Falcor/iStock via Getty Images

The Q2 Earnings Season for the Gold Miners Index (GDX) is quickly approaching, and one name set to report solid results is Franco-Nevada Corporation (NYSE:FNV). This is because while several other precious metals companies will be lapping much higher silver prices in Q2, Franco-Nevada’s energy exposure will easily offset this, given the near-parabolic run we’ve seen in oil (USO) and natural gas prices (UNG). Given Franco-Nevada’s diversification by asset, diversification by commodity, and enviable project pipeline, the company continues to be the premier pick for low-risk precious metals exposure and is a Buy below $130.00.

Condestable Mine – Peru (Company Website)

Just over three months ago, I wrote on Franco-Nevada, noting that while the stock was putting up phenomenal results, it was hard to justify chasing the stock above $156.00 per share. This is because it was trading at more than 2.5x P/NAV and over 40x earnings, which is a steep valuation even if it has a near unparalleled business model from a risk standpoint. Since then, the stock has held up much better than its peers but is still down 11% despite a near-parabolic rally in energy prices. Let’s take a closer look at the recent results below and its setup heading into Q2.

Q1 Results

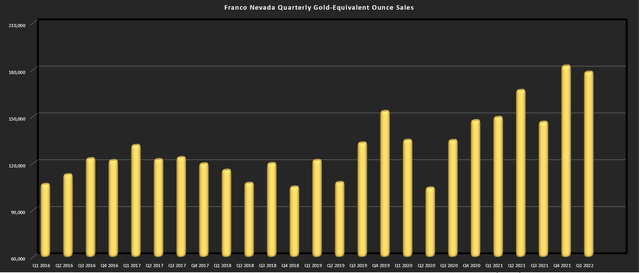

Franco-Nevada released its Q1 results last month, reporting quarterly sales of ~178,600 gold-equivalent ounces [GEOs], a 2% increase from the year-ago period. This performance was helped by significantly higher attributable GEOs from iron ore (Vale Royalty), as well as its energy assets, as well as higher production from Candelaria (improved grades), Guadalupe-Palmarejo (higher throughput), Detour Lake, and Harmony’s (HMY) Mine Waste Solutions. Unfortunately, this was offset by lower production at several assets, including Hemlo, Gold Quarry, Antamina, and Antapaccay.

Franco-Nevada – Quarterly GEO Volume (Company Filings, Author’s Chart)

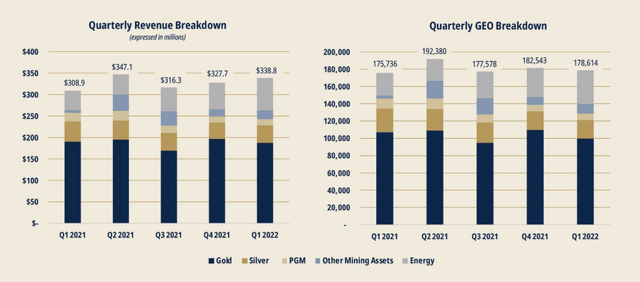

Given the lower attributable precious metals sales and the sharp increase in energy prices, Franco-Nevada saw just ~72% of its revenue from precious metals, down from ~83% in the year-ago period. The dip in precious metals revenue was exacerbated by the lower silver and platinum prices in the period, with silver and platinum down 8.6% and 10.3%, respectively on a year-over-year basis. However, as we can see below, Franco’s energy portfolio picked up all of the slack and then some, with Franco-Nevada benefiting from a ~$94.00/barrel WTI price in Q1, and a Henry Hub price of $4.57/mcf.

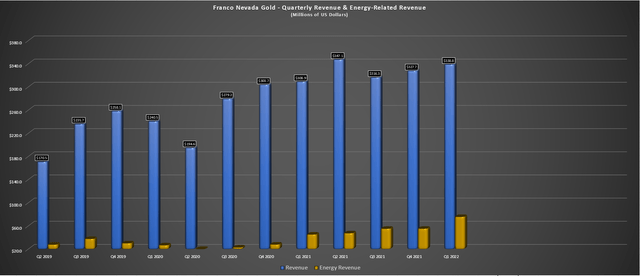

Franco-Nevada – Quarterly Revenue & GEO Breakdown (Company Filings) Franco-Nevada – Quarterly Revenue & Energy Related Revenue (Company Filings, Author’s Chart)

