Jarmo Piironen

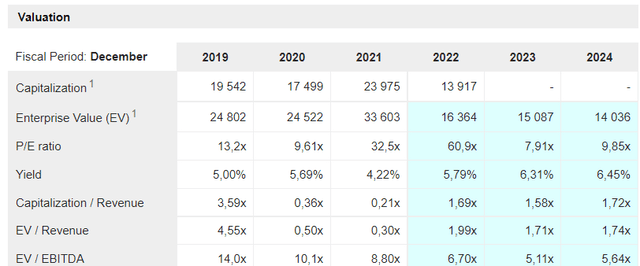

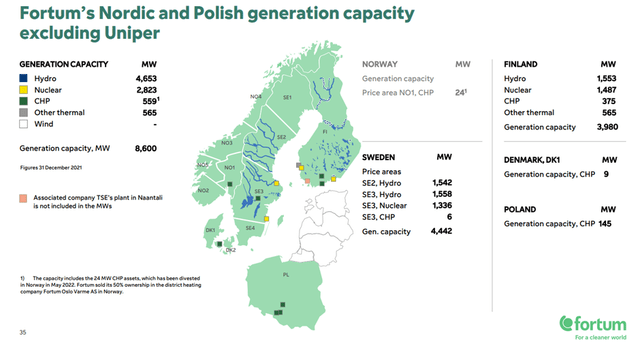

Finland-based utility company Fortum Oyj (OTCPK:FOJCF) was recently hit by a windfall profit tax proposal from the Finnish government scheduled for FY23. While the details haven’t been firmed up yet, what we do know is that the proposal defines an additional 33% tax – an even higher burden than the EUR180/MWh revenue cap already proposed by the EU, albeit only for one year. Also weighing on Fortum’s EPS trajectory is a ~1% share count dilution as part of the support package from the Finnish State. That said, Fortum’s fortunes look to be turning – not only is the company positioned to deliver more outperformance in the coming quarters amid higher electricity prices, but the Uniper (OTCPK:UNPRF) exit also remains on track. The latter is key to de-risking the balance sheet, allowing Fortum to regain favorable access to the debt markets and supporting more dividend increases down the line. At ~5x EV/EBITDA and a ~6% yield, Fortum has ample room to re-rate.

New Windfall Tax Proposal is a Negative Surprise

Recent news reports confirmed that Finland would implement a 33% tax on the excess profits of power companies in FY23. While the Finnish government had expressed interest prior to the announcement (along with a potential revenue cap), the size of the tax was a negative surprise. Given this tax will be incremental to the existing 20% corporate tax rate, the total tax burden could reach a staggering >50% for the year. The tax impact will be applied to the FY23 earnings, though the Finnish State will only accrue the tax revenue in FY24, so the cash flow impact will be reflected in FY24. Early estimates by the Finance Ministry are for windfall tax revenue of EUR0.5bn to EUR1.3bn. In terms of the timeline, the consultation process is scheduled to end this week, after which the government plans to turn the proposal into law. If all goes as planned, the new tax should be effective from 1 January 2023.

Sizing the Windfall Tax Impact

Depending on the ROE threshold, the windfall tax proposal could see an up to EUR300m tax impact for Fortum in FY23. If an allowance for a 5% ROE is applied, however, the tax would likely be closer to EUR200-250m, assuming an ~40% Finland contribution to Fortum’s generation business. Depending on the actual result in the Finland generation business, this could come in lower or higher, though given the way electricity prices have been trending, an outcome at the higher end of the range seems likely.

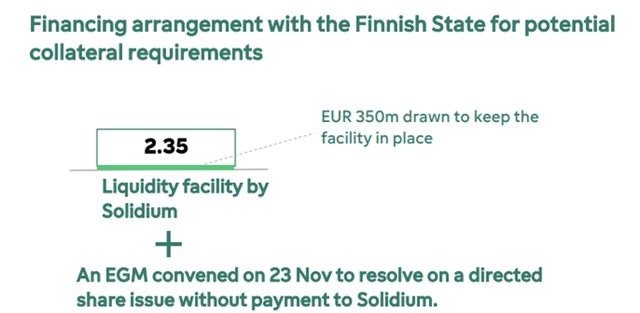

The other key variable is the duration of the tax impact. For now, the windfall tax is set to be limited to FY23, though given the Finnish tax regime, I wouldn’t rule out the prospect of a temporary tax being stretched out (or becoming permanent in a worst-case scenario). That said, Fortum’s issuance of ~9m shares to state-owned company Solidium as part of the bridge financing agreement announced in September means the Finnish government now owns 51.26% of the company. On the one hand, this will result in a ~1% dilution for existing minority shareholders. Yet, it also makes more business-friendly means of capital distribution to the State, including dividends, more attractive.

Uniper Exit on Track

While Fortum’s stake in Uniper has given shareholders much grief in recent months, there is light at the end of the tunnel. Details of a stabilization package upgrade are being finalized by the government, but reports indicate an additional capital increase of EUR25bn on top of the EUR8bn announced in September. The issue price remains pegged at EUR1.70/share to be subscribed exclusively by the German State or a related entity. While this goes some way toward providing relief to shareholders like Fortum, it isn’t quite enough. Without a meaningful gas levy, which would have allowed Uniper to pass through a significant % of the higher costs post-substitution of Russian gas to end users, the utility remains poised for record losses.

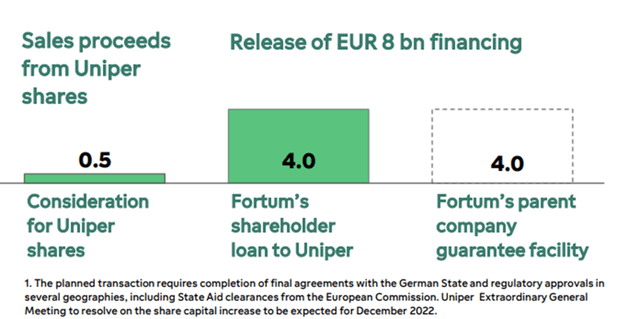

Still, the completion of the Uniper transaction remains on track, which will be well-received by Fortum investors. Recall that an agreement in principle had previously been established between Fortum, the German government, and Uniper, which would see Fortum disposing of its entire shareholding to the German State for EUR0.5bn. Given the deal would also see Fortum’s EUR4bn loan to Uniper repaid and Fortum’s EUR4bn parent company guarantee released, the implied deal value is significant. Upon completion of the Uniper transaction, Fortum’s liquidity position and balance sheet capacity should improve significantly as well, protecting against any further write-downs in Russia going forward.

Road Bumps on the Re-Rating Path

Post Fortum’s agreement with the German government over Uniper, the company looks to finally be on the path to de-risking its business model. Given its exposure to fixed generation in an elevated price environment, Fortum’s EV/EBITDA valuation seems low, even taking into account a windfall tax burden next year. Plus, the pending Uniper exit should accelerate the balance sheet deleveraging, potentially driving upside to the already elevated ~6% dividend yield. The only overhang from here will be Russia, where Fortum has yet to exit fully. Still, the risk/reward ratio makes good sense, given the favorable market environment. Key risks to monitor include the progress on the Uniper deal, as well as further energy policy developments in the EU and Finland, particularly with regard to additional taxes.

Be the first to comment