LeoPatrizi

Over the last thirteen years of dividend growth investing, my portfolio, goals, and rules have evolved. Along with the changes, I made plenty of mistakes along the way. However, through it all, the income has consistently grown at 10% annually. Investing in high-quality dividend growth companies has proven to be a forgiving strategy.

Investing Overview

The goal of the portfolio is simple: Grow the income at 10% annually with dividends reinvested or 7% without reinvesting. This growth rate roughly doubles the income every seven years with reinvestment and ten years without reinvestment.

Generally, I try to meet the goal by buying companies that have an initial yield of 3% and the ability to grow the dividend by 7% annually for decades. Of course, finding companies with these exact attributes is difficult. I often create hybrids of lower-yielding, faster-growing companies, and higher-yielding, slower-growing ones to meet my requirements.

Hybridization requires monitoring dividend growth rates, as meeting the 7% growth without reinvestment will one day be critical. Someday, I expect to withdraw dividends and want the income to continue growing. It’s easy to focus too much on the initial yield and not enough on the dividend growth rate when using hybrids.

It’s important to note that this portfolio has been closed to new capital since 2016, so the goals are only met organically. I did this to better judge the overall performance of a dividend growth strategy.

I don’t subscribe to hard and fast investment rules. Instead, I use guidelines. My guidelines give the overall direction but provide flexibility to evaluate any situation on its merits. At present, my guidelines are as follows:

- Invest in companies from the Champions and Contenders list with at least 15 years of dividend growth.

- Look for companies with a 3% starting yield and the potential to maintain a 7% dividend growth for decades. The growth is critical as it’s impossible to continue growing income at 7% without reinvesting unless companies raise distributions by at least that amount.

- Replace (or sell covered calls against) significantly overvalued positions if the opportunity exists to reduce risk and increase income. In practice, this usually means higher quality at a higher yield.

- I want to see flat to mild payout ratio creep. A payout ratio growing from 30% to 35% over ten years is acceptable. One that has gone from 30% to 60% is not. I want companies to grow the dividend with earnings, not by increasing the payout ratio.

- Unless it is well-diversified across industries, no single sector should account for more than 20% of the income. I was burned by this in 2016 when several energy companies cut dividends.

Again, these are just guidelines and are flexible to accommodate what makes sense to achieve my overall goals. I follow a few other items but don’t see them as integral to my investing. Instead, these tend to be more personal preferences. They include avoiding foreign companies because I don’t enjoy accounting for the taxes and FX rates causing fluctuating dividends.

Top Income Producers

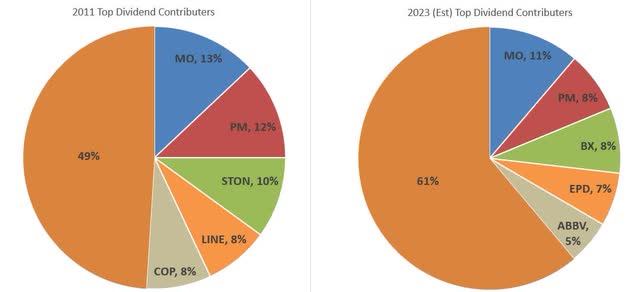

I like to look at the portfolio in a variety of ways. The first is watching the largest income producers. The portfolio has been unbalanced from the beginning, as it was very heavy in Altria (MO) and Philip Morris (PM) at inception. This was mainly due to a position in MO held pre-spinoff and adding heavily in 2009 at double-digit yields. Today, MO and PM still account for 19% of the income, down from nearly 34% in 2010 and 25% in 2011. It’s been a slow process watching the percentage of income provided by these two recede, mainly due to the strong dividend growth of Altria over the past decade.

Aside from those two companies, the top five income producers have always accounted for a significant portion of the income. Although, this has fallen from over half the total income in 2011 to 39% today. The pie charts below show the top five income producers for a few selected years. Note that two of the companies from 2011 don’t even exist anymore, a caution to chasing high yield. The ConocoPhillips (COP), shown in 2011, was a pre-split of Conoco Phillips and Phillips 66 (PSX).

The other takeaway from the top 5 is these companies have relatively slow dividend growth. This slow growth becomes a real drag on meeting my goals. Fortunately, some faster dividend growers appear when expanded to look at the top 10 largest income producers (shown below). The top 10 largest income producers currently account for around 55% of the total income.

| % of Income | |

| Altria | 11.2% |

| Blackstone (BX) | 8.1% |

| Philip Morris | 7.5% |

| Enterprise Products Partners (EPD) | 6.6% |

| AbbVie (ABBV) | 5.5% |

| Lockheed Martin (LMT) | 3.5% |

| Texas Instruments (TXN) | 3.5% |

| Ameriprise (AMP) | 3.5% |

| Omega Healthcare Investors (OHI) | 3.0% |

| Medtronic (MDT) | 2.8% |

| Total | 55% |

Note that in the above list, Omega Health Care Investors will likely fall off in 2024 due to its frozen dividend. Yet another indication that high-yield companies will lose to dividend growth in the long run.

