Khanchit Khirisutchalual

Investment Thesis

DMG Blockchain Solutions (OTCQB:DMGGF) is a full-service, vertically integrated blockchain Company focused on high growth opportunities in the blockchain and cryptocurrency mining sector. DMG’s core assets include a 27,000 square foot data center in British Columbia, Canada at which, it houses a 60 megawatt (MW) crypto mining operation. The data center operations focus on self-mining operations (most of its current operations) as well as hosted mining for third party clients.

We are encouraged by the impending deployment of its proprietary immersion cooling technology. This technology can enable DMG to use fewer miners (thus reduce capital spending) to reach its hashrate goals as well as extend their operating life compared to running fans that cool miners. DMG expects to deploy this technology by the end of FY:23.

DMG is investing significantly in new revenue generating products beyond pure crypto mining via its Blockseer platform which delivers multiple software and services solutions targeting the crypto industry. These new initiatives include a recently launched clean energy cryptocurrency mining pool, Terra Pool, which positions the Company to take advantage of the growing demand for ESG compliant cryptocurrencies.

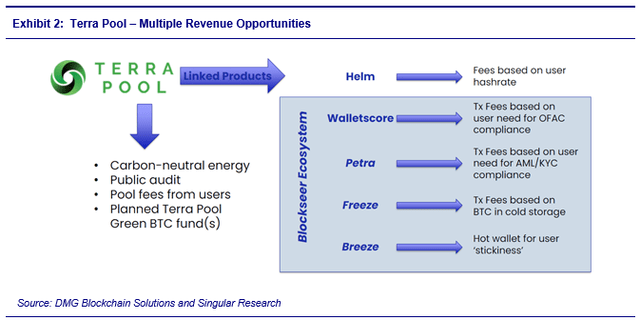

As Bitcoin mining comes into scrutiny for its growing energy use and emissions, sustainable solutions such as Terra Pool are likely to gain popularity. Terra Pool could open multiple revenue opportunities for DMG including pool fees from users as well as income from green Bitcoin funds. DMG expects to net more than a 1% fee on each Bitcoin created via Terra pool and a 20-basis point fee for moving Bitcoin through Terra Pool via Petra. Terra Pool provides DMG with additional selling opportunities for its Blockseer platform to the pool members such as the ability to exchange cryptocurrency to fiat currency via the Bosonic Network.

We are excited about the prospects of DMG, both as a mining company and as a software company, focusing on the rapidly growing cryptocurrency vertical market, including software and services.

DMG’s balance sheet is strong with no debt and 416 Bitcoin holdings (equates to C$10.6 million), and when combined with their cash of C$1.2 million, brings DMG’s total spendable balance to C$11.9 million which equates to more than 30% of the Company’s total market capitalization.

DMG trades at 0.95x forward sales, which is at a significant discount to the peer group average of 1.70x despite ongoing hashrate expansion and strong growth prospects. As a result, we believe the share price is undervalued.

We initiate coverage with a BUY rating and a U.S.$0.65 price target.

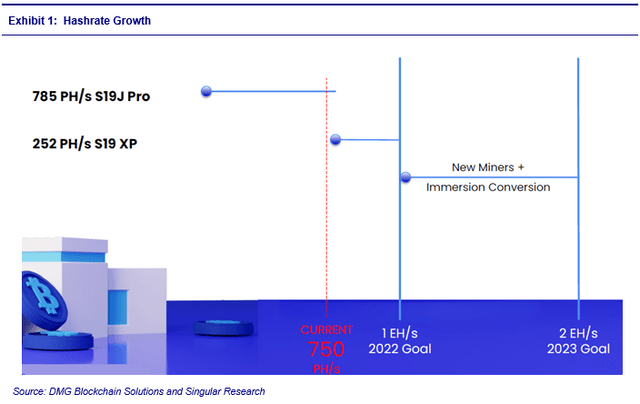

Positioned as one of the leading North American Bitcoin mining players

DMG owns a 27,000 square foot crypto mining operation at its Christina Lake Data Center facility which occupies an area of 33 acres and is one of the larger operations in North America. This facility includes a privately constructed 85-megawatt substation which will power the expansion of DMG’s cryptocurrency mining facility with green energy at favorable rates. With DMG’s current mining operation power capacity of 60 megawatts, the Company is targeting a hashrate of one EH/s by the end of calendar 2022 and two EH/s by the end of calendar 2023. DMG’s current hashrate stands at about 0.8 EH/s.

