cemagraphics

Shares of Tabula Rasa HealthCare Inc. (NASDAQ:TRHC) are up about 56% against a loss of about 1.6% for the S&P 500 since I recommended avoiding the name back in May of this year. This isn’t as bad as it seems in my view. Shares remained flat to down slightly from the time I put out my article until the company released second quarter results in July, when the shares spiked higher, reaching a high on August 12th of $5.36 per share before they started to drift ever lower. They now sit around $4.50, certainly higher than when I put out my “avoid” call, but much lower for the people who bought in a flurry of hope this past summer.

Additionally, the shares are still down fairly massively since I suggested people simply sell the stock back in September of 2018. Anyway, things have changed since, so I thought I’d review the name yet again to see if it makes sense to buy at current levels. I’ll make that determination by looking at the most recent financial results, and by looking at the valuation. Additionally, the calls I recommended in lieu of shares expired worthless this past Friday, and with great reluctance I want to write about those also.

Welcome to the “thesis statement” portion of the article. This is where I give you more than you get from bullet points, but much less than you get from the full article. I consider this to be the article equivalent of a movie trailer. It gives you the relevant highlights, so there’ll be few surprises, so you won’t need to wade through the whole thing. You’re welcome. I think the financial situation here remains troubled. Although the balance sheet has improved when compared to this time last year, it’s now simply “less bad.” Things on that front are much worse than they were in 2019. Additionally, the company has continued a long established pattern of growing losses while growing sales. This prompts the question “if growing sales won’t lead to profits, what will?” That written, the stock valuation remains near multi year lows, so the market is finally as pessimistic as I’ve been for some time. That’s why I think that those who insist on staying long here once again represent that bullishness by buying calls in lieu of shares. Years ago when I worked on Bay Street (Canada’s deeply insecure baby brother to Wall Street), I would see new clients who had 10 year old “dogs” on their statements that they “just knew” were going to come back, any year now. The opportunity cost of these losers is astounding, and call options impose a discipline on investors that stocks don’t. If the growth from new PACE centers disappoints, for instance, the call owner will be obliged to review their thesis much more immediately. Additionally, they have more capital to buy stocks that are actually profitable. The stockholder, by comparison, is doing the financial equivalent of “Waiting for Godot”, incurring ever rising opportunity costs. This is why I once again recommend call options for people who insist on staying long here.

Financial Update

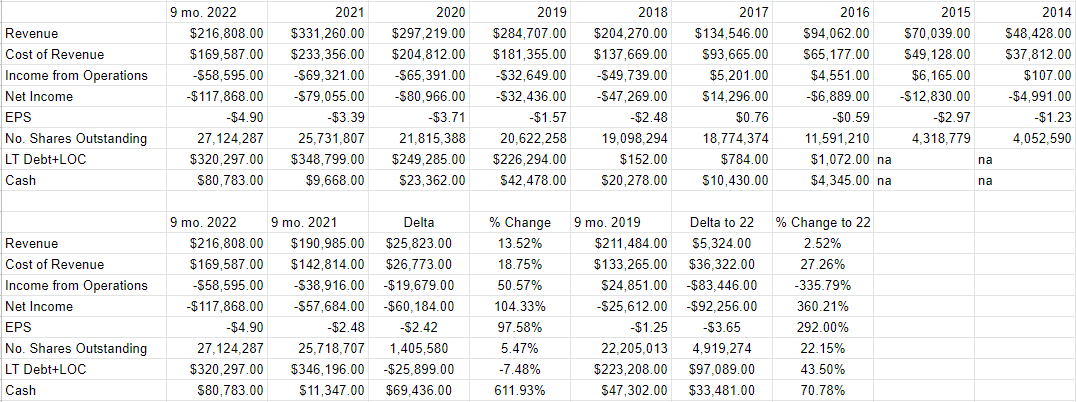

Those who follow my stuff on Tabula Rasa know that I have leveled a complaint against this company in each of my articles, namely, that there’s a very strong negative relationship between revenue and income. It seems that the more this company sells, the greater are its losses. If you thought I was going to make this complaint again, strap in and get ready to have your expectations affirmed. Relative to the same period a year ago, revenue for the first nine months of this year was up a healthy 13.5%. That is fairly impressive in my view. The problem is that the cost of revenue rose 18.8%. In the teeth of this uptick in revenue, income from operations declined by a whopping 51%, from a loss of $38.9 million to a loss of $58.6 million. In spite of the fact that revenue was higher by $25.8 million, net income cratered by an additional $60.2 million.

