eGain Corporation (EGAN) is a small company that offers a customer engagement platform. The company has revenue of $70 million and a market cap of approximately $180 million.

(Source: eGain)

eGain has nearly completed its transition to a Software-as-a-Service (SaaS) company with 87% of revenue from SaaS and professional services. But the conversion is cannibalizing its legacy business, resulting in low annual revenue growth of just 7%.

eGain does have some positive developments going on, including a very successful partnership with Cisco Systems, Inc. (CSCO) and a promising OEM partnership with Avaya Holdings Corp. (OTC:AVYA) as well as a potential partnership with Amazon.com (AMZN). The agreement with Avaya is not expected to show much top-line revenue this year but good things are expected next year. The Amazon relationship is still in the formative stage with no product announcements at present.

While eGain appears to be a solid company, it doesn’t have the revenue growth that I look for. I expect that the company’s free cash flow margin, a solid 15%, will be impacted by planned ramping of S&M this year and possibly by an imminent recession. This company also has a small number of customers and could be impacted by loss or downsizing of customers. For these reasons, I am giving eGain a neutral rating.

Stock Valuation

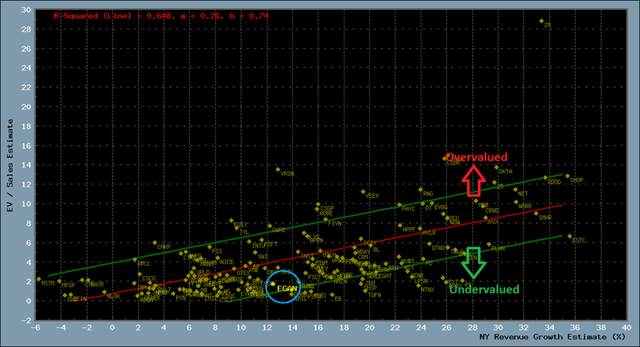

I determine stock valuation on a relative basis by comparing sales multiples and sales growth to the company’s peers. I believe that high-growth companies should be more highly valued than slow-growth companies. After all, growth is a prime factor in valuation models such as DCF. Higher future growth results in higher valuation and, therefore, higher EV/sales multiple.

To illustrate this point, I created a scatter plot of enterprise value/forward sales versus estimated YoY sales growth for the 152 stocks in my digital transformation stock universe.

(Source: Portfolio123/Private software)

The sales multiple in the vertical direction is calculated using the EV and “next year’s sales estimate” mean value based on all analysts from the Portfolio123 database. The estimated YoY sales growth is calculated using “current year’s sales estimate” and “next year’s sales estimate,” also provided by Portfolio123.

As can be seen from this scatter plot, eGain is sitting well below the best-fit trend line, suggesting that its forward sales multiple is significantly lower than its peers given its estimated future revenue growth rate. My interpretation is that eGain is undervalued relative to the average stock in my digital transformation universe.

Company Fundamentals

When it comes to software companies, I don’t rely on traditional value factors; instead, I focus on other measures, such as the software company “Rule of 40” and relative valuation, a concept that I recently developed that compares forward sales multiple versus estimated sales growth.

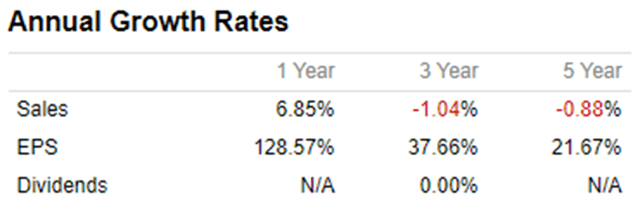

Revenue Growth

eGain’s annual sales growth rate is an anemic 7% but better than the 3-year and 5-year average growth which are both negative.

(Source: Portfolio123)

There are two issues to note when considering the growth rate. First, eGain is transforming into a SaaS-only company. The action of converting to recurring revenue results in deferred revenue, causing revenue to be depressed in the short term, making the growth rate appear lower than it actually is.

Second, the year-to-date SaaS revenue growth is 16% to 18% YoY. But this growth is occurring at the expense of the legacy business, making it difficult to identify the organic growth.

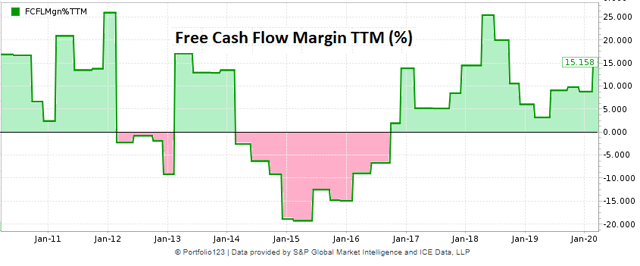

Free Cash Flow Margin

eGain’s free cash flow margin TTM is 15%. The free cash flow has been positive since the beginning of 2017.

(Source: Portfolio123)

The Rule Of 40

One industry metric that is often used for software companies is the Rule of 40. It is an industry rule of thumb that attempts to help software companies ascertain how to balance growth and profitability. There are different ways of calculating the Rule of 40 – some analysts use EBITDA and others use free cash flow margin. I use the free cash flow margin TTM.

The Rule of 40 is interpreted as follows: If a company’s growth rate plus free cash flow margin adds up to 40% or more, then the software company has growth and cash flow in balance and is considered financially healthy. In eGain’s case:

Revenue Growth + FCF margin = 7% + 15% = 22%

The calculation comes out substantially lower than 40%, indicating that eGain has a lot of work to do to achieve a healthy balance between growth and profits. Even if I use the SaaS-only revenue growth of 16% to 18%, eGain still comes up short on the Rule of 40.

Cash Burn

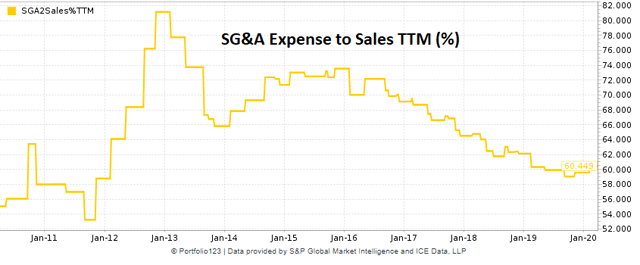

I monitor a company’s cash burn by examining the SG&A expense relative to sales.

Note that SG&A includes Sales & Marketing, General & Administrative, and R&D.

(Source: Portfolio123)

eGain is spending 60% of its total revenue on SG&A expenses (and R&D). While this level of cash burn is reasonable for a high-growth company, I don’t really put eGain in the high-growth category. I expect that SG&A expenses could rise substantially as the company ramps S&M spending as stated in the most recent earnings call:

…our Q2 SaaS plus professional services revenue grew at 16% year-over-year and on a year-to-date basis grew 18% year-over-year. This highlights our progress towards a long-term target model, total revenue growth of between 20% to 25% per year as we increase investment in sales and marketing in line with our plan.

Summary and Conclusions

eGain is a small company that provides a customer engagement platform. Revenue growth has been anemic, but this could change when S&M is ramped up this year. eGain has some promising partnerships that could boost revenue, but I don’t expect too much from the Avaya and Amazon partnerships this year. This company fails the Rule of 40 due to the low revenue growth. I would like to see a more aggressive approach to sales, higher S&M spend, and demonstrated boost to revenue growth before giving eGain anything more than a neutral rating.

Digital Transformation is a once-in-a-lifetime investment opportunity fueled by the need for businesses to convert to the new digital era or risk being left behind. You can take advantage of this opportunity by subscribing to the Digital Transformation marketplace service.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment