malerapaso/iStock via Getty Images

Written by Nick Ackerman. This article was originally published to members of Cash Builder Opportunities on June 10th, 2022. The market has been extremely volatile, please check the latest data and do your own due diligence before making any investing decisions.

Capital Southwest (NASDAQ:CSWC) was brought up to me by a reader to see if I had any thoughts on this name. I had run across this business development company (“BDC”) before but hadn’t looked at it too much in-depth. I think I regret not giving it a deeper look previously, as this seems like one solid BDC.

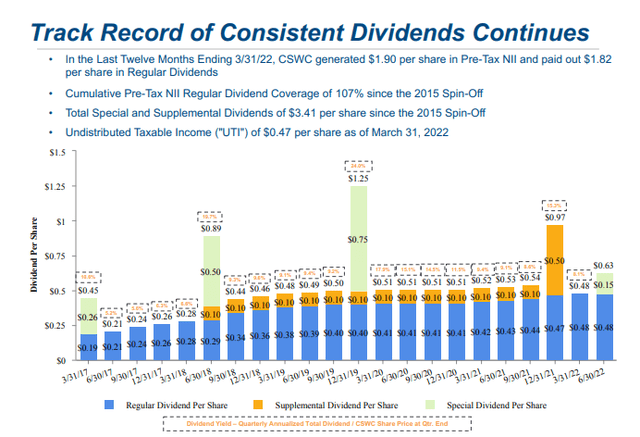

This BDC has a long history of raising its regular dividend. It paid a supplemental dividend on top of this regular dividend for years and has frequently paid special dividends. That’s certainly one attractive feature for a BDC. As a BDC, they often pay out the majority of their earnings, so retaining earnings to grow can be difficult. So when one can pull this off, it’s worth giving some attention to.

Overall, the BDC space is in a unique situation regarding the current environment. They often are heavily weighted towards a portfolio of first-lien loans that pay variable rates based on interest rates. With interest rates rising, they are in a position to take advantage of those increases. On the other end, they utilize leverage to produce enhanced returns potentially. This leverage is often fixed rates for BDCs. Meaning that they get the benefit of higher interest rates without much of the downside.

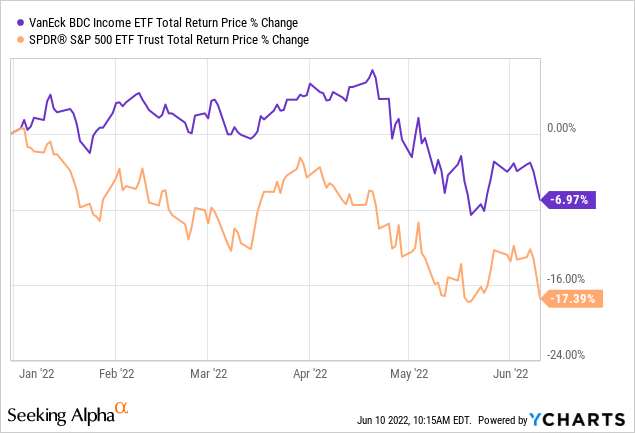

On the other hand, a slowing economy can be particularly bad for BDCs. They often are weighted towards small and mid-sized businesses. These are the most vulnerable to economic conditions. That’s why instead of seeing strong returns for the year, we are seeing a more tempered approach from investors, in my opinion. When comparing the VanEck BDC Income ETF (BIZD) to the SPDR S&P 500 (SPY), we can see that on a total return basis YTD, a basket of BDCs has been performing relatively better.

YCharts

The Portfolio And Its Debt

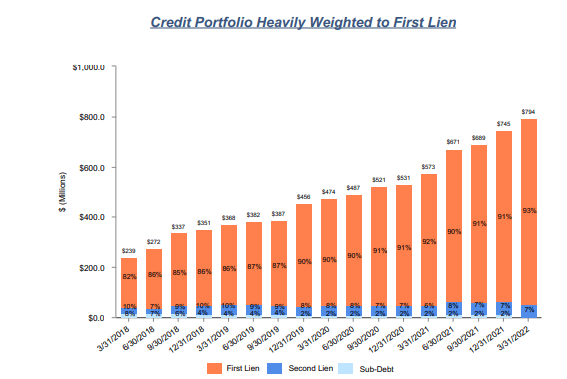

With CSWC, they are heavily weighted towards first-lien loans, as is the typical BDC. They have a total of 93% in these types of securities as of the end of their last quarter. The weighted average duration of the portfolio is 3.6 years, meaning that every 1% increase in interest rates should see the underlying portfolio decline by 3.6%. That might seem elevated, but relatively speaking, compared to investment grade or municipal bonds, it is quite low.

