Vanit Janthra

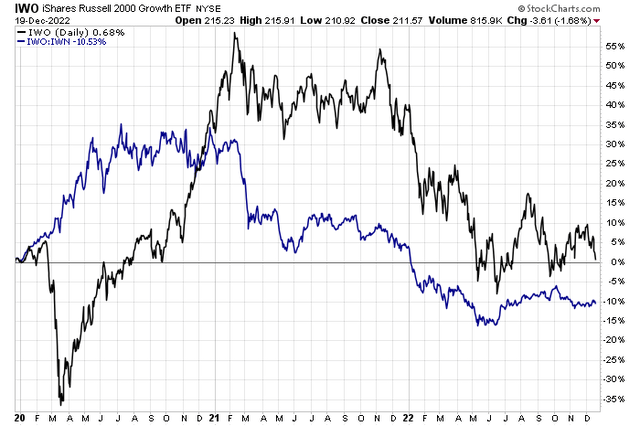

Small-cap growth stocks have been mired in a relative downtrend to their small-cap value peers since the middle of 2020. Even before the broad market topped out and interest rates began to creep higher, this high-risk, high-duration niche fell out of relative favor seemingly ages ago.

Despite a rebound off its June lows, the Russell 2000 Growth ETF (IWO) has turned lower lately and is not making much progress against the Russell 2000 Value ETF (IWN).

One stock, FuelCell Energy (NASDAQ:FCEL), in the lower-right part of the Morningstar Style Box, has struggled on its own and posted an earnings miss on Tuesday. Is there hope for its bulls? Let’s weigh the risks and reward potential.

Small Cap Growth Lags Small Cap Value Since 2020

According to Morningstar, FuelCell Energy Inc is a fuel-cell power company. FuelCell designs, manufactures, sells, installs, operates, and services fuel cell products, which efficiently convert chemical energy in fuels into electricity through a series of chemical reactions. It serves various industries such as Industrial, Wastewater treatment, Commercial and Hospitality, Data centers and Communications, Education and Healthcare, and others areas. Geographically, the company generates a majority of its revenue from the United States followed by South Korea.

The Connecticut-based $1.4 billion market cap Electrical Equipment industry company within the Industrials sector does not have positive trailing 12-month GAAP earnings and does not pay a dividend, according to The Wall Street Journal.

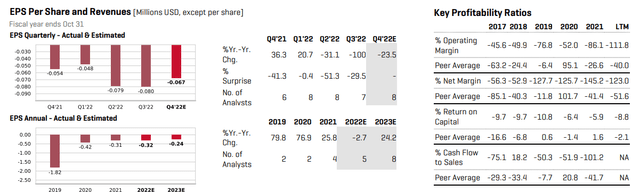

On December 20, the company reported a bottom-line miss of -$0.11 versus a consensus forecast of -$0.07. Sales also fell short of estimates. Upbeat comments from Jason Few, CEO, helped buoy shares. Few described investment plans for 2023 and increased production volume expectations. Those positive comments come as macro headwinds are likely to increase next year.

On valuation, CFRA research shows a string of quarterly per-share losses with little improvement seen in 2023. Revenues are expected to be about unchanged next year as well. The firm operates with steeply negative margins. Seeking Alpha rates the stock with a mediocre C+ valuation, and I noticed that its forward price-to-sales ratio is extremely high – above 10. For perspective FCEL’s 5-year average P/S is 13.9, so it’s still a pricey stock even with a major correction off its early 2021 peak. Even with growth potential, I see more risk than reward on this low-priced stock.

FuelCell Energy: Earnings Outlook and Key Profitability Ratios

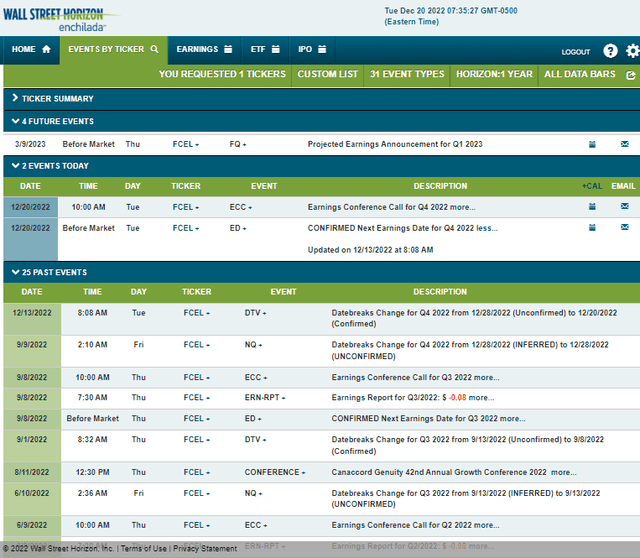

After reporting Q4 2022 results Tuesday morning, the company’s corporate event calendar is light until the next earnings report slated for Thursday, March 9 BMO, according to Wall Street Horizon.

Corporate Event Calendar

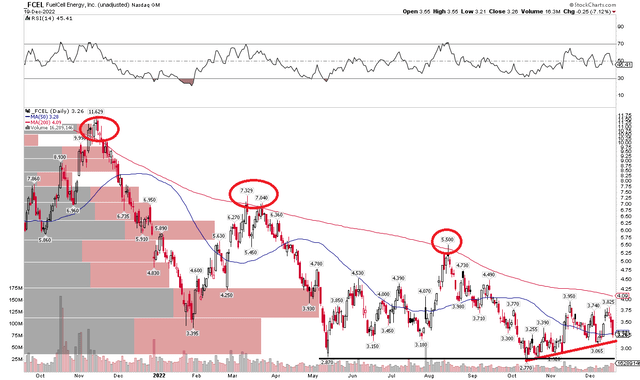

The Technical Take

FCEL remains in a bearish downtrend post-earnings. Notice in the chart below that shares have been rejected several times at the falling 200-day moving average. Currently, there’s support at an uptrend line dating back to its mid-October low of $2.77. We saw comparable price action from May through August, culminating with a big rally, nearly a double, from the Q2 low to the mid-August high.

This time around, however, gains have been less impressive on the way up. FCEL was unable to even touch the 200-day and has now fallen back to the 50-day moving average. I see further downside ahead, perhaps taking out the double bottom feature just under $3. A close above the 200-day would be helpful for the bulls, but there’s also a high supply of shares up to $4 as measured by the volume by price indicator on the left side of the chart. If we were to pull back the chart, we would see further downside risk to around $1 based on some of its pre-pandemic trading ranges.

FCEL: A Pronounced Downtrend In Place

The Bottom Line

Despite an earnings beat on Tuesday, I see more downside potential in FCEL. Maybe the stock rallies back toward the 200-day, but a protracted downtrend is in place with just modest support under $3. This is a high-risk play and investors should allocate a small portion of their capital if they are to go long.

Be the first to comment