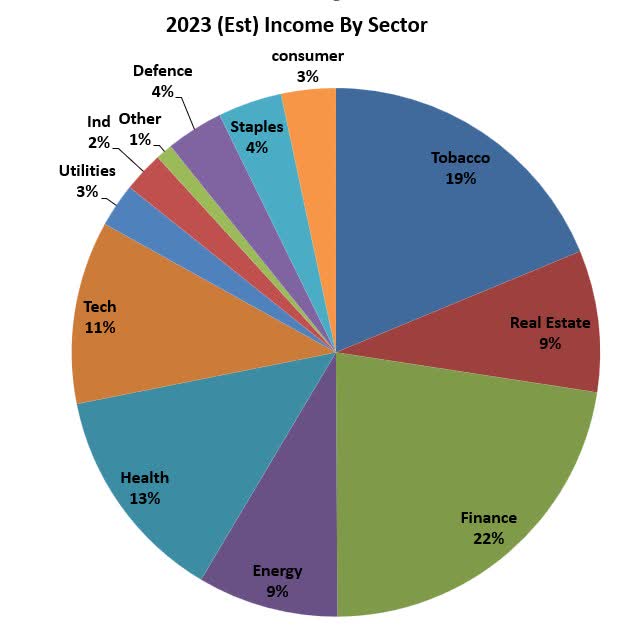

Income by Sector

At one time, I never thought about the sector weightings in this portfolio. Today, I only vaguely use them as a guide, not a rule.

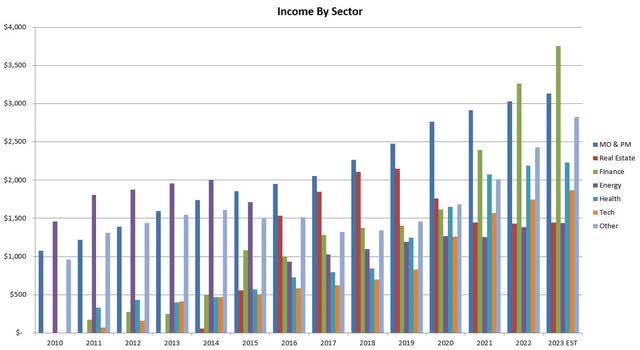

At its inception, this portfolio was loaded with energy-related MLPs. The overweighting was due to dabbling in high yield in 2009 before finding dividend growth investing. It continued to be energy-heavy until 2016, when the sector cratered, and many cuts occurred across a wide swath of energy-related industries.

Entering 2015, the energy sector comprised nearly 25% of the income, but by the end of 2016, energy was down to just 11%. This was mostly due to cuts, although partly due to purchases in other sectors. Today, I generally watch closely if a sector creeps above 20% of income. In 2018 and 2019, real estate exceeded the 20% mark, leading me to reduce my position in Omega Healthcare Investors.

The chart below shows the income from the most significant income-contributing sectors over the years. Note that I consider Altria and Philip Morris their own sector for this portfolio as they contribute so much income. In fact, I define the companies into sectors that make sense to me and fit the needs of the portfolio.

Today, financials are above my 20% target for any individual sector. Mostly this has occurred because of the massive increase in the Blackstone (BX) dividend in 2021 and 2022. This sector is well diversified, however, as detailed below. Shown is a full breakdown of estimated income by sector for 2023 and the companies comprising each.

Financials

Aflac (AFL), Ameriprise (AMP), BlackRock (BLK), Blackstone, Cincinnati Financial (CINF), CME Group (CME), Diamond Hill Investment Group (DHIL), Intercontinental Exchange (ICE), Prudential Financial (PRU), Visa (V)

A higher portion of the income from financials is warranted for two reasons. While there are several asset managers and insurance companies, most of these are distinctly different business models. Also, financials make up over 40% of the Champions, Contenders, and Challengers list. Notably absent are any banks. For the most part, I have shunned away from companies that cut during the Great Financial Crisis (GFC), but several banks continued to increase their dividend at that time and are attractively priced today.

