gradyreese/E+ via Getty Images

Co-produced with Treading Softly

I’ve been married for quite some time now. When we were first together, it was the honeymoon phase. We never fought, never disagreed, love overrode any possible issues, and you felt like nothing could ever go wrong.

Those of us who are or have been married, or even in a long-term relationship, know that phase well. Eventually, that phase ends, and you enter the stage where your relationship is more serious, and requires effort and work from both sides.

One potential landmine for any relationship is a simple slip up also known as a misunderstanding. Picture this:

Your spouse asks you to take out the trash before heading to bed, so you do. You also grab a bag next to the trash can and take it out too – you’re being proactive. Little did you know it was a present for their friend that they had placed there and forgotten to put away.

Imagine the fallout when they realize their present is missing – you threw it out! – so now it becomes a disagreement of “Why didn’t you look to see what it was?!” versus “Why did you leave it next to the trash that YOU told me to take out?!”.

In the end, it was simply a misunderstanding. Both of you had good intentions that went sideways. Both of you know that it is not at all a real threat to the relationship. Down the road, you’ll probably rib each other over the incident and laugh about it.

When it comes to investing, if a company or security is misunderstood, it often carries a higher yield. If you can unwrap the mystery and understand the situation, you can profit from it. For my team and I, we work together to help educate and inform one another. This allows us to have a breadth and depth in our portfolio that simply couldn’t exist if we didn’t work together.

Today, I want to pull back the wool, if only a little, on two misunderstood opportunities.

Pick #1: XFLT – Yield 10.3%

XAI Octagon Floating Rate & Alternative Income Term Trust (XFLT) is a CEF (closed-end fund) that invests in CLOs (collateralized loan obligations) and “leveraged loans”. At HDO, we have been extremely bullish on CLOs coming into 2022.

CLOs are bundles of leveraged loans. These are loans, usually originated by banks to companies with B/B+ credit ratings, and are “senior secured” first-lien loans. These loans are at the absolute top of the capital stack. They are senior to any other debt or equity the borrower has.

The CLO bundles these loans together and then sells “tranches” based on repayment seniority. With each payment the A-tranches have to be paid in full first, then the B-tranches, and so on. Other CLO funds we invest in focus on the “equity” tranche of the CLO. The equity tranche is the last one to get paid, putting it in the highest reward position, but also the first one that doesn’t get paid if borrowers default.

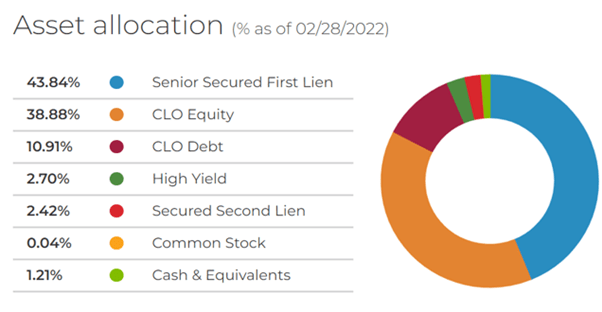

XFLT takes a more conservative approach, with CLO equity accounting for under 40% of assets.

XA Investments

This more defensive positioning is what allowed XFLT to recover its dividend more quickly than peers after the COVID crisis.

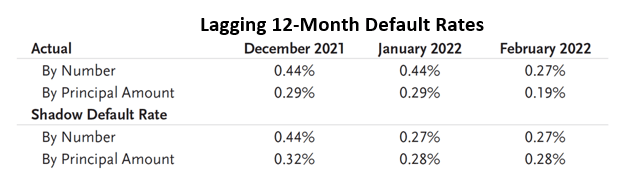

Default rates continue to be historically low.

TCW

Despite incredibly low default rates, CLO prices have also remained low creating a very attractive investment opportunity. Like most debt investments, leveraged loans saw prices decline, especially in March. They have recovered in the past few weeks and the S&P/LTSA Leverage Loan Index is down 0.74% year to date, after being down 2.7% at the bottom in March.

While leveraged loan prices have recovered, XFLT’s share price has not recovered yet and is trading near 52-week lows. Remember, XFLT’s assets are primarily floating-rate. So rising rates increase the amount of interest that is paid to XFLT!

Book value might be down, but earnings are going up. We are more than happy to be buying the dip before the market wakes up and smells the cash flow!

Pick #2: BKEPP – Yield 8.5%

Blueknight Energy Partners L.P., Series A Preferred Units (BKEPP) offer a generous 8.5% yield and issues a K-1 at tax time. BKEPP is a preferred security offered by Blueknight Energy Partners (BKEP). We have previously suggested BKEPP as a safer place to store cash and enjoy a generous yield.

What helps make BKEPP a safer place? Well, there are a few considerations at play. Firstly, BKEP has seen growing distributable cash flow, and its ability to pay BKEPP’s generous distribution is not questioned. Furthermore, BKEP has been given a take-under offer by its General Partner; they are offering to buy out the remaining common units and preferred shares they do not currently own. A prior offer from the GP in 2019 was rejected.

For our focus, they are offering $8.46 per preferred share, while BKEPP trades just below this amount, offering a small capital gains boost but also excellent income while the offer is evaluated by BKEP.

Meanwhile, BKEP’s management isn’t sitting on their laurels. They raised the common unit distribution while simultaneously repurchasing 712,000 preferred shares and retiring them.

If the offer is accepted, the preferred will be bought out at $8.46 and this is a short-term opportunity. If the offer is rejected, BKEPP cannot be called and investors can continue collecting the high yield. Also note, that unlike many preferred, BKEPP unit holders have voting rights identical to common unitholders. This means that BKEPP investors will have the right to vote if BKEP decides to recommend investors accept the GPs offer.

Do we think BKEPP will disappear soon? We hope not as BKEP is a well-run MLP at this point specializing in asphalt. However, buying BKEPP below $8.46 allows us to collect great income while they decide what’s next. Next ex-dividend date is expected May 5th.

Note: BKEPP issues a K-1 at tax time. High Dividend Opportunities strongly advises using limit orders and not buying any shares above $8.46

Getty

Conclusion

XFLT and BKEPP offer two different flavors of how a simple fund or company can be misunderstood, and often overlooked by the market.

BKEPP trades closely aligned to the pending take-under offer from its General Sponsor, while XFLT is shrouded in the confusion regarding CLOs and other credit products.

In the end, you need to understand what you’re buying and why you’re buying it before you do so. Today, we revealed more understanding for you as you weigh your options to buy these great opportunities. This is something my team and I provide to income investors in our community. You can do it for yourself as well if you put the time and effort into researching and learning.

In the end, your retirement depends on you making informed and careful choices. It can be awash in excellent income from outstanding opportunities that others misunderstand if you want it to be.

Be the first to comment