breakermaximus/iStock via Getty Images

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note’s date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

No Need To Be A Hero

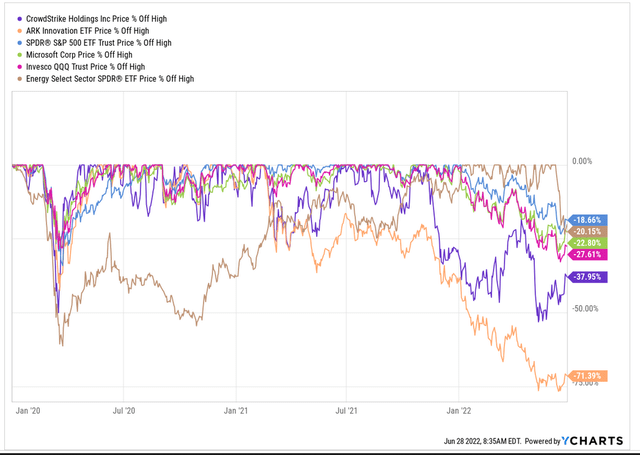

Since it’s down only 38% from its all time high, CrowdStrike Holdings, Inc. (NASDAQ:CRWD) is what right now passes for a nonvolatile growth stock. The highest of high beta bets, the ARKK poster child, is down some 72% and even the big dog Microsoft is off by 22% – since CrowdStrike has such incredible fundamentals, what’s a third off between friends? Particularly since cybersecurity spending is unlikely to be the first place that enterprises start cutting costs if indeed a winter of discontent is soon to be upon us all.

% Off Highs Chart (YCharts.com)

As you know, and can see from the chart above, the market has attempted to stage a recovery of late. So between CRWD holding up well for a banzai name, the cybersecurity category increasingly mission-critical, and the market making a comeback, CRWD is surely a buy. Right?

Well, we beg to differ. We think CRWD is a ‘hold’, as in, if we owned CRWD right now with a long term purview we would probably not be selling – but neither would we be buying.

Allow us to walk you through our logic.

CrowdStrike Earnings Review

CRWD has very strong fundamentals but we believe investors should not overlook the decelerating rate of growth, nor the shrinking cashflow margins. This is an unusual combination in a recurring-revenue software business. The typical relationship is – the faster the revenue line grows, the lower the cashflow margin goes, because more money is being put into sales costs, product development costs, etc. And the converse is usually true also – when growth slows, you can usually expect cashflow margins to rise, at least if the management team have their wits about them, because the slowing growth is a sign of a maturing business – which should tell the management team to ease up on sales and product spending because it likely will deliver suboptimal revenue returns. In software this is because product cycles can be short, and so after a while, pushing the same old product with ever more salespeople or ever more features and functions, well, you don’t get much in the way of return on sales or engineering spend because usually there is a new, new thing available from the banzai vendor down the road. So spending more can be just pushing water uphill and it’s better to spend less and generate more cash. The problem is that in most times in the market, valuations of software companies are tied more to growth rates than they are to cashflow margins or EPS or whatever. So once you enter the spiral of doom it is hard to escape, until a local Master of the Universe calls bearing junk bonds to liberate you from your public market hell.

CRWD is spending more and growing less, and we think that’s indicative of a company whose product set is maturing, with a management team that lacks the insight as to how to push on beyond that.

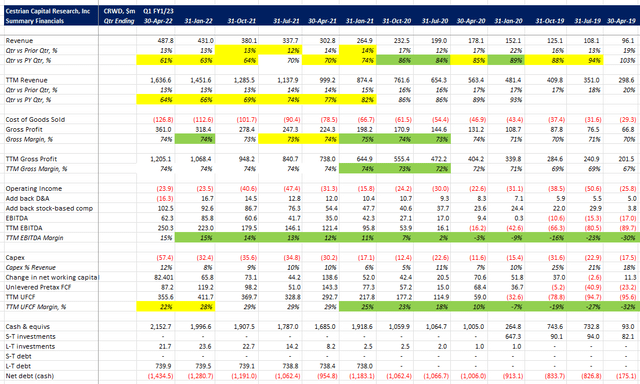

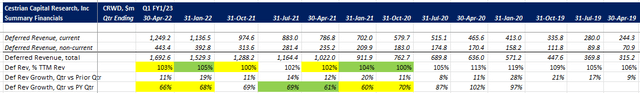

CRWD Fundamentals (Company SEC filings, YCharts.com, Cestrian Analysis) CRWD Fundamentals II (Company SEC filings, YCharts.com, Cestrian Analysis)

The revenue growth rate has declined quarterly since the October 2020 quarter, and the cashflow margin has recently begun to follow suit.

Deferred revenue – that’s the prepaid, yet to be recognized book of current business – is also falling in its rate of growth, so there’s nothing on the horizon that says CRWD’s rate of revenue growth is likely to accelerate in the near term.

Market Outlook

The next question of course is whether the current rally in markets is a fundamental turnaround from the last six months of selling, or just the latest rally to be sold when the Market Gods determine.

Let’s look at the Nasdaq – here we use the proxy ETF QQQ.

QQQ Chart (TradingView, Cestrian Analysis)

The pattern up off the Q4 2018 lows is fairly textbook so far. Wave 1 up peaks just before the Covid crisis; a 0.786 retracement to a Wave 2 low follows, amidst the crisis; a 2.618 extension Wave 3 high is hit in Q4 2021 and we’re presently in what is most likely a Wave 4 down. Where that Wave 4 hits support? Right now a key level is $288, which is the 0.5 retracement of that Wave 3 up. $288 failed once already this month; for investors to have confidence in high growth names we believe it is necessary that the QQQ turns that $288 level into support, not resistance. Before that happens, and is tested successfully a couple times, we believe it is risky to load up on long growth stock positions.

Is CRWD Stock A Buy, Sell, or Hold

Our own view is that this is a “do nothing” stock right now. If we owned it we likely would not sell it, because when capital does rotate back into growth we believe the result can be explosive to the upside, and it can lift all boats. As it happens though, we own no position in CRWD, having cashed gains in the name late last year, leaving but a modest allocation which we sold down at the start of June. We don’t plan to buy back in at this stage. We’re a little more bullish on the market turning up than most, but even then, there are other companies with better fundamentals that we would prefer as homes for personal account capital. So – Hold rating from us.

Cestrian Capital Research, Inc – 28 June 2022.

Be the first to comment