ablokhin/iStock Editorial via Getty Images

Franchise Group (NASDAQ:FRG) is an owner and operator of branded retail businesses that are ideal for franchising. The company uses the company-owned stores to refine business processes. It licenses its concepts to franchisees who either start new stores or buy stores the company has already established. In addition, the company looks for retail brands that could be franchised and could benefit from FRG’s operating capabilities.

We believe that FRG is an excellent choice for dividends and capital appreciation because of its compelling valuation, 6.4% dividend yield, and free cash flow. We believe that the series of acquisitions through FY2021 raised their cash-generating potential significantly, and thus we give it an estimated fair value of $78.

|

Franchise Group |

E2022 |

E2023 |

E2024 |

|

Price-to-Sales |

0.4 |

0.4 |

0.3 |

|

Price-to-Earnings |

8.5 |

7.4 |

6.4 |

|

EV/EBITDA |

8.8 |

8.2 |

7.8 |

Existing Business

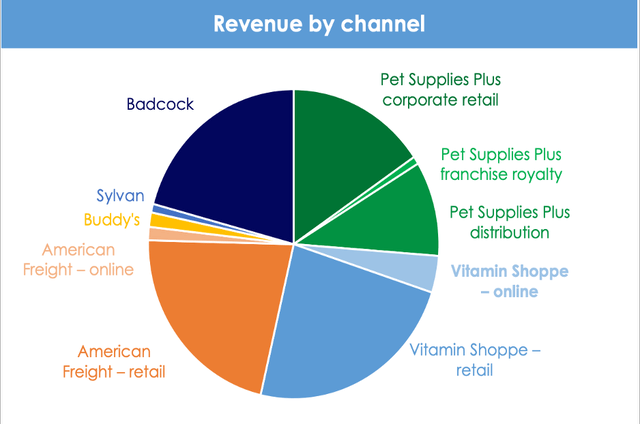

FRG currently owns the following branded businesses: The Vitamin Shoppe, Pet Supplies Plus, Buddy’s Home Furnishings, Badcock & More, Sylvan Learning, and American freight.

|

Subsidiary |

Revenue ($ millions) |

Franchised / Corporate owned |

|

Vitamin Shoppe |

1,172.7 |

1 / 711 |

|

American Freight |

988.9 |

5 / 367 |

|

Pet Supplies Plus |

1,120.5 |

374 / 602 |

|

Buddy’s Home Furnishings |

64.4 |

276 / 313 |

|

Sylvan Learning |

38.2 |

713 / 719 |

|

Badcock & More |

907.1 |

315 / 383 |

FRG Revenue by Business (FRG Investor Day 2022)

The Vitamin Shoppe is an omnichannel retailer specializing in wellness and lifestyle products. This brings in a little over $1 billion a year in sales, making it the #2 wellness retailer in the US. Wellness has an exceptionally large potential total addressable market (TAM) of $50 billion. During FY2021 the various private label brands grew to 26% of sales. As counterintuitive as it may feel, cosmetics and other beauty products see a boost during recessions, a phenomenon deemed the “lipstick effect.” This helps make this business economically resilient.

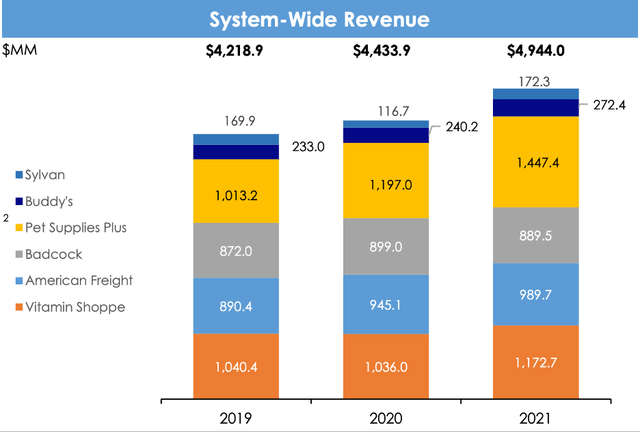

Pet Supplies Plus is a leading franchisor of and operator of pet stores offering grooming, toys, food, and other pet supplies. It is estimated that 62% of Pet Supplies Plus sales are from high-frequency replenishment sales of pet medication and pet food, making it a recession resilient business. The pet industry has an estimated TAM of $75 billion, and Pet Supplies Plus is the #3 largest pet care retailer in the US. The acquisition of Pet Supplies Plus in March 2021 was the biggest driver for increased revenues in 2021, increasing FRG’s revenue by $917 million.

