer projected operational EBIT of approximately $900m to $1.1bn[6], about twice the operating income that is expected from Take-Two Interactive (including Zynga) during the same period[7].

Mobile keeps performing. In the second quarter Embracer was the top three publisher by worldwide downloads from Google Play, only behind Meta (META) and Google (GOOG, GOOGL).[8] Half of Embracer’s total revenues come from the US (46% in 2021)[9] and should benefit from the strong dollar. Considering those developments and several stable new game releases (and first royalties from the Borderlands spin-off Tiny Tina’s Wonderlands), the implicit guidance for the upcoming quarter seems very achievable.

Embracer’s management continues to indicate significant profit growth over the next few years. Most of this growth is expected to come from hundreds of new game releases, particularly AAA-game projects (high-budget high-profile games). Embracer expects to release more than 25 AAA-projects over the next five years7.

Saints Row Reboot will be the first one of these games, launching in August and sporting a development budget likely close to what Embracer spent on last year’s entire slate of released games. Such a high budget venture requires to sell several million units to become a financial success. If a AAA-game becomes viral it can rake in multi-billions of dollars, and “gazillions” if it becomes a Bond-like franchise.

Embracer’s next quarterly financials are going to be prepared under IFRS accounting standards for the first time. Goodwill is not amortized under IFRS rules. This is going to eliminate billions of amortization ‘expenses’ from Embracer’s income statement and will significantly increase the bottom line. While IFRS standards are just another way of counting the same beans, other fund managers have expressed to us that they won’t get involved in Embracer before having a chance to look at IFRS numbers. In any event, the transfer to IFRS prepares for the uplisting to the main Swedish stock exchange this year.

The uplisting will add another arrow to the quiver: it will enable Embracer to buy back shares (which is prohibited under the rules of the current listing). Lars Wingefors knows how to use capital allocation to increase shareholder value. I don’t doubt that he would use buybacks when the right opportunity to increase long-term value presents itself. He certainly demonstrated capital allocation prowess again in early May when Embracer bought studios from SquareEnix for $300m in cash, when the stock price was at 67 krona, and then raised $1bn cash in June by selling shares at 103 krona.

This capital raise in June sold 8% of Embracer to Savvy Gaming Group (SGG), a part of the Saudi sovereign wealth fund PIF. PIF already owns 4% of SquareEnix, 5% of Activision (ATVI), 5% of Electronic Arts (EA), 6% of Nintendo (OTCPK:NTDOY), 7% of Take-Two (TTWO), 8% of Capcom (OTCPK:CCOEY), 9% of Nexon (OTCPK:NEXOF), 10% of NCSoft among many other investments. Nevertheless, the transaction with “a non-democratic country”[10] triggered an avalanche of stakeholder outreach and was followed by a significant share price decline in the days thereafter.

Nordstern Capital appreciates SGG’s investment in Embracer. Those harboring concerns about SGG should read the response issued by Lars Wingefors. SGG supports Embracer’s strategy and might help to reach more gamers in the MENA region11. I have had the opportunity to speak with Embracer employees and executives over the course of the last years and I believe that the individuals I interacted with reflect the company values of “Honesty, Trust, and Long-Term”12.

I for one trust that Embracer is a value-based company and that the SGG transaction is in the best interest of Embracer’s stakeholders.

Imperial Metals (OTCPK:IPMLF – stock price: – 23% in 2Q 2022)

“Copper will be the oil that drives the engine”

– Lucas White, Portfolio Manager at GMO[11]

Imperial Metals’ recent financial results were in line with expectations. In the meantime, the Mount Polley mine has reopened with a slight delay and will show some production from June in the second quarter. The third quarter will see the first full period of Mount Polley ore production with gold being the main revenue driver for the next six months, before mining gets to the better copper grades next year[12].

Imperial Metals raised CAD $41m at a share price of CAD $3.04 in June. The lion’s share of the funds came from Murray Edwards who increased his ownership of the company from 42% to 45%. The capital is mostly required for the buildout of the Red Chris block cave and further exploration of the newly discovered reserves at East Ridge.

The Red Chris decline ramp did pass 1,000 meters in March[13]. It passed 1,600 meters in early July16. Once it gets to 2,000 meters, early mining of the high-grade pods might become feasible. Those pods could flush hundreds of millions of dollars into Imperial Metals within months. However, Newcrest (OTCPK:NCMGF) did not yet confirm to undertake early mining and still communicates that this option is ‘under review’ as of May[14].

The East Ridge exploration is one of Newcrest’s priorities. The company is about to deploy one or two underground drill rigs from the decline ramp which is a significant improvement from the previously purely surface drilling of the area.

