gremlin/E+ via Getty Images

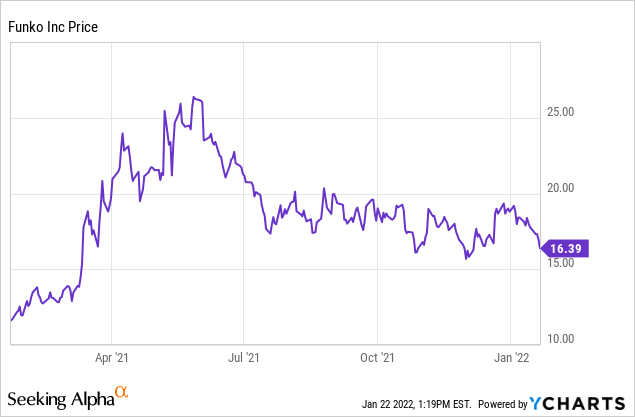

Investors are shying away from small-caps right now. So far in January, the S&P 500 has made a very sharp ~10% contraction in a matter of weeks, with tech stocks, growth stocks, and small/mid-cap stocks taking the brunt of the losses. These moves, of course, are all a reflection of the expected tightening interest rate environment.

Yet it’s in some of these “crushed” stocks that I now see some of the biggest bargains, though the plays here are less obvious than in the large-cap crowded trades. Funko (FNKO), in particular, is one company that I view as having massive upside potential. This collectibles maker, known for its Pop! figurines, has continued to ably monetize fandom and expand its brand across a number of popular franchises. Revenue growth continues to be strong, while bottom-line expansion should also secure an eventual rebound for this stock. Yet over the past three quarters, since last May after hitting a near-term peak above $26, Funko shares have lost ~40% of their value – despite the fact that fundamentals have never looked better. Losses have sharpened in the recent correction, as Funko is down 15% in January alone. Now, in my view, is a ripe time to buy this name:

The bullish thesis for Funko still rings true, at a lower valuation

For investors who are newer to Funko, here are the key reasons to be bullish on this name:

- Uncanny ability to source and monetize the best content. From Fortnite to Pokemon to Marvel and other brands, Funko’s ability to nab the best content is unrivaled. No single brand dominates Funko’s revenue, so it’s well diversified to be the beneficiary of a general rise in entertainment and pop culture.

- International growth push. Though primarily a U.S. company now, Funko is driving strong growth overseas, especially in Europe where in the most recent quarter, Funko managed to achieve >65% y/y revenue growth

- NFTs. Last year, Funko acquired a company called TokenWave, which enabled it to finally get its skin in the NFT craze that kicked up amid the pandemic. Funko notes that its first few token offerings have “sold out in minutes,” potentially opening the door to an entirely new and fast-growing revenue stream going forward.

- Healthy profitability. Surprisingly enough for a small-cap company, Funko is profitable from both an adjusted EBITDA basis as well as GAAP earnings. In my view, investors’ hesitation around small-cap stocks generally stems from their favoring growth over profitability, but in Funko’s case it can brag about having both.

After the recent correction, Funko also trades at a very modest valuation that investors should snap up. At current share prices near $16, the company trades at a forward P/E of just 11.5x versus Wall Street’s forward pro forma EPS estimate of $1.43 (data from Yahoo Finance).

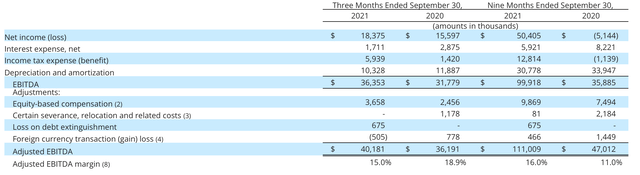

On an adjusted EBITDA basis: for next year, Wall Street is calling for $1.04 billion in revenue. If we apply Funko’s year-to-date adjusted EBITDA margin of 16% against this revenue estimate, we get to an adjusted EBITDA outlook of $166.4 million for next year.

After netting off $93.2 million of cash and $177.6 million of debt on Funko’s most recent balance sheet to the stock’s current $831.3 million market cap, Funko’s resulting enterprise value is $915.7 million – which represents just a 5.5x EV/FY22 adjusted EBITDA multiple.

Any way we slice it, I continue to view Funko as an attractive and under-appreciated niche stock that is driving quite healthy profits and enjoys a number of growth tailwinds. Stay long here and use the recent dip to buy.

