atakan/iStock via Getty Images

After the market closes on September 7th, the management team at video game retailer GameStop (NYSE:GME) is expected to report financial performance covering the second quarter of the company’s 2022 fiscal year. Already, the company is fundamentally a mess and is drastically overvalued by investors and speculators. Absent some major change in its fundamental condition, the company will not fare well in the long run. Having said that, sales so far this year have been something of a bright spot for the enterprise even as profitability and cash flows continue to worsen. The firm is making some interesting investments, but it remains to be seen whether these will pay off or not. At the end of the day, the company does look incredibly risky, but investors should continue to evaluate it whenever management releases fundamental data to gauge whether or not the picture is changing for the better. This upcoming earnings release presents one such opportunity that market participants should pay special attention to because of all that is going on with the firm.

Keep an eye on these things

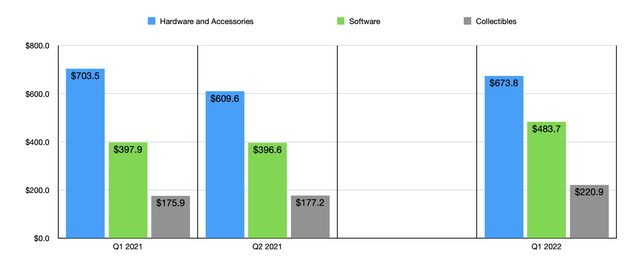

Heading into the second quarter earnings release, there are a few things that investors should keep a close eye on. First and foremost would be the revenue the company reports. For the quarter, analysts are expecting the company to report sales of $1.27 billion. If that comes to fruition, it will represent an increase of 7.4% compared to the $1.18 billion generated the same quarter last year. For a company that continues to see the number of locations that it has in operation decline, this may seem unlikely. But it would not be unprecedented. In the first quarter of this year, for instance, management reported sales of $1.38 billion. This was 7.9% higher than the $1.28 billion the company reported for the first quarter of 2021. This rise in sales came even as hardware and accessories revenue dropped from $703.5 million to $673.8 million. It was bolstered instead by a rise in software revenue from $397.9 million to $483.7 million. In addition, revenue associated with the collectibles the company sells also increased, climbing from $175.9 million to $220.9 million. It would likely be in these two categories that we see improvements in the second quarter of this year relative to the second quarter of last year.

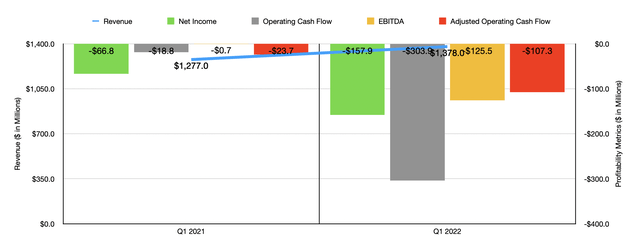

Author – SEC EDGAR Data

This is not to say, of course, that this will come to pass. It’s difficult to increase sales when the number of locations you have in operation drops. Not only that, but also there has been some disappointing data in the video game space. In July of this year, video game sales dropped yet again, plunging by 9% compared to the same time last year. This was driven by a 10% decline in game content sales and closely mirrored the 11% drop seen in June compared to June of 2021. Also in July, accessory spending fell by 22%. And in a separate report, it was reported that console video game spending this year should fall by 12% compared to the prior expected decline of 1%. Some of this change will be due to foreign currency fluctuations. But that should account for only a small portion of the decline.