DMG expects to leverage existing assets to expand one EH/s hash rate by 40% with expected completion in calendar H1:23 of its immersion cooling technology deployment. The addition of next generation miners would further grow that capacity to two EH/s by the end of calendar 2023. (The Company’s ability to acquire new miners at that time will depend on market conditions.) Immersion cooling is more energy efficient compared to fan-based cooling, as it allows for hashrate computation with reduced electrical usage. This technology can enable DMG to use fewer miners (thus reduce the capital spending) to reach its hashrate goals as well as extend their miner operating life compared to running with fans that cool miners.

DMG intends to expand its self-mining efforts with a goal of growing its hashrate faster than the network growth. DMG will continue its strategy to blend self-mining with potential expansion of hosting capacity for third-party clients for the purpose of expanding Terra Pool. This model allows the Company to earn consistent revenues from expanding its pool and related ecosystem, and at the same time benefit from surges in Bitcoin value from self-mining.

DMG Blockchain Solutions and Singular Research

Significant potential in BTC transaction monetization

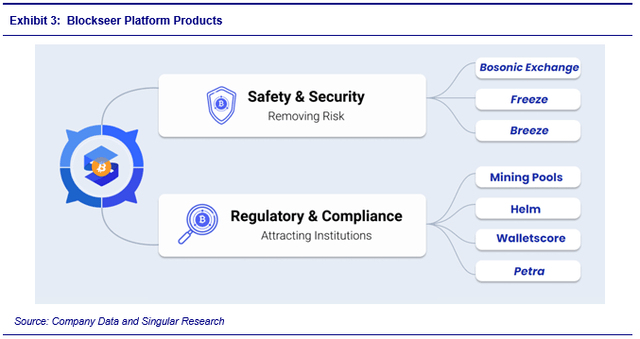

DMG is the only company that is both creating Bitcoin as a pure crypto miner (Core) and then monetizing it after creation through its Blockseer platform. Blockseer is primarily focused on two crypto areas – Safety & Security and Regulatory & Compliance.

With products such as the Bosonic Network exchange as well as its future Breeze and Freeze wallet products, DMG helps users to carry out Bitcoin transactions safely and securely. The Blockseer platform is focused on equipping anyone from individual crypto wallet users to financial institutions with an enterprise-grade custody solution to securely manage digital assets. These solutions provide the ability to monitor Bitcoin wallets, notifying the owner of any transaction and provides a mechanism to stop suspicious transactions from being executed.

With many governments signaling for both tighter regulations in cryptocurrencies and having greater acceptance of this technology entering the mainstream, Blockseer’s regulatory and compliance portfolio (Blockseer mining pools, Walletscore, Petra technology, and Helm mine manager) is well positioned to take advantage of these evolving market conditions.

Walletscore is a real-time anti-money laundering (AML) application which allows users to be properly informed, aware, and protected. As it is currently being used, Walletscore filters transactions that use U.S. Department of Treasury OFAC (Office of Foreign Asset Control) blacklisted wallets from being included with Terra Pool mined blocks. Complementing Walletscore is Petra, which enables financial institutions to ensure they can send transactions through a carbon-neutral pool, whose mined blocks are free of transactions using OFAC blacklisted wallets.

Other Bitcoin mining pools lack such standards and transparency, which makes them easy targets for nefarious criminal users. DMG’s proprietary AML technologies provide Bitcoin miners and the underlying users of Bitcoin with the best-in-class regulatory compliant solution.