Whether Imperial Metals will need any more capital raises before Mount Polley and/or Red Chris will begin to generate more cash than costs depends on the commodity price environment over the next year. Recession fears, rising interest rates and the strong dollar have pressured copper and gold prices recently.

CME (CME) copper futures traders turned to net short positions in May and LME copper inventories rose, while China (which is responsible for more than 50% of the world’s copper demand) is still grappling with Covid related lockdowns in various parts.

However, a longer time frame reveals that copper inventories are in years long decline. The structural headwinds remain: constrained supply after more than a decade of underinvestment meets rising demand from world-wide electrification of everything, and potentially explosive demand from further infrastructure needs of giant developing populations such as China, India, Indonesia, etc.

If copper is going to be the new oil, then Imperial Metals’ owners will be the new barons.

Evolution (OTCPK:EVVTY – stock price: – 4% in 2Q 2022)

“The new kids on the block still need to learn the hard way. I believe that they are losing buckets at the moment. With one, two, three studios you will not make a difference. For a small company to say that they compete with EVO, that they take business away from EVO, is embarrassing.” – Edo Haitin, CEO Playtech Live Casino[15]

Evolution AB (Evo) is the quintessential quality business. Revenues last quarter grew another 40% and margins expanded further. Net income margins topped 60% for the first time. To reiterate: when Evolution does $100 in sales, after all costs and taxes more than $60 dollars land in the owner’s pockets. In addition, the business is growing faster than many of today’s popular ‘unprofitable tech’ companies.

The second quarter is shaping up no different. Player numbers are growing consistently across the board of Evolution’s live games[16]. The company launched a major new market in April with rolling out services in Ontario, and in May Evolution landed another hit game with XXXTreme Lightning Roulette[17].

In June, Evo committed EUR 340m cash to acquire top-quality online slot provider Nolimit City, which is expected to achieve EBITDA margins even higher than Evo[18]. With Nolimit City founder Jonas Tegman, who has a reputation for unique product design, another creative pioneer is going to join EVO’s highly respected innovation machine around Nik Robinson (from BTG) and Todd Haushalter.

Evo is rolling out another brilliant innovation: The Evo Smart Lobby. There is no way to do it justice in a short paragraph (What is a ‘lobby’? Think of your Netflix app and browsing for your next show as the equivalent to Evo’s lobby to find your next game). It is a major upgrade, an app-like experience even on a browser (the AppStore doesn’t carry gambling apps in many jurisdictions).

AI-powered personalization, rich features, easy navigation: top picks for you, hot tables right now, recently played games, top games, autocomplete search, live preview (incl. last winning numbers, jackpot, bet limit, etc.) on hover (on mobile you need to click), reward games mode, in-game panel to browse the lobby while you play, beautiful side scrolling, giant hero banners, and on and on and on[19].

Image Source: Evolution AB Smart Lobby Factsheet

Evo recognizes your phone brand, type, version, and whether you hold it in landscape or portrait. Hundreds of different combinations and Evo has bespoke libraries for all of them for each of their games, thus always offering great user experience. No other company has such advanced view-optimization, not Instagram, not Tik Tok, not Netflix (NFLX).

In addition, Evo always pumps four video streams through the web, HD, high, medium and low. Should your connection worsen, Evo will automatically detect and downgrade the stream. This happens cross-platform (PC, Mac, browser, app, iPhone, low-end phone, …) with thousands of concurrent players from potentially very different locations in one and the same real-money game, where trust and smoothness are of the essence.22

Contrast this with Fortnite: only 100 concurrent players, but they complain about lags all the time. Then there are hackers and all kinds of cheaters in Fortnite. Can’t have any of this in a real-money game, and Evolution’s live security solutions are, of course, best in class.

Not even mentioning all the other issues, such as money laundering (e.g. we play Roulette on the same table, you put it on black, I put it on red..tatata..money transferred over to me), players colluding with dealers, bots measuring the speed of ball and roulette wheel, etc. etc. Advice for the crooks: don’t try this in Evo’s games. They’ll get you. Advice for the operators: why would you ever try to ‘save a nickel’ with a ‘cheap’ B2B provider, risking fraud and all kinds of security issues and potential destruction of your entire business? Just go with Evo.

Online casino operators do not like third party lobbies. They want to be masters of their own domain. No B2B game provider gets the privilege to tamper with an operator’s ‘real estate’ to set up a separate lobby, except for Evo. Evo insists on its own lobby, and no online casino can afford not to have Evo. Of course, inside Evo’s Smart Lobby you can only choose Evo’s games.

However, why would you ever want to leave? It has all the blockbusters, all the variety, offers the best viewing experience, offers the coolest features and the most compelling personalization. You like it. You trust it. And if you want to switch games, you can browse for your next one without even leaving your current game.

Just go with Evo.

