Aslan Alphan/iStock via Getty Images

Nearly 4 months have passed since my last article about GCM Mining (OTCQX:TPRFF). Although the share price increased by nearly 20%, GCM remains one of the cheapest gold miners out there. Despite the fact that GCM kept on delivering great exploration results, increased the reserves and resources at its Segovia mine, put into production the polymetallic recovery circuit, and is working on the mine expansion. But the most exciting developments occurred at GCM’s 44%-owned Aris Gold (OTCQX:ALLXF) which acquired an interest in a world-class gold project.

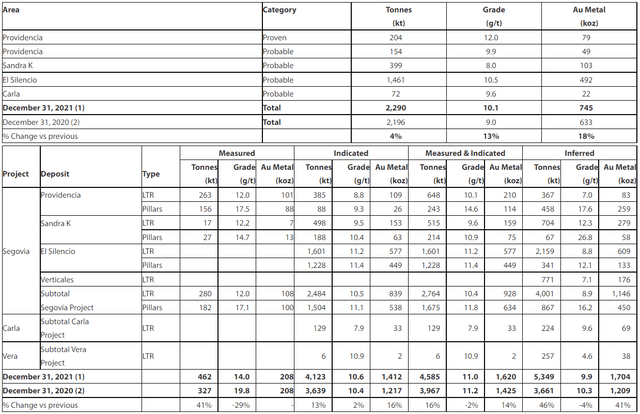

GCM was able to replenish the extracted reserves once again. In 2021, the volume of reserves increased from 633,000 toz gold to 745,000 toz gold, despite the fact that GCM mined 206,389 toz gold. Even more encouraging is the growth in resources. Compared to the previous year, the measured and indicated resources grew by 14%, to 1.62 million toz gold. And the inferred resources grew by 41%, to 1.7 million toz gold. It means that the total resources contain more than 3.3 million toz gold now. The gold grades remain very good, above 10 g/t.

Source: GCM Mining

As mentioned above, the 2021 gold production amounted to 206,389 toz. Due to the mine expansion that should be completed by the end of Q2, the 2022 production should range between 210,000 and 225,000 toz gold. Moreover, the recently completed polymetallic recovery plant should start contributing to the cash flows as well. Therefore, the 2021 revenues of $382.6 million, and operating cash flow of $80.6 million, should be beaten in 2022.

Although the news from GCM is good, the big things occurred at Aris Gold. As I wrote back in May, Aris appointed a new all-star management team that didn’t hide its intention to repeat the success achieved with Endeavour Mining (OTCQX:EDVMF) or Leagold (now part of Equinox Gold (EQX)). And on March 21, they started fulfilling their promises, when the acquisition of a 20% interest in the world-class Soto Norte Gold Project was announced.

Aris Gold will pay Mubadala Investment Company $100 million for the 20% JV interest in Soto Norte. And it will have an option to acquire further 30% of the project for $300 million. To help Aris fund the acquisition, GCM agreed to subscribe for a $35 million convertible senior unsecured debenture issued by Aris. Moreover, Aris and Wheaton Precious Metals (WPM) upsized the existing Marmato gold and silver stream by $65 million.

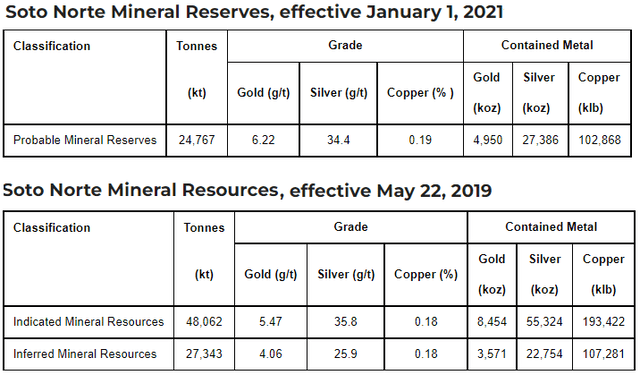

This transaction is really important, as Soto Norte contains reserves of 4.95 million toz gold, 27.39 million toz silver, and 102.87 million lb copper. But the reserves represent only less than 60% of measured and indicated resources that contain 8.45 million toz gold, 55.32 million toz silver, and 193.42 million lb copper. And there are also inferred resources of 3.57 million toz gold, 22.75 million toz silver, and 107.28 million lb copper. So there is a lot of space for a significant expansion of the reserves sometime in the future.

Source: Aris Gold

According to the feasibility study, the underground mine at Soto Norte should be able to produce 450,000 toz gold per year on average over 14-year mine life. The AISC is projected only at $471/toz gold. The initial CAPEX should be around $1.2 billion. At a gold price of $1,675/toz, the after-tax NPV(5%) equals $1.5 billion and the after-tax IRR equals 20.8%. But at the current gold price of approximately $1,950/toz, the after-tax NPV(5%) is over $2 billion and the after-tax IRR is around 25%. As GCM owns 44% of Aris Gold, it is about to indirectly own 8.8% of Soto Norte (22% after Aris acquires the additional 30% stake). It means that the Soto Norte acquisition is big news not only for Aris but also for GCM Mining. By the way, Aris Gold was the January “Idea of the month” featured in my marketplace service “Royalty & Streaming Corner”. The shares are 25% up since then.

Conclusion

GCM’s share price has been in an uptrend since last August. However, it still hasn’t been able to break the resistance in the $4.8 area. The technicals look good, the RSI is only in the mid-50s, far from the overbought levels, and the 10-day moving average is situated safely above the 50-day one. The gold price has been stabilizing in the $1,920-1,950 range over the recent weeks. If it breaks out to the upside, GCM should finally break the long-lasting resistance.

Source: TradingView

GCM Mining is heavily undervalued from a fundamental perspective. Its market capitalization is $447 million. But it held cash of $323.6 million as of the end of 2021. The net debt was approximately -$13 million which leads to an enterprise value of $434 million. Moreover, GCM holds also a 44% equity interest in Aris Gold, a 27% equity interest in Denarius (OTCPK:DNRSF), and a 26% equity interest in Western Atlas Resources (OTC:PPZRF). These assets are worth around $112 million at the current market prices (and it is important to note that Aris Gold alone is pretty cheap, as I show in this article). Therefore, a value of only $322 million is attributed to the Segovia mine and the Toroparu project. At Segovia, the reserves and resources were expanded considerably during the 2021 drill campaign. And Toroparu offers an after-tax NPV(5%) of more than $1.5 billion or an after-tax NPV(8%) of nearly $1.1 billion at the current metals prices. GCM Mining remains heavily undervalued.

Be the first to comment