Terra Pool – World’s first ‘green’ mining pool

DMG’s continued focus on eco-friendly Bitcoin mining positions the Company to take advantage of the growing demand for ESG compliant cryptocurrencies. Many financial institutions want to buy Bitcoin that can fulfill increasing demand for ESG compliance. DMG, via its green Bitcoin mining pool, Terra Pool, can tap into this growing opportunity.

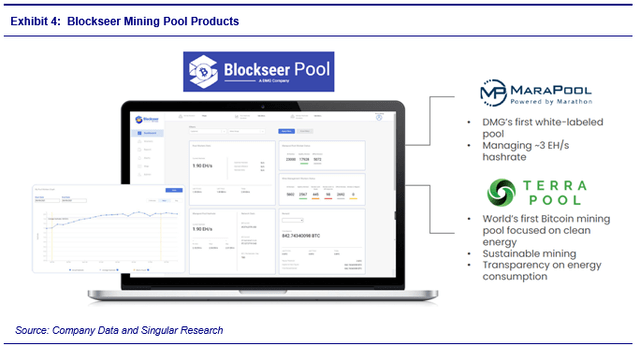

Terra Pool is the world’s first Bitcoin mining pool powered exclusively by carbon-neutral energy. The pool allows its members to showcase clean energy operations and creates new Bitcoin from renewable energy sources. It consisted initially of the hashrate of DMG and the Argo Blockchain, which is mostly generated by hydroelectric power. DMG aims for demand for Terra Pool-generated Bitcoin to serve as a strong incentive for cryptocurrency miners to produce Bitcoin in a climate-conscious manner.

According to the Cambridge’s Centre for Alternative Finance, Bitcoin’s annualized electricity consumption is estimated to be around 150 terawatt-hours, which is more than the entire electricity consumption of many countries. The Centre further notes that to produce that energy will lead to emissions of 65 megatons of carbon dioxide into the atmosphere annually (comparable to the emissions of Greece), making Bitcoin mining a significant contributor to global air pollution and climate change.

As Bitcoin mining comes into scrutiny for its growing energy use and emissions, sustainable solutions such as Terra Pool could gain popularity. We believe Terra Pool has many advantages over existing pools due to its goal of 100% clean renewable energy power sources from each miner. Furthermore, monetization of a Terra Pool-created ‘green’ Bitcoin may fetch a premium. It is estimated that 330,000 Bitcoins are mined annually, equating to a total value of $6.5 billion (based on a current Bitcoin price of $19,870). Terra pool is targeting to achieve a 10% network share of the Bitcoin mining market.

With less than two million of the 21 million total Bitcoin left to be mined, we believe Terra Pool-mined Bitcoin will be in high demand. Terra Pool also includes annual audits by an independent third-party to help provide greater transparency of pool operations.

Terra Pool could open multiple revenue opportunities for DMG including pool fees from users as well as income from a green Bitcoin marketplace. DMG expects to net more than a 1% fee on each Bitcoin created via Terra pool and a 20-basis point fee for moving Bitcoin through Terra Pool via Petra. Additionally, Terra Pool provides DMG with cross-selling opportunities for its Blockseer platform to the pool members.

DMG Blockchain Solutions and Singular Research

Business Overview

DMG focuses on both crypto infrastructure operations as well as blockchain software development. DMG Blockchain aims to provide end-to-end solutions for monetizing blockchain, including Bitcoin mining and its Blockseer software platform. DMG categorizes its solutions under two groups – Core, which focuses on crypto infrastructure, and Core plus, which focuses on software and services.

Company Data and Singular Research

Core is primarily comprised of the Christina Lake Data Center. The data center is home to a 60 MW mining facility on 33 acres. The site is powered by clean hydroelectric power, making it one of the leading eco-friendly Bitcoin mining facilities in North America. The data center operations focus is on self-mining operations with some limited hosted mining for third-party clients.

