BeeBright

In the past several months, silicon carbide (“SiC”) chipmakers have been aggressively partnering with automobile companies as demand momentum increases. Revenue generated by these partnerships also will impact the SiC supply chain.

Just last week, Coherent (NASDAQ:COHR) a major SiC wafer manufacturer, signed a memorandum of understanding with two of my institutional clients in Korea, the Electronics and Telecommunications Research Institute (ETRI) and the Korea Advanced Institute of Science & Technology (KAIST), to foster collaboration on advanced electronic and photonic devices, with a focus on the Korean market.

The collaboration will address applications in power electronics for electric vehicles, which is the topic of this article, as well as for industrial applications and optical and wireless networks.

In this article, I address the recent partnerships announced between SiC chip companies and automobile manufacturers, and then turn to supply chain partnerships between the chipmakers and their wafer suppliers. My focus will be on COHR and Infineon Technologies AG (OTCQX:IFNNY), a leader in SiC components to automobile companies.

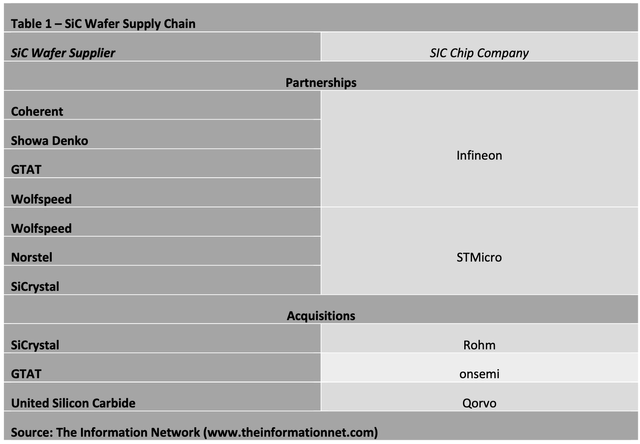

SiC Wafer Supply Chain

Coherent is a market leader in the development and manufacture of 100 mm and 150 mm semi-insulating SiC substrates, and is planning to expand SiC capacity 5x-10x over the next several years. In addition, the company is developing advanced SiC substrate growth technologies to support emerging markets in GaN RF and SiC power electronics. Coherent stated it would have wafer capacity by 2027 to make 1 million 150mm equivalent wafers as part of the $1B investment projected for the next 10 years.

Competitors include Wolfspeed (WOLF) with a 48% share followed by II-VI with a 17% share, SiCrystal with a 15% share, and the rest under a 10% share that includes Dow Corning (GLW), SICC Co, and TankeBlue Semiconductor.

SiC wafer companies have announced agreements to supply SiC chip companies, as shown in Table 1. COHR was able to secure a multi-year contract to supply Infineon with 150 mm silicon carbide substrates for power electronics on Aug. 23, 2022. Just a week earlier, COHR announced that it closed an $100 million-plus contract to supply Dongguan Tianyu Semiconductor Technology Co., Ltd., with 150 mm silicon carbide substrates to be delivered beginning this quarter and through the end of calendar year 2023.

The Information Network

Infineon has been aggressive in developing a supplier base of SiC wafers:

- Infineon introduced its first chips made from silicon carbide more than 20 years ago.

- On February 26, 2018, Cree, now Wolfspeed, announced that it signed a strategic long-term agreement to produce and supply SiC wafers to Infineon. The agreement follows a failed attempt by Infineon in 2016 to acquire the Wolfspeed division of Cree.

- On November 9 2020 – Infineon and GT Advanced Technologies (OTCPK:GTAT) signed a supply agreement for SiC boules. Infineon applies its proprietary thin-wafer technology to slice GTAT’s crystal.

- On May 6, 2021, Infineon and Showa Denko K.K. signed a two-year term with an extension option.

Many companies have made steps to full vertical integration with acquisitions of SiC substrate suppliers.

- ON Semiconductor (ON) acquired silicon carbide and sapphire materials manufacturer GT Advanced Technologies of Hudson, NH, for $415 million in November 2021.

- Qorvo (QRVO), a provider of innovative radio frequency (“RF”) solutions, acquired United Silicon Carbide, a manufacturer of SiC power semiconductors also in November 2021.