The financial life of this company isn’t universally worse than it was this time last year, though. The capital structure has improved fairly dramatically when compared to the same period a year ago. Long term debt is down by about $26 million, or fully 7.5%, and the cash hoard has improved massively, up fully $69.4 million to $81 million, or 612% (!). If you hadn’t noticed yet, though, I’m a “glass half empty” kinda guy, and as the song says, “I gotta be me.” I couldn’t live with myself if I didn’t point out that, although debt is lower than it was last year, it’s fully 43.5% higher than it was in 2019, although the cash hoard is higher by about $33.5 million. So, I’d characterise the nature of the capital structure as being “less bad” today than it was in 2021, but it’s still much worse than it was a mere 3 years ago.

All that being written, recent history has demonstrated that when this stock becomes cheap enough, it becomes a profitable investment. Given that, I would be willing to take a long position in this stock at the right price. It seems that, in spite of this financial performance, some members of the analyst community seem downright upbeat about these financial results, splashing around words and phrases like “congratulations” and “great to hear” during the most recent earnings call.

Tabula Rasa Financials (Tabula Rasa investor relations)

The Stock

If you subject yourself to my stuff regularly, you know that I think the stock is distinct from the business in many ways. I feel awful “droning on” about it, but I think it’s an important concept for investors to remember. A great business can be a terrible investment at the wrong price, and a mediocre business can be a decent investment at the right price. After all, the people who bought Tabula Rasa during the slough of despond in May have done rather well, in spite of my misgivings. At the risk of beating the proverbial dead horse (a risk I am totally willing to take), I’ll elaborate. A business pays for a number of inputs, adds value to those inputs, and then sells the results for a profit, or not in the case of Tabula Rasa. The stock, on the other hand, is a traded instrument that reflects the crowd’s aggregate belief about the long-term prospects for the company, and the stock is buffeted by a number of forces some of which may have little to do with the underlying business. Inflation and the pronouncements of central bankers may impact the business significantly, as if a 50 basis point move in the overnight rate is something significant. A fashionable analyst may decide that the shares are great value. The crowd may form a view about the relative attractiveness of stocks in general, and that drives shares up or down.

Although it’s tedious to see your favourite investment get buffeted around for reasons having little to do with the health of the business, within this tedium lies opportunity. If we can spot discrepancies between the price the crowd dropped the shares to, and likely future results, we’ll do well over time. It’s typically the case that the lower the price paid for a given stock, the greater the investor’s future returns. So back in May, I may have been a bit too pessimistic about the business, for instance, and the shares rallied nicely since then. The person on the other side of the trade from me took advantage of the pessimism surrounding this name, and has done well on their shares since.