DMG plans to retrofit its existing air-cooling infrastructure to immersion cooling. Immersion cooling requires approximately 30% less Bitcoin miners than air-cooled for the same hashrate, leading to significant capital cost reductions over air-cooled systems. Upon completion of the retrofitting upgrades, DMG’s facility will then have a future capacity for 2.0 EH/s of immersion-cooled Bitcoin mining utilizing approximately 60 megawatts of power.

The full upgrade and expansion of the company’s Christina Lake facility for its purchased miners and the delivery of Bitcoin mining servers is expected to occur mainly over the course of calendar 2022 and to be completed by December 2022, with a target hash rate of just over one EH/s.

Core Plus is comprised of DMG’s Blockseer platform primarily focused on two crypto areas – Safety & Security and Regulatory & Compliance. The Safety & Security portfolio is composed of three key products – the Bosonic Exchange, Blockseer Breeze, and Blockseer Freeze, while the Regulatory & Compliance portfolio has four products – Walletscore, Helm, Mining Pools, and Petra.

The Bosonic Exchange uses decentralized financial market infrastructure (dFMI) technology to help companies exchange Bitcoin to fiat currency at a lower cost than traditional exchanges. DMG plans to offer Bosonic’s dFMI technology to all members of the Terra Pool. The integration of the Bosonic Network with the Blockseer product line will offer many advantages for DMG’s users including:

- connecting custodians directly to institutional buyers with no intermediaries,

- better features including the ability to set limit orders for both buy and sell transaction and real-time monitoring of the bid-ask relationship,

- and instantaneous settlement for buy and sell transactions and fast transfer of BTC to fiat.

Blockseer Breeze is focused on enabling individual crypto wallet users as well as financial institutions with an enterprise-grade custody solution to securely manage digital assets. The Company is working on this platform with a target to test in a pool environment by December 2022.

Blockseer Walletscore is focused on Anti-Money Laundering (AML) compliance. The platform can identify wallets that are likely to engage in criminal activity and is being used by Terra Pool to screen transactions using OFAC blacklisted wallets.

Mine Manager (Helm) is focused on maximizing operating performance of industrial crypto-mining facilities. This platform monitors key metrics, including temperature, operational status and hashrates in real-time, allowing mining facility operators to make quick adjustments and repairs.

Blockseer Mining Pools provide a platform for other cryptocurrency miners to share resources and processing power for the mining of Bitcoin. Bitcoin mining pools generate revenue by charging fees to miners, usually between 1% to 3% of the total Bitcoin mined. Miners contribute their hash rate to the pools and receive Bitcoin rewards proportional to the total hash rate they contribute. DMG operates two mining pools – Mara Pool and Terra Pool.

Company Data and Singular Research

Petra focuses on solving regulatory issues for banks and financial institutions as they add Bitcoin operations. It is currently in development with a planned launch by December 2022.

North America Cryptomining Industry

North America has become one of the most sought out destination for Bitcoin mining. It is the largest mining destination, accounting for more than 45% of all the world’s average monthly hashrate share as of January 2022, according to data from the Cambridge Centre for Alternative Finance. This number is likely to grow further as the Chinese government’s crackdown on cryptocurrency miners is forcing Chinese miners to migrate to North America which offers better technology and in turn reduces the carbon footprint. Within North America, the U.S. is the largest cryptocurrency mining region with a 38% worldwide share followed by Canada at nearly 7%.

There are multiple factors which have made North America a top choice for miners. The primary reason is reliability of the region’s power grid which often has excess power capacity and at very attractive prices per kilowatt-hour depending on the location. Given that miners at scale compete in a low-margin industry, where energy costs comprise a large portion of their total variable costs, miners are incentivized to migrate to the world’s cheapest source of power.

North America is currently at an advantage because there is a current lack of stringent regulations on cryptocurrency mining unlike countries in Europe or China. Particularly in the U.S., regulation on Bitcoin mining is highly variable between states. Many state governments want to encourage mining operations to establish themselves in their state because they could gain significant tax revenue, employment, and public utility revenue. For instance, Texas and Wyoming have fewer red tape restrictions which ensures speedy permits for miners.

However, a White House report in September 2022, raised serious concerns about the rapidly growing industry’s energy consumption and climate footprint. The report noted that cryptocurrency mining accounts for 0.9% to 1.7% of total U.S. electricity use and causes about 0.4% to 0.8% of total U.S. greenhouse gas emissions. Despite these concerns, there is no prohibition on cryptocurrency mining.

Canada lags the U.S. in the crypto-mining sector but is quickly catching up. Canada offers several advantages over the U.S. Specifically, import taxes in Canada are much lower, roughly 5% for general sales taxes on imported goods. Compared to the U.S., there is a 27.6% tax on the Application-Specific Integrated Circuit (OTC:ASIC) mining hardware that U.S. companies purchase from China. Also, Canada offers better weather conditions (COLD) as compared to the U.S. Cooler geographical regions allow for better efficiency of miners and reduce the chances of a miner overheating.

DMG via its Lake Christina Data Center in Canada is well positioned to benefit from its presence in one of the world’s leading crypto mining destinations. In addition to self-mining, DMG also offers hosting services. Hosting is a service that data centers provide to crypto miners where they can store their mining rigs and mine digital assets for a fee without having to spend lots of money to build the accompanying infrastructure. DMG’s data center offers an attractive destination for crypto miners looking for hosting facilities in a stable jurisdiction.

MANAGEMENT AND SHAREHOLDERS

The Company is led by CEO Sheldon Bennett who is the founder of DMG and has more than 20 years of experience in leading international businesses including PricewaterhouseCoopers, Ernst & Young, and Cisco Systems. He brings significant knowledge in Environment and Sustainability practices from his stints in the Big Four accounting firms. He is supported by other senior management such as Chief Operating Officer, Steven Eliscu. Mr. Eliscu has past experience working in Blockchain/FinTech start-ups.

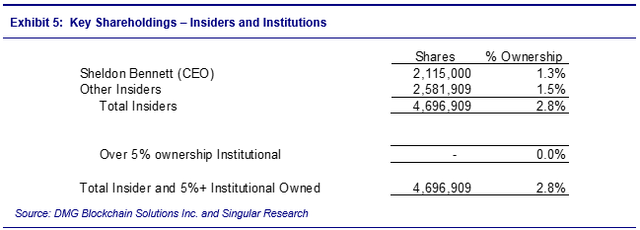

On the Company’s most recent quarterly filing, DMG reported ~167 million shares outstanding. A summary of key shareholdings follows.

DMG Blockchain Solutions Inc. and Singular Research

Latest Quarterly Results

The Company reported sales of C$10.5 million for Q2:22, an increase of 518.6% versus the prior year’s quarter driven by higher contribution from self-mining, partially offset by lower hosting revenue. Digital currency mining sales increased by 2,049% to C$8.9 million in Q2:22. This growth is in line with the strategy adopted by DMG last year, wherein the Company increased its self-mining capacity and concurrently decreased the number of hosting clients in order to make additional room for its self-mining.

Digital currency mining revenue was supported by higher prices of Bitcoin and increases in mining production. The Company mined 212.46 Bitcoin during Q2:22 at an average price of C$42,288 per Bitcoin compared to 7.13 Bitcoin mined at an average price of C$58,624 in Q2:21.

Total operating expense increased to C$11.1 million, up 122.4% YOY. However, as a percentage of revenue, operating expense declined to 106% in Q2:22 versus 295% in Q2:21.

Operating loss was C$(0.6) million in Q2:22, versus a loss of C$(3.3) million in Q2:21. DMG recorded a net loss of C$(12.2) million in Q2:22 (a loss of C$(0.07) per share) compared to a loss of C$(8.4) million (a loss of C$(0.05) per share) in Q2:21.

The Company had cash and cash equivalents (including Bitcoin holdings) of C$11.9 million as of Q2:22 which equates to nearly C$0.07 per share or 25% of the company’s total market cap. DMG had no debt as of Q2:22.