CSWC Portfolio (Capital Southwest)

Looking at the number of loans in the last quarter, it appears they have exposure to 78 different loans. That isn’t an overwhelming number, so the ones they do have, need to be performing.

In addition to this, it was only from 42 different issuers as they take multiple investments in the same company. This isn’t a bad thing as it still provides a bit of diversification for the different loans, and they have worked with and know the management. If they determined they were worth investing the first time, chances are a second or third loan is also worth taking a look at. CSWC has a strong history, which I believe means they’ve been able to show they can accomplish just that.

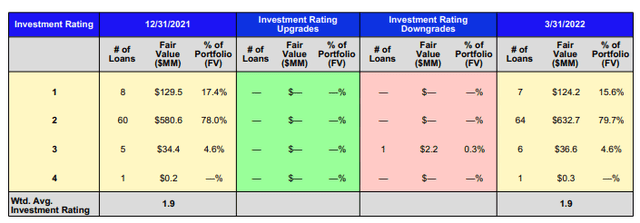

On top of this, their credit portfolio has a total of 95% in their investment rating of either a 1 or 2 rating. Indicating that despite the rough start to 2022, they are still confident in their portfolio, and it has been mostly performing as expected.

CSWC Portfolio Rating (Capital Southwest)

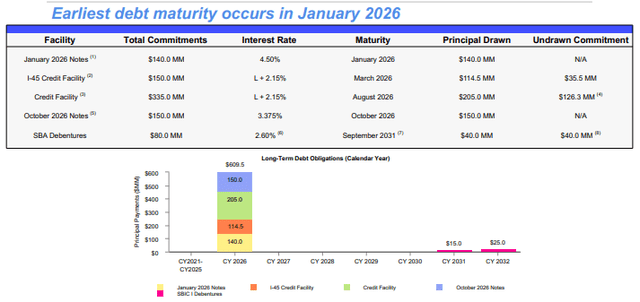

Looking at the CSWC’s debt, we see several different facilities they are withdrawing from and have outstanding. This also isn’t that uncommon for a BDC to have multiple forms of leverage – between borrowings, preferred and notes outstanding.

CSWC Debt Obligations (Capital Southwest)

We can see that of the $855 million in total commitments, they have withdrawn a total of around $649.5 million. Meaning they still have spare ammo in their magazine to make additional investments.

It is also worth noting that this BDC’s borrowings have nearly half its weighting to the variable rate credit facilities. $319.5 million of the $649.5 million is tied to LIBOR plus 2.15%.

That isn’t necessarily ideal, but it still isn’t an overwhelming amount. The fact that they still have a large amount with fixed-rate means they are still partially sheltered from higher interest rates. Plus, their portfolio has an average spread of LIBOR plus 6.2% that they can benefit from too.

Overall, CSWC seems to be in a position to be able to benefit from higher interest rates and still negate most of the negatives that come with it, too.

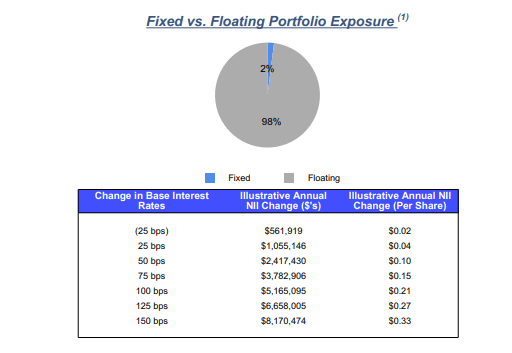

The management team is certainly confident as to the benefit of higher interest rates. Here is what they noted in their previous quarterly conference call.

Turning to slide 26, our balance sheet is well positioned to benefit from rising interest rates. Short-term interest rates have increased significantly with LIBOR increasing from 21 basis points at the end of December to 96 basis points at the end of March. And as of yesterday, LIBOR is approximately 150 basis points.