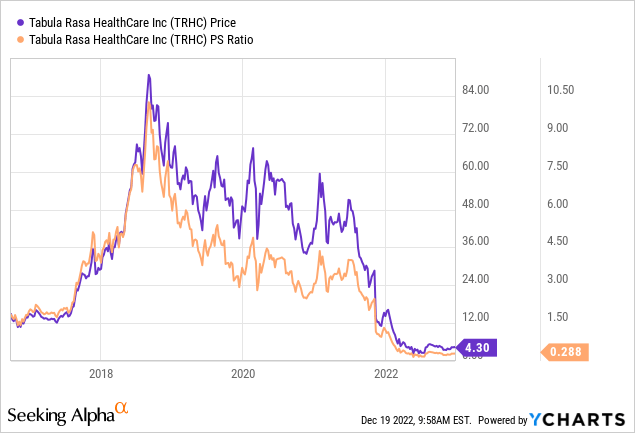

As my regular victims know, I use a host of measures to judge the relative cheapness (or not) of a given stock, some of which are quite simple, some of which are quite sophisticated. On the simple side, I like to look at the ratio of price to some measure of economic value, like earnings, sales, free cash, and the like. Because I think “cheaper wins”, I want to see a company trading at a discount to both the overall market, and the company’s own history. Previously, I considered the shares to be morbidly expensive, given that the last time the company was burdened by free cash flow, the stock was trading over 200 times free cash. At the same time, though, I admitted that they were trading at all time lows on a price to sales basis. Specifically, the market was paying just under $.23 for $1 of sales. This was the lowest in the company’s history. The shares are about 22% more expensive on this measure, per the following, but are still near the all time low achieved back in the early summer per the following:

Source: YCharts

My regulars know that I think ratios can be instructive, but I also want to try to work out what the market is “thinking” about a given investment. If you read my stuff regularly, you know that the way I do this is by turning to the work of Professor Stephen Penman and his book “Accounting for Value” for this. In this book, Penman walks investors through how they can apply some pretty basic math to a standard finance formula in order to work out what the market is “thinking” about a given company’s future growth. This involves isolating the “g” (growth) variable in this formula. In case you find Penman’s writing a bit opaque, you might want to try “Expectations Investing” by Mauboussin and Rappaport. These two have also introduced the idea of using the stock price itself as a source of information, and we can infer what the market is currently “expecting” about the future. Applying this approach to Tabula Rasa at the moment suggests the market is assuming that this company will grow at a rate of ~19%, which I consider to be wildly optimistic.

Given the above, I can’t recommend buying at current levels. I may miss out on some speculative gains from current levels. The thing is the people who bought at $5.30 are still “under water” today. I’d rather miss out on future gains than risk capital on a stock until the business is supposedly represents demonstrates the capacity to generate operating profits. In my view, that’s a minimum requirement, so I’m going to remain on the sidelines.

Options Update

In my most recent article on this name, I recommended that people who insisted on ignoring my advice and going long represent that perspective by buying call options instead of shares. That call has just expired worthless. Specifically, I suggested the December call with a strike price of $5, which was asked at $.75 previously. These calls were profitable as the shares spiked in the summer, hitting a high bid of $1.45, but they lost value as the shares fell back in price. So, it seems that a person who expressed their bullishness on the stock back in May has done much better with the shares than they would have with the call. I’d suggest that the capital at risk is also relevant. The person who bought the call back in May was risking only 26% of the capital of the stockholder, and the call was also profitable during the summer.

I remain convinced that a “long call in lieu of shares” strategy makes the most sense here. If the shares continue to languish, the call owner will lose relatively less capital. This aids in the overall strategy of preserving capital, which is a win in my view. If some catalyst comes along and rescues this perennial laggard, the call owner will benefit as they did during the summer. With that in mind, I think that if someone insisted on staying long here, they’d be wise to buy calls in lieu of shares. I think the best relative value for money is the April call with a strike of $5. These are currently priced at $.30-$1.25. Since there’s such a huge spread, I think a buyer could put in a bid at $.80, and would likely find a seller. Even if an investor hit the ask, though, they’re only risking about 29% of the capital as the stockholder for the right to capture much of the upside from the stock over the next five months. In my view, it’s best to avoid this name. If someone insists on remaining long, it’s best to do that with only 30% of the capital at risk, leaving 70% of capital for investment in actually profitable investments. If some catalyst comes along to drive the shares higher, the call owner will do well. If the shares languish, the call owner will lose their capital. This is a better outcome, in my view, than having capital locked up in a losing proposition for years. I think calls can be painful investments when you lose capital, but I think holding on to stocks that go nowhere is the financial equivalent of “Waiting for Godot.” Thus, if you insist on taking a long position here, I continue to recommend calls in lieu of shares.

Be the first to comment