eyegelb

It was a mixed Q2 Earnings Season for the Gold Miners Index (GDX), and only a handful of companies reported upside beats and guidance raises (outside of raising cost guidance). However, Galiano (NYSE:GAU) was one name that reported a surprise beat, finishing H1 with 92,300 ounces produced, tracking well ahead of guidance even after adjusting for reliance on stockpiled material in H2. Additionally, its metallurgical test work appears to be going following a rough Q1. These positive developments have certainly improved the stock’s outlook, but with GAU rallying 42% off its lows and inching towards resistance, I would view rallies above US$0.60 before October as selling opportunities.

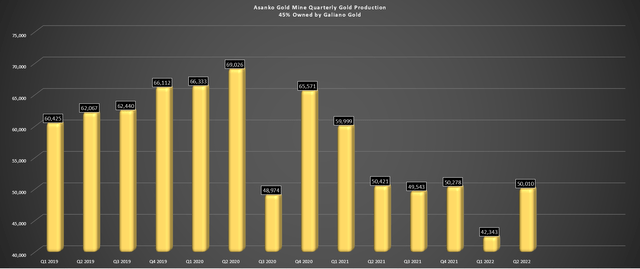

Unless otherwise noted, all figures are on a 100% basis for the Asanko Gold Mine JV. The Joint Venture is split 50/50 for the 90% economic interest, with Ghana holding 10%. Therefore, all figures are attributable on a 45% basis to Galiano.

Asanko Gold Mine Operations (Company Presentation)

Nearly four months ago, I wrote on Galiano Gold (GAU), noting that while the company was cheap with a market cap just north of $100 million, there was a lack of positive catalysts for a re-rating, making it an inferior way to play the sector. Since the article, Galiano saw a 34% drawdown, but has since recovered much of its losses. This can be attributed to a better-than-expected H1 performance, the metallurgical test work that appears to be going well (pending third-party results), and a significant increase in guidance. Let’s take a closer look at the most recent quarter below:

Q2 Production

Galiano Gold had a solid Q2 performance, a surprise for a company that just came off a very rough Q1 and could not declare mineral reserves due to metallurgical uncertainty at its shared Asanko Gold Mine. This was evidenced by the production of ~50,000 ounces of gold in Q2, a significant improvement from Q1 levels (~42,300 ounces). The sharp increase in production was related to a 1500 basis point increase in recovery rates, with the mine reporting a gold recovery rate of 84%, up from a miserable 69% in Q1 2022, prompting the company to raise FY2022 guidance to 150,000 ounces (mid-point) vs. 110,000 ounces previously.

Asanko Gold Mine – Quarterly Production (Company Filings, Author’s Chart)

Galiano noted that this increase in recoveries was related to revising the mill feed blend regime, increasing the mass pull in the gravity circuit, and adjusting operating parameters and reagent additions in the CIL circuit. The company also noted in early July that the company’s own work on metallurgy at Esaase showed encouraging results from an initial assessment that determined the cyanide soluble gold content of pulverized intervals via Bulk Leach Extractable Gold technique and followed by fire assay of solid residue. The takeaway of this testing, which is yet to be confirmed by a third party on the other half-core material, is that the results align with historical metallurgical test work done on the Esaase deposit.

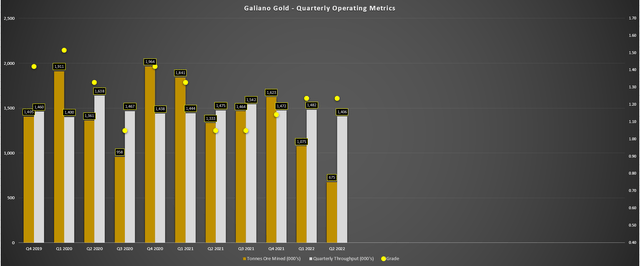

Asanko Gold Mine – Quarterly Operating Metrics (Company Filings, Author’s Chart)

