delectus/iStock via Getty Images

Friedman Industries (NYSE:FRD) is a steel rolled coil manufacturer with three facilities in the US. In March I wrote an article on the company with a hold rating considering that it was being valued with too much speculation from steel prices embedded on it.

The stock moved up, against steel prices moving down, mostly because FRD announced the acquisition of two plants near Chicago at accretive prices. With the two new plants and a third one in construction, FRD can triple its sales and manufacturing capacity.

Doing back of the envelope calculations and extending FRD’s current operating costs to the new operating capacity, yields average net income in the order of $8 million per year.

Some investors might consider that the company can do better than that, by improving its cost structure. However, I believe that FRD is going through so many changes that it is difficult to value right now. If the current market cap of $70 million is so close to the expected net income if everything goes well, then the stock does not represent such a clear opportunity.

Note: Unless otherwise stated, all information has been obtained from FRD’s filings with the SEC.

Previous business thesis

For a more detailed review of FRD’s operations during the last decade I recommend you read my previous article on FRD. The following is a simple summary.

FRD is a company with insignificant pricing power, given that its earnings move in lockstep with the prices of steel futures. That is understandable considering that hot rolled coil is a commodity.

During the last decade, through which hot rolled coil prices oscillated between $300 and $900 per ton, the company was able to generate an average of $3 million in net income.

This capacity responded to several reasons. First, all of FRD’s facilities are located very close to bigger steel manufacturers’ campuses, which provides significant logistic costs benefits. Second, based on a relatively lean SG&A structure of $5 million and a depreciation cost of $1 million, the company was also able to avoid significant losses during cyclical downturns in the market, by having a relatively low operating leverage level. In addition to that the company had no debts, meaning no financial leverage.

From a macro perspective, steel prices in the US could have benefited from an increase in trade tensions between the US, Russia, and China, and from a weakening dollar.

FRD was in the process of finishing a new plant in Sinton, Texas, close to Steel Dynamics, that would increase its coil cutting capacity by 50%.

When I wrote the article, FRD was an interesting business from the stability standpoint, with sturdy financials and somewhat interesting macro perspectives. I rejected FRD on the assumption that its stock price was incorporating already high prices. Trading at a $50 million market cap then, and assuming prices equal to those in the previous decade, the company would not be able to reach $5 million in net income even by adding the Sinton facility. Additionally, the company had started dangerous futures speculation.

The acquisition of Plateplus

In April, FRD announced several changes.

First of all, it acquired two facilities in the North-Center of the US, close to Chicago, from Plateplus, for $18 million. In addition, it acquired the client lists and inventories of two other facilities (but not the facilities), from Plateplus, for $60 million.

The acquired facilities are located in East Chicago (Indiana) and Granite City (Illinois), close to steel manufacturing hubs. In this sense the company is following the same strategy it had for its previous factories.

The new facilities are dedicated to coil cutting, which is the basis of FRD’s business, with mill characteristics that are very close to the rest of FRD’s facilities (36” to 72” width, 0.05” to 0.5” gauge, 40” to 1000” length).

The new facilities are much bigger than the previous ones in terms of both capacity and size, meaning more space for storage. The two facilities will increase year production capacity by 512 thousand tons, against current capacity of 310 thousand tons.

FRD is expecting to double sales by the first quarter of fiscal year 2023 (April-June 2022), compared to 4Q22 (January-March 2022), according to condensed pro forma financial statements published in July. It will also double its current holdings of inventories, at an approximate value of $1000 to $1200 per ton considering the data published in July for the acquired assets.

The company paid for the acquisition by issuing 7% of its outstanding share base to Plateplus owner, the Japanese Metal One (500 thousand shares), and with $64 million in cash. The transaction price approximates $80 million, or the fair value of the tangible assets acquired.

The acquisition cash payment will be financed by the increase of the company’s credit facility with JPM and BMO Harris Bank in July. Between the previous debt as of March 2022, reported in the latest 10-K, the $65 million required to pay the transaction and $50 million more announced in July, we expect FRD’s debts to climb to $135 million. The cost of this financing is SOFR + 1.7%, or currently 4%, equivalent to $5.4 million yearly.

The new capacity and cost structure

If we add up FRD’s previous capacity, plus the acquired capacity from Plateplus, plus the capacity to be provided by the Sinton facility (reaching full operation capacity in 2024, according to the latest 10-K), FRD would be able to produce 1 million tons of hot rolled coil, from a current operational capacity of 310 thousand tons.

The company will probably not reach full operational capacity. To put an example, with current hot rolled coil capacity of 310 thousand tons a year, the maximum sales ever were registered in FY22 for 150 thousand tons, less than half the facilities’ capacity.