According to our report entitled “Power Semiconductors: Markets, Materials and Technologies,” Infineon held a 21% share of the $1.2 billion SiC Power Device Market in 2021. Infineon was behind market leader STMicroelectronics (STM) and ahead of Wolfspeed. STM currently manufactures its high-volume SiC products on two 150mm wafer lines in its fabs in Catania, Italy and Ang Mo Kio (Singapore), and is building €730m silicon carbide wafer factory in Catania, Italy.

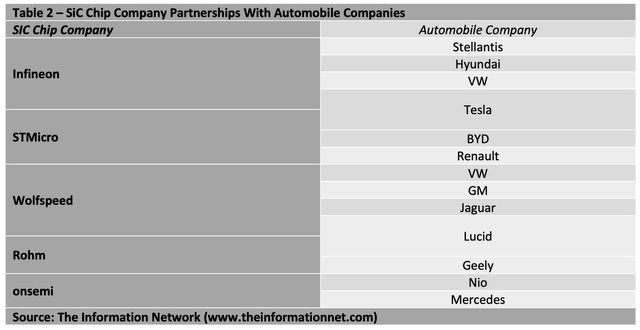

SiC Chip Supply Chain With Automobile Companies

The largest application of SiC chips, with more than a 65% share, is as power chain components for automobiles. Additional details are available in my May 17, 2022, Seeking Alpha article entitled “II-VI: Eyes On Carbide Automotive Chip Market As Semiconductor Shortage Ends.”

In Table 2, I show a partial list of partnerships between SiC Chip companies and Automobile manufacturers. As SiC chips increase their penetration rate into the Automobile sector, these partnership will continue to grow.

The Information Network

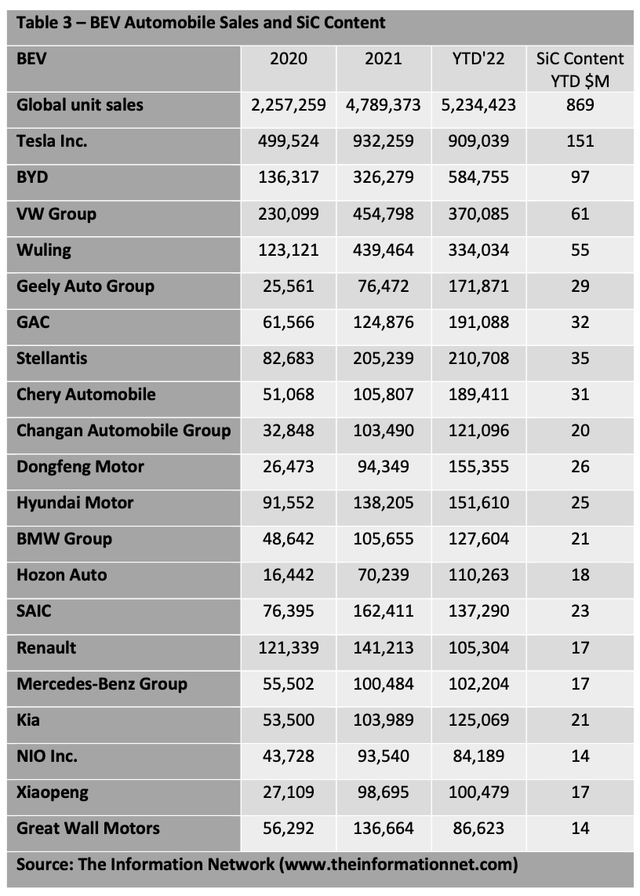

Table 3 shows BEV (battery EV) sales for 2020 through 2022 YTD through September. In this analysis, I use an average of $790 SiC content value per vehicle and a penetration of 21% of all in 2022. Keep in mind that these are just for BEVs and do not include ICE (internal combustion engine) vehicles.