The weighted average flow on our investments is approximately 1%, with the short-term rates exceeding the floor on our investments, this will have a positive impact on net investment income. Based on quarter end rates, we estimate a 50 basis point and a 150 basis point increase in reference rates would result in an annual increase of approximately $0.10 and $0.33 per share.

Here is the table on slide 26 that they were referring to.

CSWC Rate Exposure (Capital Southwest)

Attractive 9.13% Dividend Yield

The chart of their dividends over the last several years has a lot going on. As mentioned, we have seen the regular dividend increase. At the same time, a supplemental dividend was the norm for several years, and a rather frequent special dividend has been being paid.

CSWC Dividend History (Capital Southwest)

In fact, we can see that the latest special was in the dividend coming up again at the end of the month. The regular $0.48 was announced with a special $0.15. Both have the same ex-div date and payment date. Not counting the specials or supplemental, this works out to an increase from the same quarterly payout a year ago of 10.4%.

In the last quarter, they had net investment income of $0.50. For the fiscal year ended March 31st, 2022, they had reported pre-tax NII of $1.90 or $1.87 per share basic and diluted. That was actually lower than the $2.52 in total dividends they paid.

Despite this, they still had reported $0.47 in undistributed taxable income. The reason for this is because they had been realizing gains in the year. They also had an increase in unrealized appreciation that would also drive up the NAV per share. Therefore, these distributions are being covered through NII and capital gains.

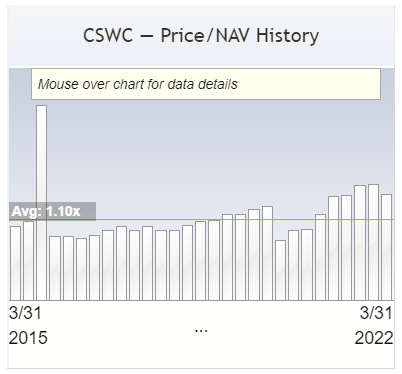

The NAV rose in the quarter, too, from $16.19 to $16.86. And that’s where some of the problems start to creep in. Given the current share price as of this writing of $21.03 – we are looking at a nearly 25% premium over NAV. That is fine when things are going well, but if we are in for a slowdown, this could put added pressure on the shares.

Historically, this is elevated compared to where the name usually trades.

CSWC Price/NAV History (BDC Investor)

Conclusion

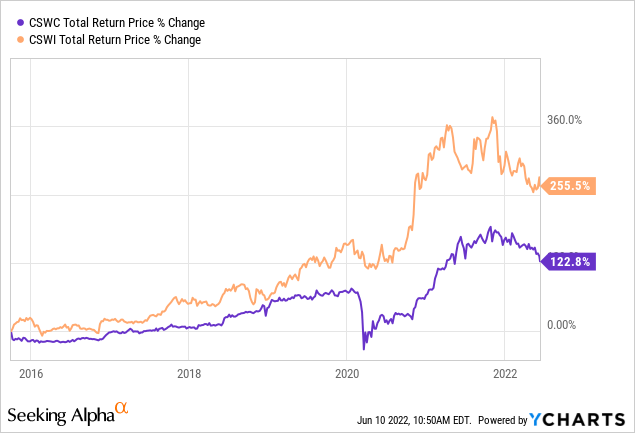

One last thing I wanted to touch on before wrapping this up completely is that the history is quite interesting with this BDC. They actually spun-off a company that turned into a big winner, at least for investors that held onto the shares of the spin. CSW Industrials (CSWI) was spun-off towards the end of 2015. The actual total returns of CSWI have eclipsed CSWC quite handily. That isn’t that unusual – as a regular C-corp., it can retain assets and grow the business.

YCharts

Anyway, I thought that was just a really interesting point to this BDC: a position had grown so large that it needed to be spun-off into its own entity. I think CSWI is worthy of its own dedicated article at some point, as it turns into a bit of a dividend grower itself now in the last couple of years.

For CSWC, I think it is a really interesting name. I fear we are looking at a fairly elevated price relative to its NAV and where that has traded relative to its history. At the same time, we are looking at the BDC near its 52-week low – which shouldn’t be discounted either. Given the focus on the income, I think that portion seems solid. For a long-term income investor, buying now can still make sense.

Be the first to comment