Luis Alvarez

Investment Thesis: While America Movil (NYSE:AMX) has seen impressive growth in revenues and earnings, the current inflationary environment could potentially see a plateau in 5G demand going forward.

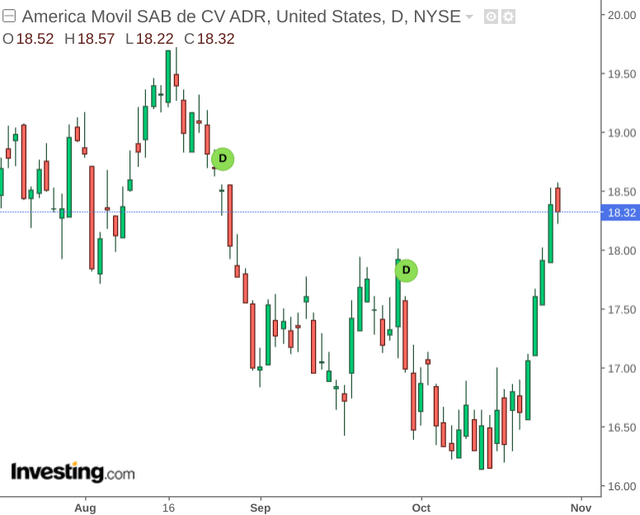

In a previous article back in August, I made the argument that America Movil could see limited upside in the short to medium-term as a result of a rise in long-term debt as well as a weakening Mexican peso affecting revenue growth.

The stock has weakened in price since my last article, but has started to see a significant recovery following the earnings release earlier this month.

The purpose of this article is to assess America Movil’s performance in light of its most recent earnings, and establish whether the recent rebound in price growth can continue going forward.

Performance

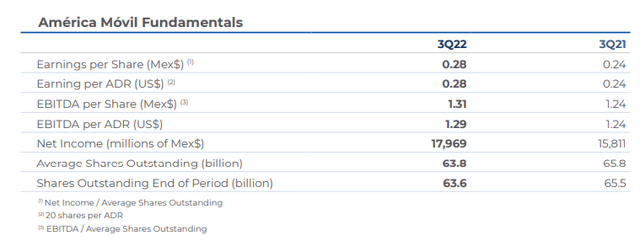

When looking at the company’s most recent earnings, we can see that earnings per share is up by 16% to Mex$0.28 and EBITDA per share is up by over 5% to Mex$1.31:

América Móvil’s third quarter of 2022 financial and operating report

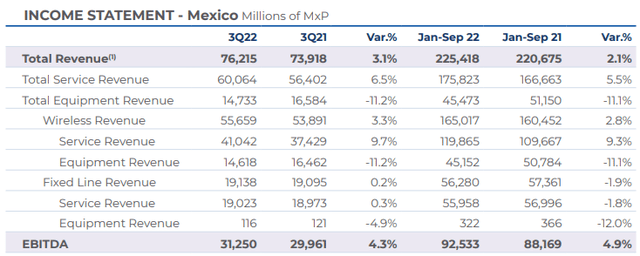

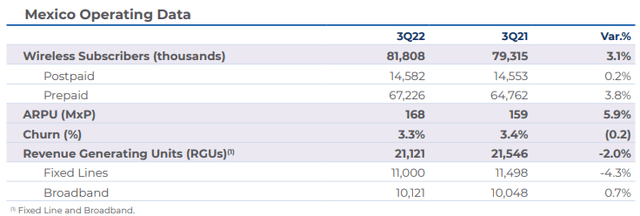

Particularly, we can see that growth in service revenue has in turn been driving growth in EBITDA – with the company seeing a 3.8% growth in prepaid wireless subscribers, along with a 5.9% growth in ARPU (average revenue per user) and a slight drop in churn from 3.4% to 3.3%.

América Móvil’s third quarter of 2022 financial and operating report América Móvil’s third quarter of 2022 financial and operating report

In this regard, revenue and earnings has been encouraging and customer interest has continued to rise in spite of inflationary pressures.

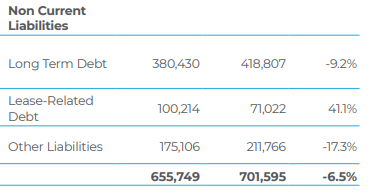

According to the company’s most recent balance sheet, long-term debt is down by over 9% from Mex$418.8 billion in December 2021 to Mex$380.4 billion in September 2022.

América Móvil’s third quarter of 2022 financial and operating report

From a short-term standpoint, the company’s quick ratio (or current assets less inventories all over current liabilities) has decreased slightly from 71% in December 2021 to 63% in September 2022.

| December 2021 | September 2022 | |

| Current Assets | 404,157 | 376,582 |

| Inventories | 24,185 | 31,822 |

| Current Liabilities | 534,013 | 542,998 |

| Quick Ratio | 71.15% | 63.49% |

Source: Figures sourced from América Móvil’s third quarter of 2022 financial and operating report. Figures provided in millions of Mexican pesos (except quick ratio). Quick ratio calculated by author.

The decline in the quick ratio indicates that America Movil is in a slightly less favourable position to fund its current liabilities than previously. While the reduction in long-term debt along with the boost in revenues and earnings has been encouraging, I take the view that investors will start to pay more attention to the quick ratio in subsequent earnings quarters – and will want to see evidence that America Movil can use revenue growth to fund its current liabilities as evidenced by growth in the quick ratio.

Looking Forward

Going forward, I take the view that while America Movil could have longer-term upside from here – investors will start taking a deeper look at whether the company can sustainably bolster its cash flow and further reduce long-term debt given the revenue growth it has seen to date.

Moreover, while the revenue growth we have seen is impressive, a significant driver of this has been expansion in 5G services. America Movil started rolling out 5G in Mexico in February of this year, with an aim of reaching 120 cities by the end of 2022.

While the uptake has been encouraging, there is the possibility that growth might start to plateau in 2023. For instance, we have already started to see handset demand drop significantly across Southeast Asia – as inflationary pressures continue to impact consumer spending.

This is in addition to 5G potentially being perceived as unnecessary given adequate availability of 4G speeds which is sufficient for most day-to-day tasks.

As a result, while there has been significant enthusiasm surrounding 5G which has helped bolster revenue growth – it is unclear as to whether this can be sustained over the next year.

Conclusion

To conclude, America Movil has seen a strong recent earnings season and revenue growth has been encouraging. However, a potential plateau in 5G demand remains a risk, and investors will increasingly look at balance sheet metrics such as a strengthening quick ratio along with a reduction in long-term debt as evidence that America Movil can convert its revenue growth into cash flow.

Be the first to comment