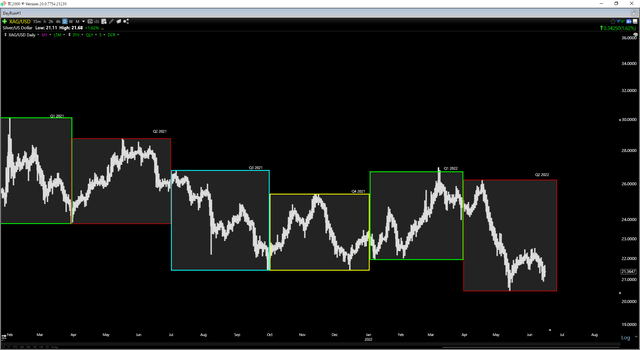

Looking ahead to the Q2 results, the company won’t get much help from the gold price, given that it’s tracking only slightly above Q2 2021 levels ($1,870/oz vs. $1,816/oz). Meanwhile, the silver price has plunged year-over-year, with the silver price coming off the attempted “silver squeeze” in Q2 2021 and averaging $26.69/oz. However, while this will make it difficult for many precious metals names to post positive revenue year-over-year, the higher prices in Franco-Nevada’s energy business will once again pick up the slack in Q2 2022.

Silver Futures Price (TC2000.com) WTI Futures Price (StockCharts.com)

Looking at the chart above, we can see that WTI has averaged $107.00/barrel thus far this quarter and is likely to average at least $110.00/barrel in Q2. This would represent a more than 65% increase from Q2 2021 levels ($66.09/barrel), easily offsetting what should be a ~15% decline in the price of silver year-over-year ($22.70/oz vs. $26.69/oz). Meanwhile, the Henry Hub price is up more than 100% vs. Q2 2021 ($2.97/mcf) and is still rising. Therefore, Franco-Nevada should have no issue lapping the tough comps from last year, with revenue likely to come in at similar levels to Q2 2021 despite the softer silver and PGM prices.

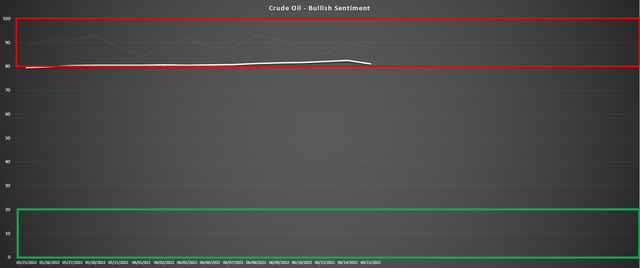

While this is good news and the increase in energy prices will provide a meaningful benefit this year, this could create difficult comps for Franco-Nevada going forward. In fact, we’re currently seeing the highest levels of bullish sentiment for oil in years, with more than four out of five market participants bullish on a rolling 3-month basis, evidenced by the below chart. While this time could be different, assets have typically run into strong selling pressure when we see these levels of exuberance, with gold having the same issue in Q3 2020 when the consensus that we were headed to $2,500/oz.

This isn’t a huge deal, and we could see precious metals take the baton and pick up the slack after taking the year off thus far. However, if we don’t see higher precious metals prices and they continue to tread water near current levels, Franco-Nevada will be up against very difficult comps in 2023.

Oil Futures – Bullish Sentiment (Daily Sentiment Index Data, Author’s Chart)

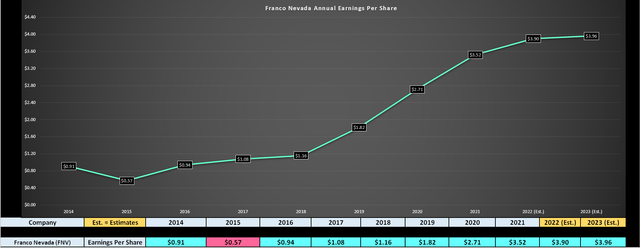

Earnings Trend

Looking at the chart above, Franco-Nevada is set to report another solid year for earnings growth, with annual EPS forecasted to increase 12% year-over-year to $3.90. This is even more impressive given that the company is lapping 30% growth last year, translating to a two-year average annual EPS growth rate of 21% and a compound annual EPS growth rate of ~26.7% since FY2016 ($3.90 vs. $0.94). However, if we look at current FY2023 estimates, the forecast is for a meaningful deceleration in earnings growth next year.