The Information Network

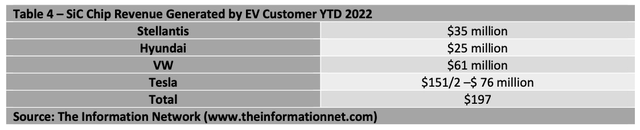

Comparing data in Table 2 and Table 3, Table 4 shows Infineon generated revenues year-to-date in 2022 of approximately $200 million from SiC chip sales to these auto companies. These are for companies identified in this article, and I suspect are non-inclusive for Infineon. But it serves as a comparative reference for all SiC chip companies and SiC wafer companies.

The Information Network

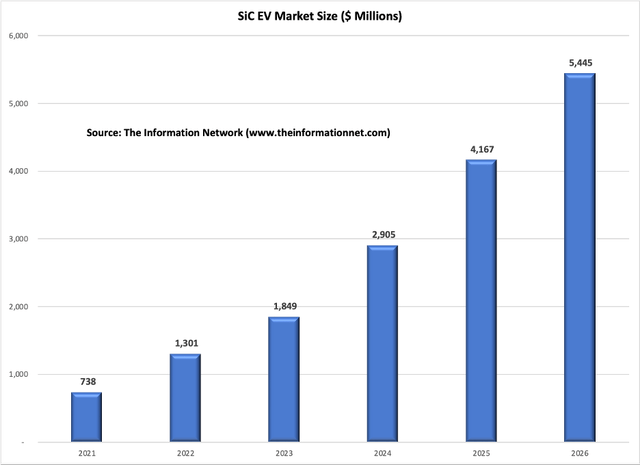

Based on data for BEV sales through 2026 and based on assumptions of increased penetration, Chart 1 shows SiC chip revenue growing from $1.3 billion in 2022 to $5.6 billion in 2026, representing a compound annual growth rate (“CAGR”) of 43%.

The Information Network

Chart 1

Calculation of SiC wafers is more difficult since wafer manufacturers have developed partnerships with multiple SiC chip companies. One way to analyze the market share and growth is based on current and future planned capacity.

Investor Takeaway

Coherent’s supply partnership with Infineon Technologies is reinforcing its role as a Silicon Carbide wafers leader. Infineon has inked deals to supply SiC chips to Stellantis, Hyundai, VW, and Tesla made on Coherent’s SiC wafers. These four EV companies shipped 31% of the 5 billion vehicles year to date through September

Growing demand for SiC devices in power applications has driven companies to shift their focus to increasing supply through partnerships and acquisition with SiC wafer suppliers and I estimate that SiC wafer capacity will increase from 125,000 150mm wafers in 2021 to more than 4 million 150mm equivalent wafers in 2030 to meet the electric vehicle market.

SiC devices for BEVs will reach $5.4 billion in sales in 2026 and further to $7.1 billion when PHEV and ICE vehicles are included.

Also, Coherent, in November 2021 announced that it closed an over $100 million contract to supply China’s Dongguan Tianyu Semiconductor Technology with 150 mm silicon carbide substrates to be delivered through the end of calendar year 2023. In the first three quarters of 2022, Tianyu realized operating income of 269 million yuan ($38.5 million). This agreement should increase Coherent’s exposure to the Chinese EV markets.

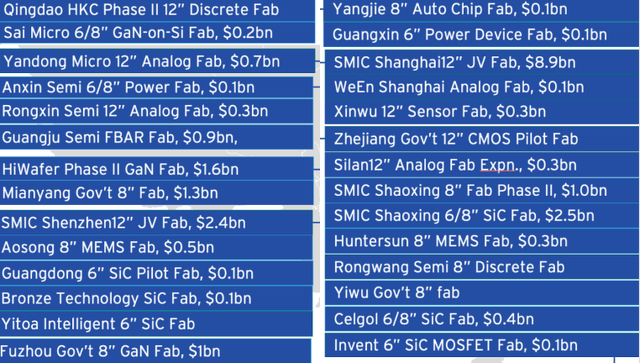

Table 5 shows new fab construction in Mainland China built in 2021 and 2022. Of the 28 fabs, six are listed as SiC fabs and another two as power device fabs, which make chips for automobiles. The strong potential growth of the China market through these new fabs represents a strong argument for expansion of Coherent’s SiC business plans.

Table 5 – New Fab Construction in Mainland China 2021-2022

The Information Network

Be the first to comment