StoneCo Ltd (STNE – stock price: – 34% in 2Q 2022)

“To grow its customer base, X.com had been giving out lines of credit to prospective customers, part of its plan for a full suite of financial services products. But with X.com expanding as fast as it had, appropriate underwriting had taken a back seat.”

– Jimmy Soni, in “The Founders”[20]

StoneCo Ltd. (Stone) today is seen as a payment provider with lower margins than its peers in a structurally difficult environment in Brazil: strong competition, declining take rates, increasing funding costs. The last two quarterly updates indicated improvement in all business lines for Stone and management did forecast further margin increases throughout all of 2022.

In contrast to the other payment providers, Stone also has a sizable software business.

In addition, Stone is working towards becoming a full-fledged financial services provider. Both endeavors add costs to the P&L, but do not yet add meaningful profits, which is about to change. Particularly the lending business could become bigger and more profitable than the current bread-and-butter payments business. However, the lending business was suspended last year after experiencing issues that resemble those of the early PayPal (PYPL) from more than two decades ago (“X.com” was renamed “PayPal” in 2001).

PayPal figured out how to solve credit underwriting and so will André Street and Stone. One of Elon Musk’s strengths was to find the right people, as evidenced in the legend of ‘The PayPal Mafia’24. To address its own lending problems Stone added the following personnel in March and April:

+ Gregor Ilg as Head of Credit: former head of Santander Brazil SME Retail Risk

+ Patricia Verderesi Schindler to the board: former Chief Risk Officer of JP Morgan Brazil

+ Pedro Zinner to the board: former Global Head of Corporate Risk Management at Vale

+ Conrado Engel to the board: former CEO of HSBC Brazil and Santander risk committee board member

If lack of executives with lending experience from the big banks was the problem, as suggested by a former Strategy Director of Stone in a conversation last year[21], then the above roaster will certainly help.

In the software business Stone intends to go after low hanging fruits in the near term: realizing back-office synergies, cross-selling into existing clients, increase share-of-wallet in existing verticals, add more premium features, improve customer service[22]. Management expects gradual improvement towards 20% EBITDA margins at a 30% growth run rate[23].

After some more testing this year, credit solutions are expected to resume in full scale next year. In the meantime, we will enjoy improved payment margins and increased profitability from the software business every quarter. The market, however, is still pricing Stone as if it were a mature payments business in decline. More power to us!

Trust

The Nordstern Capital partnership can flourish thanks to our partners’ trust, which empowers us to ignore short-term stock price volatility and to focus on decision making for long-term investment success. I am convinced that the dedicated focus on the long-term cash flow prospects of our investments will result in better long-term returns.

Long-term oriented accredited investors who are not partners yet are encouraged to apply. Looking forward to hearing from all of you.

Sincerely,

Johannes Arnold, Nordstern Capital Investors LLC

Footnotes

[1]Dalio, Ray. Principles for dealing with the changing world order: Why nations succeed and fail. Avid Reader Press, 2021

2 Blas, Javier and Farchy, Jack. The world for sale. Oxford University Press, 2021

[3]Arch Resources Inc 1Q2022 earnings call, April 26, 2022

[4]According to Nordstern Capital research

[5]Strauss Zelnick at Jefferies Global Interactive Entertainment Conference, November 11, 2022

[6]Shareholder letter CEO Lars Wingefors, May 19, 2022

[7]Embracer Group quarterly financial report 4Q2022, May 19, 2022

[8]Jefferies note on Take-Two Interactive Inc, July 11, 2022

[9]2Q2022 Sensortower Intelligence Report

[10]Embracer Group Annual Report FY2022, July 8, 2022

[11]Embracer Group press release: CEO comment on the announcement of the directed share issue to SGG, June 10, 2022

12Embracer Group Annual Report FY2022, July 8, 2022

[13]GMO 1Q 2022 quarterly letter

[14]According to Nordstern Capital research

[15]Imperial Metals press release 2022-03-22

16 According to Nordstern Capital Research

[17]Newcrest presentation at BofA conference, 2022-05-17

[18]Addressing questions about new live casino competition in a conversation with Nordstern Capital

[19]According to igamingtracker.com

[20]Topped 1,000 concurrent players on launch day, now averaging above 1,500 concurrent players and growing

[21]Evolution AB shareholder call regarding the acquisition of Nolimit City, June 22, 2022

[22]According to Nordstern Capital Research

[23]Soni, Jimmy. The Founders. The story of PayPal and the entrepreneurs who shaped Silicon Valley. Simon & Schuster, 2022

24 https://fortune.com/2007/11/13/paypal-mafia/

[25]Tegus conversation transcript from 2021-11-29

[26]According to Nordstern Capital Research

[27]StoneCo 1Q2022 earnings call, 2022-06-02

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment