BrianAJackson/iStock via Getty Images

Well, Federal Reserve officials, including Fed Chair Jerome Powell, are saying that the Fed’s policy rate of interest needs to only increase by 50 basis points in December, down from the 75 basis point movements in the previous four policy decisions.

OK, let’s move the target by only 50 basis points.

But, what is the Fed going to do about the speed at which it is reducing the reserve balances within the commercial banking system?

A decline in reserve balances with Federal Reserve banks represents a “tightening up” of the reserve position in the commercial banking system. A decline in liquidity, if you will.

In the latest banking week, the Fed oversaw a reduction in the reserve balances in the commercial banking system of $116.6 billion.

This movement increased the reduction in reserve balances since March 16, 2022, to $841.2 billion.

Thus, in eight and one-half months, the Fed reduced reserve balances by almost $850.0 billion.

Let’s see how that worked out.

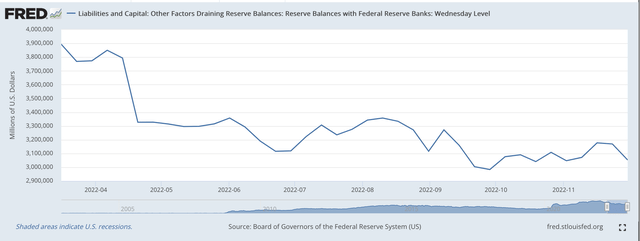

Reserve Balances with Federal Reserve Banks (Federal Reserve)

Although the decline has not been seamless, the downward trend is obvious.

The question now is, what is the Fed going to do now with respect to reducing the amount of reserve balances in the commercial banking system?

Right now, the Fed has taken out, on average, about $100.0 billion of reserve balances, every month.

The total amount of reserve balances in the commercial banking system now totals $3.05 trillion.

This is still a vast amount of money in the commercial banking system, particularly since reserve balances are somewhat comparable to what we would call “excess reserves” in the commercial banking system.

So, although the Fed has overseen the removal of almost $850.0 billion in reserve balances since March 16, 2022, it still appears as if the commercial banking system still has a massive amount of liquidity on its balance sheets.

So, what is the Federal Reserve going to do about the remaining “excess reserves”?

Federal Reserve “Bubble”

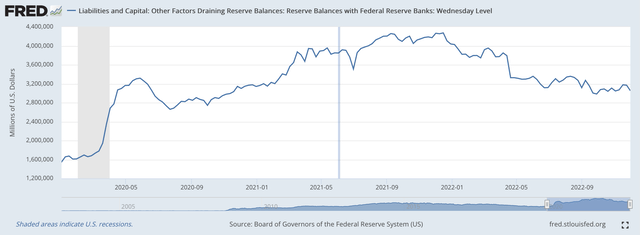

One doesn’t need to go far to discover that a big rise in the amount of reserve balances commercial banks are keeping on their balance sheets began as the Federal Reserve began to “protect” the banking system and the economy against the effects of the spread of the Covid-19 pandemic and the following recession.

Reserve Balances with Federal Reserve Banks (Federal Reserve)

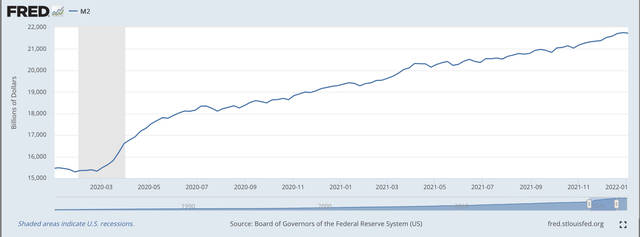

This rise in reserve balances resulted in a massive increase in the M2 money stock in the years 2020 and 2021, a massive increase I have labeled to be “The Federal Reserve Bubble“.

M2 Money Stock (Federal Reserve)

The M2 money stock grew by over 25 percent from December 2019 to December 2020, and it grew by more than 12 percent from December 2020 to December 2021. These rank very high on the historical lists of the most rapid periods of monetary expansion.

During this time, “bubbles” occurred in many asset markets.

Stock prices rose, housing prices rose, the price of bitcoin rose, and TFX, the cryptocurrency market, grew to a value of $32 billion. Note, TFX was started in 2019.

Other financial institutions grew at incredible rates, one of the more prominent was in the area of “blank check companies.” These blank check companies have the more official name of “Special Purpose Acquisition Companies,” or SPACs.

The big question for the leaders of the Federal Reserve concerns just how far the item “Reserve Balances with Federal Reserve Banks” has to fall.

As can be seen in the charts above, reserve balances with Federal Reserve Banks were around $1.6 trillion at the beginning of 2020.

Reserve balances with Federal Reserve banks were up close to $4.4 trillion early at the beginning of 2022.

Right now, reserve balances with Federal Reserve Banks are around $3.1 trillion.

How far does the Fed need to reduce these reserve balances?

Money Stock Growth

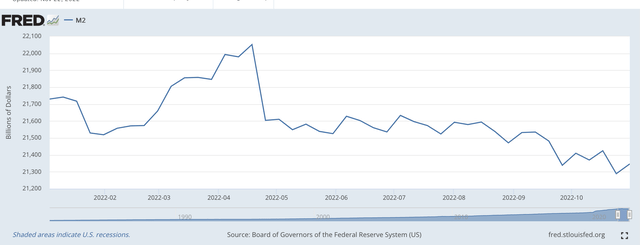

Well, as reported above, the M2 money stock grew by 12.5 percent from December 2020 to December 2021.

From October 2021 to October 2022 (the latest data available), the M2 money stock rose by just under 1.3 percent.

Given the latest Federal Reserve policy stance, Fed officials have obtained a significant reduction in the money supply statistics.

Looking further, one can also observe that the M2 money stock has peaked this year at $22,052.1 billion for the banking week ending April 18, 2022 and has declined since then.

M2 Money Stock (Federal Reserve)

It seems as if the growth rate of the M2 money stock is going to turn negative and could remain negative for some time.

Here is the inflation fighter.

Money stock growth is everywhere and at every time a monetary phenomenon. So says the monetary economist Milton Friedman.

The Fed now has created a situation that may take the M2 money stock variable into negative territory.

How long does monetary growth have to remain at these low levels?

After all, monetary policy works with a relatively long lag.

Will this be enough for Federal Reserve officials?

When might this result in a pivot for Federal Reserve officials?

This seems to be the future that is currently evolving.

The Future

Pay attention to what Federal Reserve officials have to say about what they are going to do with their policy rate of interest.

But, also pay attention to what is happening “behind the curtain.”

A lot is going on behind the Fed’s balance sheet. A lot is going on in the banking system as far as monetary growth is concerned.

This, to me, is where the real story is taking place.

And, it looks as if we are on the other side of the “bubble.”

Stock prices are going down. FTX and BlockFi have failed. There is lots of trouble brewing for “blank check companies.” And, more.

Keep your eyes open.

Be the first to comment