eugenesergeev/iStock via Getty Images

Looking for high yield exposure to supply chain logistics?

Take a look at Genco Shipping & Trading Ltd. (NYSE:GNK). Genco’s management has adopted a new Value strategy over the past ~year, focusing on three elements – dividends, deleveraging, and growth.

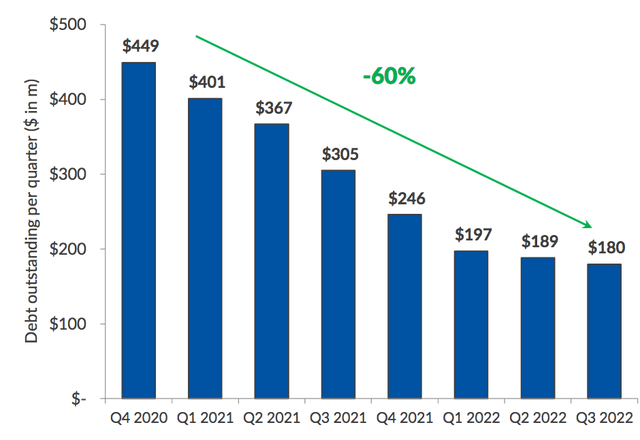

The deleveraging move has cut down GNK’s debt by 60%, subsequently reducing its daily vessel breakeven rate dramatically. Dividends have soared to $2.74/share in the past four quarters.

Company Profile:

Genco Shipping & Trading Limited is an international ship owning company. It transports iron ore, coal, grain, steel products and other drybulk cargoes along worldwide shipping routes. Its wholly owned modern fleet of dry cargo vessels consists of Capesize, Ultramax and Supramax vessels that provide an essential link in international trade. (GNK site)

Earnings:

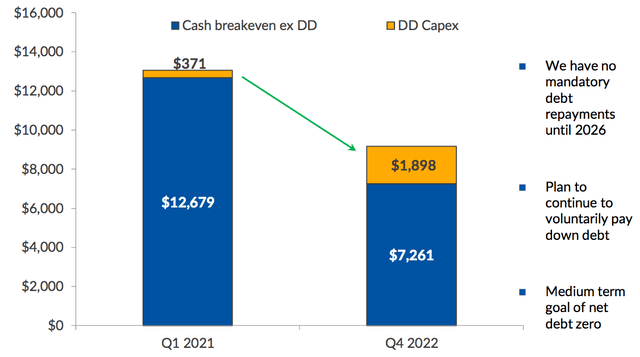

GNK’s cash breakeven/vessel improved by 43% since Q1 ’21, dropping from $12.68K to $7.26K.

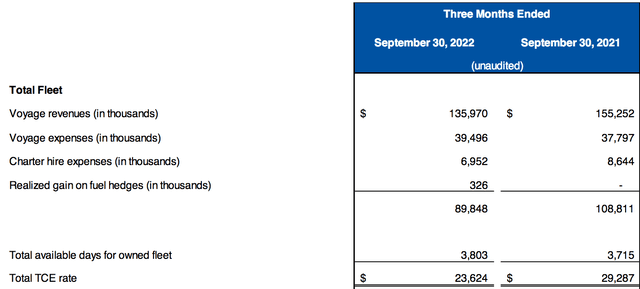

In Q3 ’22, GNK had revenues of $136M, down 12% vs. $155M in Q3 ’21, due to lower rates. Net income was $41M, vs $57M a year ago, while EPS was $.95, vs. $1.34 in Q3 ’21. Adjusted EBITDA was $60M, down 25%, vs. $80M.

TCE rates were much lower in Q3 ’22 vs. a year ago, dropping 19%, to $23.62K:

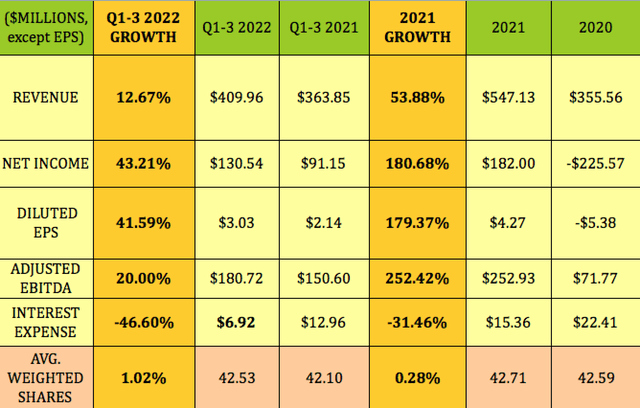

For Q1-3 ’22, GNK had 12%-plus revenue growth, with over 40% growth in Net income and EPS, while Adjusted EBITDA grew 20%. Interest expense dropped by ~$6M, improving by 47% over these three quarters, continuing the improvement seen in 2021.