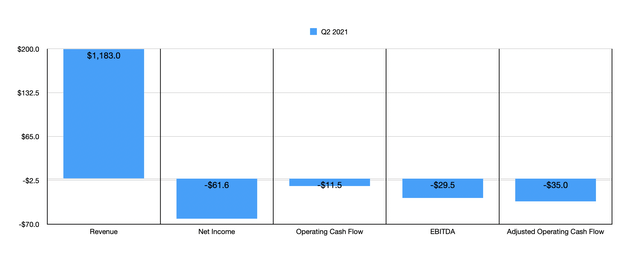

Author – SEC EDGAR Data

Investors should also pay attention to profitability. If analysts turn out to be accurate, this might be something of a bright spot for the company. The current expectation is for the company to report a loss per share of $0.55. On an adjusted basis, the loss might be even smaller at $0.42 per share. Using the official estimate, this would translate to a loss for the company of at least $41.7 million. While this is bad, the company generated a loss per share of $0.85 in the second quarter of 2021. That translated to a net loss of $61.6 million. This would be unlike what we saw in the first quarter of this year compared to the same time last year. The loss per share in the first quarter was $2.08. That was more than double the $1.01 per share loss experienced in the first quarter of 2021. Of course, we should also pay attention to other profitability metrics. In the first quarter of the year, operating cash flow was negative in the amount of $303.9 million. That was far larger than the $18.8 million cash outflow seen the same time last year. Operating cash flow in the second quarter of the 2021 fiscal year was a bit better, coming in at negative $11.5 million. Though if we adjust for changes in working capital, it would have been slightly worse at negative $35 million.

Author – SEC EDGAR Data

These profitability metrics aside, investors should also keep an eye out for other things. The first would be the number of shares the company has outstanding. Given how overpriced shares are today, issuing additional stock in order to raise cash would be a fantastic idea. Having said that, it does have the negative side effect of leaving existing shareholders with a smaller piece of the pie in the long run. So any cash raised should be put to good use or else it is a waste. At present, the company does have cash in excess of debt of $1.04 billion. So it’s not exactly hurting. But given the poor fundamental condition of the enterprise, having extra would never be a bad idea. If there is any real bright spot in the company, it would likely be with highly speculative initiatives that are unlikely to really generate significant value for shareholders. An example of this would be the launch of the company’s wallet for cryptocurrencies and NFTs that was announced in May of this year. And another would be the launch, in mid-July, of its NFT marketplace. Unfortunately, we don’t really have much to go off of to see what kind of impact this might have on the company’s top and bottom lines. But given the enthusiasm around the cryptocurrency and NFT space, management may have some interesting updates.

Author – SEC EDGAR Data

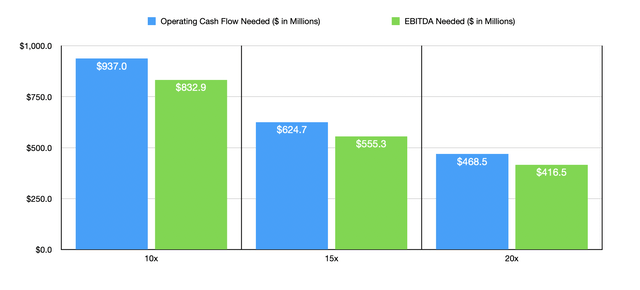

At the risk of sounding like a broken record, I don’t believe that there is much that GameStop’s management team could announce that would justify the company’s current share price. Using the most recent data available, I calculated how much cash flow the company would need to achieve in order to trade at a reasonable price. I did this based on three different scenarios. The first would be a price to adjusted operating cash flow multiple and an EV to EBITDA multiple of 10 each. The second scenario increases this multiple to 15, while the third raises it to 20. Even if the company were to be worth 20 times cash flows, it would need to generate operating cash flow of $468.5 million and EBITDA of $416.5 million just to be fairly valued. The last time numbers came anywhere close to this was in 2018 when the company generated EBITDA of $451.5 million off of revenue of $8.29 billion. The company is nowhere near that size today given the significant reduction in store count that it has seen. So to bank on these kinds of results is not a wise idea.

Takeaway: GME is a ‘strong sell’

All things considered, I have a hard time believing that shares of GameStop are still trading where they are today. Speculators have unjustifiably pushed shares into the stratosphere and it’s unlikely that the company can stay at these levels for any meaningful amount of time. I do know that my last article on the business, published in the middle of July, rated the business a ‘strong sell’. And since then, shares have plunged by 19.6% while the S&P 500 has increased by 3.1%. Absent some massive and unlikely change for the company, I do not see it being worth what it’s trading for today. And as such, I think my ‘strong sell’ rating on the company is still appropriate.

Be the first to comment