Healthcare

AbbVie, Abbott Labs (ABT), Cardinal Health (CAH), CVS (CVS), Johnson & Johnson (JNJ), Medtronic (MDT), Walgreens Boots Alliance (WBA)

This is a relatively straightforward sector, although WBA could be considered with staples, and CVS is a hybrid insurance/staples company. I’m only looking to add more here if a great opportunity arises. I would possibly consider Bristol-Myers (BMY) or Amgen (AMGN), but after a period of underperformance, these look set to outperform.

Technology

Apple (AAPL), Automatic Data Processing (ADP), Broadcom (AVGO), Intel (INTC), Microsoft (MSFT), Texas Instruments

While ADP could be moved into the financials since I placed Visa there, both are relatively minor income contributors. I am constantly evaluating companies to add to this sector, but I am being patient. Tech had a massive multiple expansion over the past decade. I wouldn’t be surprised to see several years of pain here.

Real Estate

Ladder Capital (LADR), National Retail Properties (NNN), Realty Income (O), Omega Health Care Investors, Simon Property Group (SPG)

I consider every company in this group as part of my high-yield exposure. While I am looking for opportunities to reduce my OHI position, the others are used to hybrid purchases to achieve my 3% yield and 7% dividend growth.

Energy

Enterprise Products Partners, Phillips 66

EPD is the last MLP standing after purchasing several during the Great Recession. I received the Phillips 66 shares in the split up of the old Conoco Phillips.

Staples

Pepsi (PEP), Smuckers (SJM), Unilever (UL)

The timing has never worked well for adding consumer staples companies to this portfolio. I would like to own more Pepsi, but I won’t overpay. Unilever is the only foreign company in the portfolio and has been a holding since 2010. I no longer consider foreign companies for this portfolio.

Defense

Lockheed-Martin

I distinguish defense contractors from other industrial companies, as I see them tied to different drivers.

Consumer Discretionary

Best Buy (BBY), Home Depot (HD), Starbucks (SBUX)

Starbucks was the only consumer discretionary company in the portfolio for a long time. Home Depot and Best Buy are more recent additions. Consumer discretionary has a small representation in the dividend champions, and specialty retailers even less so, with Lowe’s (LOW) being the lone representative.

Industrials

A.O. Smith (AOS), Fortune Brands Innovation (FBIN), Honeywell (HON), MasterBrand (MBC), MSA Safety (MSA), Snap-on (SNA)

Six positions are a lot for such a small representation in the portfolio. It seems like industrials have been chronically overvalued forever. MSA Safety is a long-time holding and was trimmed significantly due to overvaluation in 2021. FBIN and MBS were created when Fortune Brands Home and Security (FBHS) split up at the end of 2022. It remains to be seen if MBS will pay a dividend in the future.

Utilities

Duke Energy (DUK)

The only utility in this portfolio is Duke Energy, which I held long before I became a dividend growth investor. The zero-rate environment led to utilities being significantly overvalued, and they have yet to correct fully today.

The chart below shows the full breakdown of income by sector for 2023.

Wyo Investments

2023 Target income

The goal of this portfolio is to grow the income by 10% annually, with dividends reinvested and 7% without reinvesting. Since I am currently putting distributions back into the market, the simple target for 2023 is $17,024. This is a straight-line 10% increase over 2022’s income.

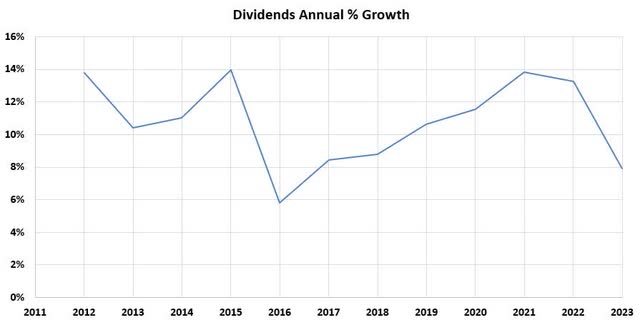

The chart below shows the percent growth in income every year. Note that in 2017 and 2018, no dividends were reinvested. Additionally, no new capital has been added to the portfolio since 2016.

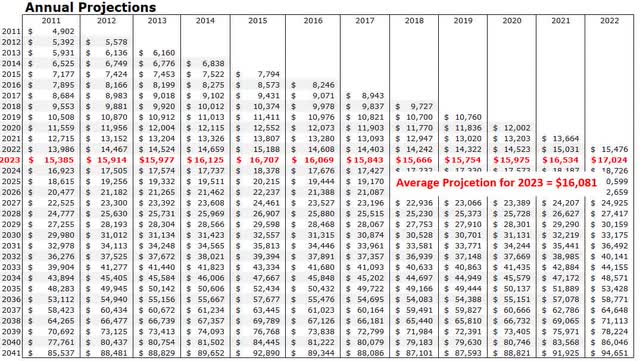

The last few years have beaten my 10% goal by a decent margin. One of the things I track is the projected income from every year. The table below shows the projected income, updated yearly. I have found that these projections are highly accurate over the long run and that dividend cuts are possible when the current year begins to deviate significantly.

