LdF/E+ via Getty Images

Recently, the watch manufacturer Fossil Group, Inc. (NASDAQ:FOSL) launched its new Harry Potter collection of watches and jewelry. Clearly, the magic of the globally beloved series has rubbed off on the stock, which is up by 12% in less than three weeks. I say magic because coincidentally the day news came in of its new collection, I published an article with a Sell rating on it. My analysis showed little upside at the time. But then again, it has published results since, so perhaps there’s something there? Here, I take a closer look at its numbers to ascertain if there’s indeed a reason for a rally in the FOSL stock or if it’s just benefiting from the improved market mood.

Revenue contraction continues

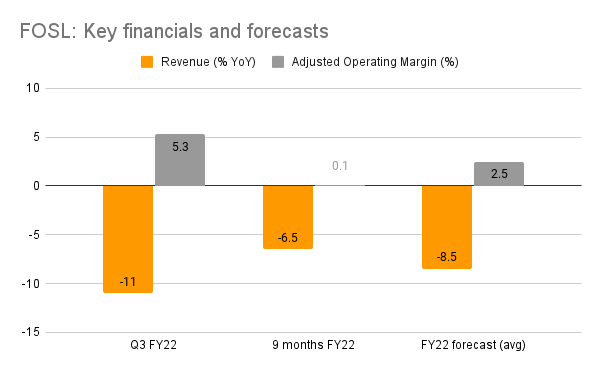

Its latest sales numbers certainly don’t do the company any favors. Continuing the trend from the previous quarter, in the third quarter of the current financial year (ending October 1, 2022, Q3 FY 22) FOSL reported an 11% year-on-year (YoY) decline in revenue at market exchange rates, a bigger decline from the 9.7% fall seen in Q2 FY22. With two straight quarters of falling revenues, for the nine months of FY22, its sales have shrunk by 6.5%. Part of this has to do with weak international sales as the U.S. dollar has been exceptionally strong recently, estimated to wipe out $10 billion from U.S. companies’ earnings in the third quarter of 2022. However, the Fossil Group’s numbers at constant exchange rates are weak too, with a 5% revenue decline in Q3 FY22, consistent with the decline in the quarter before as well.

Worryingly, its Asia sales have declined by 17% for the quarter, after already showing a fall of 11.2% for the first half of the year (H1 FY22). The company says it’s due to ongoing COVID-19 restrictions in China. However, not all consumer discretionary companies are still seeing the drag from these restrictions. Last week, the Swiss luxury group Compagnie Financière Richemont SA (OTCPK:CFRUY) released its half-year results (April-September 2022) that showed an improvement in Asia-Pacific numbers in Q2 after having been impacted in the first quarter. Of course, it’s possible that the Asia market break-up for the two companies is vastly different, allowing Richemont to benefit from growth in other Asian markets in a way that’s not possible for Fossil. At the same time, it is indicative of a potentially improved situation in the geography, which Fossil hasn’t been able to benefit from so far, which is something to be kept in mind.

Reduced guidance

Further, the company has downgraded its revenue expectations for the second time this year. It now expects sales to decline by 7-10% compared to the earlier estimate of 4-8%. Considering that revenue for the year so far has fallen by 6.5% at actual exchange rates implies that the fall is expected to be bigger in the final quarter of the year.

It has also reduced guidance for its adjusted operating margin to 2-3% from 2-4% earlier. Even though this is disappointing on the face of it, going by Fossil’s performance so far in the year, it’s not that bad even with reduced guidance. It has an almost nil operating margin for the nine months of FY22, which indicates, that it actually expects better performance on this metric in the next quarter if it has to meet its guidance.

Sources: Fossil Group, Author’s Estimates

Positive operating margin expected

Improvement in its adjusted operating margin is already visible, coming in at 5.3% in Q3 FY 22 compared to losses during both Q1 and Q2. For it to average at 2.5% for FY22, it will have to come in even higher at 10% for Q4. It isn’t clear how it intends to achieve this, but at the macroeconomic level, there are some positive indications that could bump up margins further.

Inflation has finally started cooling off in the U.S., which accounted for 44% of its revenues in the first half of the year. This could be good news as far as its operating expenses are concerned, which have been relatively elevated as a proportion of revenues so far this year. Some improvements are already visible from Q3 FY22 numbers, where it’s at 45% compared to 50%+ levels for the first two quarters of the current financial year. A slower price rise might also help improve consumer sentiment, which as the company points out in its latest release, has been impacted by elevated inflation. Further, a cooling off in inflation means that the pace of interest rate hikes can slow down.

In fact, these and other recent macroeconomic developments could also impact its demand numbers positively, besides improving margins. Recent weakness in the U.S. dollar versus the euro, which has brought it back below parity, could reduce the negative impact of a strong dollar. Europe is Fossil’s second-largest market, with a 31% share in sales in H1 FY22. At market exchange rates, there has been almost no change in sales to the geography so far this year. It also helps that the GDP in the U.S. is growing again, with a 2.6% increase in Q3 2022 on an annualized basis. This is a relief considering the probability of an extended recession until recently since it had reported two-quarters of economic contraction. While these are positive signs for now, and indeed, could show up in some improvement in Q4 figures, the fact remains that 2023 is expected to be a bad year for both the U.S. and Europe. Cyclical segments like consumer discretionary, of which Fossil is a part, could continue to be impacted as a result.

What next?

With a twelve-month trailing [TTM] net loss, the company’s price-to-earnings (P/E) ratio isn’t applicable when considering market multiples anymore. In any case, at 19.4x it looked far higher after its results for H1 compared to the consumer discretionary sector. Its TTM price-to-sales (P/S) at 0.1x is significantly more attractive than the 0.9x for the sector, but it’s also likely that the stock’s valued less because its revenues are declining and expected to decline even further. In sum, I wouldn’t put too much weight on its multiples when considering the stock right now.

Overall, the picture for Fossil has some positives, with an improvement in its operating margin for the year. Macroeconomic conditions during the quarter in terms of falling inflation in the U.S., weakening in the U.S. dollar against the Euro, and the easing of COVID-19 restrictions in China could work in its favor. However, its revenues are expected to continue shrinking, and with next year expected to be a difficult one for its big markets, how much growth is possible remains to be seen. In the near term, its share price could rise as the overall market mood is better and undervalued stocks look more attractive.

But the fundamental case for buying Fossil Group remains weak. I reiterate a Sell on Fossil. Now is a good time to take your money, while it’s still at a relative high and leave it alone for now. There are much better stocks to buy right now than Fossil Group, Inc.

Be the first to comment