However, let’s consider that the company is in fact able to triple production and sales by fiscal year 2024 (ending March 2024). How will the new structure be different from the current structure, in terms of costs?

We had calculated depreciation in the order of $1.7 million from the Sinton facility ($21 million investment over 12.5 years). The new facilities are valued at $18 million, yielding another $1.5 million in depreciation using 12.5 years as well. That means about $3 million in depreciation, added to the existing $1.4 million from the current facilities.

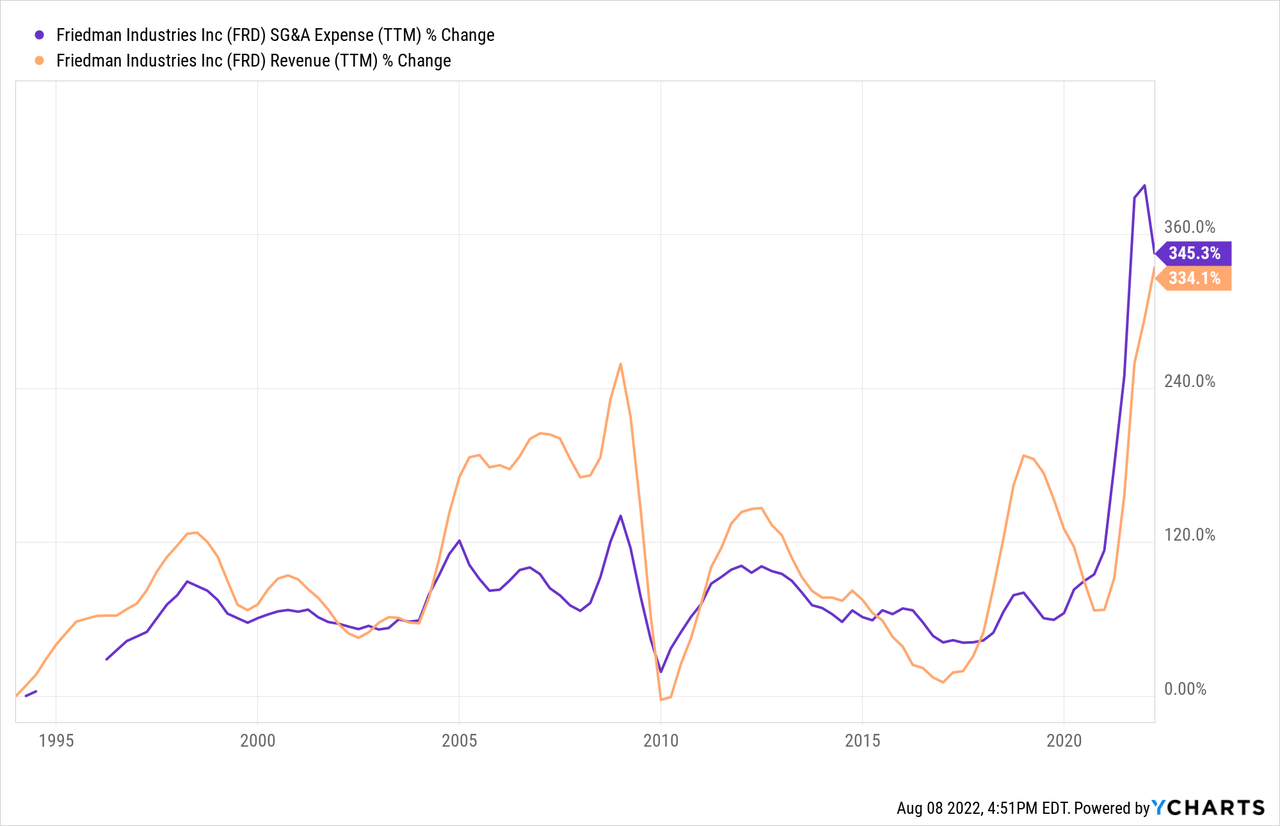

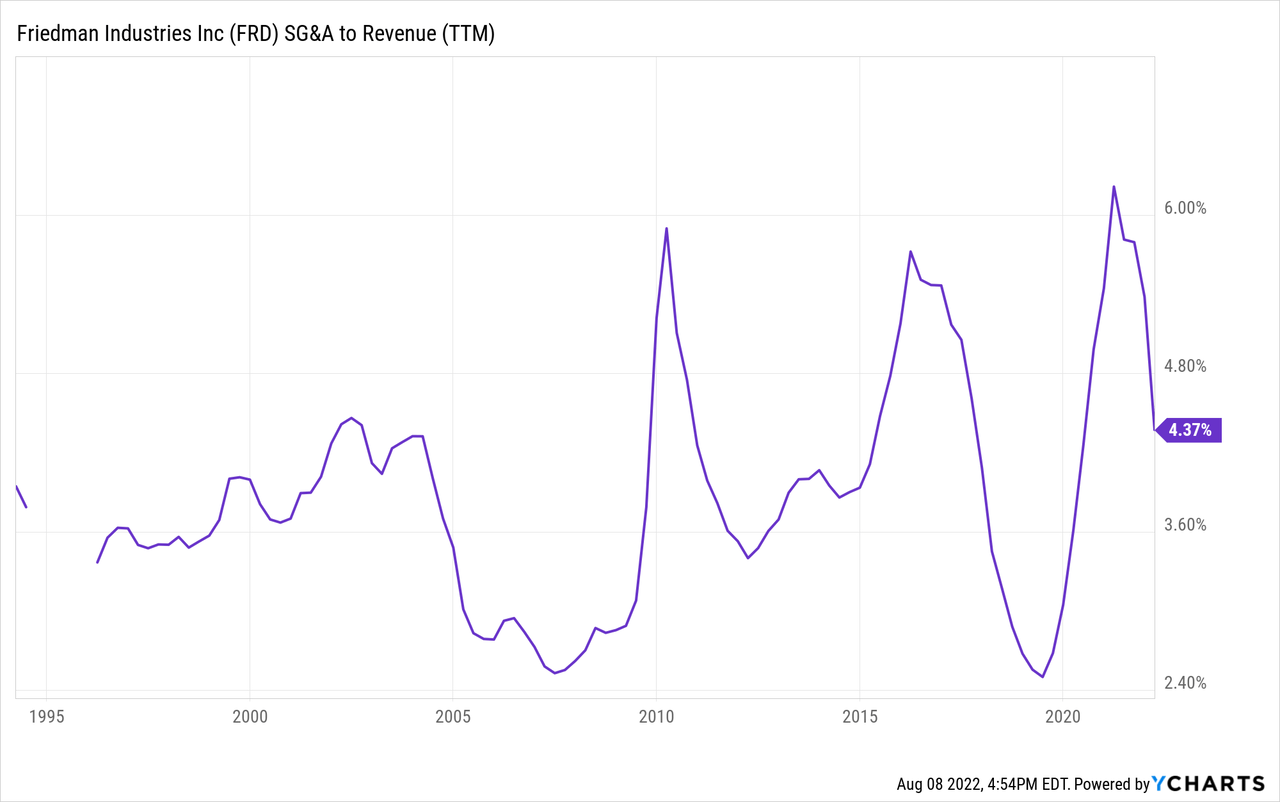

FRD’s SG&A costs were quite consistent at $5 million between 2000 and 2020. These did not move significantly with revenue movements. However, in 2021, the company’s SG&A expenses moved with revenues. There was no explanation provided in any of the company’s reports for this change.

Will SG&A expenses decrease? Will they move with increased production? Difficult to answer, considering the company provides very little information. For the time being, let’s consider it a variable cost equal to 4% of revenue.

The company’s debts have to be paid as well, yielding, as we calculated, $5.5 million yearly at current rates. These are variable interest rates, so the calculation can vary substantially.

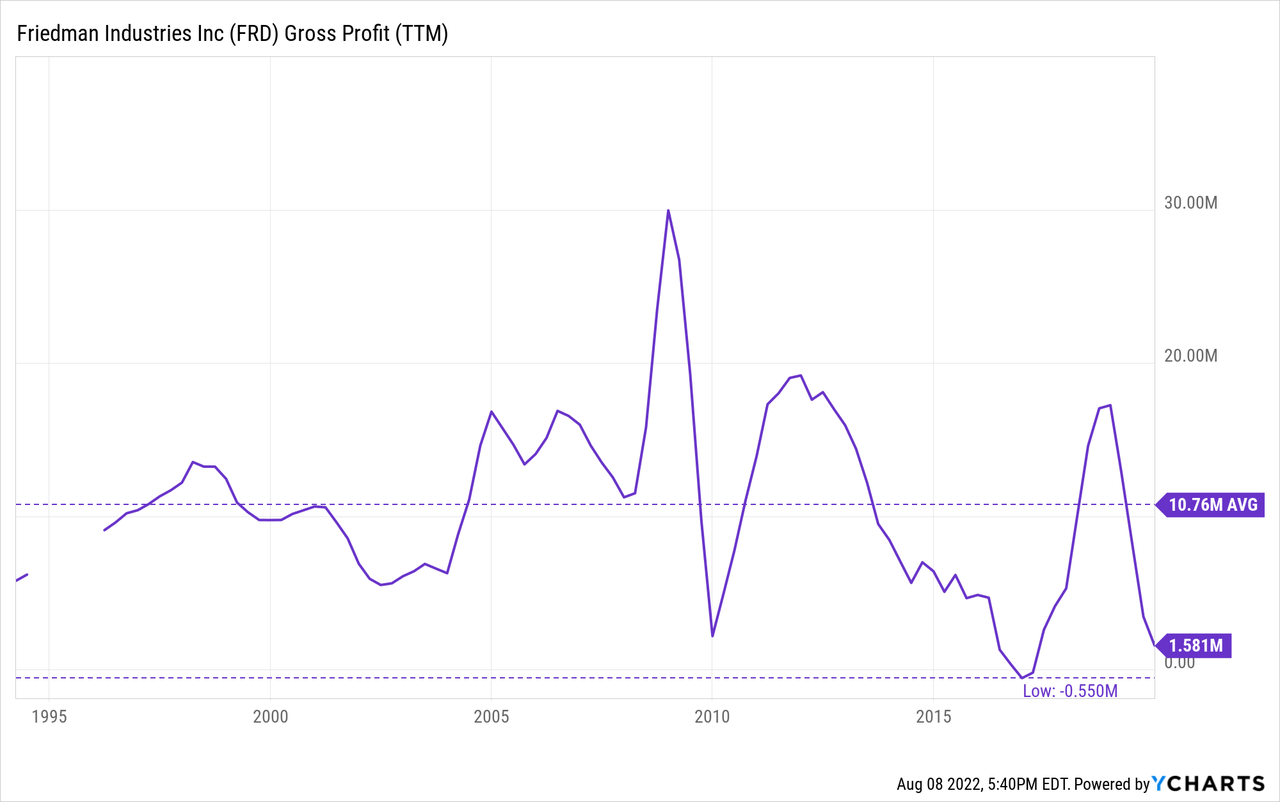

The company can pay those expenses using its gross profits, which averaged $10.5 million for the past two decades. If we add approximately $1.5 million in depreciation, we arrive at an EBITDA of about $12 million.

If we consider that the company can keep its cost structure and triple its sales, then it can increase EBITDA to $36 million. From that, it has to expense $4.5 million in depreciation, $5.5 million in interest taxes and about $15 million in SG&A expenses (considering no SG&A efficiencies).

That leaves $10 million before taxes or $8 million after taxes.

Increased risks

By increasing its size, FRD has increased its risks substantially in some aspects.

First, it now has a credit facility, maturing in 2026, from which it will draw more than $100 million, or 10 years of expected pre-tax income. In our previous analysis the company was unleveraged. This provided an enormous cushion against downward cycle movements.

Second, it has increased its down cycle portion risk. If before the acquisitions FRD was able to be unscathered even in the downward portion of the cycle, with gross profits close to zero, after the acquisitions it may face up to $25 million in fixed costs (interest, depreciation, SG&A). Posting significant losses is very different from a sustainability perspective than passing the bottom of the cycle almost unscathed.

Third, it now faces enormous price risks, because it has leveraged its long steel positions.

The company recognized in FY22 $12 million in unhedged futures losses (futures sales that lose money because prices go up but are unmatched by real sales because demand dries up). It still has more than $14 million in derivative liabilities that, if not matched against actual sales, will become unhedged losses. With steel prices down, and most positions being short, the company is relatively protected.

In the same vein, but long, FRD accumulated enormous amounts of inventories. FRD recognized negative gross profits for 4Q22 because its inventory costs were higher than its sale price, but it has now acquired $70 million more in inventories at about $1000 to $1200 per ton. That means the company has a $140 million inventory position in steel. With steel prices already 30% down from the $1200 mark, the cumulative losses for 1Q23 can be significant.

Conclusions

FRD is not the same company it was before. It now faces more risk, and has a higher operational footprint to cover. It is unknown how the new company will do in a downward cycle environment.

One thing is certain though. Like any commodity, steel will face a downward cycle leg, with oversupply driving prices down. If FRD has unknown but significant risks under that scenario, then it is better to stay away from it, at any price.

But even if the investor wanted to take risks, the price offered today by FRD provides only regular, 10 PE ratio returns, in the best scenarios. That means, regular returns if things go well, very bad returns if things go bad. In my opinion, that is not a value opportunity, and therefore I pass on FRD.

Be the first to comment