Franco-Nevada Gold – Annual Earnings Trend (YCharts.com, FactSet, Author’s Chart)

Obviously, a pause is to be expected after the company has managed to double annual EPS in three years ($3.90 estimates vs. $1.82). Still, with the market being forward-looking and energy prices looking vulnerable after a parabolic run, I believe the best course of action is waiting for a deeper pullback to start a position in the stock. Of course, I could be wrong, and energy prices could continue higher, and precious metals prices could also recover. Still, with the commodities related to a chunk of Franco-Nevada’s revenue contribution (oil/gas) being very extended on a short-term and medium-term basis technically, it’s hard to rely on this business to perform similarly over the next year, and I would argue that the risk is to the downside in oil/gas prices.

The good news is that Franco-Nevada will see new royalties come online next year, providing a slight boost from a GEO standpoint. This includes copper exposure from its recent Caserones royalty acquisition (~0.45% NSR), some contribution, and the under-construction Seguela Mine in Cote d’Ivoire (1.2% NSR), as well as the Tasiast Expansion. Meanwhile, post-2023, the company has multiple projects in its pipeline to drive growth, including Mara Rosa, Salares Norte, Castle Mountain, Eskay Creek, Valentine Lake, and Greenstone, to name a few. So, while 2022 could be a tough year to lap if energy prices do soften, which would lead to much lower earnings growth, the long-term outlook for the company remains solid as ever.

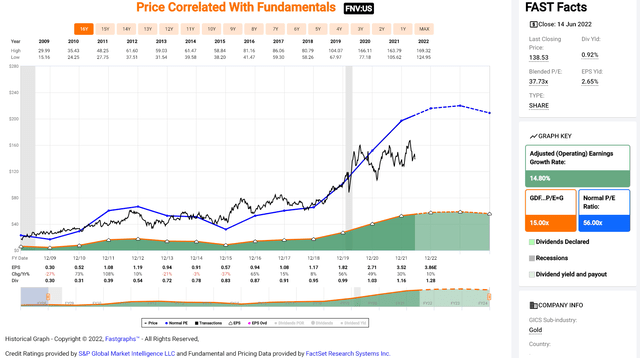

Valuation

Based on ~192 million shares and a share price of $140.00, Franco-Nevada trades at a market cap of ~$26.9 billion, making it the highest market cap precious metals royalty company by a wide margin. As the chart below shows, the stock has historically traded at 56x earnings due to its solid execution and low-risk business model, and in a time of rising costs, it’s no surprise that it continues to trade at a premium multiple to its peer group. However, I believe a more conservative earnings multiple for the stock is 44, given that it’s harder for FNV to grow relative to other royalty/streaming peers due to its size. Based on FY2023 earnings estimates of $3.96, this translates to a fair $174.20.

Franco-Nevada – Historical Earnings Multiple (FAST Graphs)

While this price target points to a 23% upside from current levels, I prefer to bake in a meaningful margin of safety, even if buying large-cap, low-risk businesses. For large-cap stocks, I require a minimum 25% discount to fair value to justify starting new positions, which translates to a low-risk buy zone on Franco-Nevada of $130.65 or lower. Obviously, there is no guarantee that the stock will pull back to this level. However, I would consider this a lower-risk buy point, with a low probability of a double-digit drawdown from this area and the potential for double-digit annualized returns. Hence, if I were anxious to add the stock to my portfolio, this is the area I would be watching if we see further weakness.

Summary

Franco-Nevada is the gold standard for low-risk exposure to precious metals, and with the recent rise in energy prices, the stock is seeing an acceleration in its earnings growth above that of its peers. However, Franco-Nevada lacks meaningful growth like other royalty/streaming names, and while its diversification across assets and commodities commands a premium, I still don’t see enough margin of safety to justify paying up for the stock at $140.00. So, while I think Franco-Nevada is a long-term hold and a staple for a precious metals portfolio, I continue to see better value elsewhere in the sector. Having said that, any dip below $130.00 should present a buying opportunity.

Be the first to comment