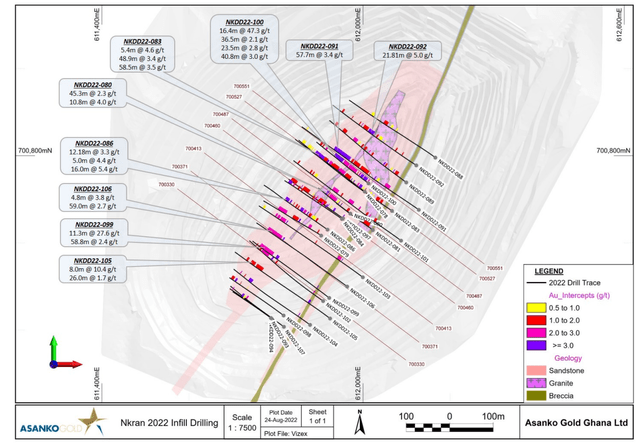

This is excellent news for the company, given that a 1500+ basis point decline in recovery rates would have significantly affected profitability at the lower-grade Esaase deposit. The final results from independent laboratory testing should be available in Q3, which will inform a new Life of Mine Plan that’s set to be unveiled early next year. While this updated Technical Report is likely to see higher operating costs due to inflationary pressures (fuel, reagents, materials), we could see some partial offset from the Nkran deposit, which recently reported some phenomenal drill results from within and below the current resource shell:

- 16 meters at 47.3 grams per tonne of gold / 41 meters at 3.0 grams per tonne of gold

- 11 meters at 27.6 grams per tonne of gold

- 49 meters at 3.4 grams per tonne of gold / 58.5 meters at 3.5 grams per tonne of gold

- 16 meters at 5.4 grams per tonne of gold

- 59 meters at 2.7 grams per tonne of gold

Obviously, these results are not indicative of the average grade, or this would be one of the highest-grade gold deposits globally. Still, these highlight intercepts from infill drilling are undoubtedly encouraging, helping to confirm the above-average grades at Nkran. This is a positive development for the company, given that this deposit has been a cash-flow machine, sitting close to the processing plant and benefiting from much higher grades and recovery rates. Assuming a 1.6 gram per tonne head grade and 92% recoveries with a blend of Nkran ore with other lower-grade deposits, the mine could easily ramp back up to above 250,000 ounces per annum (FY2022 guidance: 150,000 ounces).

Nkran Drilling (Company News Release)

While these results are very encouraging and point to 2.0+ gram per tonne grades from Nkran being more than achievable, the only negative is that Nkran makes up less than 20% of current measured & indicated resources. So, while this deposit can be used to spike grades vs. the other lower-grade deposits, it won’t be easy to maintain a 250,000-ounce production rate without adding significant tonnes at this high-grade deposit. The good news is that if Esaase’s past recovery rates can be maintained, we won’t see a drag on recoveries from this asset, which currently makes up the bulk of tonnes at the asset.

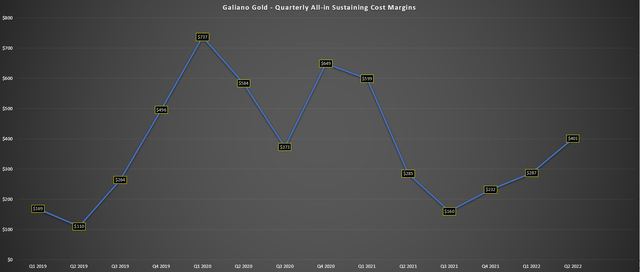

Costs & Margins

Moving over to costs, Galiano also managed to buck the trend here, with all-in-sustaining costs [AISC] coming in at $1,431/oz, a 4% improvement from last year’s levels despite inflationary pressures. It’s worth noting that this was partially related to being up against easy year-over-year comps, with AISC increasing 40% from Q2 2020 to Q2 2021 ($1,497/oz vs. $1,067/oz). That said, the company reported lower labor costs, which was a surprise in a sector where labor costs have been creeping higher by double-digits for some companies. This was related to workforce restructuring, and this optimization is expected to continue to improve costs.

Galiano Gold – All-in Sustaining Cost Margins (Company Filings, Author’s Chart)

From a margin standpoint, Galiano saw its AISC margins increase for the third consecutive quarter to $401/oz, helped by a higher average realized gold price of $1,832/oz. However, while this represented a large improvement sequentially and year-over-year, we have seen a considerable margin degradation since 2020, with Galiano again up against easy year-over-year comps. Finally, from a financial standpoint, the asset reported a quarterly free cash inflow of $25.3 million (~$11 million attributable to Galiano). While a solid improvement, Q3 and Q4 should look much different, with lower production and a much weaker gold price. Let’s see whether the uncertainty related to the updated Life of Mine Plan is baked into the stock:

Valuation & Summary

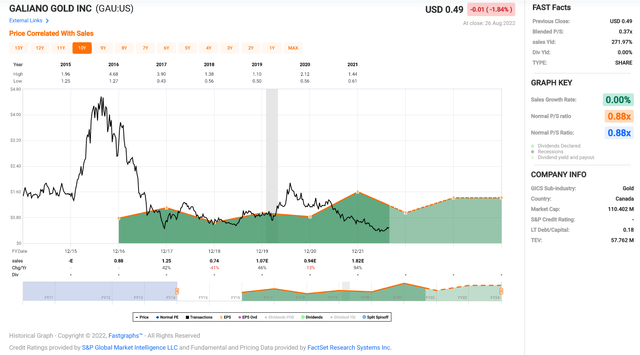

Based on an estimated year-end fully diluted share count of 236 million, Galiano Gold has a market cap of ~$118 million. This valuation is typically reserved for an early-stage developer, not a producer, and is actually well below the crazy valuations we’re seeing for some explorers like Snowline Gold (OTCQB:SNWGF) at ~$300 million. Based on ~1.45 million ounces of measured & indicated resources in the most recent update (50% basis), Galiano trades at a valuation of just $81.40/oz, a reasonable figure even if its all-in costs to extract gold are above $1,500/oz, translating to $250/oz+ all-in cost margins.

Galiano Gold – Price-to-Sales Ratio (FASTGraphs.com)

From a financial standpoint, the Asanko Gold Mine should generate at least $85 million in cash flow in FY2023, with Galiano’s 45% interest translating to ~$38 million. This leaves Galiano at barely 3x forward cash flow estimates, a very reasonable valuation even if this is a Tier-3 jurisdiction, single-asset gold producer, placing it in the highest-risk category among its peers. Finally, from a revenue standpoint, Galiano should see attributable sales of $120+ million in FY2023, leaving the company trading at less than 1x revenue. These valuation metrics suggest a lot of negativity is priced into the stock. Let’s look at the technical picture:

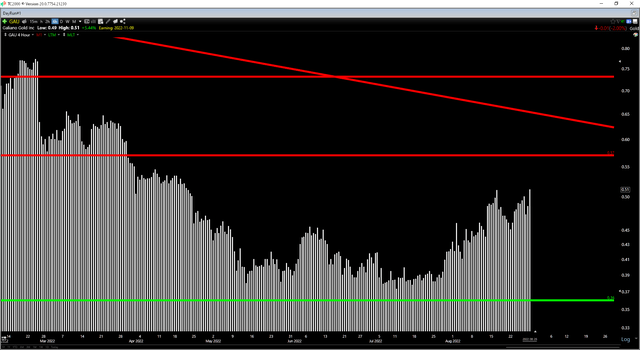

GAU 6-Month Chart (TC2000.com)

Although Galiano’s valuation is attractive and could easily support a share price of $0.60, the technical picture leaves much to be desired after its recent rally. This is because the stock is rallying toward a broken support level at $0.57 and is now extended relative to its most recently confirmed support level at US$0.36. From a current share price of $0.51, this translates to a reward/risk ratio of just 0.40 to 1.0, based on $0.06 in potential upside to resistance and $0.15 in potential downside to support. Generally, when it comes to micro-cap producers, I prefer a minimum reward/risk ratio of 6 to 1, placing the stock’s buy zone at $0.385 or lower, suggesting GAU is nowhere near a low-risk buying opportunity.

Summary

Galiano had a much better H1 than I expected, metallurgical testing appears to be going better than planned, and recent drill results out of Nkran appear to confirm phenomenal grades below the current pit. The latter two points should help to improve project economics at the Asanko Gold Mine in the Q1 2023 life of mine plan vs. prior expectations and provide some partial offset vs. the impact of inflationary pressures.

That said, while Galiano is reasonably valued, I would not be surprised to see profit-taking occur if this rally continues. Therefore, I would view any rallies above US$0.60 before year-end as selling opportunities, and I see much more attractive bets elsewhere in the sector. My preference for African gold exposure is Endeavour Mining (OTCQX:EDVMF). This is because it also trades at a discount to fair value but offers diversification (7 mines vs. 1), industry-leading margins (sub $1,000/oz costs), and an attractive dividend yield (~3.5%).

Be the first to comment