Annual Projected Income (Wyo Investments)

Note that the average projection for 2023 is $16,081. The straight-line $17,024 is 5.5% above this, a significant deviation from the long-term forecasts. A large portion of the variation comes from trimming the very low-yielding companies MSA in 2021 and Apple in 2022. These were replaced with higher-yielding companies. However, the possibility of seeing a cut is building.

The obvious candidates for a cut are Omega Health Care Investors and Ladder Capital, as high-yield positions. Investors have speculated on a collapse of the OHI dividend since at least 2017. With its variable dividend policy, Blackstone is another possible candidate; they have a fixed dividend policy and no commitment to dividend growth. The final candidate for a potential cut is Best Buy, although they successfully navigated the Great Recession with dividend increases.

All in all, it’s unlikely this is the year that income growth corrects itself. The portfolio holds nearly 3% cash coming into the new year, the highest amount since entering 2020. This reserve provides a nice buffer to pick up quality companies on the cheap should a recession materialize.

At present, the projection for 2023 stands at $16,698, or an increase of only 7.9%. While short of the 10% goal, this is better than the last couple of years have started. I use a conservative estimate on dividend increases and don’t project any reinvestments. For these reasons, the projected income will grow as the year progresses and dividends are reinvested.

Companies I’m targeting in 2023

I have focused on faster dividend growth over the last couple of years, sacrificing initial yield to do so. There were a couple of reasons for making this decision. As shown earlier, the five largest income producers account for a large portion of the income. These five have low, slowing, or inconsistent income growth. The second reason is the strong dividend growth performance of the last couple of years. The extra income was placed to work in faster-growing dividends.

Finding companies with a 3% initial yield and 7% consistent growth has been challenging in recent years. Fortunately, 2022 brought a reprieve, and many opportunities existed. I’m expecting 2023 to continue bringing more of these opportunities. I am not looking to start any new positions, but sometimes the right opportunity presents itself. Below are the companies I am looking to add to in 2023 and the yields I am wanting.

| 1st Target | 2nd Target | 3rd Target | |

| Blackrock | 2.9% | 3.4% | 4.0% |

| Home Depot | 2.5% | 2.8% | 3.0% |

| Snap-On | 3.1% | 3.5% | 4.0% |

| Texas Instruments | 2.6% | 2.8% | 3.0% |

| Broadcom | 2.9% | 3.4% | 4.0% |

There are other positions I want to add to, but the timing needs to be right. I would love to expand my Johnson & Johnson position but healthcare looks like a relatively expensive sector right now; additionally, I want to evaluate this company further after the spin-off. Along the same line as health care, there are better times to buy consumer staples. Too many investors have turned defensive. Otherwise, I would have Pepsi as a potential add as well.

Two positions I would love to add to are Microsoft and ADP. I consider both significantly overvalued still. However, sectors come in and out of favor, and tech is due for an extended down period. I don’t see any reason to rush to buy these.

The other position I will watch in 2023 is Best Buy. This company has 19 years of dividend growth and survived the Great Recession with its dividend growth streak intact. The company will likely offer slower dividend growth for a few years, but I think the company is a long-term winner.

While these are the companies I’m hoping to add to the most, there are several companies I may add to at the right price. Additionally, I have long wanted to start a position in Air Products and Chemicals (APD), as it fills a hole in my portfolio, but I won’t overpay to do it. For those interested, my target entry yield on APD is 3.5%, which it last reached during the Great Recession.

Final Notes

My non-scientific gut-based guess on the S&P 500 for 2023 is that we will see it bottom in the first half of the year around 3000 and end up the year flat. I probably feel this way because that is the pattern of the last few major downturns. Additionally, recessions typically lead to a 30% drop in the market, but I am giving some credit for this year’s correction. I have positioned most of my CDs to close out in Jan, Feb, and March of 2023 and will only be opening new ones once I see what the market is doing.

Of course, predicting another down year is the popular choice. Could this be a contrarian sign of large gains ahead?

Fortunately, dividend growth investing isn’t about timing the market. It doesn’t matter what the market does. There will always be high-quality dividend growth companies to buy at reasonable valuations. I may not get the initial yields I want, but as long as I don’t overpay, I will be happy over the next twenty-plus years.

Be the first to comment