2021 saw big growth numbers for GNK, with higher rates supporting revenues and earnings. Management has kept the share count roughly flat in 2021 and 2022:

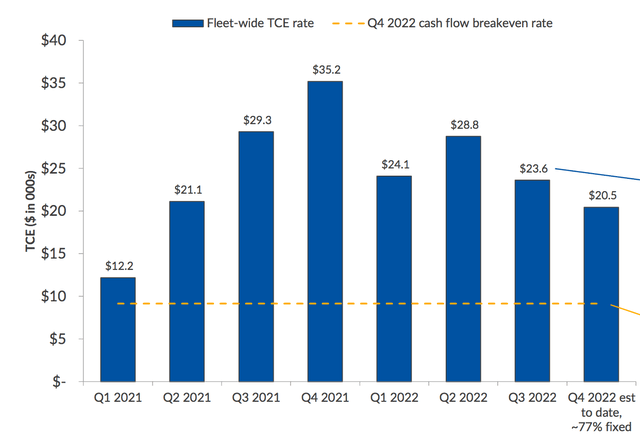

Looking ahead to Q4 ’22 earnings, management sees GNK’s average TCE rate at being over $20K, far above BDI rates:

“Our estimated fourth quarter TCE based on fixtures to date remains strong at $20,451 per day well above current spot rates of approximately $13,500/day for Capesize and Supramax vessels. We also expect our low cash flow breakeven rates to continue to be a core differentiator for Genco and support our ability to continue to execute our value strategy for the remainder of 2022 and into 2023 as we take advantage of our sizeable and leading drybulk platform for the benefit of shareholders.” (GNK site)

Dividends:

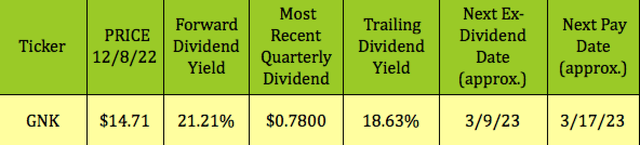

At its 12/8/22 price of $14.71, GNK’s trailing dividend yield is 18.63%, and its forward yield is over 21%, based upon its most recent $.78 quarterly dividend.

The $0.78 dividend was the 13th straight payout, reflecting cumulative dividends totaling $3.795/share. GNK should go ex-dividend next on ~3/9/23, with a ~3/17/23 pay date:

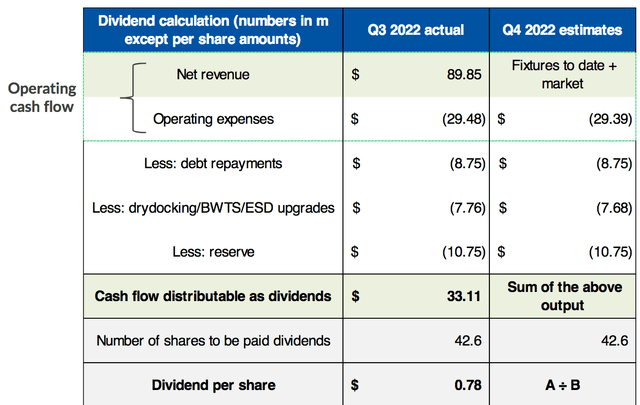

Under management’s new system, dividends are calculated based upon cash flow distributable as dividends. Operating expenses, debt repayments, drydocking/upgrades, and a reserve are all deducted from net revenue, leaving an amount to be distributed as dividends.

That figure was $33.11M for Q3 ’22. Using $20K as the potential overall Q4 TCE rate implies a ~15% lower revenue amount. So, the Q4 dividend may be in the $.65 – $.66/share range.

