SWInsider

Freeport-McMoRan (NYSE:FCX) is a more than $50 billion mining company and one that has seen its share price remain incredibly volatile. Unfortunately, it’s a nasty side effect of operating in the commodity markets. However, there still remains substantial demand for the company’s assets and we expect that to support substantial returns.

Copper Demand

Copper demand is expected to grow dramatically buoyed by electric vehicles and other electronics. Evident in that is Codelco’s proposal for a 33% price increase in copper prices.

Freeport-McMoRan Investor Presentation

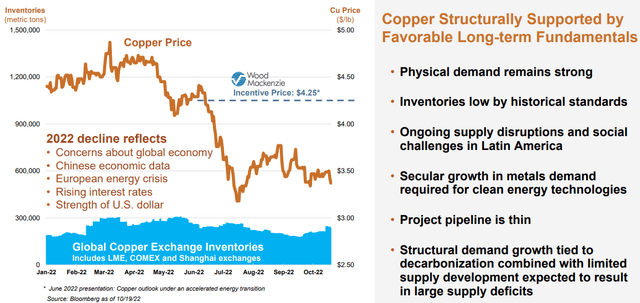

(Source: Copper Prices – Freeport-McMoRan Investor Presentation)

Freeport-McMoRan has seen copper prices drop since mid-2022 pushing prices below the incentive price of $4.25/pound. Continued concerns about the global economy have continued to push down prices along with the strength of the U.S. dollar impacting trade and prices. However, the product pipeline is thin and the rate of inventory growth has slowed down.

From a historic perspective, inventory volumes aren’t particularly high. Long-term fundamentals are strong. By 2040, copper demand is expected to grow 50%, to 40 million metric tonnes annually, and the projects aren’t there in the pipeline to support it.

Freeport-McMoRan 3Q 2022 Performance

The company performed reasonably well during the quarter highlighting the strength of its assets.

Freeport-McMoRan Investor Presentation

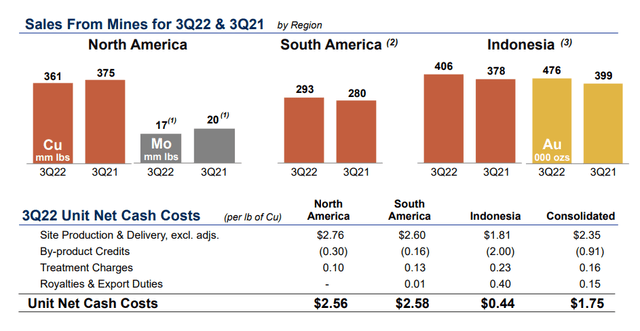

The company’s North America copper production decreased some YoY, however, its South America and Indonesia sales both increased substantially along with the company’s Gold production. Molybdenum production decreased slightly, but overall the company’s volumes have managed to improve year-over-year.

The company’s cash costs remain high in both North America and South America where the company has substantial volumes. Indonesia costs continue to remain incredibly low, however, the company is supported by strong gold volumes. Overall, the company’s incentive price for production is roughly $2.6/pound minimum.

The company is profitable at $3.5/pound, but profitability doubles at $4.4/pound. That shows how the company is susceptible to fluctuating commodity prices.

Freeport-McMoRan Annual Sales and Growth

Freeport-McMoRan has continued to focus on its annual sales and growing its asset portfolio.

Freeport-McMoRan Investor Presentation

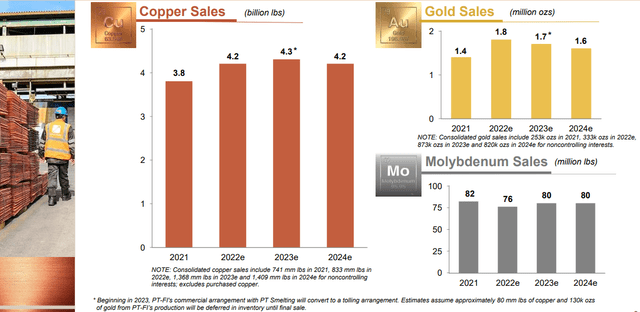

The company is continuing to maintain strong volumes while investing heavily in the business. The company’s 2023 sales volumes are expected to increase while 2024 sale volumes are expected to be more in line with 2022 sales. The company’s core copper presence will continue to support ~8% of global demand while the company will continue to maintain massive gold and molybdenum businesses.

The transition of its Grasberg Mine is continuing to perform well. The company is keeping capital expenditures substantial with 2023 capital expenditures of $3.3 billion of which $1 billion is discretionary. That’s a ramp up from 2022 capital spending of $2.7 billion, however, as we’ll see both of these are numbers the company can afford.

Freeport-McMoRan Financial Returns

The company has focused on maintaining an incredibly strong position financially.

Freeport-McMoRan Investor Presentation

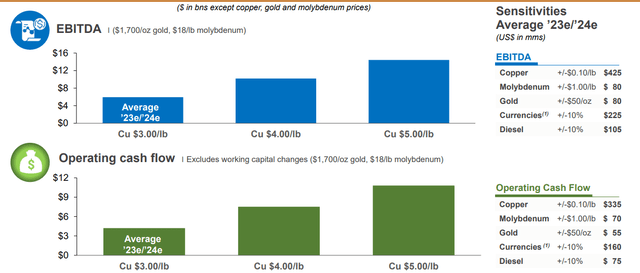

Current copper prices are roughly $3.9/pound. For simplicity, we’d expect it’d be more like $4/pound. The company’s 2023/2024 operating cash flow is expected to be roughly $7-8 billion at that level. Given forecasts for capital spending, the company’s FCF can be expected to be roughly $4 billion, implying an 8% FCF yield for the company.

The company has a mere $2.1 billion in net debt, but it does have $10.7 billion in total debt costing it roughly $500 million/year in interest. That’s all interest that could go straight to the company’s FCF should it choose to pay down its debt, which we expect to happen slowly. However, regardless of how the company spends cash, we expect it to generate substantial FCF.

Those are incredibly strong 2023/2024 averages, while also showing the company’s potential to increase cash flow should markets improve. $5 per pound for copper could add an additional $3 billion in FCF to the bottom line moving the FCF yield from 8% to 14% for the company. That improvement is worth paying close attention to.

Freeport-McMoRan Thesis Risk

The largest risk to our thesis is intermediate term commodity prices. The company is profitable and has a substantial amount of exciting growth ahead of it; however, there’s no guarantee that that growth pans out. Commodity prices could drop and remain lower in a recession, hurting the company’s ability to drive returns. That risk is worth paying close attention to.

Conclusion

Freeport-McMoRan has a unique and impressive portfolio of assets. The company has the ability to continue expanding that portfolio of assets, looking for increased efficiency and ramping up capital projects. The company’s annual capital spending of just over $3 billion is roughly $1 billion discretionary, and will support this growth for the company.

At the same time, the company’s assets remain incredibly profitable. The company is currently at a roughly 8% FCF yield, strong for a growing industry where commodity prices have been pushed down. The company remains incredibly susceptible to commodity prices and their performance. However, overall, with its asset strength, we expect the company to continue performing well for the long run.

Be the first to comment