sykono

Copper giant Freeport-McMoRan (NYSE:FCX) reported third quarter earnings yesterday, and results were decent, but not great. The company has seen its share price crushed from 2022 highs as its principal commodity – copper – has had a rough go of it. The last time I covered Freeport, I said copper looked weak and that meant that Freeport would be weak as well. I slapped a sell rating on Freeport as a result, and after Q3 earnings, I still don’t see anything to like here. I’m sticking with my sell rating, because I think there are numerous places where your capital will be better utilized.

A weak chart, and a failed bounce

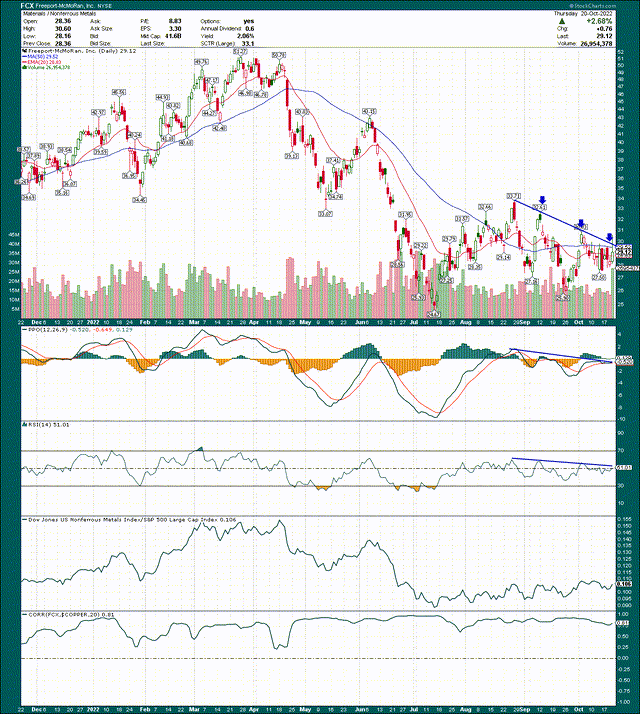

Let’s start our charting journey with a daily chart of Freeport itself. Copper perma-bulls continue to point to how Freeport fell by half earlier this year and that this makes it cheap. However, a lower price on its own its not enough for something to be cheap, and I certainly don’t think Freeport is cheap right now. We’ll come on to that but for now, the chart says we’re more likely to get additional downside than a sustainable rally.

I’ve drawn in a trendline that started at the end of August, and was continued yesterday. The candle we saw yesterday off the earnings report was ugly: a huge bounce that almost entirely faded away throughout the day. If you need evidence that Wall Street is not interested in owning this stock, that’s about as clear as it gets.

There was a higher low put in place earlier this month, but I now think that is in jeopardy in the coming weeks.

If we look at the PPO and 14-day RSI, both have been putting in lower highs, signaling waning bullish momentum. Both are below their centerlines, meaning they are far from bull market behavior. The only real positive here is that the peer group of nonferrous metals producers have outperformed what has been an awful S&P 500 since the summer months. That’s fine, but I have no reason to believe this will continue.

The final panel is the stock’s 20-day rolling correlation to copper itself, and we can see it is extremely high. That makes logical sense given Freeport is essentially a copper producer that happens to produce a couple of other things, but I wanted to show just how high the correlation is given what we’re going to look at next.

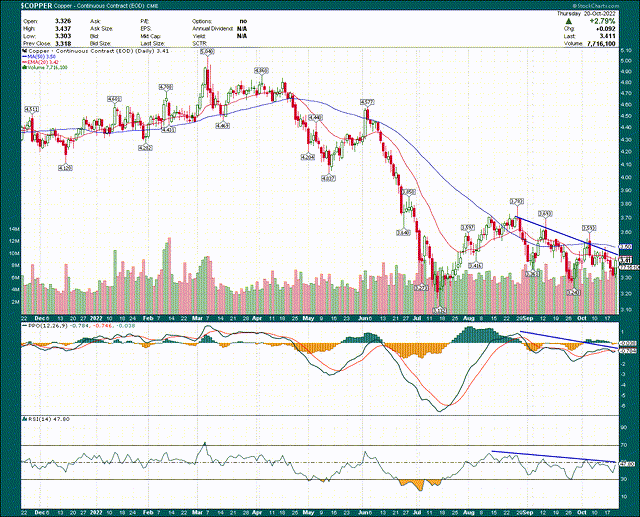

This is a daily chart of copper, and we can see the chart is very similar to FCX.

We have all the same primary points so I won’t repeat them, but again, I wanted to show just how correlated they are.

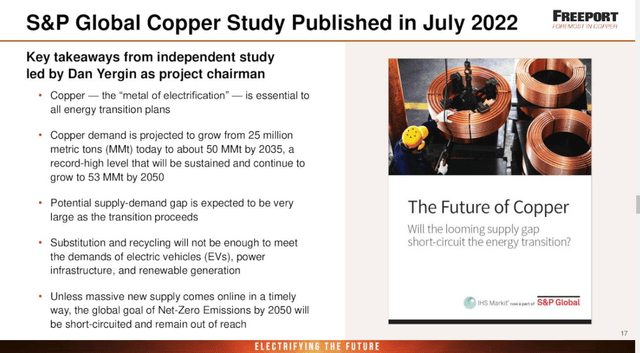

Now, Freeport perma-bulls have said in the comments section of my articles that copper is the metal of the future, that it is needed in vast quantities for electric vehicle production, carbon reduction targets that have been set globally, and so forth. That’s all true, but I do not personally think you should invest based on some idea that may or may not come to fruition 10 or 15 years from now. My preference is to use price action to determine where money is rotating, and right now, I don’t see money rotating into copper or Freeport.

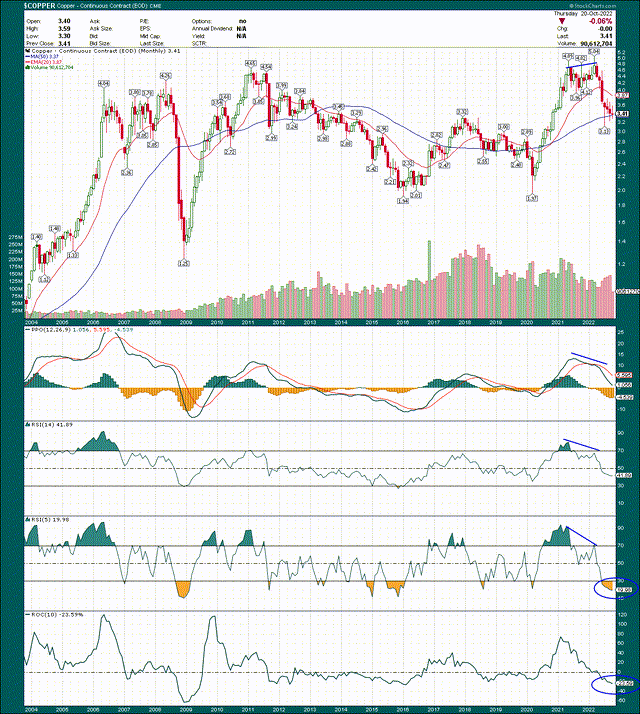

Below is a monthly chart of copper to get a very long-term sense of where the commodity has been, and may go.

We can see the tops put in during 2021 and 2022 produced a series of negative divergences on the momentum indicators. In other words, price put in new highs, while momentum put in lower highs. That means bullish momentum was waning, and if you saw this, it was a tremendous short opportunity. This action reeks of an intermediate-term top to me, so I do not see a raging bull market for copper coming anytime soon. Obviously there are those that disagree with this sentiment, but I simply do not see it on this chart.

The only saving grace is that on the monthly chart, copper is very oversold. It is possible we get a sizable bounce into next year, particularly if the outlook for economic growth clears up a bit, and/or the dollar ends its relentless move up. However, this chart suggests to me that bounces should be sold, not bought. Also remember that just because something is oversold, it can become more oversold, and can work off that oversold condition simply by going sideways. There is absolutely no guarantee of a rally just because something is oversold.

A decent quarter by Freeport-McMoRan, but murky outlook

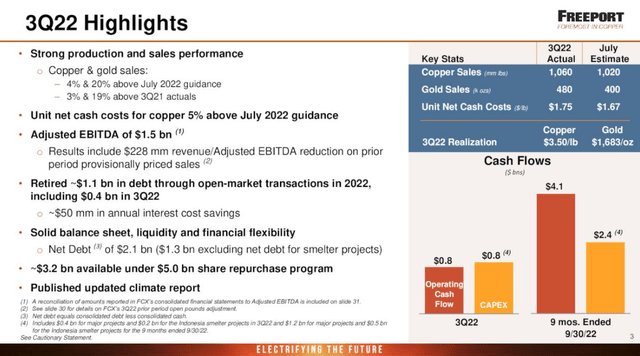

Freeport’s third quarter beat estimates on the top and bottom lines by modest amounts. That was good enough to push the stock to a sharp gain in the morning, only to see that gain fade throughout the day. As we can see below, the boom cycle the company went through in the past couple of years is dead and gone, and it is entirely possible we get an intermediate-term top in revenue this year. For me, that’s good enough to warrant a sell rating on this stock.

I won’t read this slide to you but I do want to point out that while copper and gold volumes were ahead of schedule, so were costs. Commodities producers need volume to drive unit costs down and push margins higher. Since they have essentially no control over the price at which their product is sold, volume is really the only lever they can pull to boost profitability. However, Freeport’s volume simply wasn’t enough, and as we’ll see in a bit, it hasn’t been for some time. This should worry Freeport bulls because if there’s no revenue growth, and no margin growth, there isn’t much left.

Realized copper pricing fell from $4.20 per pound to $3.50 year-over-year, which was much worse than a 2% gain in production. Management said that current prices for copper were insufficient for new mine development, and that this would eventually add to what it perceives as supply deficits. That sounds reasonable enough, but if that were any sort of near-term catalyst, Wall Street would have bid up assets like copper and Freeport. As we saw above, literally the opposite is happening. Again, while some want to invest based upon some idea that may or may not come to fruition years from now, I’m following the money, and the money is elsewhere.

This slide from the company’s earnings presentation outlines the long-term bull case for copper.

These are very long-term demand goals for the industry, and there will be a time when copper is an asset investors will want exposure to. What I’m saying is that time is not now, given it’s mired in a nasty bull market that to my eye, is nowhere near completion.

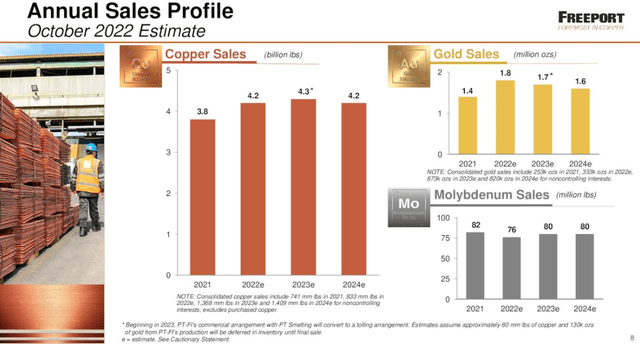

Back to Freeport, the company provided us an updated outlook for sales, and I’m really struggling to be bullish with this information in hand.

The company is expecting 4.2 billion pounds of copper sales this year, 4.3 next year, and 4.2 again in 2024. Where I come from that just means there’s no growth coming on the top line, unless the price of copper itself flies higher. We have covered how I feel about that, so my outlook for Freeport’s revenue is flat at best for the foreseeable future.

Gold and molybdenum are showing the same thing, although I’d argue they’re small enough they really don’t matter; we’ll stick to copper.

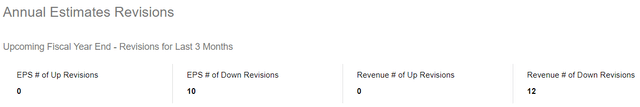

I’m apparently not the only one that feels this way, so let’s turn our attention now to analyst estimates. First up, revenue revisions for revenue and earnings-per-share.

This is literally as bad as it could be as there have been zero upward revisions, and collectively, 22 downward revisions. If you look at the price chart of copper, this makes perfect sense. If you’re focused on global copper demand in 2035, maybe it doesn’t.

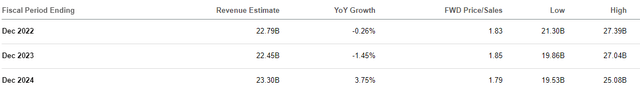

Revenue is expected to be flat this year, slightly lower next year, and a potential low-single digit bounce in 2024. Again, this is all dependent upon copper pricing because we know from company guidance that volumes will be essentially flat during this period. This is actually pricing in higher copper prices than today, so I’m skeptical of even these lower estimates.

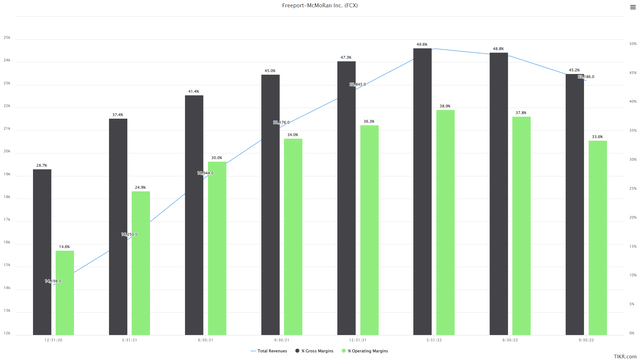

I mentioned margins briefly above, and here’s what I’m on about. Below we have revenue for the past several quarters, as well as gross margins and operating margins. All values are trailing-twelve-months to smooth out quarterly oscillations, and this shows just how beholden Freeport is to volumes and copper pricing.

Revenue peaked on a TTM basis back in the January quarter, and both gross and operating margins dutifully followed suit. I’m showing you this because if volumes are going to be flat, and the outlook for copper pricing isn’t exactly bullish in the near-term, these are likely to get worse.

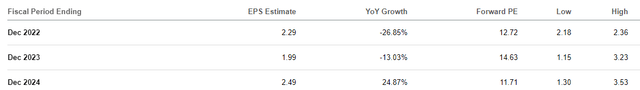

In fact, that’s exactly what we see here. Analysts have EPS falling 27% this year and another 13% next year. There’s currently a nice rebound set for 2024, but keep in mind the trajectory of these estimates, and it’s clear we may not actually see anything close to $2.49 in 2024.

Final thoughts

It’s clear to me that copper has been left out in the proverbial cold by Wall Street. If there were some massive boom in copper demand coming, copper would be priced accordingly. It isn’t, and so while that boom may come, it certainly doesn’t appear to me that it’s coming anytime soon.

Freeport’s estimates have been revised downward repeatedly this year, and to my eye, there’s more room to fall before it gets better. However, even if you believe current estimates are correct, this stock is a long way from being cheap.

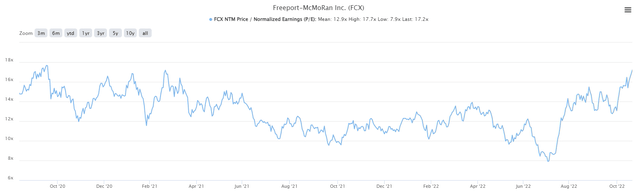

Here’s a look at two years’ worth of forward P/E multiples, and you’ll have an impossible time convincing me this stock is cheap.

Shares go for ~17X forward earnings, which is very near the peak of the past two years. The stock has been pummeled this year, and is more expensive than when the year started. That’s why it’s important to understand the trajectory of EPS estimates, and anyone that bought Freeport earlier this year hoping for 2035 copper demand to come to fruition in the form of a higher share price has been sorely disappointed.

The bottom line for me is this: we have a commodity that is in a very clear bear market with no end in sight, as far as I can tell. We have a stock that is almost 100% beholden to how that commodity behaves, and estimates that continue to decline as a result. Finally, this stock is in a downtrend itself, but has also become very expensive. I simply don’t see any reason to own this stock today given the weight of the evidence. There will be a time to own Freeport, but that time is not now. In short, winter is coming.

Be the first to comment