tonefotografia

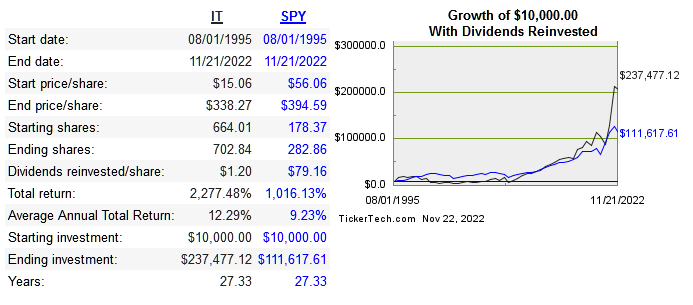

Gartner, Inc. (NYSE:IT) is one of the larger IT companies in the world, more specifically in the market research side of the industry. The business is comprised of three segments: research, conferences, and consulting. Currently the research segment brings in the majority of revenue. The market research industry is estimated to grow at 3.5% till 2025. Below is the long-term share price performance:

dividend channel

Next is the return on capital metrics versus peers:

|

Company |

Revenue 10-Yer CAGR |

Median 10-Year ROE |

Median 10-Year ROIC |

EPS 10-Year CAGR |

FCF/Share 10-Year CAGR |

|

12.4% |

40.5% |

23.8% |

20.8% |

17.6% |

|

|

NLSN* |

-4.1% |

8.4% |

3.2% |

27.8% |

4.3% |

|

1.4% |

36.7% |

5% |

11.4% |

4.5% |

|

|

5.7% |

8.9% |

8% |

3% |

3% |

*NLSN was very recently taken private by PE firm EverGreen Coast Capital Corp

Revenue is currently at a record high, and margins at all levels are very healthy. Gross margins remain close to 70%, with operating margins at 18% and net at 14.4%. Free cash flow also hit a record high of $1.25 billion in 2021.

Capital Allocation

M&A has been a key focus for most of the company’s history. They’ve made over 30 acquisitions since 1993. The largest was CEB which was purchased for $2.6 billion in 2017. They’ve never paid a dividend, but have been a regular repurchaser of shares. Starting in 2021, the amount used for buybacks increased dramatically. In Q3 alone, over $1 billion USD was spent on buybacks, compared to much less in previous years.

I’m very pleased to see this increase in repurchases and the overall commitment to reducing share count over paying dividends. I have a preference for companies that consistently cannibalize their shares instead of paying dividends as this boosts EPS without the taxation of dividends. For long term investors, returns can be dragged down by paying taxes on dividends.

Risk

While the long-term top line growth is still strong, revenue has tended to dip during recessionary times. There isn’t much that can be done about demand for their services dropping when economic uncertainty is high. In spite of this fact, the company has only had two years of negative net income (2001 and 2005) and only one year of negative free cash flow (2001).

The debt levels do look somewhat concerning at first glance. Long term debt increased in 2017 as a result of the CEB acquisition. They also diluted shares to make this purchase happen as it was a cash and stock deal. Long term debt currently sits at $2.45 billion whereas last year’s free cash flow was $1.25 billion. Along with a cash balance of $528 million, the debt load shouldn’t cause any issues. They do deleverage aggressively when needed and there’s no reason to think this won’t continue.

The debt levels and potential macro headwinds don’t add much in the way of risk. IT has proven its resiliency through several economic cycles so far. This means fundamental business risk is low, so the real risk comes from potentially paying too high of a price right now. This brings us to the valuation.

Valuation

Share prices did peak in 2021 and fell like so many others, but the difference is that it reclaimed last year’s peak after dropping 30%. This means the chance to capitalize on the overall market/sector drop is over.

Below is the comparison of price multiples:

|

Company |

EV/Sales |

EV/EBITDA |

EV/FCF |

P/B |

Div Yield |

|

IT |

5.5 |

25.1 |

27.8 |

-417 |

n/a |

|

BFH |

2 |

6.1 |

4.9 |

1.4 |

2.2% |

|

FORR |

1.1 |

7.4 |

11 |

3.1 |

n/a |

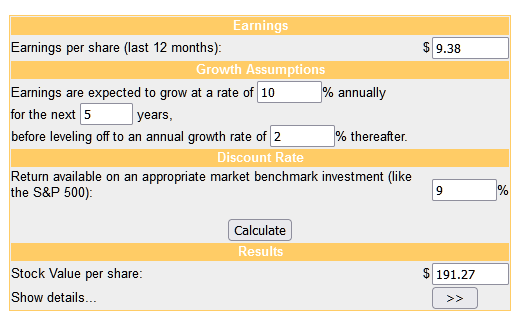

The multiples seem to indicate that the quality is priced in. The sales multiple in particular is far too high for me to consider unless the company is still close to the hyper growth phase. Below is the dcf model:

moneychimp

It’s hard to determine how much the newer and more aggressive repurchase strategy will boost EPS, mostly because of the prices these shares are bought at. I still feel my projections are on the conservative side, but in spite of that I don’t see any real undervaluation.

Conclusion

Gartner stock hasn’t always outperformed the market, getting in the right time makes all the difference. Shares are already up 48% since June so the chance for a discount has passed for now. The business has proven itself to be resilient and can keep growing without seeing margins contract. The quality is also evident with free cash flow and returns on capital trending much higher in the past few years.

As much as I like the company and capital allocation, the price is just too high right now on a multiples and intrinsic basis.

Be the first to comment