Q3 download

Funko’s recent quarterly earnings updates have also been nothing short of excellent, save for global supply chain woes that put a slight damper on its profitability margins but didn’t stop profits from expanding on a dollar basis.

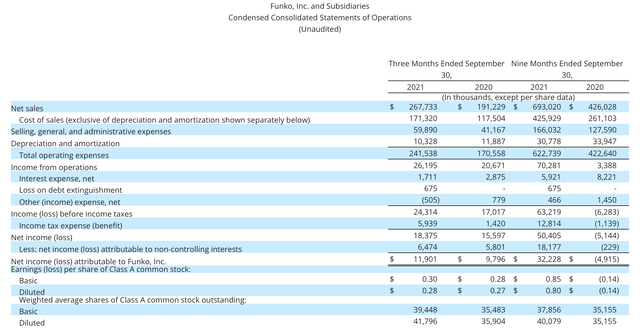

Take a look at the Q3 earnings summary below:

Funko Q3 results Funko Q3 earnings release

In Q3, Funko grew its revenue at a 40% y/y pace to $267.7 million, beating Wall Street’s expectations of $240.7 million (+26% y/y) by a massive fourteen-point margin. Sales of Pop! branded figurines, Funko’s flagship product, grew at a 41% y/y pace, driven by what Pop considers its “evergreen” categories – which are figurines featuring content like sports, that don’t rely on near-term fads and acquiring new licenses.

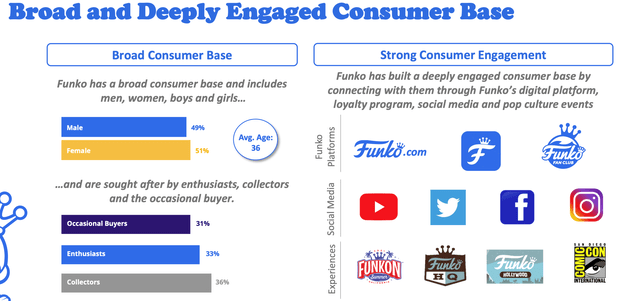

A snapshot of the typical Funko customer also helps to demonstrate the broad appeal that this company has managed to attain. The Funko customer is split roughly evenly among men and women, with an average age of 36. Even more importantly, note as well that Funko’s customers are also roughly evenly split between collectors, personal enthusiasts of certain pop brands, and more casual “occasional buyers.”

Funko customer snapshot Funko Q3 investor presentation

Here’s some helpful anecdotal commentary on the company’s go-to-market progress from CEO Andrew Perlmutter’s prepared remarks on the Q3 earnings call:

Recovering our specialty channel domestically and in Europe continues to provide a tremendous lift. While strong growth in the mass market channel, including third party e-commerce exceeded expectations. Because of our excellent third quarter results and exceptional demand, we continue to see, we are raising our net sales guidance for the year. Throughout the Funko portfolio, we’re developing products that resonate with our fans while continuing to expand our categories and fan base.

We’ve extended our flagship pop brand beyond figures in the entertainment and collectable aisle into soft lines and accessories. We’ve also broadened our figure lineup beyond the pop brand and into the toy aisle with top selling action figures like our new Turbo Man figure. We’re not only expanding our shelf space with these moves. We’re also continuing to broaden our fan base.

With regards to NFT sales, the company describes its recent drops as “massively oversubscribed” with tens of thousands of fans lining up in the digital queue, with each drop selling out within minutes.

The major headwind in the quarter was freight costs, coupled with the same supply chain challenges as virtually all consumer products companies are facing at the moment. Funko shed 260bps of gross margin in the quarter to 36%, though slightly improved product gross margins were able to offset the higher freight costs.

Funko adjusted EBITDA Funko Q3 earnings release

And as shown in the table above, Funko still managed to grow adjusted EBITDA at an 11% y/y pace to $40.2 million in the quarter, though on a margin basis the 15.0% adjusted EBITDA margin this quarter represented a 390bps reduction from the prior year.

Key takeaways

Given Funko’s healthy growth rates amid a bottom-line that more than justifies its current share price, investors have a “safe” entry opportunity in Funko stock right now. Take advantage of the recent dip to buy a little-known small cap stock at a sizable discount.

Be the first to comment