American Freight is an “as-is” furniture, appliance, and mattress outlet, benefitting from a merger with Sears Outlet. The furniture industry has a TAM of nearly $500 billion which leaves much room for expansion. American Freight leads the discount appliance industry in the US with the #1 market share. For the highly value-conscious market segment, consumer durables are bought as necessitated (the need to be replaced), not as truly discretionary spending items; hence, American Freight is more recession-resistant than most consumer durables.

Buddy’s Home Furnishings is a rent-to-own furniture store, with operations similar to American Freight, being the #3 rent-to-own store in the US. The rent-to-own market targets what are called “subprime” buyers; these are consumers whose credit score may not meet the financing requirements of other furniture stores. While the total addressable market is not as large as the traditional furniture and retail markets, 34% of the US population has a credit score rating as “subprime,” meaning Buddy’s still has a large potential addressable market.

Badcock & more is a mid-price point home furnishings store, with all locations in 8 southeastern states, with most locations being in Florida. Being one of the most recent acquisitions, Badcock & more is likely to see expansion to the rest of the US now that it has the FRG instructional backing – though these plans have not been relayed to the investment community yet. The entire purchase price of Badcock & More will be covered by a sale-leaseback of retail real estate, amounting to a total of $175 million. In addition, the acquisition added $102 million in revenue to FRG.

Sylvan is a franchised tutoring service, providing a range of services for remedial students to advanced students. Sylvan is centered around in-center tutoring but does offer remote, in-home, and satellite location services for students. The total addressable market for education services is $20 billion and growing.

Strategy and Valuation

FRG’s new brand acquisition strategy focuses on the following investment profile: asset-light business, high product margin, large free cash generation, consumer facing, and difficult to replicate online. These new companies are acquired by the holding company and leverage common policies and scale to grow the franchise business. This strategy allows for the management of the franchise to focus exclusively on growing into the target market rather than having limitations on capacity. Home office costs are thus shared across multiple branded companies improving efficiency and lowering costs.

FRG System-Wide Revenue (FRG Investor Day 2021)

Brands that are fully franchised produce ample free cash and only spend 1.5-2.0% of cash flow on capital expenditures and attempt to remain conservatively leveraged at 2-3x (Net Debt/EBITDA). FRG will stretch to a 4x margin for an opportunistic acquisition that offers an ability to quickly generate profits and free cash.

This strategy allows FRG to trade cash on hand for incremental cash flow growth, allowing for them to quickly de-lever after a large acquisition. Through 2021 FRG opened 109 new locations, and increased its backlog to 360 planned locations, with 54% of all locations (planned and currently open) being owned by independent franchise owners.

FRG primarily funds acquisitions and sustaining operations through operating cash flow, though as previously stated they will stretch leverage if there is significant opportunity. The leverage ratio for FY2021 is 5.5x (total debt / EBITDA) primarily due to 3 significant acquisitions in 2021. However with increased cash flow associated with these businesses, we expect the leverage ratio will be paid down to approximately 4.1x by the end of FY2022.

The E2022 price-to-cash-flow ratio is 5.9.

|

E2022 |

E2023 |

E2024 |

|

|

Cash Flow ($ millions) |

$274.0 |

$314.8 |

$334.2 |

|

Cash Flow / Share |

$6.67 |

$7.66 |

$8.13 |

|

Price / Cash Flow |

5.86 |

5.11 |

4.81 |

Our estimated fair value for FRG is $78.

Estimated P/E: 13.0

Estimated 2024 EPS: $6.00

Normalized earnings power surges to $6.00 by FY2024 after the most recent acquisitions.

Therefore, 13 times $6.00 = $78.

Risk

While FRG’s acquisition strategy focuses on recession-resistant business models, consumer spending behavior is often volatile and preferences change. A severe recession will adversely affect operations at FRG.

Because FRG is mainly a franchisor, individual stores or groups expose FRG to brand-related risks such as poor customer experience and lack of franchisee execution talent. Retailing also has risks from competition from other brick and mortar retailers and online retailers.

Conclusion

We believe that FRG is an excellent choice for dividends and capital appreciation. The FY2021 acquisitions increased earnings potential significantly, and much of the acquired business is recession-resistant which may prove useful for continuing dividend yield should an economic downturn occur.

Management is strong, and we believe that the customer base and total addressable markets for the businesses are solid even if consumer expenditures should drop.

Be the first to comment