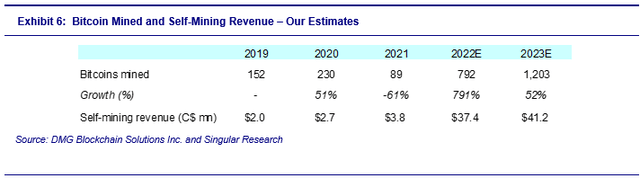

EPS GUIDANCE AND ESTIMATES

Management expects hashrate expansion to expand to one EH/s in 2022 and further to two EH/s in 2023. Therefore, we expect an increase in Bitcoin mined in the near to medium term. We expect total Bitcoin mined at ~791.5 in 2022. We expect self-mining to account for most sales going forward. Our revenue forecast for 2022 is C$43.1 million. We forecast a net loss of C$(11.4) million (an EPS loss of C$(0.07)) for 2022.

For FY:23, we expect total Bitcoins mined at 1,203, an increase of 52% YOY. Our revenue forecast for 2023 is C$46.5 million, with a net loss of C$(1.1) million (or EPS loss of C$(0.01)).

DMG Blockchain Solutions Inc. and Singular Research

INVESTMENT RISKS

- Cryptocurrency miners require a significant amount of electrical power to operate which will increase further as DMG deploys more miners. If the Company is unable to secure sufficient electrical power to operate its miners, then business operations will be adversely impacted.

- The Company’s performance is linked to the market price of Bitcoin which is subject to high volatility.

- Cryptocurrency regulation, both in Canada and internationally, could adversely affect the price of cryptocurrencies and the cryptocurrency mining industry.

- Cryptocurrency mining is a capital-intensive industry and requires significant capital to acquire new miners to expand hash rate capacity to compete with other large-scale miners which may lead to more dilution or higher debt for the Company.

VALUATION

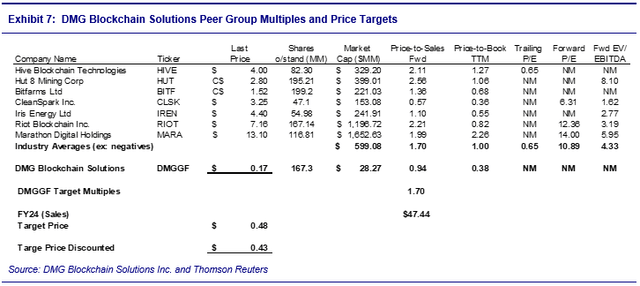

We value DMG using industry peer companies (a Price/Sales multiple) blended with our Discounted Cash Flow (DCF) valuation to derive a fair value target price for the Company.

DMG trades at 0.95x Price to Sales which is at a steep discount to the peer group average of 1.70x. We have primarily taken cryptocurrency miners and blockchain solutions providers in North America as DMG’s peer group. We believe this discount should narrow given the ongoing expansion at its Lake Christina Data Center which is expected to increase its hashrate by more than 2.5 times in the next 12 to 15 months. This expansion is likely to result in an increase in the number of Bitcoins mined and should boost revenue and cash flow. We value DMG at 1.70x 2024 sales of U.S.$47.4 million. This valuation results in a price target of U.S.$0.48, which, when discounted back at our cost of capital (12.75%) arrives at target price of U.S.$0.43.

We weight the other 50% of our target using our Discounted Cash Flow target. Our DCF model uses our forecasted free cash flow to the firm over three years, and then grows EBIT at a 30% rate over years four and five, 20% over years six and seven, 10% over years eight and nine, and 3% thereafter. We apply a weighted average cost of capital of 12.75%. Our DCF produces a value of U.S.$0.87.

The combination of U.S.$0.43 at 50% and U.S.$0.87 at 50% results in a weighted average price target of U.S.$0.65.

The exhibit below summarizes our peer group multiples, while the DCF is included at the end of this report.

DMG Blockchain Solutions Inc. and Thomson Reuters

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Be the first to comment