Management feels that GNK should be able to continue to pay attractive dividends in the future: “We remain in a strong position to pay sizeable dividends to shareholders while seeking opportunities to take advantage of attractive growth opportunities as markets develop.” (Q3 call)

Profitability and Leverage:

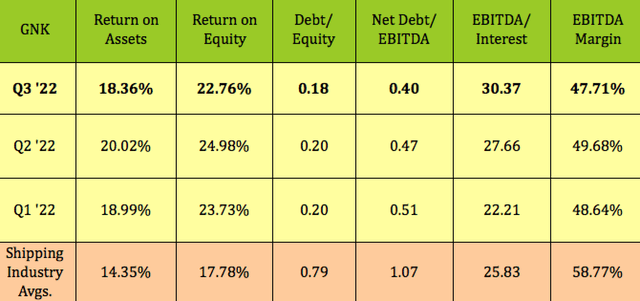

While ROA and ROE were lower in Q3 ’22, they remained well above industry averages.

Surprisingly, for a capital-intensive industry, marine shipping industry companies often have low debt, with a 1.07X net debt/EBITDA average and a .79X average debt/equity.

GNK’s debt leverage continued to improve in Q3 ’22, with debt/equity of .18X and net debt/EBITDA of .40X both stronger than industry averages:

Debt and Liquidity:

Management prepaid $8.75M of debt on a voluntary basis during Q3 2022 to reduce GNK’s debt to $179.8M. Since the start of 2021, they’ve paid down $269.5 million or 60% of GNK’s debt load:

As of 9/30/22, GNK had total liquidity of $287.4M, consisting of $71.5M of cash and $215.9M of revolver availability. GNK has no quarterly debt paydown obligations until 2026, but management has continued to pay down $8.75M per quarter.

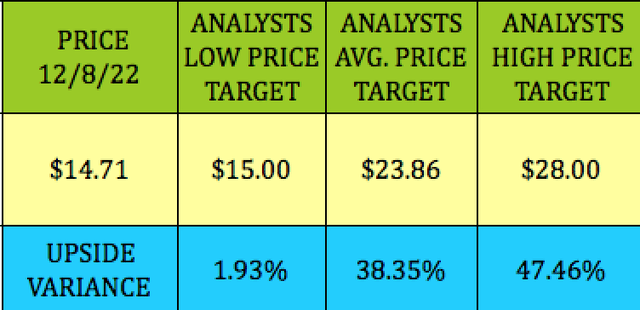

Analysts’ Targets:

At its 12/8/22 $14.71 price, GNK was ~2% below the street’s lowest target of $15.00, and 38% below the $23.86 average price target.

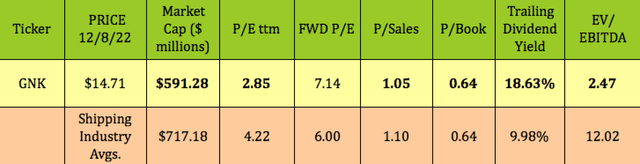

Valuations:

Coincidentally, GNK is valued at a P/Book of .64X, the same as its industry’s average. It’s cheaper on a trailing P/E basis, but a bit higher on a forward P/E basis. Its P/Sales is roughly in line, while its EV/EBITDA of 2.47X is much lower than the 12X industry average.

Performance:

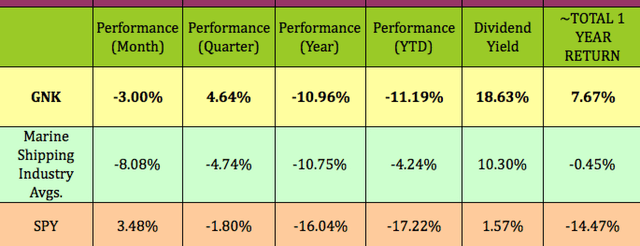

GNK has outperformed its industry and the S&P over the past month and quarter, and has delivered a much higher total return over the past year:

Parting Thoughts:

While TCE rates may be lower in 2023, the global fleet’s historically low order book and the IMO 2023 Environmental Regulations are still expected to be supportive for freight rates going forward. GNK’s lower breakeven costs will continue to give it an edge in profitability, and, ultimately, in its ability to pay attractive dividends. Another advantage is that GNK will have much lower drydocking events in 2023-2025 vs. the global fleet, which should give it an advantage.

All tables furnished by Hidden Dividend Stocks Plus, unless otherwise noted.

Be the first to comment